Cable Assembly Market Size, Share, Analysis, Trends, Forecasts, 2032

Cable Assembly Market By Cable Length (Short Cable Assemblies, Medium Cable Assemblies, and Long Cable Assemblies), By Product Type (Copper Cable Assemblies, Fiber Optic Cable Assemblies, Power Cable Assemblies, Data Cable Assemblies, Signal Cable Assemblies, Ribbon Cable Assemblies, Radiofrequency (RF) Assemblies, Circular Assemblies, Printed Circuit Board (PCB) Assemblies, and Others), By Industry Vertical (Automotive, Telecommunications, Consumer Electronics, Aerospace & Defense, Healthcare, Energy & Utilities, and Others) and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

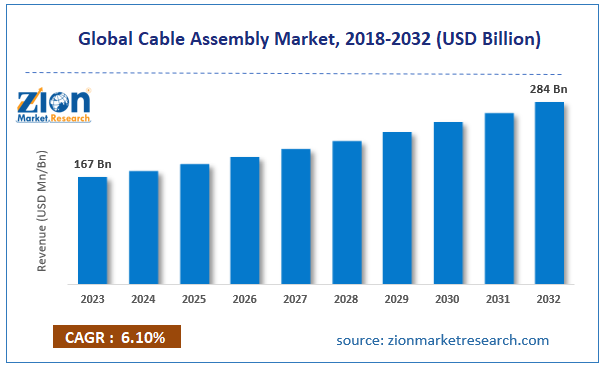

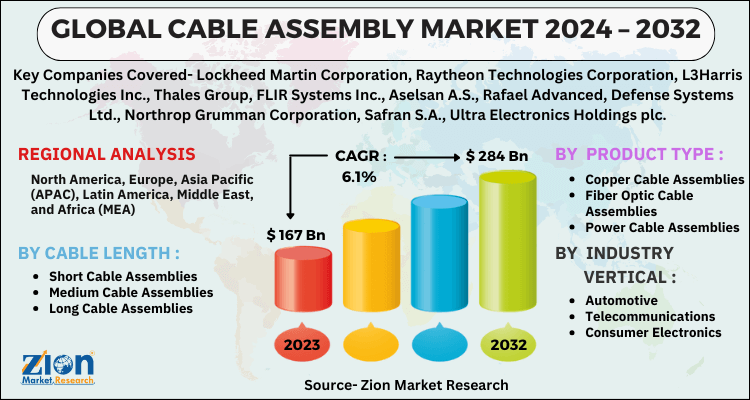

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 167 Billion | USD 284 Billion | 6.1% | 2023 |

Cable Assembly Industry Perspective:

The global cable assembly market size was worth around USD 167 billion in 2023 and is predicted to grow to around USD 284 billion by 2032 with a compound annual growth rate (CAGR) of roughly 6.1% between 2024 and 2032.

Cable Assembly Market: Overview

A cable assembly is an orderly grouping of cables or wires joined into one seamless piece, typically featuring one or more connections on the ends. These assemblies are made to constantly transmit data, messages, or electrical power while keeping a simplified and organized system. Among numerous sectors, like automotive, telecommunications, healthcare, and aerospace, cable assemblies are absolutely vital. They facilitate efficient connectivity and help one to grasp difficult wire layouts.

Apart from the wires, they comprise protective elements like connections, insulation, and shielding, so shielding against environmental risks such as moisture, heat, and electromagnetic interference (EMI). As electronic systems develop increasingly complex, innovations in electric vehicles, 5G networks, industrial automation, and medical technologies raise the demand for robust and high-performance cable assemblies.

Key Insights

- As per the analysis shared by our research analyst, the global cable assembly market is estimated to grow annually at a CAGR of around 6.1% over the forecast period (2024-2032).

- In terms of revenue, the global cable assembly market size was valued at around USD 167 billion in 2023 and is projected to reach USD 284 billion by 2032.

- The rapid rollout of 5G infrastructure is expected to drive the cable assembly market over the forecast period.

- Based on cable length, the medium cable assemblies segment is expected to dominate the cable assembly market over the forecast period.

- Based on product type, the fiber optic cable assemblies segment is expected to hold the largest market share over the forecast period.

- Based on industry vertical, the telecommunications segment is expected to capture a significant revenue share over the forecast period.

- Based on region, North America is expected to dominate the market during the forecast period.

Cable Assembly Market: Growth Drivers

Rising EV sales drive market growth

Since battery prices have decreased and EV efficiency has improved due to technological advancements, EV sales have surged over the past decade, especially in countries like the US, Germany, China, the UK, and the Netherlands. The adoption of low costs and the availability of subsidies will result in a rise in EV sales during the anticipated period. Numerous onboard systems use cable assemblies, such as the battery and power supply, ignition system, steering system, brake system, exterior and interior lighting, safety, and security.

Many more cable assemblies are used in EVs than in ICE vehicles since EVs have additional cable connections for batteries and other associated circuits. Thus, the growth in EV sales is expected to drive the development of the global cable assembly market over the forecast period.

Cable Assembly Market: Restraints

Availability of counterfeit products hinders market growth

Many end users who buy large amounts of raw materials switch to suppliers who produce counterfeit items to increase their profit margins. Many local vendors make low-quality, unbranded products or use the brands of well-known vendors due to the increased availability and lack of product differentiation. The presence of such counterfeit items affects foreign merchants' sales and reputations.

The small capital investment required allows many providers to manufacture cable assemblies and sell them under respectable brand names. Vendors sell fake cable assemblies at a discount to increase sales. Fake goods have become more widely available due to several factors, including minimal starting investment, a huge number of product variations, strong aftermarket demand, and extensive raw material availability. These factors are impeding the growth of the global cable assembly sector.

Cable Assembly Market: Opportunities

Increasing product launches offers a lucrative opportunity for market growth

The cable assembly industry is driven by the rising product launch. For instance, in September 2023, USB-C's tiny size, ubiquitous and easy-to-use connectors, and ability to handle a variety of data protocols, including USB4, Thunderbolt, and DisplayPort, are the reasons for its quick industrial adoption.

Furthermore, USB-C is the preferred power connector for a wide range of applications due to its capacity to deliver up to 240 W of power. Infineon Technologies AG unveiled the EZ-PDTM CMG2, a USB-C Electronically-Marked Cable Assembly (eMarker) controller with improved functionality, to satisfy the growing need for reliable end-to-end power distribution and data transfer capabilities for contemporary mobile devices. The controller is made to provide reliable USB-C Power Delivery (PD) solutions for Thunderbolt passive cables, USB-C, USB4, and Extended Power Range (EPR) USB-C applications.

The most extensive selection of USB-C power supply options in the market is Infineon's EZ-PD line of USB-C PD controllers. The EZ-PD CMG2 (Cable Marker Generation 2) is a specialized eMarker controller that supports USB-PD 3.1 and Type-C 2.1 standards and is made for passive non-Thunderbolt and Thunderbolt Type-C cables. Up to 240 W (48 V/5 A) of power and USB4 and TBT4 data speeds can be handled using EZ-PD CMG2-based USB-C eMarker cables. The EZ-PD CMG2 has built-in protection against short circuits from V BUS to V CONN and V BUS to V CC up to 54 V. It also incorporates an oscillator and IEC ESD (electrostatic discharge) protection, which removes the requirement for an external clock and external ESD, respectively, and supports R A weakening to save power consumption.

Cable Assembly Market: Challenges

Competition from wireless technologies poses a major challenge to market expansion

The cable assembly market is facing a big threat from the emergence of wireless technology, which will affect demand for the product in several industries. The necessity for cable assemblies in networking and communication is decreased by technologies like Wi-Fi, Bluetooth, and Zigbee that do not require physical connections. Compared to wired systems, wireless systems are frequently simpler to install and maintain, particularly in settings that are difficult to reach or complex.

Request Free Sample

Request Free Sample

Cable Assembly Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Cable Assembly Market |

| Market Size in 2023 | USD 167 Billion |

| Market Forecast in 2032 | USD 284 Billion |

| Growth Rate | CAGR of 6.1% |

| Number of Pages | 223 |

| Key Companies Covered | Lockheed Martin Corporation, Raytheon Technologies Corporation, L3Harris Technologies Inc., Thales Group, FLIR Systems Inc., Aselsan A.S., Rafael Advanced, Defense Systems Ltd., Northrop Grumman Corporation, Safran S.A., Ultra Electronics Holdings plc, Israel Aerospace Industries Ltd., Leonardo S.p.A., Jenoptik AG, Sagem Defense Securite, Terma A/S, Elbit Systems Ltd., Qioptik Ltd., Rheinmetall AG, UTC Aerospace Systems, Kollsman Inc., and others. |

| Segments Covered | By Cable Length, By Product Type, By Industry Vertical, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Cable Assembly Market: Segmentation

The global cable assembly industry is segmented based on cable length, product type, industry vertical, and region.

Based on cable length, the global cable assembly market is segmented into short cable assemblies, medium cable assemblies, and long cable assemblies. The medium cable assemblies segment is expected to dominate the cable assembly market over the forecast period. The growing adoption of electric vehicles (EVs) and hybrid vehicles has led to increased demand for medium cable assemblies to support charging systems, battery connections, and internal systems.

Based on product type, the global cable assembly industry is bifurcated into copper cable assemblies, fiber optic cable assemblies, power cable assemblies, data cable assemblies, signal cable assemblies, ribbon cable assemblies, Radiofrequency (RF) assemblies, circular assemblies, Printed Circuit Board (PCB) assemblies, and others. The fiber optic cable assemblies segment is expected to hold the largest market share over the forecast period. The need for fiber optic cable assemblies to support the backbone infrastructure has increased dramatically as a result of the global rollout of 5G networks. Sustained demand is driven by fiber-to-the-home (FTTH) programs and rising broadband penetration.

Based on the industry vertical, the global cable assembly market is bifurcated into automotive, telecommunications, consumer electronics, aerospace & defense, healthcare, energy & utilities, and others. The telecommunications segment is expected to capture a significant revenue share over the forecast period. To manage the massive volumes of data and guarantee high-speed, low-latency connections, the deployment of 5G networks demands sophisticated cable assemblies, especially fiber optic cables and high-performance copper cables. Telecom businesses are making significant investments in infrastructure, such as small cell networks and fiber optic backhaul, which need specific cable assemblies for reliable connectivity.

Cable Assembly Market: Regional Analysis

North America dominates the market over the projected period

North America is expected to dominate the global cable assembly market. Cable assemblies, especially fiber optic and high-speed copper cables, are driven by the continuous implementation of 5G networks in North America. These assemblies are necessary to enable small cell networks and connect base stations and data centers.

The market for telecom cable assemblies is further driven by the rising demand for broadband and high-speed internet services in urban and rural locations. Furthermore, the need for specialty cable assemblies is fueled by the growth of electric vehicles (EVs) and the increased emphasis on automotive electrification in North America. Electric drivetrains, battery management systems, and high-voltage power transmission all require these assemblies.

Cable Assembly Market: Competitive Analysis

The global cable assembly market is dominated by players like:

- Lockheed Martin Corporation

- Raytheon Technologies Corporation

- L3Harris Technologies Inc.

- Thales Group

- FLIR Systems Inc.

- Aselsan A.S.

- Rafael Advanced

- Defense Systems Ltd.

- Northrop Grumman Corporation

- Safran S.A.

- Ultra Electronics Holdings plc

- Israel Aerospace Industries Ltd.

- Leonardo S.p.A.

- Jenoptik AG

- Sagem Defense Securite

- Terma A/S

- Elbit Systems Ltd.

- Qioptik Ltd.

- Rheinmetall AG

- UTC Aerospace Systems

- Kollsman Inc.

The global cable assembly market is segmented as follows:

By Cable Length

- Short Cable Assemblies

- Medium Cable Assemblies

- Long Cable Assemblies

By Product Type

- Copper Cable Assemblies

- Fiber Optic Cable Assemblies

- Power Cable Assemblies

- Data Cable Assemblies

- Signal Cable Assemblies

- Ribbon Cable Assemblies

- Radiofrequency (RF) Assemblies

- Circular Assemblies

- Printed Circuit Board (PCB) Assemblies

- Others

By Industry Vertical

- Automotive

- Telecommunications

- Consumer Electronics

- Aerospace & Defense

- Healthcare

- Energy & Utilities

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A cable assembly is an orderly grouping of cables or wires joined into one seamless piece, typically featuring one or more connections on the ends. These assemblies are made to constantly transmit data, messages, or electrical power while keeping a simplified and organized system.

The cable assembly market is driven by the increasing demand for EVs, technological advancements, investment, rapid rollout of 5G infrastructure, and increasing collaboration among the key market players.

According to the report, the global cable assembly market size was worth around USD 167 billion in 2023 and is predicted to grow to around USD 284 billion by 2032.

The global cable assembly market is expected to grow at a CAGR of 6.1% during the forecast period.

The global cable assembly market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market due to the increasing investment in advanced technology and the presence of major players.

Players like Lockheed Martin Corporation, Raytheon Technologies Corporation, L3Harris Technologies, Inc., Thales Group, FLIR Systems, Inc., Aselsan A.S., Rafael Advanced, Defense Systems Ltd., Northrop Grumman Corporation, Safran S.A., Ultra Electronics Holdings plc, Israel Aerospace Industries Ltd., Leonardo S.p.A., Jenoptik AG, Sagem Defense Securite, Terma A/S, Elbit Systems Ltd., Qioptik Ltd., Rheinmetall AG, UTC Aerospace Systems and Kollsman, Inc. among others dominate the global cable assembly market.

The cable assembly market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed