Banking Cyber Security Market Size, Share, Analysis, Trends, Growth, 2032

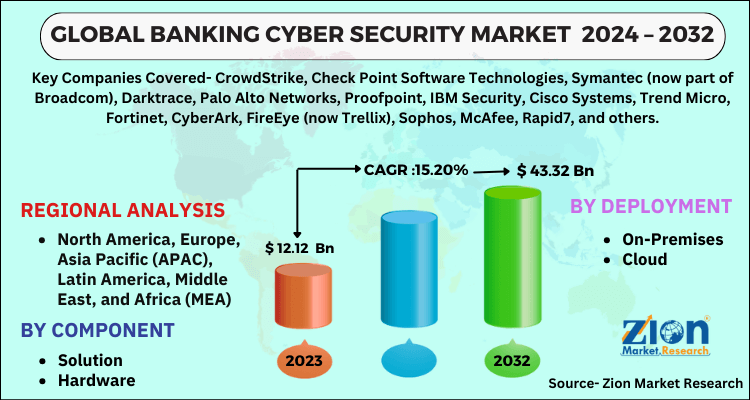

Banking Cyber Security Market By Component (Solution and Hardware), By Deployment (On-Premises and Cloud), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024-2032

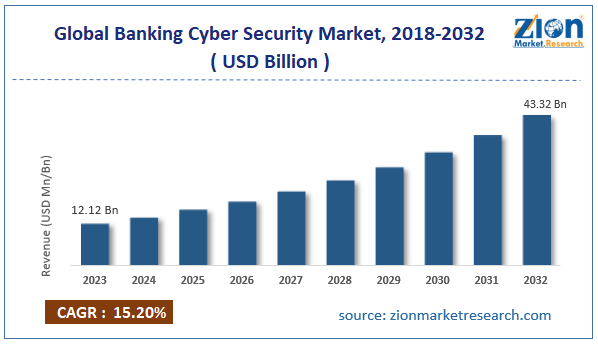

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 12.12 Billion | USD 43.32 Billion | 15.20% | 2023 |

Banking Cyber Security Industry Perspective:

The global banking cyber security market size was worth around USD 12.12 billion in 2023 and is predicted to grow to around USD 43.32 billion by 2032 with a compound annual growth rate (CAGR) of roughly 15.20% between 2024 and 2032.

Banking Cyber Security Market: Overview

Banking cyber security refers to the list of practices, technologies, and protocols that are specially designed to safeguard a bank’s confidential information, database, and network from digital threats. Cyber security is considered the first line of defense against the ever-growing intensity of digital crimes. Banks across the globe including regional units and international bank facilities deal with huge volumes of money and highly sensitive data. Thus, banks are often the target of cybercriminals that aim to compromise the integrity of banking facilities by targeting and hacking crucial information stored on bank’s networking systems.

Due to the nature of the information held by banks worldwide, any hacking event can lead to severe economic setbacks not only for the customers of the bank but the entire banking infrastructure of the region. Cybersecurity in banking consists of a comprehensive infrastructure. It covers the protection of internal databases as well as online platforms against unauthorized access and use of the information. The demand for banking cybersecurity systems has been growing due to rising incidents of cybercrimes all over the world. Moreover, government mandates regarding the use of advanced cybercrime-prevention solutions will create more growth opportunities.

Key Insights:

- As per the analysis shared by our research analyst, the global banking cyber security market is estimated to grow annually at a CAGR of around 15.20% over the forecast period (2024-2032)

- In terms of revenue, the global banking cyber security market size was valued at around USD 12.12 billion in 2023 and is projected to reach USD 43.32 billion, by 2032.

- The market is projected to grow at a significant rate due to the growing number of cybercrimes worldwide.

- Based on the component, the solution segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the deployment, the cloud segment is anticipated to command the largest market share.

- Based on region, North America is projected to dominate the global market during the forecast period.

Banking Cyber Security Market: Growth Drivers

Growing number of cyber-crimes worldwide will drive market demand rate in the future

The global banking cyber security market is expected to grow due to the rising number of cybercrimes worldwide. These types of activities refer to the use of digital solutions and devices to conduct criminal activities ranging from financial fraud to data theft. Cyber Crimes are also targeted at damaging or disrupting business operations, network infrastructure, or the reputation of the company.

Cybersecurity in banking systems is specially crafted to meet the digital security needs of financial institutions that deal with hundreds and thousands of customers every day. The digital safety of banking facilities is crucial to a country’s economy driving the demand for advanced cyber security systems specially created for banks of all sizes.

In February 2024, Bank of America, one of the most valued banks in the US, announced a data breach compromising the personally identifiable information (PII) of around 57,028 customers. According to official reports, confidential information about deferred compensation plans includes names, social security numbers, and date of birth. The victims were managed by third-party provider Infosys McCamish. According to market reports, such types of data breaches mostly originate from third parties.

In November 2024, Check Point Software Technologies, a leading provider of cyber security platforms, conducted a survey that indicated that Nigerian banks including other financial institutions are targeted 182.01% times more than the other facilities globally.

Government mandates surrounding the protection of customer information will create extensive revenue in the long run

Governments worldwide are increasingly working on new frameworks that are designed to safeguard the confidential information of their populations. Banks have access to highly sensitive information of their customers and hence they are required to seek the latest cybercrime-preventing solutions. In October 2024, the European Union (EU) announced the enforcement of novel cybersecurity laws that enhance the region’s resilience against digital crimes.

EU members are now required to adhere to the directives published in NIS2 cybersecurity rules. Such measures are expected to promote growth in the global banking cybersecurity market. The NIS2 directive will require member states to be appropriately equipped to handle cyber-crimes using a competent national network and information systems (NIS) authority and a Computer Security Incident Response Team (CSIRT).

Banking Cyber Security Market: Restraints

High cost of the system and compatibility issues with legacy systems will limit the overall revenue

The global industry is expected to be restricted by the high cost of the solutions and infrastructure supporting the use of cybercrime-prevention systems. For instance, large banks are generally required to spend nearly 10% of their information technology (IT) budget on the installation and maintenance of cybersecurity tools such as software programs.

Furthermore, banks may face challenges in ensuring compatibility between existing IT infrastructure and novel cybersecurity tools leading to a limited adoption rate. The lack of implementation policies ensuring optimal use of cyber security programs and devices may further filter the overall revenue in the industry.

Banking Cyber Security Market: Opportunities

Ongoing research & innovation in the field of cyber security for banks to generate growth opportunities

The global banking cyber security market is projected to generate growth opportunities due to the ongoing research & development (R&D) in the industry. Companies providing cyber security solutions for banks are increasingly offering cutting-edge tools and programs that can meet the evolving digital security needs of banking facilities.

In November 2024, NVIDIA and Temenos announced a new strategic partnership. Temenos is a leading provider of power core systems serving more than 3000 financial firms. The companies have launched a new on-premise generative Artificial Intelligence (AI) solution. Banks and financial institutions can gain complete control of sensitive information using the large language models (LLMs) deployed as a collaboration. Banks will now have access to processing information without reliance on a third party thus reducing the chances of digital threats significantly.

In August 2024, the IDBI Bank and the Indian Institute of Technology Madras (IIT Madras) announced a novel partnership for the development of a cybersecurity research center. The agencies plan to develop cybersecurity tools serving a vast range of industries including financial institutions.

Banking Cyber Security Market: Challenges

Ever evolving nature of cyber-crimes to challenge market expansion

The global industry for banking cyber security is projected to be challenged by the ever-evolving nature of digital crimes. According to industry analysis, cybercriminals continue to use sophisticated and ever-changing malware to attack information-sensitive industries. Thus, end-users are required to consistently upgrade cyber security infrastructure to manage the latest trends in digital crimes which can be a time-consuming and resource-intensive task.

Banking Cyber Security Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Banking Cyber Security Market |

| Market Size in 2023 | USD 12.12 Billion |

| Market Forecast in 2032 | USD 43.32 Billion |

| Growth Rate | CAGR of 15.20% |

| Number of Pages | 219 |

| Key Companies Covered | CrowdStrike, Check Point Software Technologies, Symantec (now part of Broadcom), Darktrace, Palo Alto Networks, Proofpoint, IBM Security, Cisco Systems, Trend Micro, Fortinet, CyberArk, FireEye (now Trellix), Sophos, McAfee, Rapid7, and others. |

| Segments Covered | By Component, By Deployment, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Banking Cyber Security Market: Segmentation

The global banking cyber security market is segmented based on component, deployment, and region.

Based on the components, the global market segments are solutions and hardware. In 2023, the highest demand was listed in the solution segment due to the excessive reliance of banking firms on third-party vendors to provide cybersecurity solutions. During the forecast period, the solution segment is expected to continue receiving more revenue due to increased R&D among solution providers. The use of generative AI and machine learning (ML) to develop banking cybersecurity tools may help the industry flourish further in the coming years. The global AI in the finance market was valued at over USD 39 billion in 2023.

Based on the deployment, the global market divisions are on-premises and cloud. In 2023, the highest revenue-generating segment was the cloud. This format offers several advantages to the customers. For instance, cloud-based solutions promote scalability and are cost-efficient as compared to on-premises tools. Moreover, a rising shift toward cloud technology across industries will promote segmental demand. According to market findings, more than 93% of companies worldwide are using cloud-based solutions.

Banking Cyber Security Market: Regional Analysis

North America to register the highest growth rate during the projection period

The global banking cyber security market is expected to be led by North America during the projection period. The US will emerge as the highest revenue generator driven by the growing number of cyber-crimes, especially in the banking sector across the country. In June 2024, Truist Bank, a leading financial firm in the US, confirmed a data breach incident that occurred in October 2023. The confirmation followed after some of the bank’s data was published by the perpetrator for sale on a hacking platform.

According to the hacker going by the name Sp1d3r, they have access to information on more than 65,000 employees of the firm which they plan to sell for USD 1 million. In November 2024, the US Justice Department announced that they had seized PopeyeTools. It is an illegal website that facilitates the sale of stolen credit cards and other financial tools.

According to the official department, the website has generated more than USD 1.7 million in revenue since its inception. In addition to this, the regional market can benefit from the growing government mandates to protect the sovereignty of banking facilities and their customers. The rising introduction of new cyber security tools with advanced features and higher safety will be crucial to shaping North America’s revenue in the long run.

Banking Cyber Security Market: Competitive Analysis

The global banking cyber security market is led by players like:

- CrowdStrike

- Check Point Software Technologies

- Symantec (now part of Broadcom)

- Darktrace

- Palo Alto Networks

- Proofpoint

- IBM Security

- Cisco Systems

- Trend Micro

- Fortinet

- CyberArk

- FireEye (now Trellix)

- Sophos

- McAfee

- Rapid7

The global banking cyber security market is segmented as follows:

By Component

- Solution

- Hardware

By Deployment

- On-Premises

- Cloud

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Banking cyber security refers to the list of practices, technologies, and protocols that are specially designed to safeguard a bank’s confidential information, database, and network from digital threats.

The global banking cyber security market is expected to grow due to the rising number of cybercrimes worldwide.

According to study, the global banking cyber security market size was worth around USD 12.12 billion in 2023 and is predicted to grow to around USD 43.32 billion by 2032

The CAGR value of the banking cyber security market is expected to be around 15.20% during 2024-2032.

The global banking cyber security market is expected to be led by North America during the projection period.

The global banking cyber security market is led by players like CrowdStrike, Check Point Software Technologies, Symantec (now part of Broadcom), Darktrace, Palo Alto Networks, Proofpoint, IBM Security, Cisco Systems, Trend Micro, Fortinet, CyberArk, FireEye (now Trellix), Sophos, McAfee and Rapid7.

The report explores crucial aspects of the banking cyber security market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed