Business Intelligence Software Market Size, Share, Analysis, Trends, Growth, 2032

Business Intelligence Software Market By Deployment Type (On-Premise, Cloud, Hybrid), By Component (Platform, Services), By Enterprise Size (Large Enterprises, Small and Medium-Sized Enterprises), By Application (Predictive Analytics, Reporting and Visualization, Data Mining, Performance Management, and Others), By Industry Vertical (BFSI, Retail and E-commerce, Healthcare, IT and Telecom, Manufacturing, Government and Defense, Media and Entertainment, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

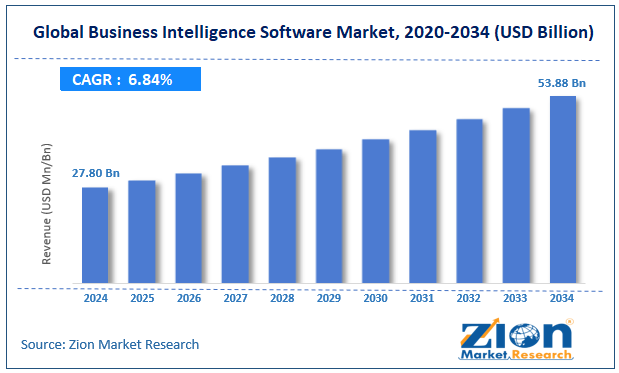

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 27.80 Billion | USD 53.88 Billion | 6.84% | 2024 |

Business Intelligence Software Industry Prospective:

The global business intelligence software market size was valued at approximately USD 27.80 billion in 2024 and is expected to reach around USD 53.88 billion by 2034, growing at a compound annual growth rate (CAGR) of roughly 6.84% between 2025 and 2034.

Business Intelligence Software Market: Overview

Business intelligence software refers to applications that collect, process, analyze, and visualize large volumes of data to support data-driven decision-making within organizations. This rapidly evolving sector has changed how businesses run operations, find market opportunities, and drive strategy.

Business intelligence is the base of modern corporate analytics, providing answers through dashboards, reports, and predictive models so organizations can understand past performance, current state, and future trends. The focus on data-driven decision-making, growth in data across industries, and the need for operational efficiency are all driving the business intelligence software industry.

The widespread adoption of cloud computing, integration of artificial intelligence and machine learning capabilities, and the increasing demand for self-service analytics tools across organizations of all sizes are expected to drive significant growth in the market over the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global business intelligence software market is estimated to grow annually at a CAGR of around 6.84% over the forecast period (2025-2034)

- In terms of revenue, the global business intelligence software market size was valued at around USD 27.80 billion in 2024 and is projected to reach USD 53.88 billion by 2034.

- The business intelligence software market is projected to grow significantly due to the increasing need for real-time analytics, rising adoption of cloud-based business intelligence solutions, and expanding digital transformation initiatives across industries.

- Based on deployment type, cloud-based solutions lead the segment and will continue to dominate the global market.

- Based on component, platforms are anticipated to command the largest market share.

- Based on the application, the reporting and visualization segment is expected to lead the market during the forecast period.

- Based on industry vertical, BFSI will remain the dominant sector during the forecast period.

- Based on region, North America is projected to dominate the global market during the forecast period.

Business Intelligence Software Market: Growth Drivers

Rising demand for advanced analytics and data-driven decision-making

In the business intelligence software industry, with competition for market share intensifying, there is a greater emphasis on leveraging data for strategic decision-making and competitive advantage. Companies seek business intelligence solutions that provide deeper insights, predictive capabilities, and actionable intelligence to optimize operations and identify growth opportunities.

According to recent industry surveys, companies with advanced analytics are 5x more likely to make decisions faster than their competitors.

Digital transformation initiatives and cloud adoption

Digital transformation initiatives across industries drive the business intelligence software market, with companies moving their data infrastructure to the cloud. Cloud business intelligence solutions offer scalability, flexibility, and cost benefits over on-premise deployments.

Research shows that over 65% of enterprise data is stored in cloud environments, so it is a natural path for adoption by cloud business intelligence. Companies are allocating more of their IT budget to business intelligence and analytics tools, with cloud business intelligence spending growing at 25% per annum.

Business Intelligence Software Market: Restraints

Data security and privacy concerns

Data security, governance, and compliance with regulations like GDPR and CCPA are significant challenges faced by the business intelligence software industry. As companies are collecting and analyzing more and more sensitive data, data protection is crucial. Industry reports say 78% of companies cite security as the top barrier to wider business intelligence adoption, especially for cloud-based solutions handling sensitive financial, customer, or operational data.

Business Intelligence Software Market: Opportunities

Integration of artificial intelligence and machine learning capabilities

Artificial intelligence and machine learning are transforming the market by making data analysis, insights discovery, and predictive analytics possible. AI-powered business intelligence tools can now find patterns, anomalies, and correlations in data that human analysts would miss, as well as natural language processing, to make data insights accessible to non-technical users.

For example, companies using AI-enabled business intelligence solutions report 35% faster analysis time and 25% better forecast accuracy than traditional business intelligence tools.

Business Intelligence Software Market: Challenges

Skills gap and adoption barriers across organizations

The business intelligence software industry is robust, but the lack of skilled data analysts and data scientists is a significant barrier to adoption. 67% of organizations say they can't find qualified people to implement and use business intelligence solutions effectively. 45% of executives say organizational change management is the biggest challenge in business intelligence implementation.

Additionally, integration complexities with existing IT infrastructure and data silos further hinder seamless adoption. Many organizations struggle with ensuring data accuracy and consistency, which impacts the reliability of insights generated. As businesses increasingly rely on real-time analytics, the demand for intuitive, AI-driven BI tools that require minimal technical expertise continues to rise.

Business Intelligence Software Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Business Intelligence Software Market |

| Market Size in 2024 | USD 27.80 Billion |

| Market Forecast in 2034 | USD 53.88 Billion |

| Growth Rate | CAGR of 6.84% |

| Number of Pages | 227 |

| Key Companies Covered | Microsoft Corporation, Tableau Software (Salesforce), SAP SE, Oracle Corporation, IBM Corporation, SAS Institute, Qlik Technologies, MicroStrategy Incorporated, Domo Inc., Zoho Corporation, Sisense Inc., ThoughtSpot Inc., Looker (Google Cloud), TIBCO Software Inc., Yellowfin International, Board International, Infor, Information Builders, Dundas Data Visualization Inc., Logi Analytics, Pyramid Analytics, GoodData Corporation, Alteryx Inc., InsightSquared LLC, Targit A/S, and others. |

| Segments Covered | By Deployment Type, By Component, By Enterprise Size, By Application, By Industry Vertical, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Business Intelligence Software Market: Segmentation

The global business intelligence software market is segmented into deployment type, component, enterprise size, application, industry vertical, and region.

Based on deployment type, the industry is segregated into on-premise, cloud, and hybrid solutions. Cloud-based solutions lead the market by offering organizations scalability, lower upfront costs, and faster implementation timelines. Cloud business intelligence solutions account for approximately 58% of new business intelligence deployments.

Based on component, the business intelligence software industry is divided into platforms and services. Platforms are expected to lead the market during the forecast period as they account for over 65% of revenue and provide the core functionality for data processing, analysis, and visualization across organizations.

Based on application, the business intelligence software market is categorized into predictive analytics, reporting and visualization, data mining, performance management, and others. The reporting and visualization segment is expected to lead the market since it delivers immediate value to organizations through accessible dashboards and visual data storytelling, accounting for approximately 42% of business intelligence usage.

Based on industry vertical, the industry is segregated into BFSI, retail and e-commerce, healthcare, IT and telecom, manufacturing, government and defense, media and entertainment, and others. The BFSI sector dominates the market due to its data-intensive operations and regulatory reporting requirements, accounting for approximately 28% of global business intelligence software spending.

Business Intelligence Software Market: Regional Analysis

North America to lead the market

North America leads the global business intelligence software market due to its advanced IT infrastructure, high digital maturity across industries, and the presence of significant business intelligence solution providers and technology innovators. The U.S. alone accounts for approximately 45% of global business intelligence software spending as aggressive digital transformation initiatives occur across sectors. The region's lively technology ecosystem has led to many analytics startups driving innovation in AI-powered business intelligence tools and advanced visualization techniques.

Major technology companies like Microsoft, Tableau (Salesforce), and IBM are enhancing their business intelligence platforms, setting industry standards and best practices. North American companies allocate 15-20% more of their IT budgets to analytics and business intelligence solutions than their global peers, allowing for more complex implementations.

Asia Pacific to grow significantly

Asia Pacific is the fastest-growing business intelligence software industry, driven by digital transformation, cloud adoption, and increasing data recognition as a strategic asset among businesses. China's enterprise software market has grown 17% yearly for the past 5 years, with business intelligence being a top investment area for many companies.

Companies in Japan, South Korea, and Singapore are deploying advanced analytics to stay competitive in global markets. India has seen significant growth in business intelligence adoption, especially in IT services, financial services, and e-commerce, with annual analytics spending growing by 22%. The region's diverse economy requires flexible and scalable business intelligence solutions that cater to different data maturity stages.

Recent Market Developments:

- In January 2024, Microsoft enhanced its power business intelligence platform with advanced natural language querying capabilities and augmented analytics features that reduced analysis time by up to 35%.

- In March 2024, Tableau introduced an enterprise-grade embedded analytics solution with enhanced security controls and customization options for organizations looking to integrate analytics into their applications.

- In June 2024, IBM launched a specialized Watson Analytics suite for industry-specific applications with pre-built templates and KPIs for sectors like healthcare, financial services, and manufacturing.

Business Intelligence Software Market: Competitive Analysis

The global business intelligence software market is led by players like:

- Microsoft Corporation

- Tableau Software (Salesforce)

- SAP SE

- Oracle Corporation

- IBM Corporation

- SAS Institute

- Qlik Technologies

- MicroStrategy Incorporated

- Domo Inc.

- Zoho Corporation

- Sisense Inc.

- ThoughtSpot Inc.

- Looker (Google Cloud)

- TIBCO Software Inc.

- Yellowfin International

- Board International

- Infor

- Information Builders

- Dundas Data Visualization Inc.

- Logi Analytics

- Pyramid Analytics

- GoodData Corporation

- Alteryx Inc.

- InsightSquared LLC

- Targit A/S

The global business intelligence software market is segmented as follows:

By Deployment Type

- On-Premise

- Cloud

- Hybrid

By Component

- Platform

- Services

By Enterprise Size

- Large Enterprises

- Small and Medium-Sized Enterprises

By Application

- Predictive Analytics

- Reporting and Visualization

- Data Mining

- Performance Management

- Others

By Industry Vertical

- BFSI

- Retail and E-commerce

- Healthcare

- IT and Telecom

- Manufacturing

- Government and Defense

- Media and Entertainment

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Business intelligence software refers to applications that collect, process, analyze, and visualize large volumes of data to support data-driven decision-making within organizations.

The business intelligence software market is expected to be driven by increasing demand for real-time analytics, rising adoption of cloud-based business intelligence solutions, integration of AI and ML capabilities, growing data volumes across industries, and expansion of digital transformation initiatives.

According to our study, the global business intelligence software market was worth around USD 27.80 billion in 2024 and is predicted to grow to around USD 53.88 billion by 2034.

The CAGR value of the business intelligence software market is expected to be around 6.84% during 2025-2034.

The global business intelligence software market will register the highest growth in North America during the forecast period.

Key players in the business intelligence software market include Microsoft Corporation, Tableau Software (Salesforce), SAP SE, Oracle Corporation, IBM Corporation, SAS Institute, Qlik Technologies, MicroStrategy Incorporated, Domo Inc., Zoho Corporation, Sisense Inc., ThoughtSpot Inc., Looker (Google Cloud), TIBCO Software Inc., Yellowfin International, Board International, Infor, Information Builders, Dundas Data Visualization, Inc., Logi Analytics, Pyramid Analytics, GoodData Corporation, Alteryx, Inc., InsightSquared, LLC, and Targit A/S.

The report provides a comprehensive analysis of the business intelligence software market, including an in-depth discussion of market drivers, restraints, emerging trends, regional dynamics, and future growth opportunities. It also examines competitive dynamics, technological innovations, and the evolving landscape of analytics capabilities, integration requirements, and deployment models shaping the business intelligence ecosystem.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed