Cellulosic Ethanol Market Size, Share, Trends and Forecast, 2030

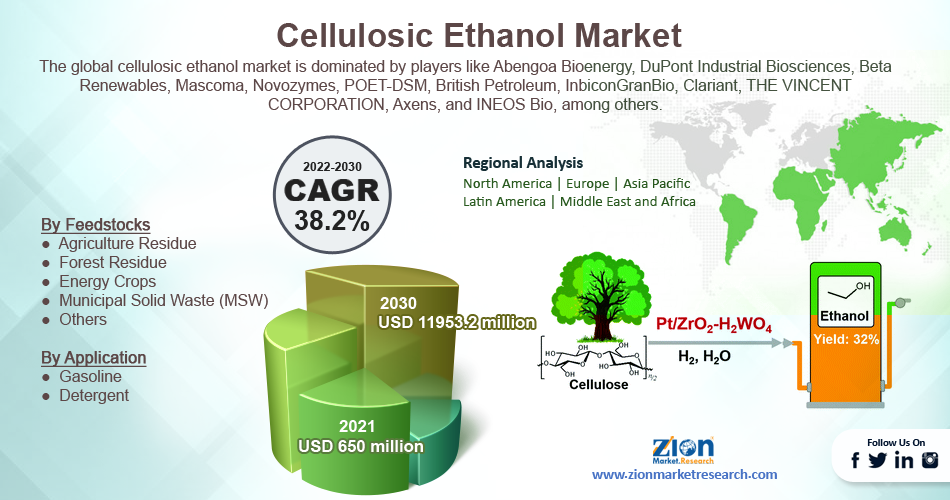

Cellulosic Ethanol Market By Feedstocks (Agriculture Residue, Forest Residue, Energy Crops, Municipal Solid Waste (MSW) and Others), By Application (Gasoline and Detergent), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2022 - 2030

| Market Size in 2021 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 650 Million | USD 11953.2 Million | 38.2% | 2021 |

Cellulosic Ethanol Market Size & Industry Analysis:

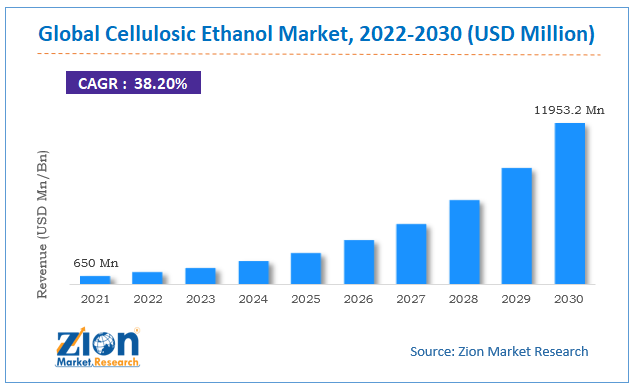

The global cellulosic ethanol market size was worth around USD 650 million in 2021 and is predicted to grow to around USD 11953.2 million by 2030 with a compound annual growth rate (CAGR) of roughly 38.2% between 2022 and 2030. The report analyzes the global cellulosic ethanol market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the cellulosic ethanol market.

Cellulosic Ethanol Market: Overview

Cellulosic ethanol is a biofuel that is made from plant, grass, and wood waste. Cellulose, like hemicelluloses and lignin, is a plant material derived from lignocellulose. Cellulosic materials utilized in the manufacturing of ethanol include Panicum virgatum, wood chips, and various byproducts of trees.

When compared to other sources such as corn and sugar cane, ethanol synthesis from lignocellulose has the benefit of ample raw materials. Another aspect driving cellulosic ethanol production towards lignocellulose is the amount of processing time required to give microorganisms with sugar monomers that create ethanol. Switchgrass and miscanthus have recently been explored as potential source materials for ethanol production due to their high productivity per acre.

Key Insights

- As per the analysis shared by our research analyst, the global cellulosic ethanol market is estimated to grow annually at a CAGR of around 38.2% over the forecast period (2022-2028).

- In terms of revenue, the global cellulosic ethanol market size was valued at around USD 650 million in 2021 and is projected to reach USD 11953.2 million, by 2030.

- The increasing demand for cellulosic ethanol owing to environmental concerns is expected to drive the growth of the market over the forecast period.

- Based on the feedstocks, the energy crop segment accounted for the largest market share in 2021.

- Based on the application, the gasoline segment is expected to dominate the market over the forecast period.

- Based on region, North America is expected to hold the largest market share during the forecast period.

To know more about this report, request a sample copy.

Cellulosic Ethanol Market: Growth Drivers

Increasing government initiatives to drive the market growth

Several reasons, including rising urbanization, rising energy consumption, and increased environmental concerns, are projected to accelerate global cellulosic ethanol use. Aside from that, bioethanol's lower carbon footprint compared to conventional fuels, as well as government backing - both policy and tariffs - are expected to drive its acceptance as a transportation fuel across different locations. Various legislation for clean air (clean air act) and GHG (greenhouse gas) reduction, among other things, are expected to play a significant role in the industry's growth.

The European Union sponsored the Bioethanol for Sustainable Transportation (BEST) initiative, which includes six countries, to develop bioethanol vehicles. The government has introduced the "Pradhan Mantri JI-VAN Yojana" to help fund integrated bio-ethanol projects that employ lignocellulosic biomass and other renewable feedstocks, according to the Ministry of Petroleum and Natural Gas. From 2018-19 to 2023-24, this scheme would provide financial support to twelve integrated bioethanol facilities using lignocellulosic biomass and other renewable feedstock, with a total financial investment of Rs 1969.50 crore, as well as support to ten 2G technology demonstration projects. These government initiatives are expected to boost demand for the global cellulosic ethanol market.

Cellulosic Ethanol Market: Restraints

Lack of infrastructure limits the market growth

Cellulosic ethanol cannot be carried through pipes; instead, it must be transported by vehicle, which could pose a problem for the infrastructure used to distribute it. Geographical areas suitable for the production of feedstock and the demand for ethanol may vary, necessitating the installation of substantial infrastructures, such as road and rail networks. Furthermore, more money is required for processing and storage, especially in the preliminary stage. Thus, a lack of infrastructure restrains market expansion.

Cellulosic Ethanol Market: Opportunities

Increasing research and development activities

The increased research activity for sustainable bioethanol production systems is a key trend in the bioethanol sector. Bioethanol production from plant waste that can be utilized to produce second-generation bioethanol (SGB) is being widely researched. Several projects have been launched to successfully replace gasoline and diesel with bioethanol. Scientists at Kanazawa University's Institute of Science and Engineering, for example, developed novel solvent combinations in August 2021 to break down the strong structure of plant cellulose to manufacture bioethanol. These novel solvents work under moderate circumstances, have lesser toxicity, and are more environmentally friendly than existing solvents. Furthermore, the NILE (New Improvements for Lignocellulosic Ethanol) project brings together 21 industrial and scientific entities from 11 member countries to pursue bioethanol manufacturing research.

Cellulosic Ethanol Market: Challenges

Increasing electric vehicle market

The global cellulosic ethanol market is expected to be constrained in the near future as the use of electric vehicles increases. Sales of electric vehicles have increased in recent years, and this trend is predicted to continue during the forecast period. According to the International Energy Agency, the worldwide electric vehicle stock topped ten million units in 2020, a 43% increase from 2019. The global electric vehicle market is booming. As a result, the demand for fossil and bioethanol fuels would fall. As a result, the bioethanol market is expected to be stifled in the near future as the use of electric vehicles grows.

Cellulosic Ethanol Market: Segmentation

The global cellulosic ethanol market is segmented based on feedstocks, applications, and region

Based on the type, the global market is bifurcated into agriculture residue, forest residue, energy crops, municipal solid waste (MSW), and others. The energy crops segment accounted for the largest revenue share in 2021 and is expected to remain dominant over the forecast period. Energy crops are non-food crops that are used to produce cellulosic ethanol and other biofuels. Growing demand for biomass as a biofuel feedstock, as well as increased awareness of the need to reduce greenhouse gas and carbon emissions, are projected to drive up demand for energy crops as a biofuel feedstock.

Based on the application, the global market is segmented into gasoline and detergent. The gasoline segment is expected to dominate the market during the forecast period. The growth in the segment is attributed to the increasing demand for automobiles along with the growing population. For instance, according to the Society of Indian Automobile Manufacturers, from April 2021 to March 2022, Passenger Vehicle Exports increased from 404,397 to 577,875 units, Commercial Vehicle Exports increased from 50,334 to 92,297 units, Three Wheeler Exports increased from 393,001 to 499,730 units and Two Wheelers Exports increased from 3,282,786 to 4,443,018 units in April 2021 to March 2022 over the same period last year. Moreover, the simple availability of gasoline is expected to drive the market during the analysis period.

Recent Developments:

- In June 2022, Clariant, a focused, sustainable, and innovative specialty chemical company, announced that it has produced the first commercial cellulosic ethanol at its sunliquid® production plant in Podari, Romania. The entire offtake is contracted with a multi-year agreement to Shell, a leading global energy company. Over the last six months, the plant underwent a thorough commissioning process resulting in the successful start of production. Approximately 50,000 tons of second-generation biofuels will be derived from 250,000 tons of locally sourced agricultural residues. The cellulosic ethanol produced at this plant can be applied as a drop-in solution for fuel blending but also offers further downstream application opportunities for sustainable aviation fuel and bio-based chemicals.

- In June 2021, POET, a US-based biofuel company, acquired the bioethanol assets from Flint Hills Resources for an undisclosed amount. This acquisition would bring even more plant-based, high-quality biofuels and bioproducts to the customers and expand the company’s production capacity by 40%.

Cellulosic Ethanol Market Report Scope:

| Report Attributes | Report Details |

|---|---|

| Report Name | Cellulosic Ethanol Market Research Report |

| Market Size in 2021 | USD 650 Million |

| Market Forecast in 2030 | USD 11953.2 Million |

| Compound Annual Growth Rate | CAGR of 38.2% |

| Number of Pages | 193 |

| Forecast Units | Value (USD Million), and Volume (Units) |

| Key Companies Covered | Abengoa Bioenergy, DuPont Industrial Biosciences, Beta Renewables, Mascoma, Novozymes, POET-DSM, British Petroleum, InbiconGranBio, Clariant, THE VINCENT CORPORATION, Axens, and INEOS Bio, among others. |

| Segments Covered | By Feedstocks, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East and Africa (MEA) |

| Countries Covered | North America: U.S and Canada Europe: Germany, Italy, Russia, U.K, Spain, France, Rest of Europe APAC: China, Australia, Japan, India, South Korea, South East Asia, Rest of Asia Pacific Latin America: Brazil, Argentina, Chile The Middle East And Africa: South Africa, GCC, Rest of MEA |

| Base Year | 2021 |

| Historical Year | 2016 to 2020 |

| Forecast Year | 2022 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Cellulosic Ethanol Market: Regional Analysis

North America held the largest market share in 2021

North America held the largest global cellulosic ethanol market share of more than 35% in 2021 and is expected to continue this pattern over the forecast period. The growth in the region is attributed to the increasing demand for clean biofuel and the cheap availability of feedstocks. The United States is the largest producer of bioethanol globally, followed by Brazil, China, India, and Canada. It is also the largest consumer of bioethanol. For instance, according to US Energy Information Administration, In 2021, U.S. fuel ethanol production (as measured by renewable fuels and oxygenate plant net production of fuel ethanol) equaled about 15 billion gallons (0.4 billion barrels). Moreover, the rising number of vehicles in the North American region also fuels market expansion. For instance, as per secondary analysis,

The total number of automobiles produced in North America in 2021 was around 1,34,27,869 units, up from 1,33,74,404 units in 2020. E15 is compatible with approximately 93% of the country's 263 million registered autos. Furthermore, around 22 million flex-fuel vehicles (FFVs) in the United States can run on ethanol blends up to E85. Thus, this is expected to boost the growth of the cellulosic ethanol market during the forecast period.

On the other hand, Europe is expected to hold a significant market share over the forecast period owing to the increased environmental concerns and increasing government initiatives in the region. For instance, according to the International Energy Agency, The "Fit for 55" package in the European Union contains a proposal for a transport GHG intensity requirement that would double the existing renewable energy target for transport of 14% by 2030. (European Commission, 2021b).

A projected 2% SAF blending mandate by 2025 under the ReFuelEU Aviation effort (European Commission 2021d) and a 2% GHG improvement for shipping under FuelEU Maritime are also included in the package (European Commission, 2021e). Therefore, government support is expected to flourish the market expansion in the region.

Cellulosic Ethanol Market: Competitive Analysis

The global cellulosic ethanol market is dominated by players like:

- Abengoa Bioenergy

- DuPont Industrial Biosciences

- Beta Renewables

- Mascoma

- Novozymes

- POET-DSM

- British Petroleum

- InbiconGranBio

- Clariant

- THE VINCENT CORPORATION

- Axens

- INEOS Bio

The global cellulosic ethanol market is segmented as follows:

By Feedstocks

- Agriculture Residue

- Forest Residue

- Energy Crops

- Municipal Solid Waste (MSW)

- Others

By Application

- Gasoline

- Detergent

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The growing demand for eco-friendly fuel, supporting government policies & regulations, and the rise in the use of cellulosic ethanol as an alternative to corn-based ethanol are the major factors that are driving the growth of the global cellulosic ethanol market.

According to the report, the global cellulosic ethanol market size was worth around USD 650 million in 2021 and is predicted to grow to around USD 11953.2 million by 2030 with a compound annual growth rate (CAGR) of roughly 38.2% between 2022 and 2030.

The global cellulosic ethanol market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market due to the increasing production of bio-based ethanol in the region.

The global cellulosic ethanol market is dominated by players like Abengoa Bioenergy, DuPont Industrial Biosciences, Beta Renewables, Mascoma, Novozymes, POET-DSM, British Petroleum, InbiconGranBio, Clariant, THE VINCENT CORPORATION, Axens, and INEOS Bio, among others.

Choose License Type

List of Contents

MarketSize Industry Analysis:OverviewTo know more about this report,request a sample copy.Growth DriversRestraintsOpportunitiesChallengesSegmentationRecent Developments:Market Report Scope:Regional AnalysisCompetitive AnalysisThe global cellulosic ethanol market is segmented as follows:RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed