Cannabis Cosmetics Market Size, Share, Analysis, Trends, Growth, Forecasts, 2032

Cannabis Cosmetics Market By Product (Makeup & Haircare, Skincare, Fragrances, and Others), By Source (Marijuana and Hemp), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

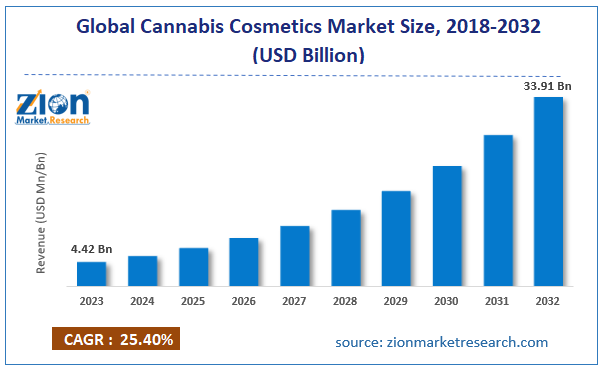

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.42 Billion | USD 33.91 Billion | 25.40% | 2023 |

Cannabis Cosmetics Industry Prospective:

The global cannabis cosmetics market size was worth around USD 4.42 billion in 2023 and is predicted to grow to around USD 33.91 billion by 2032 with a compound annual growth rate (CAGR) of roughly 25.40% between 2024 and 2032.

Cannabis Cosmetics Market: Overview

The cannabis cosmetics industry is an emerging segment of the global cosmetics and personal care industry. It deals with personal care products made using cannabis-derived ingredients. The most common elements of cannabis plants used in cosmetic products are hemp seed oil, cannabidiol (CBD), and tetrahydrocannabinol (THC). Cannabidiol is the preferred ingredient by several key players. Cosmetic items made using cannabis-based ingredients are known to have several benefits. For instance, CBD offers hydrating and anti-oxidant properties. Additionally, it is also known to impart anti-aging and anti-sebum characteristics to the products. The market for cannabis cosmetics is growing at a steady pace, but the industry is heavily regulated. For instance, CBD is allowed to be used as an ingredient in certain countries in cosmetic products. However, THC is considered a contaminant and hence tetrahydrocannabinol presence in products is extensively regulated. During the forecast period, the cannabis cosmetics industry is projected to generate higher growth revenue but will face challenges due to complex rules and regulations governing the use of cannabis.

Key Insights:

- As per the analysis shared by our research analyst, the global cannabis cosmetics market is estimated to grow annually at a CAGR of around 25.40% over the forecast period (2024-2032)

- In terms of revenue, the global cannabis cosmetics market size was valued at around USD 4.42 billion in 2023 and is projected to reach USD 33.91 billion by 2032.

- The cannabis cosmetics market is projected to grow at a significant rate due to the rising demand for natural cosmetic products with fewer chemicals

- Based on the product, the makeup & hair care products segment is growing at a high rate and will continue to dominate the global market as per industry projection

- Based on the source, the hemp segment is anticipated to command the largest market share

- Based on region, North America is projected to dominate the global market during the forecast period

Request Free Sample

Request Free Sample

Cannabis Cosmetics Market: Growth Drivers

Rising demand for natural cosmetic products with fewer chemicals will drive the market demand rate

The global cannabis cosmetics market is expected to be driven by the rising demand among consumers for natural ingredients-rich cosmetic items. Most brands offering personal care and makeup products are chemically loaded. Depending on the product and its applications, chemical components may vary. However, the majority of products contain some form of preservatives such as parabens, emulsifiers such as polysorbates, and surfactants such as Sodium Lauryl Sulfate (SLS). Although these chemicals enhance the effect of cosmetic products, they are also known to be harmful to human health and the environment. For instance, leading welfare organizations such as the Food & Drugs Administration (FDA) and Environmental Protection Agency (EPA) have reported coal tar as a Human Carcinogen. Coal tar is regularly used in cosmetic products and personal care items. Long-term exposure to coal tar is linked to several cancers. In March 2024, Valisure LLC, a leading independent testing laboratory, filed a petition with the US FDA. The agency found the presence of high levels of chemical benzene in products sold by leading brands such as Clearasil, Clinique, and Proactiv. Valisure has requested a recall of these products. Such events are likely to promote the adoption of natural cosmetic products since they limit the use of harmful ingredients.

Product innovation, surge in social media influence, and impact of e-commerce sales to drive market revenue rate

The demand for cannabis cosmetics is expected to benefit from the surge in product innovation. Cosmetic companies are actively investing in research activities to innovate and explore new ingredients that deliver optimal results with minimal to zero side effects. In April 2019, Lime Crime, a leading cosmetic brand, launched a new line of lipstick made using cannabis sativa seed oil. In addition to this, the rise of celebrity-owned beauty brands and the growing impact of social media influence may further promote regional market expansion. In recent times, several celebrities worldwide have forayed into the beauty industry, creating growth opportunities for cannabis cosmetics. Additionally, the impact of the thriving e-commerce sector cannot be ignored, as online sales are pivotal to shaping the global cannabis cosmetics market during the projection period.

Cannabis Cosmetics Market: Restraints

Strict government regulations and compliance issues will limit the market’s growth rate

The global industry for cannabis cosmetics is expected to be limited due to the strict regulations surrounding cannabis cultivation. Several countries across the globe have banned the cultivation and use of cannabis in any form. These nations include India, Iceland, Hong Kong, and several others. In addition to this, other countries have legalized the use of medicinal CBD only. The compliance regulations surrounding cannabis and derived products are highly dynamic. It changes from one region to another, even in the same country. Ensuring compliance with complex regulatory frameworks can be difficult.

Cannabis Cosmetics Market: Opportunities

Changing regional stance toward cannabis may generate more growth opportunities

The global cannabis cosmetics market can benefit from the recent and expected changes in regional regulations regarding the use of cannabis and its derived ingredients. For instance, in June 2021, New York State in the US legalized recreational use of marijuana among adults. According to the new law, New York citizens over the age of 21 are allowed to have up to three ounces of marijuana for recreational purposes. In 2022, the Food & Drugs Administration unit of Thailand voted for the removal of hemp and marijuana from the Category 5 narcotics list. This move allowed the decriminalization of the substances. In February 2024, Germany legalized the recreational consumption of cannabis for people over the age of 18 years. As the regional governments continue to change their stance on cannabis, the market players will get more opportunities to expand.

Cannabis Cosmetics Market: Challenges

Competition from other natural cosmetic products will challenge the market expansion trend

Cannabis cosmetics offer significant benefits since they contain natural ingredients. However, the current global cosmetic industry is filled with several other natural alternatives that are readily available. The cosmetics and personal care industry is heavily saturated making it difficult for new entrants to leave a mark. Additionally, access to cannabis ingredients in the backdrop of changing international relationships and supply chain disruptions is a major growth limitation for the cannabis cosmetics industry players.

Cannabis Cosmetics Market: Segmentation

The global cannabis cosmetics market is segmented based on product, source, and region.

Based on the product, the global market segments are makeup & haircare, skincare, fragrances, and others. In 2023, the highest growth was witnessed in makeup & hair care products. The surge in the number of makeup users globally driven by rising population and changes in consumer preferences is driving the segmental demand. On average, CBD content in makeup products ranges between 0.1% and 2%. The fragrance segment has been growing over the forecast period. Product innovation is crucial for the fragrance segment to generate greater revenue in the coming years.

Based on the source, the cannabis cosmetics industry divisions are marijuana and hemp. In 2023, the highest demand was registered in the hemp segment. The segmental demand is a result of the legal status of the source in several parts of the world. The THC content in hemp is less than 0.3%, making the ingredient a preferred choice to be incorporated in cosmetic items. Marijuana has higher THC content and does not enjoy the benefits of legal content in the majority parts of the world.

Cannabis Cosmetics Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Cannabis Cosmetics Market |

| Market Size in 2023 | USD 4.42 Billion |

| Market Forecast in 2032 | USD 33.91 Billion |

| Growth Rate | CAGR of 25.40% |

| Number of Pages | 224 |

| Key Companies Covered | Hempz, Lord Jones, High Beauty, Milk Makeup, Cannuka, Saint Jane Beauty, Josie Maran, Leef Organics, CBD for Life, Herb Essntls, The Body Shop, Kush Queen, MGC Derma, Vertly, Kiehl's., and others. |

| Segments Covered | By Product, By Source, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Cannabis Cosmetics Market: Regional Analysis

North America to deliver the best results during the projection period

The global cannabis cosmetics market is expected to be led by North America during the projection period. Cannabis is legalized in several parts of the US and Canada, making it legally easier for companies to incorporate cannabis ingredients in cosmetic products. According to market research, around 24 states in the US have legalized the use of cannabis. In addition, the regional market trend is further promoted by the presence of a large and internationally dominant cosmetic sector. Global brands such as Maybelline, Fenty Beauty, Glossier, e.l.f cosmetics, and Estee Lauder originate from the US. The expansion of cannabis-related research programs in North America can prove beneficial for the industry players. In August 2024, the Cannabis Research Coalition (CRC), an advocate of cannabis research and studies based in the US, announced a partnership with Sollum Technologies. The latter has provided CRC with Sollum®'s dynamic lighting solution across its facilities.

Europe is a growing market for cannabis cosmetics. The growing regional demand for natural cosmetic products will fuel the demand rate. Additionally, product innovation, higher consumer awareness, and increased sales through regional e-commerce channels will aid in higher revenue in Europe. In July 2022, Cann Global, an Australian medical cannabis expert, launched FussPot in the French market. The brand consists of hemp and CBD-based skin care products.

Cannabis Cosmetics Market: Competitive Analysis

The global cannabis cosmetics market is led by players like:

- Hempz

- Lord Jones

- High Beauty

- Milk Makeup

- Cannuka

- Saint Jane Beauty

- Josie Maran

- Leef Organics

- CBD for Life

- Herb Essntls

- The Body Shop

- Kush Queen

- MGC Derma

- Vertly

- Kiehl's.

The global cannabis cosmetics market is segmented as follows:

By Product

- Makeup & Haircare

- Skincare

- Fragrances

- Others

By Source

- Marijuana

- Hemp

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The cannabis cosmetics industry is an emerging segment of the global cosmetics and personal care industry.

The global cannabis cosmetics market is expected to be driven by the rising demand among consumers for natural ingredients-rich cosmetic items.

According to study, the global cannabis cosmetics market size was worth around USD 4.42 billion in 2023 and is predicted to grow to around USD 33.91 billion by 2032.

The CAGR value of the cannabis cosmetics market is expected to be around 25.40% during 2024-2032.

The global cannabis cosmetics market is expected to be led by North America during the projection period.

The global cannabis cosmetics market is led by players like Hempz, Lord Jones, High Beauty, Milk Makeup, Cannuka, Saint Jane Beauty, Josie Maran, Leef Organics, CBD for Life, Herb Essntls, The Body Shop, Kush Queen, MGC Derma, Vertly and Kiehl's.

The report explores crucial aspects of the cannabis cosmetics market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed