Children's Furniture Market Trend, Share, Growth, Size and Forecast 2030

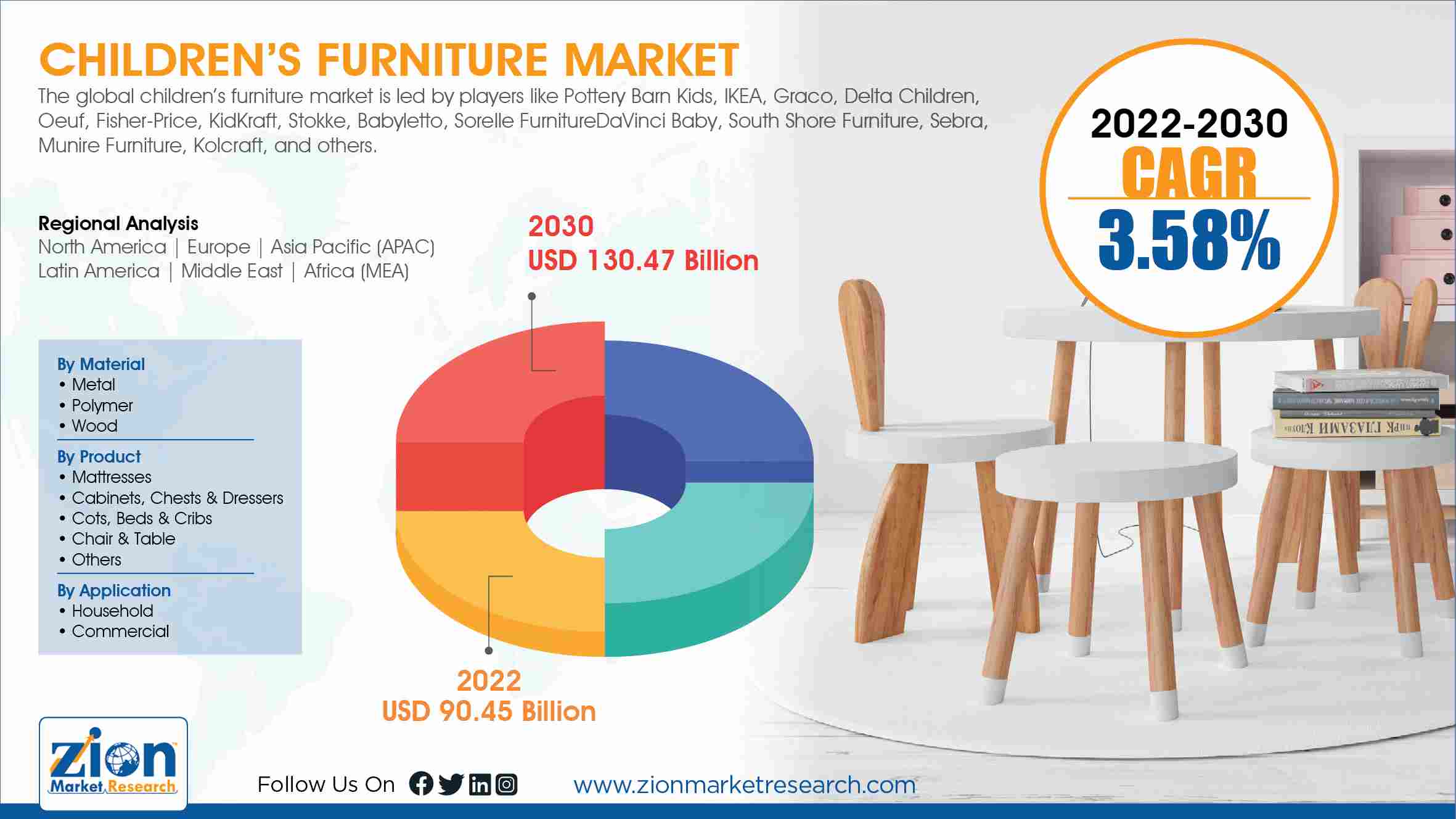

Children’s Furniture Market By Material (Metal, Polymer, and Wood), By Product (Mattresses, Cabinets, Chests, & Dressers, Cots, Beds, & Cribs, Chair & Table, and Others), By Application (Household and Commercial), By and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030-

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

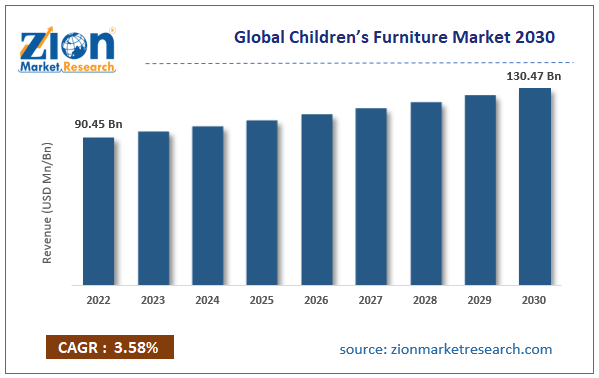

| USD 90.45 Billion | USD 130.47 Billion | 3.58% | 2022 |

Children's Furniture Industry Prospective:

The global children's furniture market size was worth around USD 90.45 billion in 2022 and is predicted to grow to around USD 130.47 billion by 2030 with a compound annual growth rate (CAGR) of roughly 3.58% between 2023 and 2030.

Children's Furniture Market: Overview

Children's furniture consists of products that are specially designed for children. These objects are used in day-to-day settings such as educational facilities, homes, or recreational centers and are meant solely for the purpose of being used by children. The industry for children's furniture includes products such as chairs, tables, beds, mattresses, sofas, learning desks, and other items that provide support in daily activities such as studying, sleeping, playing, and seating. Children's furniture is comparatively different from furniture made for adults. The main difference is the size of the object but the overall appeal is another essential contributor that determines the popularity of a certain product over others.

The innovative approach adopted by manufacturers of furniture for children has helped them survive and is expected to continue doing the same in the coming years. The innovation can be associated with product designing, packaging, or providing additional customer services to new parents. The market holds several growth opportunities as the world population continues to grow at a rapid pace.

Key Insights:

- As per the analysis shared by our research analyst, the global children's furniture market is estimated to grow annually at a CAGR of around 3.58% over the forecast period (2023-2030)

- In terms of revenue, the global children's furniture market size was valued at around USD 90.45 billion in 2022 and is projected to reach USD 130.47 billion, by 2030.

- The children's furniture market is projected to grow at a significant rate due to the growing number of educational facilities for children

- Based on material segmentation, wood industry was predicted to show maximum market share in the year 2022

- Based on application segmentation, household was the leading segment in 2022

- On the basis of region, North America was the leading revenue generator in 2022

Request Free Sample

Request Free Sample

Children's Furniture Market: Growth Drivers

Growing number of educational facilities for children to drive market growth

The global children's furniture market is projected to grow owing to the increasing investments and construction or development of educational facilities for children across age groups. As per the current educational systems worldwide, more parents can send their children to nursery care as early as when they are 2 years old. Several external and personal factors influence the decision of caregivers to send young children to play schools for a few hours during the day. Apart from the mandatory schooling structure that generally starts from 1st grade, pre-primary educational facilities also have become popular in recent times.

For instance, in December 2023, Ralph Bell Elementary in Kamloops, British Columbia witnessed the inauguration of a new childcare center that is affordable and yet efficient in managing children. The total spending for the center is expected to reach CAD 2.8 million. Similarly, several other smaller facilities have opened globally. Furniture is an important part of the overall setting. It is practically impossible to develop an educational facility without constructing comfortable furniture for the children in the form of desks, chairs, and other objects. As per official reports, Australia incurred a total expense of AUD 21 billion on school expenses.

Increasing undertakings by international agencies and welfare organizations to facilitate child care may drive market demand

As millions of children around the world lack access to primary care, several local and international welfare agencies have undertaken key projects as they are working toward ensuring that children across the globe gain access to minimum care such as beds and cots. Furthermore, the recent ongoing war between Russia and Ukraine or Israel and Hamas has displaced several people including children from their homes. Global aid has increased in these times.

In December 2023, UK-based charity organization Zarach and the Independent, a leading newspaper, announced that they would be distributing nearly 500 beds to the children in need in the city of Leeds.

Children's Furniture Market: Restraints

Role in promoting excessive consumerism may restrict market growth

The global children's furniture industry is expected to be restricted as the industry, in a way, promotes excessive consumerism. This is especially true for specially designed children's furniture. Kids tend to outgrow their personal furniture quickly since they are in their primary developing stage. This translates to limited use time for the products unlike furniture made for general purpose. It also adds to resource waste especially if natural resources are used to manufacture the item. On the other hand, plastic-based furniture for children leads to increased plastic pollution in the environment.

Children's Furniture Market: Opportunities

Growing launch of new and innovative designs or marketing strategies may create growth opportunities

The global children's furniture market is expected to encounter growth opportunities due to the increasing launch of novel designs that not only are visually appealing but also offer enhanced comfort to children. In August 2023, Sleepeezee, a UK-based mattress designer announced the launch of Little Bedz. The new range is designed especially for children and offers bouncy comfort during play and sleep mode. The spring technology used in the mattress will help the furniture take the shape of the child sleeping on it.

In December 2022, Birch, a sustainable brand operating through Helix Sleep, launched Birch Kids Natural Mattress. They are specially drafted and do not contain any form of toxic chemicals. The company has obtained Global Organic Textile Standard (GOTS) certification thus proving the non-toxicity of the furniture products.

High emphasis on customized furniture especially for children with special needs may create new growth opportunities

The global children's furniture industry is projected to be affected by the growing emphasis and importance of designing furniture keeping in view the exact physical needs of children. This is especially applicable when manufacturers are dealing with designing products that are meant for children with special needs.

For instance, employing sensors for alarms in furniture such as beds or chairs as the child can send out an alarm in case of emergency. Additionally, keeping the edges rounded to protect children from physical harm. Focusing on innovation and meeting customer expectations hold the key to sustainable growth.

Children's Furniture Market: Challenges

Growing trend of reusing pre-owned furniture could be a challenge for new furniture makers

The global children's furniture market may be challenged as several parents and guardians are seeking ways to reuse pre-owned furniture. In large families, people tend to pass furniture to younger children since the new furniture may be more expensive or due to other personal reasons.

The transactions that occur through e-commerce portals continue to contribute to the market. However, the revenue is lost when the transaction takes place on a more personal note.

Children's Furniture Market: Segmentation

The global children's furniture market is segmented based on material product, application, and region.

Based on material, the global market is segmented as metal, polymer, and wood. In 2022, the highest growth was observed in the wood segment. It dominated over 55.6% of the total share. Wood is, in most cases, the preferred choice for furniture designed for children. The material is sturdy and offers excellent load-bearing capacity. Furthermore, it can be designed to exhibit an excellent visually appealing structure. Metal is not a preferred choice, since there is a risk of physical hurt especially if the edges are sharp.

Based on product, the global children's furniture industry is divided into mattresses, cabinets, chests & dressers, cots, beds & cribs, chair & table, and others.

Based on application, the global market divisions are household and commercial. In 2022, over 65.5% of the total revenue was generated from the household segment. The primary reason for higher segmental growth is the increasing number of remote educational facilities especially encouraged during COVID-19. Several schools for young children have initiated remote learning programs. This has resulted in a greater need for a comfortable space for children in a homecare setting. The commercial segment is growing at a fast pace driven by rising investments in the education sector.

Children’s Furniture Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Children’s Furniture Market |

| Market Size in 2022 | USD 90.45 Billion |

| Market Forecast in 2030 | USD 130.47 Billion |

| Growth Rate | CAGR of 3.58% |

| Number of Pages | 220 |

| Key Companies Covered | Pottery Barn Kids, IKEA, Graco, Delta Children, Oeuf, Fisher-Price, KidKraft, Stokke, Babyletto, Sorelle FurnitureDaVinci Baby, South Shore Furniture, Sebra, Munire Furniture, Kolcraft, and others. |

| Segments Covered | By Material, By Product, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Children's Furniture Market: Regional Analysis

North America to lead the way during the forecast period

The global children's furniture market will be led by North America during the projection period. The high growth rate is expected to be the result of higher spending capacity as well as the presence of a stringent child welfare ecosystem government by regulatory bodies. The US is home to one of the world’s most robust child healthcare systems that prioritizes the mental and physical well-being of children. Around 31% of the global revenue was reported to originate from North America in 2022. The growing number of child births as well as an increasing rate of foreign immigration in Canada and the US add to the total number of consumers. The regional market is further influenced by the presence of several mass producers of furniture for children.

In November 2023, Dorel Industries, Inc owned Little Seeds announced a new line of nursery furniture. The company is a designer of smart furniture that grows along with the child thus promoting sustainable and smart ways of incorporating new furniture in children’s daily routine. Europe is an important market for the global industry. It has several players that offer exceptionally well-designed furniture for children across age ranges.

Children's Furniture Market: Competitive Analysis

The global children's furniture market is led by players like:

- Pottery Barn Kids

- IKEA

- Graco

- Delta Children

- Oeuf

- Fisher-Price

- KidKraft

- Stokke

- Babyletto

- Sorelle FurnitureDaVinci Baby

- South Shore Furniture

- Sebra

- Munire Furniture

- Kolcraft

The global children's furniture market is segmented as follows:

By Material

- Metal

- Polymer

- Wood

By Product

- Mattresses

- Cabinets, Chests & Dressers

- Cots, Beds & Cribs

- Chair & Table

- Others

By Application

- Household

- Commercial

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Children's furniture consists of products that are specially designed for children.

The global children's furniture market is projected to grow owing to the increasing investments and construction or development of educational facilities for children across age groups.

According to study, the global children's furniture market size was worth around USD 90.45 billion in 2022 and is predicted to grow to around USD 130.47 billion by 2030.

The CAGR value of the children's furniture market is expected to be around 3.58% during 2023-2030.

The global children's furniture market will be led by North America during the projection period.

The global children's furniture market is led by players like Pottery Barn Kids, IKEA, Graco, Delta Children, Oeuf, Fisher-Price, KidKraft, Stokke, Babyletto, Sorelle FurnitureDaVinci Baby, South Shore Furniture, Sebra, Munire Furniture, and Kolcraft among others.

The report explores crucial aspects of the children's furniture market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

Choose License Type

List of Contents

Childrens FurnitureIndustry Prospective:Childrens Furniture OverviewKey Insights:Childrens Furniture Growth DriversChildrens Furniture RestraintsChildrens Furniture OpportunitiesChildrens Furniture ChallengesChildrens Furniture SegmentationChildrens Furniture Report ScopeChildrens Furniture Regional AnalysisChildrens Furniture Competitive AnalysisThe global childrens furniture market is segmented as follows:By RegionHappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed