Bancassurance Market Size, Share, Industry Analysis, Trends, Growth, 2032

Bancassurance Market By Product Type (Life Bancassurance and Non-Life Bancassurance), By Model Type (Pure Distributor, Exclusive Partnership, Financial Holding, and Joint Venture), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

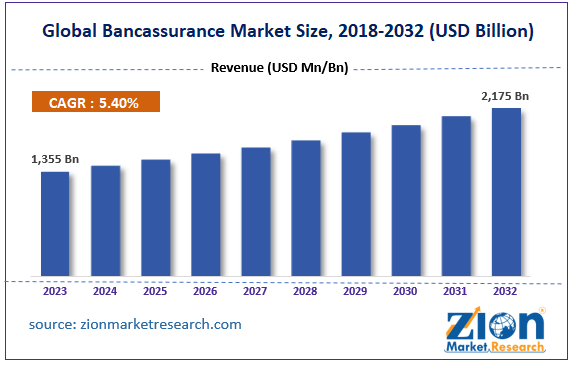

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1,355 Billion | USD 2,175 Billion | 5.4% | 2023 |

Bancassurance Industry Prospective:

The global bancassurance market size was worth around USD 1,355 billion in 2023 and is predicted to grow to around USD 2,175 billion by 2032 with a compound annual growth rate (CAGR) of roughly 5.4% between 2024 and 2032.

Bancassurance Market: Overview

A bank and insurance business can offer their goods to the bank's customer base through a partnership known as bancassurance. Both businesses stand to gain financially from this cooperation. Insurance goods bring in more money for banks, and insurance businesses grow their clientele without adding more salespeople. They increase profitability for both insurance companies and banks because the latter get commissions on the sale of insurance policies to banks and the former get access to the bank's customer base to sell policies without having to spend money on product marketing.

Key Insights

- As per the analysis shared by our research analyst, the global Bancassurance market is estimated to grow annually at a CAGR of around 5.4% over the forecast period (2024-2032).

- In terms of revenue, the global Bancassurance market size was valued at around USD 1,355 billion in 2023 and is projected to reach USD 2,175 billion, by 2032.

- The increasing collaboration is expected to drive the bancassurance market growth over the forecast period.

- Based on the product type, the life bancassurance segment is expected to capture the largest market share over the projected period.

- Based on the model type, the pure distributor segment is expected to hold a prominent market share over the projected period.

- Based on region, the Asia Pacific is expected to dominate the market during the forecast period.

Request Free Sample

Request Free Sample

Bancassurance Market: Growth Drivers

Technological advancements drive market growth

An important factor propelling the bancassurance sector is the quick development of digital technologies. Developments in artificial intelligence, machine learning, and data analytics allow banks and insurance providers to provide more efficient and customized products. As an example, predictive analytics can pinpoint particular clientele groups that would be more open to particular kinds of insurance offerings. Furthermore, digital platforms facilitate consumer outreach by providing easy-to-use online channels for policy application, claim submission, and other transactions. Because of these technological advancements, bancassurance is more profitable for all parties involved and increases client happiness and operational efficiency. The potential of the bancassurance market is anticipated to increase even more as technology develops.

Bancassurance Market: Restraints

Risk to bank’s reputation hinders the market growth

Word-of-mouth marketing is one of the most important ways that banks are promoted, and their reputation is a crucial component in creating trust between the consumer and the bank. As a result, the bank's reputation could be damaged by subpar customer service or any other inefficiencies in the way its services are provided. In the model, banks serve as corporate agents for insurance businesses, therefore even if the insurance company may be at fault, they are accountable for any issues relating to ineffective or delayed service delivery to the consumer. Therefore, if services are provided slowly or poorly, the banks' reputation is in danger. Furthermore, insurance fraud can damage a bank's standing. This might have a significant impact on the profits of a bank and its image thereby hampering the bancassurance industry growth.

Bancassurance Market: Opportunities

Increasing adoption of digital marketing platforms offers a lucrative opportunity for market growth

One important development in digital marketing is the use of social media and other digital channels. With more than 60% of people on the globe having access to the Internet, and this percentage is expected to rise, these platforms let businesses reach a wider audience and enable more specialized communication. Consumers can ensure ease and flexibility by completing the KYC verification process online. Furthermore, this digital transformation helps the insurance industry promote health insurance, retirement product plans, non-life insurance, and life insurance premiums. Collaborations between banks and insurers foster synergies that support economic growth and the demands of an older population. Digital distribution of insurance goods is in line with European economic progress and selling culture. Such a factor offers an attractive opportunity for the bancassurance market growth.

Bancassurance Market: Challenges

Cross-selling of products poses a major challenge to market expansion

The bancassurance market's development is being impeded by cross-selling. Cross-selling insurance products and services alongside bank products is a challenging task for bank workers. Consequently, they are the main causes impeding the bancassurance industry. Technical issues will lower revenue from the industry.

Bancassurance Market: Segmentation

The global bancassurance industry is segmented based on product type, model type, and region.

Based on the product type, the global bancassurance market is bifurcated into life bancassurance and non-life bancassurance. The life bancassurance segment is expected to capture the largest market share over the projected period. A big contributing factor is the growing understanding of the value of life planning and financial stability. Growing in financial literacy, consumers understand the importance of life insurance plans for safeguarding their families' future, particularly in the event of unanticipated events such as incapacity or death. Banks are in an excellent position to launch these essential goods because of their current clientele. Furthermore, a larger portion of the population may now purchase life insurance due to the rise in dual-income households and higher disposable income. The process of buying life insurance has also been made easier by technological improvements, as consumers can now compare and purchase policies with ease via online banking platforms. In addition, as the population ages and older people look to secure their post-retirement lives, demand is further increased by demographic reasons. Subsequently, the market has grown as a result of regulatory changes that give banks more latitude to cross-sell financial products. Together, these factors increase the demand for life bancassurance products, which is advantageous for both customers and financial institutions.

Based on the model type, the global bancassurance industry is bifurcated into pure distributor, exclusive partnership, financial holding, and joint venture. The pure distributor segment is expected to hold a prominent market share over the projected period. This strategy is quite attractive to financial institutions that wish to expand their offers without taking on additional liabilities, as the bank only functions as a distributor of insurance products, not engaging in any underwriting risk. The cheap operating cost is one of the main stimulants. Banks don't need to make large additional investments because they may make use of their current infrastructure, clientele, and routes of communication. The strategy is very appealing to both larger banks and smaller regional institutions because of its cost-effectiveness. This strategy has also been supported by regulatory frameworks in some areas, which have made compliance simpler and the law less complex. Thus, driving the market growth.

Bancassurance Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Bancassurance Market |

| Market Size in 2023 | USD 1,355 Billion |

| Market Forecast in 2032 | USD 2,175 Billion |

| Growth Rate | CAGR of 5.4% |

| Number of Pages | 211 |

| Key Companies Covered | Banco Santander S.A., ABN AMRO Bank N.V., Banco Bradesco SA, The American Express Company, The Australia and New Zealand Banking Group Limited, Wells Fargo & Company, BNP Paribas S.A., Intesa Sanpaolo S.p.A., Lloyds Banking Group plc, Barclays plc, Crédit Agricole S.A., The ING Group, Citigroup Inc., Nordea Group, NongHyup Financial Group, Société Générale, HSBC Holdings plc, and others. |

| Segments Covered | By Product Type, By Model Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Bancassurance Market: Regional Analysis

Asia Pacific is expected to dominate the market during the forecast period

The Asia Pacific is expected to dominate the bancassurance market during the forecast period. The growing middle class with more disposable income and financial literacy is one of the most important reasons. There is an increasing trend in this group's interest in varied financial goods, such as insurance. Furthermore, there is a sizable untapped market for bancassurance in this area due to the comparatively low penetration of insurance services. Several Asia Pacific countries have implemented regulatory changes that are making bancassurance more viable as a business model for banks and insurance companies. Furthermore, bancassurance has benefited from technology developments owing to strong rates of digital usage in nations like China, South Korea, and Singapore. Thus, this is expected to drive the market growth in the region.

Bancassurance Market: Competitive Analysis

The global bancassurance market is dominated by players like:

- Banco Santander S.A.

- ABN AMRO Bank N.V.

- Banco Bradesco SA

- The American Express Company

- The Australia and New Zealand Banking Group Limited

- Wells Fargo & Company

- BNP Paribas S.A.

- Intesa Sanpaolo S.p.A.

- Lloyds Banking Group plc

- Barclays plc

- Crédit Agricole S.A.

- The ING Group

- Citigroup Inc.

- Nordea Group

- NongHyup Financial Group

- Société Générale

- HSBC Holdings plc

The global bancassurance market is segmented as follows:

By Product Type

- Life Bancassurance

- Non-Life Bancassurance

By Model Type

- Pure Distributor

- Exclusive Partnership

- Financial Holding

- Joint Venture

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A bank and insurance business can offer their goods to the bank's customer base through a partnership known as bancassurance. Both businesses stand to gain financially from this cooperation. Insurance goods bring in more money for banks, and insurance businesses grow their clientele without adding more salespeople. They increase profitability for both insurance companies and banks because the latter get commissions on the sale of insurance policies to banks and the former get access to the bank's customer base to sell policies without having to spend money on product marketing.

The bancassurance market is being driven by several factors including growing consumer demand for integrated financial services, rising healthcare costs, growing collaboration, and others.

According to the report, the global bancassurance market size was worth around USD 1,355 billion in 2023 and is predicted to grow to around USD 2,175 billion by 2032.

The global bancassurance market is expected to grow at a CAGR of 5.4% during the forecast period.

The global bancassurance market growth is expected to be driven by the Asia Pacific. It is currently the world’s highest revenue-generating market due to the rising disposable income.

The global bancassurance market is dominated by players like Banco Santander, S.A., ABN AMRO Bank N.V., Banco Bradesco SA, The American Express Company, The Australia and New Zealand Banking Group Limited, Wells Fargo & Company, BNP Paribas S.A., Intesa Sanpaolo S.p.A., Lloyds Banking Group plc, Barclays plc, Crédit Agricole S.A., The ING Group, Citigroup Inc., Nordea Group, NongHyup Financial Group, Société Générale and HSBC Holdings plc among others.

The bancassurance market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed