Beauty and Personal Care Products Market Size, Share, Industry Analysis, Trends, Growth, 2030

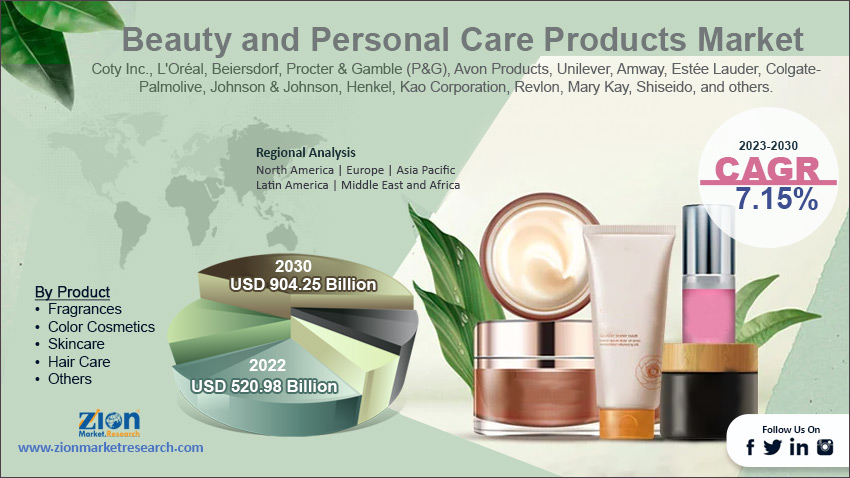

Beauty and Personal Care Products Market By Product (Fragrances, Color Cosmetics, Skincare, Hair Care, and Others), By Sales Channel (Offline Stores and Online Channels), By Type (Organic and Chemically Formulated), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

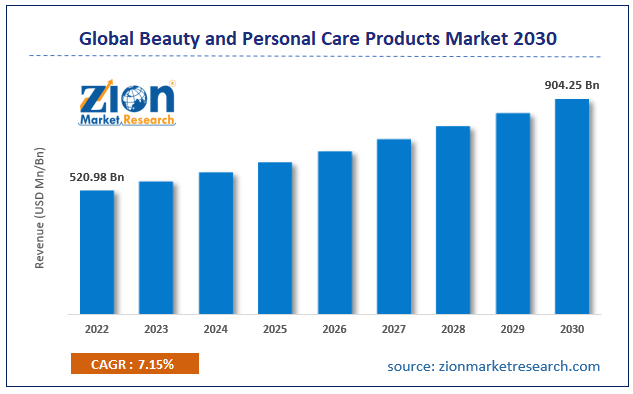

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 520.98 Billion | USD 904.25 Billion | 7.15% | 2022 |

Beauty and Personal Care Products Industry Prospective:

The global beauty and personal care products market size was worth around USD 520.98 billion in 2022 and is predicted to grow to around USD 904.25 billion by 2030 with a compound annual growth rate (CAGR) of roughly 7.15% between 2023 and 2030.

Beauty and Personal Care Products Market: Overview

Beauty and personal care products are items used by individuals on an everyday basis. These products are applied to the face and body with the final aim of improving physical appearance and maintaining hygiene. Additional goals of using these products include beautification or promoting attractiveness. Products included in the extensive range of beauty and personal care products include fragrances, antiperspirants, soaps, shampoos, cosmetic items, and a wide range of other commodities. Items that enhance or maintain hygiene and beauty have been used for several centuries. However, the industry has evolved with time as personal care and cosmetic products are produced as per the resources available.

The industry for beauty and personal care products is one of the most significant industries since in most regions, it enjoys more than 95% regional market penetration. For instance, as per official data published by Cosmetic Europe, almost 85% of men and 95% of women in the UK use deodorant regularly. Beauty care merchandise is heavily regulated since certain variants contain chemicals and can lead to negative health impacts in case they are ingested.

Key Insights:

- As per the analysis shared by our research analyst, the global beauty and personal care products market is estimated to grow annually at a CAGR of around 7.15% over the forecast period (2023-2030)

- In terms of revenue, the global beauty and personal care products market size was valued at around USD 520.98 billion in 2022 and is projected to reach USD 904.25 billion, by 2030.

- The beauty and personal care products market is projected to grow at a significant rate due to the growing population rate

- Based on product segmentation, skincare was predicted to show maximum market share in the year 2022

- Based on type segmentation, chemically formulated was the leading segment in 2022

- On the basis of region, Asia-Pacific was the leading revenue generator in 2022

Request Free Sample

Request Free Sample

Beauty and Personal Care Products Market: Growth Drivers

Growing population rate to act as key market drivers

The global beauty and personal care products market is expected to grow owing to the increasing population rate. Personal care items are everyday products used by the majority of the world's population. Moreover, these products are not restricted to specific audiences since people of all age groups, genders, ethnicities, and cultural backgrounds use these products in some form or the other. Market players have managed to create a highly diverse product portfolio keeping in view the changing consumer expectations and this strategy has helped key companies to continue thriving even during a global economic slowdown.

Currently, the world population is over 8 billion and by 2050, as per official projections, the population level is expected to cross 9.7 billion as per the United Nations allowing industry players to tap into an immense consumer segment during the forecast period.

Rising rate of new product releases to deliver high growth rate

Since the consumer base is extremely dynamic, companies offering beauty and personal care products have ensured that each consumer set finds relatable products in the commercial world. They offer products across price ranges with varying key ingredients. This helps in improving the buying experience even for consumers with specific preferences. In addition to this, companies are increasingly investing in developing an online infrastructure that aids in creating a functional online buying space for consumers. These strategies include leveraging the supply chain of existing e-commerce firms or developing websites in-house.

For instance, in April 2023, India witnessed the launch of a new beauty e-commerce platform called Tira. The project is being handled by Reliance Retail which has also invested in a 4,300 sq. ft. flagship store thus tapping into online and offline consumer groups and aiding the global beauty and personal care products market.

Beauty and Personal Care Products Market: Restraints

Extreme market saturation to impact the otherwise positive growth trend

The global beauty and personal care products industry is expected to be impacted by the extreme market saturation with multiple brands currently selling their products through various mediums. Although this means that every consumer can find something in the market as per their personal preference, there is a growing trend of beauty and personal care product fatigue among customers. Navigating through loss of interest can only be achieved by investing in research and innovation either about product ingredients or marketing strategies. However, the high competition further restricts the innovation rate in the industry.

Beauty and Personal Care Products Market: Opportunities

Rising development in terms of new product ingredients to create growth opportunities

The global beauty and personal care products market players can expect higher growth opportunities as they continue to invest in the development of new product ingredients as consumer demands change. For instance, in March 2023, Symrise announced the launch of a new range of Diana food™ bioactives. The company will use these products in their specially formulated beauty products including items such as skin brightening cream, skin conditioning lotion, and nail care products. In September 2023, BASF, another leading player in the market, launched a new sunscreen ingredient called TinomaxTM CC. The innovation is influenced by the growing demand for multipurpose and multifunctional solutions that provide enhanced Sun Protection Factor (SPF) and defense against UltraViolet rays. Such developments are facilitated by funding new-age research facilities equipped with novel technologies and research talent.

In September 2022, L'Oréal USA announced that it had invested in developing a highly technologically advanced Research & Innovation (R&I) Center in New Jersey. The project is worth USD 140 million and is expected to help the company strengthen its hold in the personal care product segment worldwide. Colgate-Palmolive, one of the world’s leading consumer groups, launched Volpe Clinical Research Center as the company targets a healthier future for all its customers.

Increasing demand for organic and chemical-free substitutes holds excellent expansion possibilities

The market potential for chemical-free beauty and personal care products is exceptionally high. Consumers are becoming more aware of the several harmful effects of products made using chemical components. Additionally, organic alternatives are considered safer as they do not have any potential side effects.

Beauty and Personal Care Products Market: Challenges

Managing environmental pollution caused by consumer products to challenge growth rate

The global beauty and personal care products market is expected to be challenged by the mounting pressure on the environment due to the excessive use of consumer products. As per reports by Earth.Org, beauty packaging alone leads to 120 billion units of plastic waste every year. Consumers are becoming increasingly aware of the environmental impacts leading to more people opting for environmentally conscious brands.

Beauty and Personal Care Products Market: Segmentation

The global beauty and personal care products market is segmented based on product, sales channel, type, and region.

Based on product, the global market is segmented into fragrances, color cosmetics, skincare, hair care, and others. In 2022, the highest growth was registered in the skin care segment as it held control over 33.65% of the total revenue. Skincare is an essential daily routine for all genders. The growing trend of incorporating active ingredients for enhanced appearance is further pushed by growing consumer consciousness as a result of information availability on the Internet.

Based on sales channels, the global beauty and personal care products market is divided into offline stores and online channels.

Based on type, the global market is divided into organic and chemically formulated. In 2022, more than 85% of the market share was led by the chemically formulated segment since it enjoys the benefits of a mature sector with existing loyal customers. Traditionally, most beauty and personal care products are produced using some form of chemicals in limited quantities. The growth trend for the organic sector looks promising during the forecast period.

Beauty and Personal Care Products Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Beauty and Personal Care Products Market |

| Market Size in 2022 | USD 520.98 Billion |

| Market Forecast in 2030 | USD 904.25 Billion |

| Growth Rate | CAGR of 7.15% |

| Number of Pages | 209 |

| Key Companies Covered | Coty Inc., L'Oréal, Beiersdorf, Procter & Gamble (P&G), Avon Products, Unilever, Amway, Estée Lauder, Colgate-Palmolive, Johnson & Johnson, Henkel, Kao Corporation, Revlon, Mary Kay, Shiseido, and others. |

| Segments Covered | By Product, By Sales Channel, By Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Beauty and Personal Care Products Market: Regional Analysis

Asia-Pacific to generate the highest revenue during the projection period

The global beauty and personal care products market was driven by Asia-Pacific in 2022 as it generated around 33.5% of the global revenue. During the projection period, the same trend can be expected mainly due to the presence of an extensive and growing consumer base in countries such as India, China, South Korea, Japan, Australia, and others. China and India are the most densely populated countries while also being termed as the fastest-growing economies. The rising rate of consumer purchasing power in addition to the immense proliferation of the beauty e-commerce sector further helps the regional market growth trend.

South Korea has recently become internationally famous for producing affordable, unique, and highly effective skincare products. In a short span, these commodities have become highly popular. Europe is an important market since it is one of the largest contributors to the global market share. It is home to leading personal and beauty care product developers such as L’Oreal, Clarins, Bioderma, and others. The international market hold of European skincare brands remains unparalleled.

Beauty and Personal Care Products Market: Competitive Analysis

The global beauty and personal care products market is led by players like:

- Coty Inc.

- L'Oréal

- Beiersdorf

- Procter & Gamble (P&G)

- Avon Products

- Unilever

- Amway

- Estée Lauder

- Colgate-Palmolive

- Johnson & Johnson

- Henkel

- Kao Corporation

- Revlon

- Mary Kay

- Shiseido

The global beauty and personal care products market is segmented as follows:

By Product

- Fragrances

- Color Cosmetics

- Skincare

- Hair Care

- Others

By Sales Channel

- Offline Stores

- Online Channels

By Type

- Organic

- Chemically Formulated

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Beauty and personal care products are items used by individuals on an everyday basis. These products are applied to the face and body with the final aim of improving physical appearance and maintaining hygiene.

The global beauty and personal care products market is expected to grow owing to the increasing population rate.

According to study, the global beauty and personal care products market size was worth around USD 520.98 billion in 2022 and is predicted to grow to around USD 904.25 billion by 2030.

The CAGR value of beauty and personal care products market is expected to be around 7.15% during 2023-2030.

The global beauty and personal care products market will be drive by Asia-Pacific during the forecast period.

The global beauty and personal care products market is led by players like Coty Inc., L'Oréal, Beiersdorf, Procter & Gamble (P&G), Avon Products, Unilever, Amway, Estée Lauder, Colgate-Palmolive, Johnson & Johnson, Henkel, Kao Corporation, Revlon, Mary Kay, and Shiseido among many others.

The report explores crucial aspects of the beauty and personal care products market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

Choose License Type

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed