B2B Payments Market Size, Share, Analysis, Trends, Growth, Forecasts, 2032

B2B Payments Market By Payment Type (Electronic Funds Transfer, Cheque Payment, Mobile Payment, and Card Payment), By Enterprise Size (Large Enterprises and Small & Mid-Sized Enterprises), By End-User (Retail, Manufacturing, Healthcare, Energy & Utilities, Telecom & Technology, and Financial Securities), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

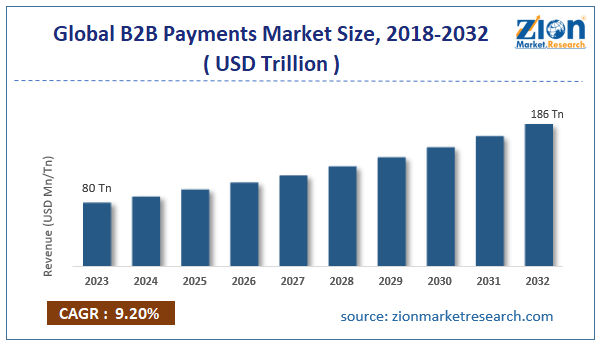

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 80 Trillion | USD 186 Trillion | 9.2% | 2023 |

B2B Payments Industry Perspective:

The global B2B payments market size was evaluated at $80 trillion in 2023 and is slated to hit $186 trillion by the end of 2032 with a CAGR of nearly 9.2% between 2024 and 2032.

B2B Payments Market: Overview

B2B payments refer to transactions performed between firms that exchange goods and services. These financial transactions help in the seamless operations of retail, production, and other kind of B2B services. Reportedly, B2B payments play a pivotal role in effectively handling cash flows and accounting operations. For the record, various B2B payment methods include wire transfers, ACH payments, online payments, credit cards, and cheques.

Key Insights

- As per the analysis shared by our research analyst, the global B2B payments market is projected to expand annually at the annual growth rate of around 9.2% over the forecast timespan (2024-2032)

- In terms of revenue, the global B2B payments market size was evaluated at nearly $80 trillion in 2023 and is expected to reach $186 trillion by 2032.

- The global B2B payments market is anticipated to grow rapidly over the forecast timespan owing to surging digitization and automation along with rapidly expanding commerce & trade.

- In terms of payment type, the electronic funds transfer segment is slated to register the highest CAGR over the forecast period.

- Based on enterprise size, the large enterprises segment is predicted to record immense growth in the upcoming years.

- On the basis of end-user, the manufacturing segment is likely to foster the global market size in the years to come.

- Region-wise, the North American B2B payments industry is projected to register the fastest CAGR during the projected timespan.

Request Free Sample

Request Free Sample

B2B Payments Market: Growth Factors

A rise in online retail activities and digital trading will drive the global market trends

Surging digitization and automation, along with rapidly expanding commerce & trade, will expedite the growth of the global B2B payments market.

Additionally, an increase in e-commerce activities, along with strategic alliances between fintech and conventional financial organizations, will prop up the market expansion in the coming years.

Growing trend for real-time payments has translated into an improvement in cash-flow management activities and transactional efficacy. Huge focus on securing payment services and supportive government schemes will proliferate the size of the global market.

Onset of blockchain technologies and the use of AI & machine learning methods for detecting fraud in B2B transactions and the need for enhancing business decision-making will steer the expansion of the global market trends.

B2B Payments Market: Restraints

An increment in cyber terrorism is projected to restrict the growth of the global industry over forecast period

Complicated laws regulating cross-border payments and an increase in cyber-attack cases will restrict the growth of the global B2B payments industry.

Furthermore, the requirement for improving payment infrastructure can offset the growth of the industry globally in the coming years.

Moreover, resistance to change and low awareness about the benefits accrued due to the application of B2B payments can inhibit global industry growth.

B2B Payments Market: Opportunities

Surging adoption of online payment methods will open new growth opportunities for the global market

Growing acceptance of digital payments has proved to be a time-saving process for both banking professionals and customers, thereby culminating in a massive global B2B payments market.

Furthermore, API-based services help various businesses easily integrate payment solutions in current systems, which will open new growth avenues for the market across the globe.

B2B Payments Market: Challenges

Growing number of online frauds can challenge the global industry surge over the forecast period

Surging transaction charges, along with delays in refunds & payments due to transaction failure, can challenge the growth of the global B2B payments industry.

Additionally, an increase in the cases of frauds such as identity theft along with fluctuating exchange rates can severely impact the profitability of the global industry.

B2B Payments Market: Segmentation

The global B2B payments market is divided into payment type, enterprise size, end-user, and region.

In terms of payment type, the B2B payments market across the globe is segmented into electronic funds transfer, cheque payment, mobile payment, and card payment segments.

Apparently, the electronic funds transfer segment, which amassed nearly over half of the global market revenue in 2023, is foreseen to record the fastest CAGR in the coming seven years. This can be a result of the electronic funds transfer payment mode facilitating automated payment processing, which increases payment cycles.

Apart from this, electronic funds transfer includes fewer transaction charges in comparison to other modes of payment and it can be easily integrated with enterprise resource planning systems, thereby improving the financial operations.

Based on enterprise size, the global B2B payments industry is sectored into large enterprises and small & mid-sized enterprises segments.

Apparently, the large enterprises segment, which accounted incredibly to the global industry earnings in 2023, is slated to register lucrative growth in the years ahead. This can be credited to the huge volume of B2B transactions made by large enterprises in comparison to small and mid-sized firms.

On the basis of end-user, the B2B payments market globally is bifurcated into retail, manufacturing, healthcare, energy & utilities, telecom & technology, and financial securities segments.

In addition, the manufacturing segment, which contributed majorly towards the global market size in 2023, is anticipated to bolster the global market expansion in the forecasting timeline.

Moreover, the segmental expansion in the next few years can be due to the growing need for high-value financial deals by the manufacturing sector.

Apart from this, a large number of manufacturing firms operate across the globe, thereby requiring proficient cross-border payment systems and currency exchange. This has enhanced the popularity of B2B payments in the manufacturing segment.

B2B Payments Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | B2B Payments Market |

| Market Size in 2023 | USD 80 Trillion |

| Market Forecast in 2032 | USD 186 Trillion |

| Growth Rate | CAGR of 9.2% |

| Number of Pages | 225 |

| Key Companies Covered | Block, PayPal, Visa, Fiserv, MasterCard, FIS, American Express, JPMorgan & Chase Company, Payoneer, Stripe, ACI Worldwide, Citibank, Square, Global Payments, Bank of America, Razorpay., and others. |

| Segments Covered | By Payment Type, By Enterprise Size, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

B2B Payments Market: Regional Insights

Asia-Pacific is likely to maintain leading status in the global market over the analysis timeline

Asia-Pacific, which contributed about 46% of the global B2B payments market earnings in 2023, is slated to mark a huge growth in the global market in the next few years.

Apparently, the regional market exponentiation in the next couple of years can be ascribed to escalating acceptance of digital technologies, swift economic development, and a large number of emerging economies requiring secured payment systems. Flourishing e-commerce sector and supportive government schemes will aid the growth of the market in the region.

The North American B2B payments industry is likely to record the fastest compound annual growth rate in the forecast timespan. The elevation of the industry in North America can be a result of the surging use of digital systems and automation for payment in B2B transactions in countries such as the U.S.

In addition, demand for real-time payments, open banking activities, and the use of blockchain in financial transactions will drive the industry growth in North America.

Key Developments

- In April 2024, HighRadius, a key provider of automated finance software for various financial transactions, launched a B2B payments tool for improving payment processes across more than 100 payment procedures globally. Reportedly, the B2B payments tool includes a payment gateway, interchange fee optimizer, and surcharge management, which can be integrated to improve fiscal efficacy.

B2B Payments Market: Competitive Space

The global B2B payments market profiles key players such as:

- Block

- PayPal

- Visa

- Fiserv

- MasterCard

- FIS

- American Express

- JPMorgan & Chase Company

- Payoneer

- Stripe

- ACI Worldwide

- Citibank

- Square

- Global Payments

- Bank of America

- Razorpay.

The global B2B payments market is segmented as follows:

By Payment Type

- Electronic Funds Transfer

- Cheque Payment

- Mobile Payment

- Card Payment

By Enterprise Size

- Large Enterprises

- Small & Mid-Sized Enterprises

By End-User

- Retail

- Manufacturing

- Healthcare

- Energy & Utilities

- Telecom & Technology

- Financial Securities

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

B2B payments refer to transactions performed between firms that exchange goods and services. These financial transactions help in the seamless operations of retail, production, and other B2B services.

The global B2B payments market's growth over the forecast period can be attributed to an increase in e-commerce activities and strategic alliances between fintech organizations and conventional financial organizations.

According to a study, the global B2B payments industry size was $80 trillion in 2023 and is projected to reach $186 trillion by the end of 2032.

The global B2B Payments market is anticipated to record a CAGR of nearly 9.2% from 2024 to 2032.

The North American B2B payments industry is set to register the fastest CAGR over the forecasting timeframe owing to the surging use of digital systems and automation for payment in B2B transactions in countries such as the U.S. In addition to this, demand for real-time payments, open banking activities, and the use of blockchain in financial transactions will drive the industry's growth in North America.

The global B2B payments market is led by players such as Block, PayPal, Visa, Fiserv, MasterCard, FIS, American Express, JPMorgan & Chase Company, Payoneer, Stripe, ACI Worldwide, Citibank, Square, Global Payments, Bank of America, and Razorpay.

The global B2B payments market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, cash-benefit analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, factor analysis, and value chain analysis. It provides an apt scenario about demand and factor conditions in the country impacting the profitability of the firms in the domestic and international markets.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed