Calcium Acetate Market Size, Share, Trends and Forecast, 2028

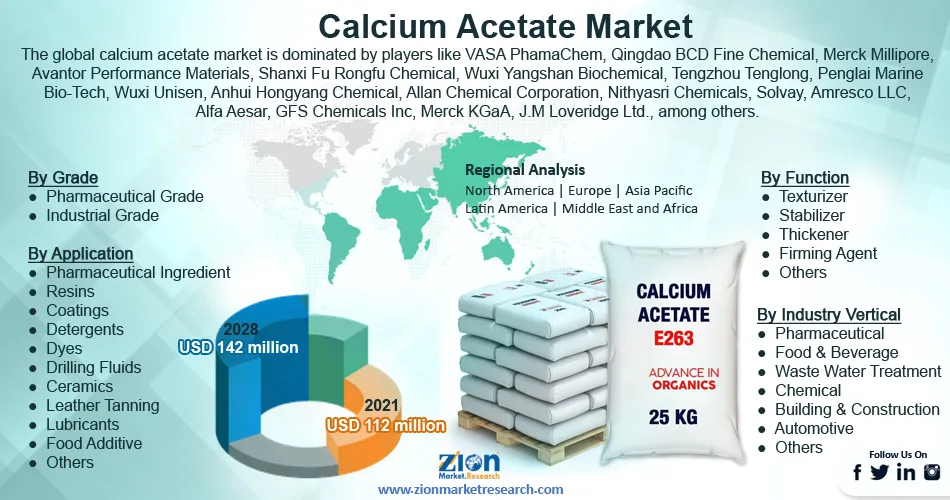

Calcium Acetate Market By Grade (Pharmaceutical Grade and Industrial Grade), By Function (Texturizer, Stabilizer, Thickener, Firming Agent and Others), By Application (Pharmaceutical Ingredient, Resins, Coatings, Detergents, Dyes, Drilling Fluids, Ceramics, Leather Tanning, Lubricants, Food Additive and Others), By Industry Vertical (Pharmaceutical, Food & Beverage, Waste Water Treatment, Chemical, Building & Construction, Automotive and Others) and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2022 - 2028

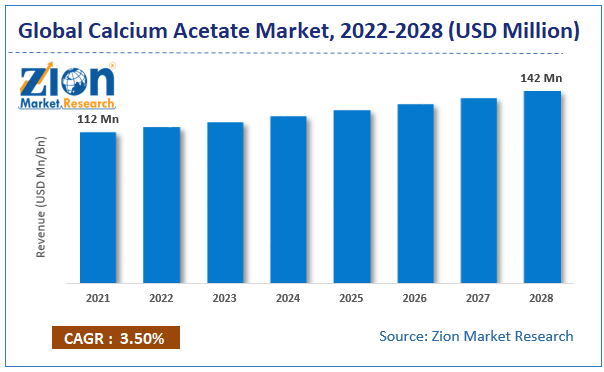

| Market Size in 2021 | Market Forecast in 2028 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 112 Million | USD 142 Million | 3.5% | 2021 |

Calcium Acetate Market Size & Industry Analysis:

The global calcium acetate market size was worth around USD 112 million in 2021 and is predicted to grow to around USD 142 million by 2028 with a compound annual growth rate (CAGR) of roughly 3.5% between 2022 and 2028. The report analyzes the global calcium acetate market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the calcium acetate market.

Calcium Acetate Market: Overview

Calcium acetate is a type of chemical compound that is a salt of the acetic acid family. It is also called vinegar salt, lime acetate, and brown acetate. Calcium acetate does not have any odor and is white. It's a crystalline solid structure that is easily soluble in water and is not soluble in solvents like benzene, ethanol, and acetone. It has wide applications in the pharmaceutical and industrial sectors. It possesses a low level of toxicity, but it can irritate if exposed to the eyes or skin for a longer period. It is majorly available in hydrate forms. Moreover, the anhydrous form crystallizes when it comes in contact with moist air. Calcium acetate emits acetone gas, which is highly flammable when burned.

Key Insights

- As per the analysis shared by our research analyst, the global calcium acetate market is estimated to grow annually at a CAGR of around 3.5% over the forecast period (2022-2028).

- In terms of revenue, the global calcium acetate market size was valued at around USD 112 million in 2021 and is projected to reach USD 142 million, by 2028.

- The calcium acetate market is growing due to increasing demand from the pharmaceutical sector is expected to drive the market growth during the forecast period.

- Based on the grade, the pharmaceutical grade accounted for the largest market share in 2021.

- Based on the application, the pharmaceutical ingredient segment is projected to dominate the market during the forecast period.

- Based on the industry vertical, the pharmaceutical industry segment is projected to hold the majority of the market share during the forecast period.

- Based on region, Asia Pacific is expected to dominate the market during the forecast period.

To know more about this report, request a sample copy.

Calcium Acetate Market: Growth Drivers

Growing bakery industry to drive the market growth

Molds and rope bacteria flourish in bread products due to their high moisture content. Calcium acetate inhibits the growth of several bacteria and molds. As a result, to increase the shelf life of bread and other bakery items and prevent rope formation, calcium acetate, a compound of acetic acid and calcium salt, is frequently employed in those products.

The bakery sector is expanding as a result of causes including rising consumer preference for convenience foods, nutritional values, and more. For instance, the China Chain Store Association reports that the number of dessert and bakery franchisees is increasing in China. 2019 will see a 95% increase in bakery and dessert store franchises in China's Tier 1 and Tier 2 cities, and in Tier 3 and Tier 4 cities, it was 43%. Additionally, according to the Federation of Bakers Ltd., the production of breakfast and snack baked goods in the United Kingdom increased from 1.09 billion units in 2020 to 1.18 billion units in 2021, a 7.6% increase. As a result, the demand for calcium acetate is increasing due to the expansion of the baking industry. This is fueling market expansion.

Calcium Acetate Market: Restraints

The high price of calcium acetate might be hampering the market growth

High freight costs, a lack of available shipping containers, and the spike in calcium acetate prices as a result of the global business effect of rising acetate prices all contributed to the expanding calcium acetate pricing trend. As an example, the monthly average price for calcium acetate IR Grade CFR-Kandla in September 2021 was US$1946.13 per MT, a slight rise from July 2021. Thus, the high prices of calcium acetate are expected to hamper the market growth during the forecast period.

Calcium Acetate Market: Opportunities

Increasing application in the pharmaceutical industry is expected to flourish the market expansion

Increasing application in the pharmaceutical industry to treat End-Stage Renal Disease (ESRD) is expected to flourish the growth of the market during the forecast period. To lower excessive blood phosphorus levels in dialysis patients with end-stage renal disease, calcium acetate is used in medications (ESRD). The crucial reasons speeding the rise in end-stage renal disease (ESRD) cases include the growing number of diabetes patients and the rising number of high blood pressure cases.

For instance, the National Institute of Diabetes and Digestive and Renal Diseases (NIDDK) estimates that approximately 2 out of 1,000 Americans will have end-stage kidney disease in 2021. (ESKD). Additionally, 134,608 people were assessed to have the end-stage renal disease (ESRD) in 2019, up 2.7% from 2018, according to the most recent United States Renal Data System (USRDS) report.

Calcium Acetate Market: Challenges

The availability of substitutes act as a challenge for the market expansion

Calcium carbonate, phoslyra, calphron, and other substances can be used in place of calcium acetate. These alternatives have a number of the same features as calcium acetate and in some cases even better ones. Calcium carbonate, for instance, has several crucial qualities, including superior light scattering ability, great brightness, and cheaper costs. As a result, calcium carbonate is chosen over calcium acetate for use in application industries like textile, construction, and other applications. Thus, the availability of substitute act as a major challenge for market expansion.

Calcium Acetate Market: Segmentation

The global calcium acetate market is segmented based on grade, function, application, industry verticals and region

Based on the grade, the global market is bifurcated into pharmaceutical grade and industrial grade. The pharmaceutical grade segment accounted for the largest market share in 2021 and is expected to show its dominance during the forecast period. Pharmaceutical grade calcium acetate can be utilized as a phosphate binder in the treatment of Hyperphosphatemia (high blood phosphorus levels), as well as in laboratory reagents for the manufacture of anti-epileptic drugs. However, the industrial grade is expected to grow at the highest CAGR over the forecast period.

Calcium acetate of industrial grade is used in the manufacture of lubricants, carbon black and resins for printing ink, calcium soap, as a gelling agent, in water treatment, as a concrete accelerator, and as a PVC foam blowing agent. The product is also utilized as a calcium source in fertilizers, with a minimum calcium (Ca) content of 23.8% (33.4% expressed as CaO). Thus, driving segmental growth.

Based on application, the market is segmented into pharmaceutical ingredients, resins, coatings, detergents, dyes, drilling fluids, ceramics, leather tanning, lubricants, food additive and others. The pharmaceutical ingredient is expected to lead the market over the projected period. To lessen the body's absorption of phosphate, calcium acetate, a chemical substance that is the calcium salt of acetic acid, is used as a phosphate binder in medicinal products.

Patients with end-stage renal disease (ESRD) whose kidneys are unable to filter out the phosphates contained in common meals due to hyperphosphatemia are treated with calcium acetate-containing medications. Additionally, neither kidney dialysis nor hemodialysis can entirely rid the body of all phosphorus.

The majority of meals and drinks contain phosphates, which combine with calcium acetate to form insoluble calcium phosphate complexes that are expelled from the body. Less phosphorus is absorbed by the body as a result, which lowers the phosphorus levels in the blood. Thus, owing to these benefits the application of pharmaceutical ingredients is increasing.

Based on industry vertical, the global calcium acetate market is bifurcated into the pharmaceutical, food & beverage, wastewater treatment, chemical, building & construction, automotive and others. The pharmaceutical segment is projected to hold the majority of the market share during the forecast period. In the pharmaceutical sector, calcium acetate is used to treat hyperphosphatemia in dialysis-dependent patients with end-stage kidney disease.

The pharmaceutical sector is expanding quickly due to causes including the rising need for renal disease medications, the expansion of contemporary technologies, and other related aspects. For instance, the European Federation of Pharmaceutical Industries and Associations (EFPIA) estimates that the total production of pharmaceuticals in Europe in 2020 was EURO 310,000,000,000 (roughly US$354,080.76,000,000), an increase of 5.7% over 2019.

This figure includes medications for kidney diseases. As a result, it is anticipated that the pharmaceutical industry's expansion will increase demand for calcium acetate. As a result, during the anticipated forecast period, market growth will accelerate.

Recent Developments:

- In June 2021, Kerry Group PLC announced it has reached an agreement to acquire Hare Topco, Inc., which does business as Niacet Corp., from an affiliate of investment funds advised by SK Capital Partners and other shareholders. Based in Niagara Falls, NY, Niacet specializes in preservation technologies and is a category leader in the baking and pharmaceutical segments. Niacet products in baking preservation and quality enhancement include calcium propionate, sodium propionate, the Proniaturel line of antimicrobial additives, calcium stearoyl lactylate, calcium acetate and potassium propionate.

Calcium Acetate Market Report Scope:

| Report Attributes | Report Details |

|---|---|

| Report Name | Calcium Acetate Market Research Report |

| Market Size in 2021 | USD 112 Million |

| Market Forecast in 2028 | USD 142 Million |

| Compound Annual Growth Rate | CAGR of 3.5% |

| Number of Pages | 177 |

| Forecast Units | Value (USD Million), and Volume (Units) |

| Key Companies Covered | VASA PhamaChem, Qingdao BCD Fine Chemical, Merck Millipore, Avantor Performance Materials, Shanxi Fu Rongfu Chemical, Wuxi Yangshan Biochemical, Tengzhou Tenglong, Penglai Marine Bio-Tech, Wuxi Unisen, Anhui Hongyang Chemical, Allan Chemical Corporation, Nithyasri Chemicals, Solvay, Amresco LLC, Alfa Aesar, GFS Chemicals Inc, Merck KGaA, J.M Loveridge Ltd., among others. |

| Segments Covered | By Grade, By Function, By Application, By Industry Vertical and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East and Africa (MEA) |

| Countries Covered | North America: U.S and Canada Europe: Germany, Italy, Russia, U.K, Spain, France, Rest of Europe APAC: China, Australia, Japan, India, South Korea, South East Asia, Rest of Asia Pacific Latin America: Brazil, Argentina, Chile The Middle East And Africa: South Africa, GCC, Rest of MEA |

| Base Year | 2021 |

| Historical Year | 2016 to 2020 |

| Forecast Year | 2022 - 2028 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Calcium Acetate Market: Regional Analysis

The Asia Pacific is expected to dominate the market during the forecast period

Asia-Pacific is the dominant region as it accounted for more than 40% of the global calcium acetate market in 2021 and is expected to show the same pattern over the forecast period. The expansion of numerous industries, including pharmaceuticals, food & beverage, and others, has contributed to the sectoral growth of the Asia-Pacific region.

The expansion of the pharmaceutical industry in the Asia-Pacific region is ascribed to several factors, including continued research and development on drugs for renal patients, the creation of specialist hospitals for kidney patients, and others. For instance, according to the International Trade Administration, the pharmaceuticals market, including medicines for kidney diseases in Vietnam is expected to grow by a 10% annual rate from 2017 to 2028, with revenues per capita virtually tripling in ten years from 2017 to 2027.

Furthermore, according to a recent report by the United States Renal Data System (USRDS), an organization for collecting data on end-stage renal disease (ESRD), in 2019, treated ESRD cases were reported in some Asian nations, including Taiwan (529 per million people), Thailand (377 per million people), South Korea (360 per million people), and others. As a result, the demand for calcium acetate is being fueled by the expansion of the pharmaceutical industry and the rise in end-stage renal disease (ESRD) patients in the Asia-Pacific region.

Calcium Acetate Market: Competitive Analysis

The global calcium acetate market is dominated by players like:

- VASA PhamaChem

- Qingdao BCD Fine Chemical

- Merck Millipore

- Avantor Performance Materials

- Shanxi Fu Rongfu Chemical

- Wuxi Yangshan Biochemical

- Tengzhou Tenglong

- Penglai Marine Bio-Tech

- Wuxi Unisen

- Anhui Hongyang Chemical

- Allan Chemical Corporation

- Nithyasri Chemicals

- Solvay

- Amresco LLC

- Alfa Aesar

- GFS Chemicals Inc

- Merck KGaA

- J.M Loveridge Ltd., among others.

The global calcium acetate market is segmented as follows:

By Grade

- Pharmaceutical Grade

- Industrial Grade

By Function

- Texturizer

- Stabilizer

- Thickener

- Firming Agent

- Others

By Application

- Pharmaceutical Ingredient

- Resins

- Coatings

- Detergents

- Dyes

- Drilling Fluids

- Ceramics

- Leather Tanning

- Lubricants

- Food Additive

- Others

By Industry Vertical

- Pharmaceutical

- Food & Beverage

- Waste Water Treatment

- Chemical

- Building & Construction

- Automotive

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The rapid proliferation of the food & beverage sector propels the demand for calcium acetate and thus boosts the global calcium acetate market. It is majorly utilized as a preservative in the food & beverage sector for improving the shelf life of food products like processed meat and baked products.

According to the report, the global calcium acetate market size was worth around USD 112 million in 2021 and is predicted to grow to around USD 142 million by 2028 with a compound annual growth rate (CAGR) of roughly 3.5% between 2022 and 2028.

The global calcium acetate market growth is expected to be driven by the Asia Pacific. It is currently the world’s highest revenue-generating market owing to the expansion of the pharmaceutical industry and a growing population that are prone to infectious disease.

The global calcium acetate market is dominated by players like VASA PhamaChem, Qingdao BCD Fine Chemical, Merck Millipore, Avantor Performance Materials, Shanxi Fu Rongfu Chemical, Wuxi Yangshan Biochemical, Tengzhou Tenglong, Penglai Marine Bio-Tech, Wuxi Unisen, Anhui Hongyang Chemical, Allan Chemical Corporation, Nithyasri Chemicals, Solvay, Amresco LLC, Alfa Aesar, GFS Chemicals Inc, Merck KGaA, J.M Loveridge Ltd., among others.

Choose License Type

List of Contents

Market Size Industry Analysis:OverviewTo know more about this report,request a sample copy.Growth DriversRestraintsOpportunitiesChallengesSegmentationRecent Developments:Market Report Scope:Regional AnalysisCompetitive AnalysisThe global calcium acetate market is segmented as follows:RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed