Buy Now Pay Later Platforms Market Size, Share, Growth, Forecast 2032

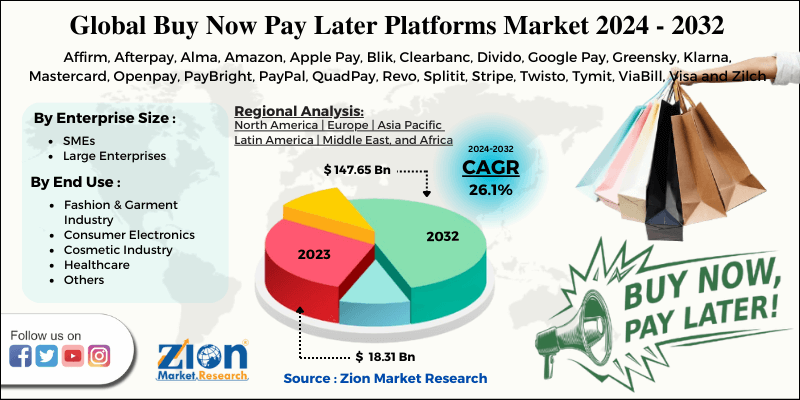

Buy Now Pay Later Platforms Market by End Use Industry (Fashion & Garment Industry, Consumer Electronics, Cosmetic Industry, Healthcare, and Others), by Enterprise Size (SMEs and Large Enterprises): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024-2032

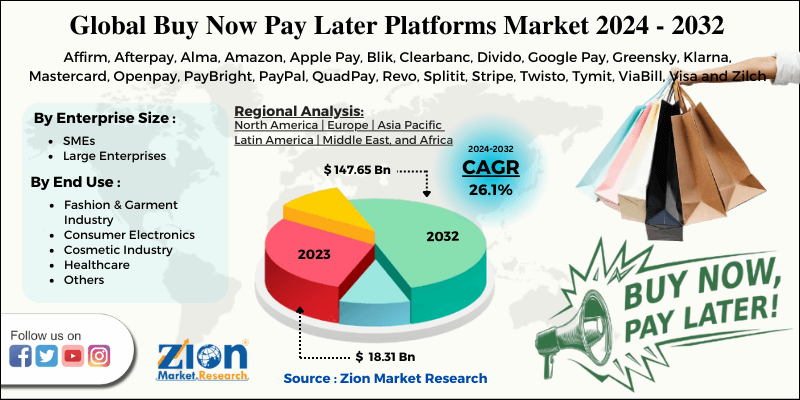

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 18.31 Billion | USD 147.65 Billion | 26.1% | 2023 |

Buy Now Pay Later Platforms Market Insights

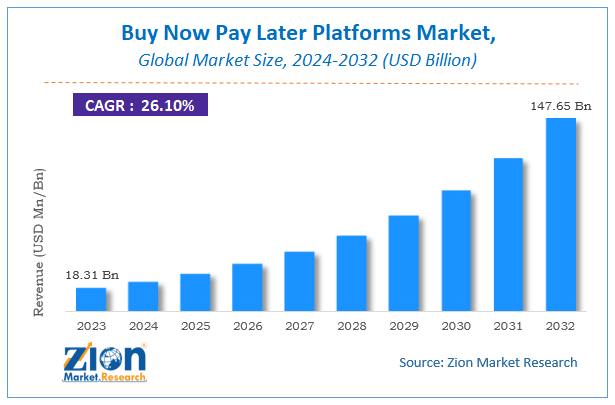

Zion Market Research has published a report on the global Buy Now Pay Later Platforms Market, estimating its value at USD 18.31 Billion in 2023, with projections indicating that it will reach USD 147.65 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 26.1% over the forecast period 2024-2032. The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Buy Now Pay Later Platforms Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Buy Now Pay Later Platforms Market: Overview

The Buy Now Pay Later Platforms market is referring to the customer taking home their purchase but paying for it over time. Of the many digital payment methods used for e-commerce transactions, a relatively new entrant Buy Now Pay Later seems to have been gaining steam. The use of the ‘buy now pay later (BNPL) facility, which allows customers to turn purchases into EMIs, is growing fast across the regions as consumers find the instrument not only convenient but also affordable. Also, the majority of millennials as the decision maker and buyer of the family have made this method of payment to gain a boost.

Request Free Sample

Request Free Sample

To know more about this report, request a sample copy.

Buy Now Pay Later Platforms Market: Growth Factors

The major factor capturing the growth of the global buy now pay later platforms market is majorly attributed to a wide number of benefits offered like easy access, option for emergency purchases, the Potential to pay no interest if payments are met on time, Lowering and removing shoppers buying hesitations, etc. the market is expected to experience significant growth in the forecasted period. Also, the empirical data shows that the pandemic year has accelerated the growth of the digital payments industry.

Users from tier 2 and tier 3 cities make the major part of users of buy now pay later platforms. Additionally, the consumer base which is chiefly consisting of Gen Z and millennials as buyers has made the payment method a trend. One of the retraining factors is complaints regarding the high late fees and mounting debts but still, the virtues of it are expected to overshadow them and grow even further in coming times. Moreover, it helps merchants to Increase average order value (AOV) and entice shoppers to make bigger ticket purchases, and increase overall sales.

Buy Now Pay Later Platforms Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Buy Now Pay Later Platforms Market |

| Market Size in 2023 | USD 18.31 Billion |

| Market Forecast in 2032 | USD 147.65 Billion |

| Growth Rate | CAGR of 26.1% |

| Number of Pages | 135 |

| Key Companies Covered | Affirm, Afterpay, Alma, Amazon, Apple Pay, Blik, Clearbanc, Divido, Google Pay, Greensky, Klarna, Mastercard, Openpay, PayBright, PayPal, QuadPay, Revo, Splitit, Stripe, Twisto, Tymit, ViaBill, Visa and Zilch |

| Segments Covered | By Enterprise Size, By End Use Industry and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Buy Now Pay Later Platforms Market: Segmentation

End Use Industry Segment Analysis Preview

Among end-use industry, the fashion & garment industry segment is expected to hold dominant position in the global buy now pay later platforms market during the forecasted period. This is due to the partnerships done by BNPL platforms with the fashion and apparels brands. For example, Afterpay was launched in May 2014, since then it has partnered with various fashion brands such as Ray-Ban, ALLY shoes, NEU Nomads, STIO, KINFLYTE, and others. The retail and online stores of mentioned brands accept Afterpay as bill payment method. Also, due to the increase in e-commerce online sites and apps accepting buy now pay later are gaining market. The consumer electronics market too accounts for the largest share in this segment as they are high in prices consumers prefer part payment or later date payment resulting in increase in usage of buy now pay later platforms.

Enterprise Size Segment Analysis Preview

Although small and medium size industries are increasing the use of buy now pay later platforms but large enterprises hold a power over other in this market. However, medium and small enterprises are expected to grow considerably in coming years with relevance to usage of buy now pay later platforms.

To know more about this report, Request For Customization.

Regional Analysis Preview

The North American region held a share of 40.2% in 2020. This is attributable to the presence of top companies such as Klarna, Afterpay, ViaBill, Twisto, Zilch, and Revo, among others.

The Asia Pacific region is projected to grow at a CAGR of 8.4% over the forecast period. This surge is due to the increasing adoption of online shopping in the region. Retailers are using buy now pay later methods to increase the customer base. Additionally, the adoption of the Internet of Things (IoT) in various industrial and business operations is expected to open new avenues for the buy now pay later platforms market over the coming years.

Buy Now Pay Later Platforms Market: Competitive Landscape

Some of the key players in the buy now pay later platforms market are

- Affirm

- Afterpay

- Alma

- Amazon

- Apple Pay

- Blik

- Clearbanc

- Divido

- Google Pay

- Greensky

- Klarna

- Mastercard

- Openpay

- PayBright

- PayPal

- QuadPay

- Revo

- Splitit

- Stripe

- Twisto

- Tymit

- ViaBill

- Visa and Zilch

- among others.

Dozens of market players now allow shoppers to order everyday items online, take delivery of them, and then pay for them over time. The Buy now pay later is also an option that’s available with e-commerce websites like Flipkart, Amazon, and BigBasket, and also players are collaborating with online players to grow the market.

The global buy now pay later platform market is segmented as follows:

By End Use Industry

- Fashion & Garment Industry

- Consumer Electronics

- Cosmetic Industry

- Healthcare

- Others

By Enterprise Size

- SMEs

- Large Enterprises

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global Buy Now Pay Later Platforms market was valued at USD 18.31 Billion in 2023.

The global Buy Now Pay Later Platforms market is expected to reach USD 147.65 Billion by 2032, growing at a CAGR of 26.1% between 2024 to 2032.

Some of the key factors driving the global Buy Now Pay Later Platforms market growth are increasing number of smartphone users, rising demand for credit payments, major population of youth and benefits from no interest terms.

North America region held a substantial share of the Buy Now Pay Later Platforms market in 2023. This is attributable to the presence of major players such as Google Pay, Amazon and Apple Buy among others. Asia Pacific region is projected to grow at a significant rate owing to the rising demand for Buy Now Pay Later Platforms in developing economies such as China and India.

Some of the major companies operating in the Buy Now Pay Later Platforms market are Affirm, Afterpay, Alma, Amazon, Apple Pay, Blik, Clearbanc, Divido, Google Pay, Greensky, Klarna, Mastercard, Openpay, PayBright, PayPal, QuadPay, among others.

Choose License Type

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed