Blockchain Finance Market Size, Share, Analysis, Trends, Growth, 2032

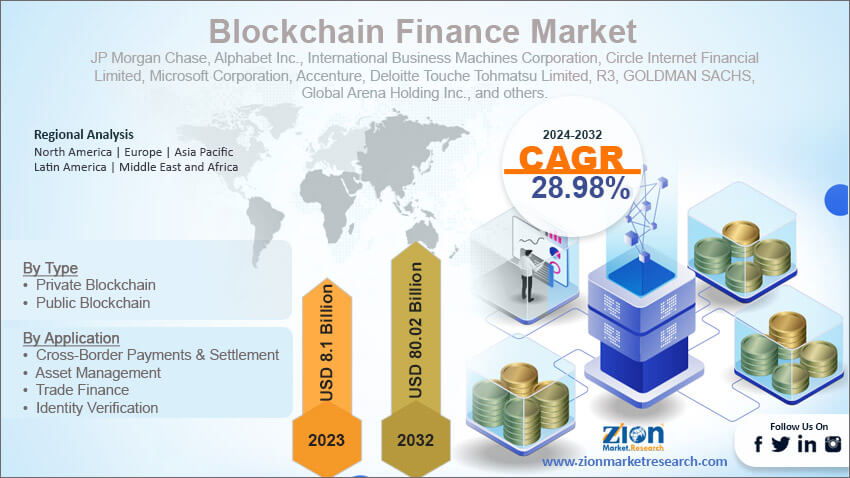

Blockchain Finance Market By Type (Private Blockchain and Public Blockchain), By Application (Cross-Border Payments & Settlement, Asset Management, Trade Finance, and Identity Verification), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

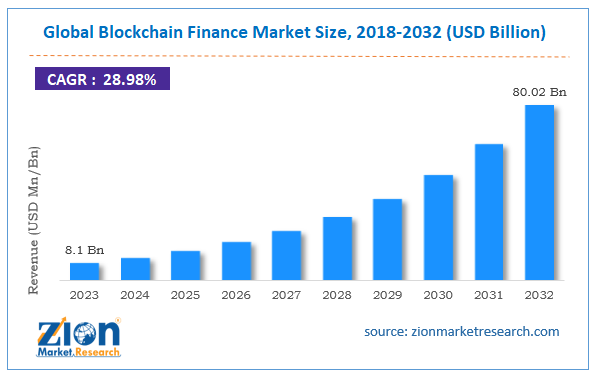

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 8.1 Billion | USD 80.02 Billion | 28.98% | 2023 |

Blockchain Finance Industry Prospective:

The global blockchain finance market size was evaluated at $8.1 billion in 2023 and is slated to hit $80.02 billion by the end of 2032 with a CAGR of nearly 28.98% between 2024 and 2032.

Blockchain Finance Market: Overview

Blockchain is a decentralized distributed ledger system that makes use of cryptography for securing stored data. Furthermore, blockchain helps users in transferring digital assets from one party to another in a secure manner without involving third parties. Moreover, for finance firms, blockchain technology can be a path for rapid and cost-efficient transactions, high security, and automated contracts.

Key Insights

- As per the analysis shared by our research analyst, the global blockchain finance market is projected to expand annually at the annual growth rate of around 28.98% over the forecast timespan (2024-2032)

- In terms of revenue, the global blockchain finance market size was evaluated at nearly $8.1 billion in 2023 and is expected to reach $80.02 billion by 2032.

- The global blockchain finance market is anticipated to grow rapidly over the forecast timeline owing to the escalating use of blockchain in finance activities such as customer data storage, money transfers, automation via smart contracts, and added transaction security.

- In terms of type, the public blockchain segment is slated to register the highest CAGR over the forecast period.

- Based on application, the cross-border payments & settlement segment is predicted to lead the segmental space in the upcoming years.

- Region-wise, the Asia-Pacific blockchain finance industry is projected to register the fastest CAGR during the projected timespan.

Request Free Sample

Request Free Sample

Blockchain Finance Market: Growth Factors

Huge demand for blockchain in financial sector to drive the global market trends over 2024-2032

The growing use of blockchain in finance activities such as customer data storage, money transfers, automation via smart contracts, and added transaction security will steer the expansion of the global blockchain finance market. Furthermore, blockchain can make the process of payment more efficient. It assists financial institutes in saving costs on international transactions, thereby driving the global market trends. In addition to this, financial firms promote the use of blockchain by making investments in blockchain stocks, thereby paving the way for the humongous growth of the global market.

Blockchain Finance Market: Restraints

Nonscalable nature of blockchain can put brakes on the global industry expansion by 2032

The immutable nature of blockchain and the lack of scalability of the blockchain can hinder the growth of the global blockchain finance industry.

Blockchain Finance Market: Opportunities

Escalating need for constant fiscal deals will create new growth avenues for the global market

Rise in the use of blockchain in smaller as well as giant enterprises will open new avenues of growth for the global blockchain finance market. Demand for seamless financial transactions as well as peer-to-peer transactions will proliferate the growth of the global market.

Blockchain Finance Market: Challenges

Low awareness pertaining to advantages offered by blockchain in financial sector can deter the expansion of the industry globally

Lack of awareness about the benefits of using blockchain technology in financial institutions and low availability of expert staff can pose a huge challenge to the expansion of the global blockchain finance industry.

Blockchain Finance Market: Segmentation

The global blockchain finance market is divided into type, application, and region.

In type terms, the blockchain finance market across the globe is segregated into private blockchain and public blockchain segments. Furthermore, the public blockchain segment, which acquired nearly 55% of the global market revenue in 2023, is predicted to register the largest gains in the ensuing years. The expansion of the segment in the projected timespan can be attributed to the public blockchain being an open network & permissionless system that allows unfettered involvement. Apart from this, public blockchains assure data security. Additionally, Bitcoin and Ethereum are some of the major examples of public blockchains. Reportedly, public blockchain impacts computational power, thereby enabling them to maintain a huge number of distributed ledgers related to financial deals.

On the basis of the application, the global blockchain finance industry is segmented into cross-border payments & settlement, asset management, trade finance, and identity verification segments. Additionally, the cross-border payments & settlement segment, which garnered a key share of the global industry in 2023, is forecast to lead the segment in the coming years. The segmental growth over the timeline from 2024 to 2032 can be due to the use of blockchain in cross-border payments for easing cross-border payment procedures.

Blockchain Finance Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Blockchain Finance Market |

| Market Size in 2023 | USD 8.1 Billion |

| Market Forecast in 2032 | USD 80.02 Billion |

| Growth Rate | CAGR of 28.98% |

| Number of Pages | 211 |

| Key Companies Covered | JP Morgan Chase, Alphabet Inc., International Business Machines Corporation, Circle Internet Financial Limited, Microsoft Corporation, Accenture, Deloitte Touche Tohmatsu Limited, R3, GOLDMAN SACHS, Global Arena Holding Inc., and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Blockchain Finance Market: Regional Insights

North America is predicted to maintain the leading position in the global blockchain finance market in the upcoming years

North America, which accounted for nearly 77% of the global blockchain finance market earnings in 2023, is predicted to be a dominating region in the coming decade. Apart from this, the regional market surge over the forecast timespan can be attributed to favorable government schemes for improving the blockchain infrastructure in the financial sector. In addition to this, the use of blockchain in the banking & finance sector augments cryptographic transparency & safety, thereby minimizing bank fraud. This, in turn, will prompt the growth of the market in the region as the region has a large number of banks.

Asia-Pacific blockchain finance industry is slated to register the fastest CAGR in the forecast timespan. The progress of the industry in the Asia-Pacific zone can be attributed to the huge presence of key players in countries such as India, South Korea, Taiwan, Japan, Philippines, Singapore, Malaysia, and China. An increase in bitcoin transactions as an alternate currency for the dollar by BRICS nations, particularly, India and China will further boost the growth of the industry in the region.

Key Developments

- In the first half of 2015, Visa invested nearly $30 million in Chain.com, a blockchain developer. The move is likely to embellish the growth of the blockchain finance market globally.

- In the second quarter of 2017, the firm introduced Visa B2B Connect making use of blockchain technology for global B2B payments.

- For the record, Visa became the first key payment network for settling transactions in cryptocurrency in the first quarter of 2021

Blockchain Finance Market: Competitive Space

The global blockchain finance market profiles key players such as:

- JP Morgan Chase

- Alphabet Inc.

- International Business Machines Corporation

- Circle Internet Financial Limited

- Microsoft Corporation

- Accenture

- Deloitte Touche Tohmatsu Limited

- R3

- GOLDMAN SACHS

- Global Arena Holding Inc.

The global blockchain finance market is segmented as follows:

By Type

- Private Blockchain

- Public Blockchain

By Application

- Cross-Border Payments & Settlement

- Asset Management

- Trade Finance

- Identity Verification

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Blockchain is a decentralized distributed ledger system that makes use of cryptography for securing stored data.

The global blockchain finance market growth over forecast period can be owing to a blockchain can make process of payment more efficient. It assists financial institutes in saving costs on international transactions.

According to a study, the global blockchain finance industry size was $8.1 billion in 2023 and is projected to reach $80.02 billion by the end of 2032.

The global blockchain finance market is anticipated to record a CAGR of nearly 28.98% from 2024 to 2032.

Asia-Pacific blockchain finance industry is set to register the fastest CAGR over the forecasting timeline owing to huge presence of key players in the countries such as India, South Korea, Taiwan, Japan, Philippines, Singapore, Malaysia, and China. Increase in the bitcoin transactions as alternate currency for dollar by BRICS nations, particularly, India and China will further boost the growth of the industry in the region.

The global blockchain finance market is led by players such as JP Morgan Chase, Alphabet, Inc., International Business Machines Corporation, Circle Internet Financial Limited, Microsoft Corporation, Accenture, Deloitte Touche Tohmatsu Limited, R3, GOLDMAN SACHS, and Global Arena Holding Inc.

The global blockchain finance market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed