Carotenoids Market Size, Share, Growth, Trends, and Forecast 2030

Carotenoids Market By Type (Lutein, Beta-carotene, Lycopene, Astaxanthin, Capsanthin, Canthaxanthin, Annatto, Zeaxanthin, And Other Types), By Source (Natural And Synthetic), By Application (Animal Feed, Food & Beverage, Dietary Supplement, Cosmetics, Pharmaceuticals, And Other Applications), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2023 - 2030

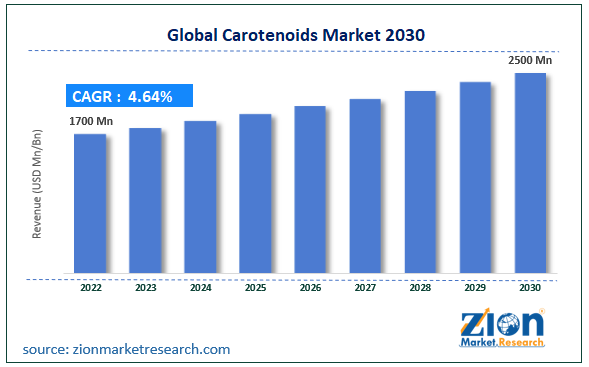

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1700 million | USD 2500 million | 4.64% | 2022 |

Carotenoids Industry Prospective:

The global carotenoids market size was worth around USD 1700 million in 2022 and is predicted to grow to around USD 2500 million by 2030 with a compound annual growth rate (CAGR) of roughly 4.64% between 2023 and 2030.

Carotenoids Market: Overview

Carotenoids are bioactive agents, which are used in dietary supplement manufacturing & cosmetic formulations. In addition, carotenoids are one of the most important classes of pigments, derived from both synthetic & natural sources. Carotenoids are lipid-soluble C-40 tetraterpenoids. Most of the carotenoids are derived from a C-40 (carbon-40) polyene chain, which is considered the backbone of the molecule. Specifically, the usage of beta-carotene, astaxanthin, lycopene, zeaxanthin, lutein, and canthaxanthin has been increasing for pharmaceutical & nutraceutical applications in recent years.

Dietary carotenoids are used for the prevention of different diseases such as cardiovascular disease, cancers, and eye disease, among others. Various manufacturing firms are investing to expand their production capacity to produce Carotenoids. For instance, in January 2022, Lycored announced a processing facility in Branchburg, New Jersey, United States for its carotenoids, vitamins, and other related products. In addition, rising demand trends in the nutraceutical & food & beverage industry are supporting the carotenoids industry’s growth.

Key Insights

- As per the analysis shared by our research analyst, the global carotenoids market is estimated to grow annually at a CAGR of around 4.64% over the forecast period (2023-2030).

- In terms of revenue, the global carotenoids market size was valued at around USD 1700 million in 2022 and is projected to reach USD 2500 million, by 2030.

- The global carotenoids market is projected to grow at a significant rate due to the rising demand trends in the nutraceutical & food & beverage industry.

- Based on type segmentation, beta-carotene was predicted to show maximum market share in the year 2022.

- Based on source segmentation, Synthetic was the leading revenue-generating source in 2022.

- Based on application segmentation, food & beverage was the leading revenue-generating application in 2022.

- On the basis of region, Asia Pacific was the leading revenue generator in 2022.

Carotenoids Market: Growth Drivers

Rising demand trends in the nutraceutical & food & beverage industry to drive market growth during the forecast period.

The global carotenoids market is projected to grow owing to the increasing demand trends in the nutraceutical & food & beverage industry. Carotenoids are used in nutritional supplement products. Various carotenoids such as zeaxanthin & lutein are widely used for bone health nutraceutical products. Lycopene is used as a nutritional supplement in the treatment of cardiovascular diseases. Lycopene can enhance antioxidant properties, and reduce oxidative stress & cholesterol oxidation. In addition, various carotenoids are used as natural pigments or as colorants in food & beverage products. These pigments are used in the production of bakery & confectionery products, snacks, dairy items, and other food products. Carotenoids such as carotenes, etc. are approved food additives by different regulatory bodies such as the European Commission. BASF SE & DSM are among the key manufacturers of carotenoids for food & beverage applications.

Some of the key firms engaged in nutraceutical manufacturing are Nestlé S.A., General Mills, Inc., Kellogg Company, Herbalife International of America, Inc., and PepsiCo, Inc., among others. In Europe, the nutraceuticals industry is growing at a significant rate in Germany, France, Italy, and the United Kingdom, among others.

In the United States, the domestic nutraceutical manufacturing industry is flourishing, owing to the rising concerns for the health of children & elderly populations, increasing awareness about immune health, and others.

In India, according to the Ministry of Food Processing Industries, the country’s nutraceutical industry accounted for around USD 5 billion in 2022 and is expected to reach around USD 18 billion by 2025.

Moreover, in the food & beverage industry, Europe is one of the leading global regions. According to the FoodDrinkEurope, European Union food & beverage industry production increased by 1.4% in the first quarter of 2023, compared to the previous quarter. In addition, the European Union food & beverage industry turnover increased by 2.3% in Q1 2023, compared to the previous quarter.

According to the United States Census Bureau, the annual sales of retail food & beverage stores in the United States valued at around USD 947 billion in 2022, registering a growth rate of around 7.6% compared to the previous year. In the United States, agriculture, food, and related industries contribute around 5.4% share of the country’s gross domestic product (GDP).

Carotenoids Market: Restraints

High cost of natural carotenoids to restrict market expansion

Natural carotenoids are costly compared to their synthetic counterparts. The key factor related to the high cost of natural carotenoids is its complicated production processes. Moreover, carotenoids such as astaxanthin & lutein, which are available in different fruits, flowers, and microorganisms, also have high economic value. Moreover, the limited availability of high-content & high productivity sources of natural carotenoids is further increasing the cost of the end products. According to NovoNutrients, a manufacturer of carotenoids, pure natural carotenoids such as natural astaxanthin are valued at over USD 7,000 per kilogram. However, synthetic astaxanthin costs around USD 2,000 per kilogram. All such factors limit the carotenoids industry’s growth.

Carotenoids Market: Opportunities

Increasing R&D & technological advancement in the carotenoid industry to provide growth opportunities

Various manufacturing firms are investing heavily in R&D & technology development for the production & application of carotenoids in different sectors. Recently, researchers from Peter the Great St. Petersburg Polytechnic University based in Russia found microalgae biomass with a high content of carotenoid pigments. The obtained carotenoid pigments can be used in the food industry. Further, researchers are working on the development of economical & high-end biotechnologically produced carotenoids. Considering its high antioxidant characteristics, natural microbial carotenoids have been proposed as alternatives to synthetic carotenoids for pigment application.

In March 2023, NovoNutrients, a manufacturer of carotenoids, announced an innovation in carotenoid production technology. The company said that its general carbon capture process upcycles around 2 tons of carbon dioxide (CO2) for each ton of protein-rich ingredient production. The company’s biomanufacturing platform provides advantages of scalability, cost savings, and sustainability, compared to conventional manufacturing. By utilizing carbon dioxide & renewable energy through gas fermentation, the company is scaling up its carotenoid production to acquire a significant market share in the coming years.

Carotenoids Market: Challenges

Associated side-effects of Carotenoid to challenge market cap growth

Various carotenoids can cause low to severe side effects, after consumption. Some of the key side effects of high doses of beta-carotene are joint pain, skin discoloration, and others. Beta-carotene supplements can interact with different medications such as Statins, Orlistat, Cholestyramine, and Colestipol, among others. However, correct dosage & right product selection can avoid these side effects of carotenoids.

Carotenoids Market: Segmentation

The global carotenoids market is segmented based on type, source, application, and region.

Based on type, the global market segments are lutein, beta-carotene, lycopene, astaxanthin, capsanthin, canthaxanthin, annatto, zeaxanthin, and other types. Currently, the global carotenoids market is dominated by beta-carotene, considering their wide application in dietary supplements, food & beverage, and other applications. Beta-carotene is an organic compound and is used as a colored pigment. Some of the key manufacturers of beta-carotene are Allied Biotech Corporation, Divi's Laboratories Limited, BASF SE, DSM, and others.

Based on the source, the global carotenoids market segments are natural & synthetic. Currently, the global market is dominated by synthetic, owing to its wide availability & low cost. Carotenoids such as beta-carotene are, generally, produced through chemical synthesis. Synthetic beta-carotene is available in the form of red crystalline powder.

Based on application, the global market segments are animal feed, food & beverage, dietary supplements, cosmetics, pharmaceuticals, and other applications. Currently, the carotenoids industry is dominated by the food & beverage segment. Carotenoids are used as a pigment in different food & beverage manufacturing such as dairy products, confectionery, and others. The e-commerce penetration in the food & beverage industry is fueling the demand for carotenoids-based products. According to FoodDrinkEurope, the European Union (EU) food & beverage industry generated around a turnover of EUR 1.1 trillion and EUR 230 billion in value-added in 2022. European Union is the largest exporter of food & beverage products, across the globe, with exports outside the European Union valued at around EUR 156 billion in 2022. All such factors are expected to support the carotenoids industry’s growth.

Carotenoids Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Carotenoids Market |

| Market Size in 2022 | USD 1700 Million |

| Market Forecast in 2030 | USD 2500 Million |

| Growth Rate | CAGR of 4.64% |

| Number of Pages | 211 |

| Key Companies Covered | ADM, Algatech LTD, Allied Biotech Corporation, BASF SE, Chenguang Biotechnology Group Co. Ltd., Chr. Hansen Holding A/S, Cyanotech Corporation, Divi's Laboratories Limited, Döhler GmbH, DSM, DYNADIS, E.I.D. - Parry (India) Limited, ExcelVite, Farbest Brands, Fuji Chemical Industries Co. Ltd., Givaudan, Kemin Industries Inc., Lycored, NovoNutrients, Novus International Inc, Vidya Herbs Pvt. Ltd., Zhejiang NHU Co. Ltd., and others. |

| Segments Covered | By Type, By Source, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Carotenoids Market: Regional Analysis

Asia Pacific to lead the market during the forecast period

The global carotenoids market growth is expected to be driven by Asia Pacific, during the forecast period. China, India, Japan, and Southeast Asia are among the key revenue generators for the carotenoids industry in the Asia Pacific.

In China, the food & beverage industry is majorly concentrated in Beijing, Hangzhou, Foshan, Zhongshan, Hohhot, Luohe, and Quanzhou, among other regions. Some of the key food & beverage firms in China are Foshan Haitian Flavouring & Food Co. Ltd. (Haitian), Inner Mongolia Yili Industrial Group Co., Ltd., Heilongjiang Feihe Dairy Co., Ltd., China Mengniu Dairy Company Limited, and others. Furthermore, the Chinese meat industry produced around 92.27 million tons of meat in 2022, registering a significant growth rate over the previous year, which increased the demand for animal feed in the country. According to the China Feed Industry Association (CFIA), animal feed production in China accounted for 302.23 million tons in 2022, witnessing a growth rate of around 3% compared to the previous year. Pig & poultry feed production occupied around 45% & 40% of total feed production, respectively, in 2022.

Moreover, the cosmetics industry in China has grown rapidly in recent years. According to the National Bureau of Statistics of China, the retail sales value of cosmetic products accounted for around CNY 393.6 billion in 2022. Some of the key market players in the Chinese cosmetics industry are L’Oréal, Maybelline, LVMH, Aurora Formula Co., Ltd, Yiwu Kasey Cosmetic Co., Ltd, and others.

In India, according to the India Brand Equity Foundation (IBEF), India's pharmaceutical sector, which is renowned for its affordable generic medications, comes in third place globally in terms of pharmaceutical manufacturing volume. India’s pharmaceutical industry is expected to reach around USD 65 billion by 2024 and around USD 130 billion by 2030, owing to rising exports from the country.

India’s food & beverage sector contributes around 3% of the country’s overall gross domestic product (GDP). according to the India Brand Equity Foundation (IBEF), the Indian food industry was valued at around USD 866 billion in 2022 and is expected to reach around USD 963 billion in 2023.

Moreover, according to Japan Customs, the export value of cosmetics from Japan declined by around 5.5% to JPY 646 billion in 2022, compared to JPY 684 billion in 2021, thereby, negatively impacting the carotenoids industry growth in the country. Further, as per the Japan Pharmaceutical Wholesalers Association (JPWA), the volume share of generics in the country’s prescription drugs industry accounted for around 79% in 2022, which was similar to 2021.

All the above-mentioned factors related to the carotenoid end-user sectors are likely to support the carotenoid industry’s growth.

Carotenoids Market: Competitive Analysis

The global carotenoids market is dominated by players like:

- ADM

- Algatech LTD

- Allied Biotech Corporation

- BASF SE

- Chenguang Biotechnology Group Co., Ltd.

- Chr. Hansen Holding A/S

- Cyanotech Corporation

- Divi's Laboratories Limited

- Döhler GmbH

- DSM

- DYNADIS

- E.I.D. - Parry (India) Limited

- ExcelVite

- Farbest Brands

- Fuji Chemical Industries Co., Ltd.

- Givaudan

- Kemin Industries, Inc.

- Lycored

- NovoNutrients

- Novus International, Inc

- Vidya Herbs Pvt. Ltd.

- Zhejiang NHU Co., Ltd.

The global carotenoids market is segmented as follows:

By Type

- Lutein

- Beta-carotene

- Lycopene

- Astaxanthin

- Capsanthin

- Canthaxanthin

- Annatto

- Zeaxanthin

- Other Types

By Source

- Natural

- Synthetic

By Application

- Animal Feed

- Food & Beverage

- Dietary Supplement

- Cosmetics

- Pharmaceuticals

- Other Applications

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Carotenoids is a bioactive agent, which is used in dietary supplement manufacturing & cosmetic formulations. In addition, carotenoid is one of the most important types of pigments, derived from both synthetic & natural sources.

The global carotenoids market cap may grow owing to the rising demand trends in the nutraceutical & food & beverage industry. Significant growth opportunities can be expected due to the increasing R&D & technological advancement in the carotenoid industry.

According to study, the global carotenoids market size was worth around USD 1700 million in 2022 and is predicted to grow to around USD 2500 million by 2030.

The CAGR value of the carotenoids market is expected to be around 4.64% during 2023-2030.

The global carotenoids market growth is expected to be driven by Asia Pacific. It is currently the world’s highest revenue-generating market owing to the presence of large footprints of end-user sectors such as food & beverage, pharmaceutical, nutraceutical, cosmetics, and animal feed, among others.

The global carotenoids market is led by players like ADM, Algatech LTD, Allied Biotech Corporation, BASF SE, Chenguang Biotechnology Group Co., Ltd., Chr. Hansen Holding A/S, Cyanotech Corporation, Divi's Laboratories Limited, Döhler GmbH, DSM, DYNADIS, E.I.D. - Parry (India) Limited, ExcelVite, Farbest Brands, Fuji Chemical Industries Co., Ltd., Givaudan, Kemin Industries, Inc., Lycored, NovoNutrients, Novus International, Inc, Vidya Herbs Pvt. Ltd., and Zhejiang NHU Co., Ltd.

The report incorporates demand/consumption and in-depth market insights on the global carotenoids industry. The report analyzes the global carotenoids market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the carotenoids industry. Moreover, the study covers the competitive landscape for carotenoids industry.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed