B2B2C Insurance Market Size, Share Report, Analysis, Trends, Growth, 2030

B2B2C Insurance Market - By Product Type (Life Insurance and Non-Life Insurance), By End-User (Automotive, Retailers, BFSI, Travel, Utilities, and Real Estate), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

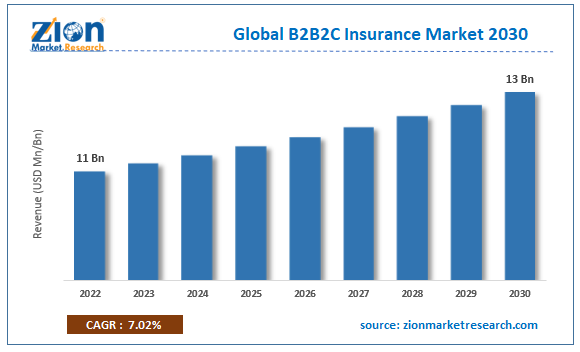

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 11 Billion | USD 13 Billion | 7.02% | 2022 |

B2B2C Insurance Industry Prospective:

The global B2B2C insurance market size was evaluated at $11 billion in 2022 and is slated to hit $13 billion by the end of 2030 with a CAGR of nearly 7.02% between 2023 and 2030.

B2B2C Insurance Market: Overview

B2B2C insurance referred to as business to business to consumer is an insurance distribution procedure in which an insurer makes use of a retailer for selling insurance to consumers. Moreover, the deal of providing B2B2C can take place with the help of insurance agents, telecom organizations, private banks, retailers, and various other digital participants.

Key Insights

- As per the analysis shared by our research analyst, the global B2B2C insurance market is projected to expand annually at the annual growth rate of around 7.02% over the forecast timespan (2023-2030)

- In terms of revenue, the global B2B2C insurance market size was evaluated at nearly $11 billion in 2022 and is expected to reach $13 billion by 2030.

- The global B2B2C insurance market is anticipated to grow rapidly over the forecast timeline owing to rising in the end-user awareness about B2B2C insurance among customers.

- In terms of product type, the life insurance segment is slated to register the highest CAGR over the analysis period.

- Based on end-user, the automotive segment is expected to dominate the segmental growth over the assessment timeline.

- Region-wise, the North American B2B2C Insurance industry is projected to register the fastest CAGR during the assessment timeline.

B2B2C Insurance Market: Growth Factors

Rise in end-user awareness about B2B2C insurance will drive the global market surge over 2023-2030

Surge in customer awareness about insurance and an increment in the number of insurance firms will prompt the expansion of the global B2B2C insurance market trends. A rampant increase in the competition between key industry participants will drive the global market expansion. Furthermore, strict government laws regulating insurance services will proliferate the growth of the market globally. Growing insurance subscriptions in the emerging economies of Latin America and Asia will expand the scope of the growth of the market space across the globe in the upcoming years. Rapid digitization and increase in the users of social media tools such as Facebook, Instagram, and Pinterest will promulgate the growth of the global market.

A paradigm shift in the domain of technology with the onset of AI, telematics, and Chabot has prompted the expansion of the market across the globe. An increment in insurance devices will expand the size of the global market in the upcoming years. Strategic alliances have played a key role in the growth of any business and B2B2C business is no exception to this. For instance, in the first quarter of 2022, Aditya Birla Health Insurance Company, a key healthcare insurance provider in India, declared to have entered into an alliance with UCO Bank, an Indian public sector bank, for distributing healthcare insurance products through a slew of branches of UCO bank based in India.

B2B2C Insurance Market: Restraints

Availability of traditional insurance at a reasonable premium can shrink the global industry expansion by 2030

Easy access to traditional insurance at low costs can pose a huge threat to the expansion of the global B2B2C insurance industry. Data security concerns can further hamper the global industry growth in the near future.

B2B2C Insurance Market: Opportunities

Rise in the production of electric vehicles can protrude the scale of growth of the global market

Swift expansion of electric vehicle manufacturing activities and demand for lightweight components in vehicles will open new growth avenues for the global B2B2C insurance market. Thriving transport sector will also contribute notably towards the global market earnings in the upcoming years.

B2B2C Insurance Market: Challenges

High taxation rates can put curbs on the expansion of the global industry in the years ahead

Imposing heavy taxes such as GST in countries such as India will increase the premium of insurance coverage, thereby posing a huge challenge to the expansion of the B2B2C insurance industry globally.

B2B2C Insurance Market: Segmentation

The global B2B2C Insurance market is sectored into product type, end-user, and region.

In product type terms, the global B2B2C insurance market is segregated into non-life insurance and life insurance segments. Furthermore, the life insurance segment, which gathered nearly half of the global market proceeds in 2022, is projected to register the fastest CAGR in the upcoming years. The growth of the segment over the next couple of years can be owing to a rise in the offering of life insurance coverage by government and private players across the globe.

Based on the end-user, the global B2B2C insurance industry is sectored into travel, automotive, utilities, retailers, BFSI, and real estate segments. Additionally, the automotive segment, which garnered a huge chunk of the global industry share in 2022, is projected to lead the global industry over the analysis timespan. The segmental expansion over the assessment period can be subject to escalating demand for B2B2C insurance in the automotive segment globally.

B2B2C Insurance Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | B2B2C Insurance Market |

| Market Size in 2022 | USD 11 Billion |

| Market Forecast in 2030 | USD 13 Billion |

| Growth Rate | CAGR of 7.02% |

| Number of Pages | 219 |

| Key Companies Covered | Aditya Birla General Insurance, Edelweiss General Insurance Company Limited, AXA SA, BNP Paribas S.A., Allianz SE, Assicurazioni Generali S.p.A., Berkshire Hathaway Inc., ICICI Lombard, UnitedHealth Group Inc., Tata-AIG General Insurance Co. Ltd., and others. |

| Segments Covered | By Product Type, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

B2B2C Insurance Market: Regional Insights

Asia-Pacific is anticipated to retain dominating position in the global B2B2C insurance market over the predicted timeline

Asia-Pacific, which contributed about two-fifths of the global B2B2C insurance market revenue in 2022, will be a leading region over the estimated timespan. Furthermore, the regional market surge can be subject to a rise in the presence of customers in densely populous countries such as India and China. Furthermore, the surging urban populace along with a rise in the per capita income in the emerging economies of Asia will steer the regional market expansion.

North American B2B2C insurance industry is set to record the fastest CAGR in the upcoming years owing to surging awareness among customers about benefits accrued due to B2B2C insurance purchases in countries such as Canada and the U.S. need for safety and protection as well as reliability will further drive the regional industry trends.

B2B2C Insurance Market: Competitive Space

The global B2B2C insurance market profiles key players such as:

- Aditya Birla General Insurance

- Edelweiss General Insurance Company Limited

- AXA SA

- BNP Paribas S.A.

- Allianz SE

- Assicurazioni Generali S.p.A.

- Berkshire Hathaway Inc.

- ICICI Lombard

- UnitedHealth Group Inc.

- Tata-AIG General Insurance Co. Ltd.

The global B2B2C insurance market is segmented as follows:

By Product Type

- Life Insurance

- Non-Life Insurance

By End-User

- Automotive

- Retailers

- BFSI

- Travel

- Utilities

- Real Estate

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

B2B2C insurance is referred to business to business to consumer as an insurance distribution procedure in which an insurer makes use of a retailer for selling insurance to consumers.

The global B2B2C insurance market growth can be owing to a surge in customer awareness about insurance and an increment in the number of insurance firms.

According to a study, the global B2B2C insurance industry size was $11 billion in 2022 and is projected to reach $13 billion by the end of 2030.

The global B2B2C insurance market is anticipated to record a CAGR of nearly 7.02% from 2023 to 2030.

The North American B2B2C insurance industry is set to register the highest CAGR over the forecasting timeline owing to surging awareness among customers about benefits accrued due to B2B2C insurance purchase in countries such as Canada and the U.S. need for safety and protection as well as reliability will further drive the regional industry trends.

The global B2B2C insurance market is led by players such as Aditya Birla General Insurance, Edelweiss General Insurance Company Limited, AXA SA, BNP Paribas S.A., Allianz SE, Assicurazioni Generali S.p.A., Berkshire Hathaway Inc., ICICI Lombard, UnitedHealth Group Inc., and Tata-AIG General Insurance Co. Ltd.

The B2B2C insurance market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed