Blood Testing Market Size, Share, Trends, Growth and Forecast 2028

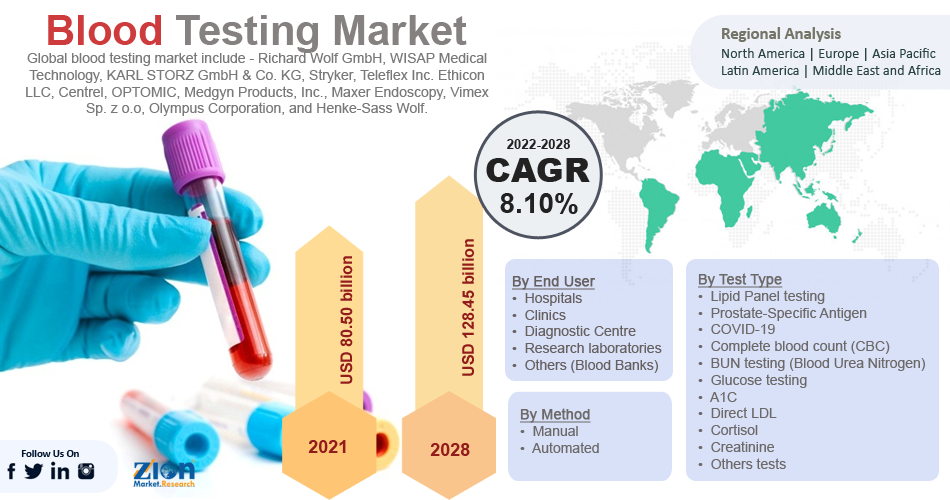

Blood Testing Market By Test Type (Lipid Panel Testing, Prostate-Specific Antigen, Complete blood count (CBC), BUN testing (Blood Urea Nitrogen), Glucose testing, A1C, Direct LDL, Cortisol, Creatinine, and Others tests), By End-user (Hospitals, Clinic, Diagnostic Centre, Research laboratories, and Others (Blood Banks)), By Method (Manual and Automated), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data and Forecasts 2022-2028

| Market Size in 2021 | Market Forecast in 2028 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 80.50 Billion | USD 128.45 Billion | 8.10% | 2021 |

Industry Perspective:

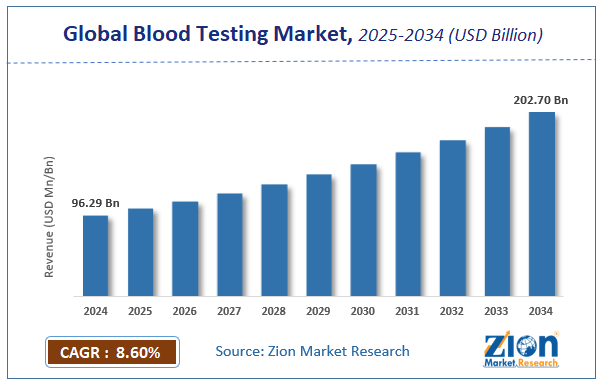

The global blood testing market size was worth USD 80.50 billion in 2021 and is estimated to grow to USD 128.45 billion by 2028, with a compound annual growth rate (CAGR) of approximately 8.10 percent over the forecast period. The report analyzes the blood testing market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the blood testing market.

Blood Testing Market: Overview

Blood tests are the most basic diagnostic method used to determine the malfunction of the human system. Regular blood tests are the easiest way to track your health. It is essential to have regular blood tests for good health and to make informed decisions about health in particular. Blood tests are also important to reduce the risk of various illnesses and related complications. Increased government and regulatory healthcare costs are expected to drive the market during the forecast period. Therefore, governments and key organizations constantly strive to encourage patients to undergo regular diagnostic tests. Furthermore, recent advances, the regulatory approval process, and a lack of awareness of the high cost of automated blood tests will hinder market growth over the next few years. Multinational healthcare institutions can help discover new technologies and raise awareness for eradicating & diagnosing common and chronic diseases. Solid external funding for clinical trials being conducted to develop new and innovative diagnostic tests is expected to boost the market. The introduction of constructive regulatory parameters to encourage POC tests is a major rendering driver on the market.

Covid-19 Impact

With the exponential increase in the number of COVID-19 cases worldwide, the demand for large diagnostic tests is increasing. Prompt diagnosis, effective treatment options, and future prevention plans are essential for the management of COVID-19. The current competition to develop test kits that enable proximity detection of coronavirus infections at low cost has brought about rapid innovation in diagnosis. In July 2020, Washington doctors examined the blood of people affected by COVID-19 to identify patients at high risk of developing serious illnesses and artificially ventilate patients under treatment.

Key Insights

- The global blood testing market was worth around USD 80.50 billion in 2021 and is estimated to grow to about USD 128.45billion by 2028, with a compound annual growth rate (CAGR) of approximately 8.10 percent over the forecast period.

- The continued increase in the prevalence of chronic diseases and the high demand for rapid health assessment products are expected to spur the market expansion during the forecast period.

- Factors such as strict regulatory approvals, lack of skills, and high operating costs hamper market growth.

- The glucose testing segment dominated the blood testing market due to the high penetration of these tests in the global market.

- The increasing number of strategic initiatives taken by government agencies and market players to increase blood donations across North America, which is expected to drive market growth.

Blood Testing Market: Growth Drivers

Rising initiative of regulatory bodies and healthcare organizations in blood test help to drive the market

Regulators such as the FDA, Medicare and Medicaid Service Center (CMS), and the Federal Trade Commission play an important role in regulating diagnostic tests. These agencies have taken the initiative to commercialize clinical laboratory improvement and modification compliant diagnostic tests that may help in the early detection of illness. The introduction of CLIA in the United States is expected to increase blood test used during the prediction period.

Blood Testing Market: Restraints

Stringent regulatory approval process will hinder the market growth

Rigid regulatory approval strategies are likely to hamper the market growth in the coming years. In the U.S., the development of commercial trials is regulated by the U.S. Food and Drug Administration (U.S. FDA). The US FDA is responsible for approving the use of clinical tests. Lack of awareness of the development of new technologies and procedures related to blood tests will hamper the market over the forecast period.

Blood Testing Market: Segmentation

The global blood testing market is segregated based on test type, end-use, method, and region.

By test type, the market is divided into lipid panel testing, prostate-specific, antigen, COVID-19, complete blood count (CBC), BUN testing (blood urea nitrogen), glucose testing, A1C, direct LDL, cortisol, creatinine, and other tests. Among these, the glucose testing segment dominates the market owing to technological advances in these glucose meters, etc. Wireless connectivity and Bluetooth capabilities further drive the market acceptance of these products. iHealth Smart, iHealth Align, Dario Health Smart Meter and Glooko are examples of smart blood glucose monitoring products.

By end user, the market is classified into hospitals, clinics, diagnostic centers, research laboratories, and others (blood banks). Over the forecast period, the research laboratories segment is expected to develop at the fastest rate. Laboratory tests of blood and blood products provided for infections are an important safety measure to protect patients and prevent the spread of serious infections. Factors such as increased blood donation & blood transfusion-related screening, increased awareness of blood transfusion-related infectious diseases, and increased incidence of infectious diseases are driving the growth of this segment.

By method, the market is classified into manual and automated. The automated segment dominates the market.

Recent Developments

- In February of 2022, Tasso, a manufacturer of portable blood collection devices, partnered with telemedicine company Vault Health to help perform diagnostic tests at home. Vault offers remote services such as COVID-19 testing, alcohol testing, and drug testing for businesses.

- In March 2022, AXIM Biotechnologies, Inc, an international healthcare solutions company focused on the dry eye (DED), has changed the focus of COVID-19 rapid neutralizing antibody testing to "research use only".

Report Scope:

| Report Attributes | Report Details |

|---|---|

| Report Name | Blood Testing Market Size |

| Market Size in 2021 | USD 80.50 Billion |

| Market Forecast in 2028 | USD 128.45 Billion |

| Growth Rate | CAGR of 8.10% |

| Number of Pages | 266 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | Richard Wolf GmbH, WISAP Medical Technology, KARL STORZ GmbH & Co. KG, Stryker, Teleflex Inc. Ethicon LLC, Centrel, OPTOMIC, Medgyn Products, Inc., Maxer Endoscopy, Vimex Sp. z o.o, Olympus Corporation, and Henke-Sass Wolf. |

| Segments Covered | By Test Type, By End User, By Method And By Region. |

| Base Year | 2021 |

| Historical Year | 2018 to 2020 |

| Forecast Year | 2021 - 2028 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Blood Testing Market: Regional Landscape

Increasing strategies of key market players and government organizations likely to help North America dominate the global market

Increasing the number of strategic initiatives taken by government agencies and market players to increase blood donations across the region is one of the factors expected to drive North America market growth. Blood centers across the country are stepping up efforts to collect blood from people who have recovered from their illnesses. Several organizations, such as the New York Blood Center, American Red Cross, AABB, America's Blood Centers, Armed Services Blood Program, and Blood Centers of America, provide information on plasma collection and plasma delivery. Increased blood donations are expected to further drive demand for testing products for pre-transplant and post-transplant procedures. In the Asia Pacific region, the blood testing market is expected to show the fastest CAGR during the forecast period. The increasing prevalence of chronic diseases in developing countries such as India and China is a major driver of market growth.

Blood Testing Market: Competitive Landscape

Some of the main competitors dominating the global blood testing market include -

- Richard Wolf GmbH

- WISAP Medical Technology

- KARL STORZ GmbH & Co. KG

- Stryker

- Teleflex Inc. Ethicon LLC

- Centrel

- OPTOMIC

- Medgyn Products

- Maxer Endoscopy

- Vimex Sp. z o.o

- Olympus Corporation

- Henke-Sass Wolf.

Global blood testing market is segmented as follows:

By Test Type

- Lipid Panel testing

- Prostate-Specific Antigen

- COVID-19

- Complete blood count (CBC)

- BUN testing (Blood Urea Nitrogen)

- Glucose testing

- A1C

- Direct LDL

- Cortisol

- Creatinine

- Others tests

By End User

- Hospitals

- Clinics

- Diagnostic Centre

- Research laboratories

- Others (Blood Banks)

By Method

- Manual

- Automated

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The blood testing market has expanded dramatically due to the impact of ageing around the world is driving the market growth. The number of strategies in the global market has increased dramatically in recent years, leading to an expansion of the market leader's product portfolio and a stronger market presence. In addition, blood tests increase in other diagnostic areas and develop various diseases such as bacterial and viral allergic diseases, thyroid diseases, human immunodeficiency virus (HIV) infections, hereditary diseases, cancer and hepatitis. Additional factors, such as higher rates, will propel the market growth during the forecast period.

According to the report, the global blood testing market was worth 80.50 (USD billion) in 2021 and is predicted to grow to 128.45 (USD billion) by 2028, with a compound annual growth rate (CAGR) of around 8.10 percent.

North America will dominate the blood testing market in the coming years. Due to the increased incidence of diseases such as kidney disease, bloodstream infections and other infections, the high demand for rapid diagnostic testing, and the ageing population, the North American region has become a medical test in the global blood testing market has the largest market share over the forecast period.

Some of the main competitors dominating the global blood testing market include - Richard Wolf GmbH, WISAP Medical Technology, KARL STORZ GmbH & Co. KG, Stryker, Teleflex Inc. Ethicon LLC, Centrel, OPTOMIC, Medgyn Products, Inc., Maxer Endoscopy, Vimex Sp. z o.o, Olympus Corporation, and Henke-Sass Wolf.

Choose License Type

List of Contents

Industry Perspective:OverviewCovid-19 ImpactKey InsightsGrowth DriversRising initiative of regulatory bodies and healthcare organizations in blood test help to drive the marketRestraintsStringent regulatory approval process will hinder the market growthSegmentationRecent DevelopmentsReport Scope:Regional LandscapeIncreasing strategies of key market players and government organizations likely to help North America dominate the global marketCompetitive Landscape Global blood testing market is segmented as follows:RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed