Clinical Trial Outsourcing Market Size, Share, Trends, Growth and Forecast 2032

Clinical Trial Outsourcing Market By Services (Protocol Designing, Site Identification, Patient Recruitment, Laboratory Services, Bioanalytical Testing Services, Clinical Trial Data Management Services, and Others), By Phase (Phase I, Phase II, Phase III and Phase IV), By Study Design (Interventional, Observational, and Expanded Access), By Application (Cancer, Cardiovascular Diseases, Nervous System Diseases, Infectious Diseases, Musculoskeletal Disease, Gastroenterology Diseases, and Others), By End User (Pharmaceutical & Biopharmaceutical Companies, Medical Device Companies, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

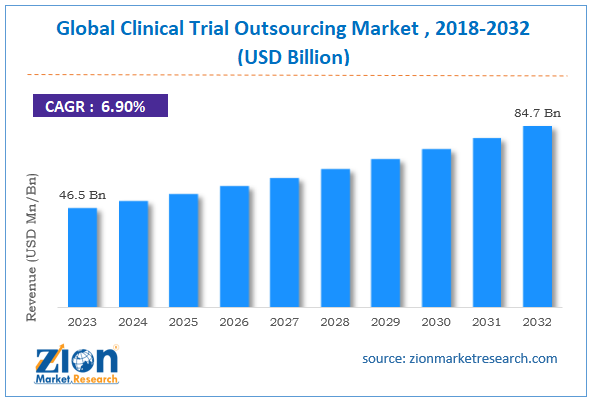

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 46.5 Billion | USD 84.7 Billion | 6.9% | 2023 |

Clinical Trial Outsourcing Industry Prospective:

The global clinical trial outsourcing market size was worth around USD 46.5 billion in 2023 and is predicted to grow to around USD 84.7 billion by 2032, with a compound annual growth rate (CAGR) of roughly 6.9% between 2024 and 2032.

Clinical Trial Outsourcing Market: Overview

The process of allocating some aspects of clinical trial administration to outside companies, such as Contract Research Organizations (CROs) or specialized service providers, is known as clinical trial outsourcing. This approach allows medical device, biotechnology, and pharmaceutical companies to perform more efficient clinical tests, save money, and apply outside knowledge.

Growing desire for cost-effectiveness, the complexity of clinical trials, and the necessity of specialist knowledge mostly drive the clinical trial outsourcing business. Pharmaceutical, biotechnology, and medical device companies are looking for Contract Research Organizations (CROs) and other service providers more and more to manage a spectrum of trial-related responsibilities, from patient recruitment to regulatory compliance.

Key Insights

- As per the analysis shared by our research analyst, the global clinical trial outsourcing market is estimated to grow annually at a CAGR of around 6.9% over the forecast period (2024-2032).

- In terms of revenue, the global clinical trial outsourcing market size was valued at around USD 46.5 billion in 2023 and is projected to reach USD 84.7 billion by 2032.

- The growing pharmaceutical and biotechnology industry is expected to drive the clinical trial outsourcing market over the forecast period.

- Based on the services, the protocol designing segment is expected to hold the largest market share over the forecast period.

- Based on the phase, the Phase I segment is expected to dominate the market expansion over the projected period.

- Based on the study design, the interventional segment is expected to capture a significant market share during the projected period.

- Based on the application, the cancer segment is expected to hold the largest market share over the forecast period.

- Based on the end user, the pharmaceutical & biopharmaceutical companies segment is expected to capture the largest revenue share over the forecast period.

- Based on region, North America is expected to dominate the market during the forecast period.

Clinical Trial Outsourcing Market: Growth Drivers

The increasing complexity of clinical trials drives market growth.

The growing complexity of clinical trials is mostly driving the expansion of the clinical trial clinical trial outsourcing market. Studies increasingly focus on complicated drugs such as biologics, gene treatments, and personalized medicine, so advanced trial designs, thorough data management, and strict adherence to regulatory standards are needed.

Pharmaceutical companies seeking to address these problems are appealing to specialized Contract Research Organizations (CROs). Apart from increasing compliance and efficiency, outsourcing to CROs reduces the risks and costs of maintaining internal knowledge for these very challenging projects.

Thermo Fisher Scientific Inc. stated in July 2023, for instance, that CROs now run around 75% of clinical trials, thereby underscoring the growing demand for outsourcing to satisfy the complicated needs of modern medical developments. As the complexity of clinical trials keeps increasing, CROs become ever more vital in ensuring effective operations, regulatory compliance, and economical management of the drug development process.

Clinical Trial Outsourcing Market: Restraints

Quality and consistency concerns hinder market growth

In the field of clinical trial outsourcing, consistency and quality are the main difficulties. Pharmaceutical companies depend more on contract research organizations (CROs) to oversee trials, so ensuring homogeneous quality and comparable rules across several sites and studies is becoming increasingly challenging. Variations in CRO processes, data management, and protocol adherence could produce differences, compromising the integrity of study results and postponing regulatory clearances.

For instance, the U.S. FDA observed in June 2023 that in several well-known pharmaceutical studies, varied data management techniques among CROs led to delays and extra regulatory investigation. These problems underscore the requirement of strict control and the need for consistent and predictable results across all phases of clinical trials, thereby stressing the need for standardized procedures. The success of outsourcing in the field of clinical research could be restricted by the lack of such defenses against the possible hazards of erroneous and inconsistent data.

Clinical Trial Outsourcing Market: Opportunities

Technological innovations in clinical trials outsourcing offer a lucrative opportunity for market growth

As Contract Research Organizations (CROs) automate clinical trial processes, this trend of big change is opening significant opportunities in the worldwide market based on technical developments. Automation means including innovative technologies such as robotic process automation (RPA), artificial intelligence (AI), and machine learning (ML) to maximize trial management, improve data correctness, and raise general efficiency.

For instance, Avance Clinical used Ryght's AI technology in February 2024 to enhance its clinical trial processes. This relationship aims to accelerate trial plans, raise data accuracy, and simplify procedures. Avance Clinical wants to use artificial intelligence to better manage complex clinical investigations and save trial running costs.

Using such technologies allows CROs to more precisely oversee bigger and more complex trials, offering pharmaceutical companies faster and more reasonably priced options. This move towards automation has the potential to transform the market by raising operational efficiency and enabling CROs to manage the growing complexity of modern drug development.

Clinical Trial Outsourcing Market: Challenges

The rising cost of outsourcing services poses a major challenge to market expansion

Pharmaceutical, biotechnology, and medical device businesses are all impacted by the growing prices of outsourcing services, a major obstacle in the clinical trial outsourcing market. Delegating clinical trial activities to Contract Research Organizations (CROs) and other service providers is becoming more costly due to several variables. Higher wages are a result of the growing need for seasoned data analysts, regulatory specialists, and clinical researchers.

Clinical research talent shortages increase hiring and retention expenses, particularly for specialized therapeutic areas like rare illnesses and cancer. Therefore, the high cost of outsourcing services poses a major challenge for the market during the projected period.

Clinical Trial Outsourcing Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Clinical Trial Outsourcing Market |

| Market Size in 2023 | USD 46.5 Billion |

| Market Forecast in 2032 | USD 84.7 Billion |

| Growth Rate | CAGR of 6.9% |

| Number of Pages | 222 |

| Key Companies Covered | ICON plc, IQVIA, Thermo Fisher Scientific Inc., SGS Life Sciences, Charles River Laboratories, Parexel, Syneos Health, Medpace, LabCorp, KCR, PRA Health Sciences, WuXi AppTec, Avance Clinical, Pharmaron, and others. |

| Segments Covered | By Services, By Phase, By Study Design, By Application, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Clinical Trial Outsourcing Market: Segmentation

The global clinical trial outsourcing industry is segmented based on services, phase, study design, application, end-user, and region.

Based on the services, the global clinical trial outsourcing market is bifurcated into protocol designing, site identification, patient recruitment, laboratory services, bioanalytical testing services, clinical trial data management services, and others. The protocol designing segment is expected to hold the largest market share over the forecast period because outsourcing protocol design eliminates the need for internal teams and infrastructure, and it can lower operating costs for biotechnology and pharmaceutical companies.

Based on the phase, the global clinical trial outsourcing industry is bifurcated into Phase I, Phase II, Phase III, and Phase IV. The Phase I segment is expected to dominate the market expansion over the projected period. Phase I clinical studies, which evaluate the pharmacokinetics, safety, and tolerability of novel medications in a small cohort of healthy volunteers or patients, are increasingly being contracted out to specialized Contract Research Organizations (CROs) in this growing industry. The necessity for specialized facilities, regulatory knowledge, and the need to expedite development schedules are the main drivers of this trend.

Based on the study design, the global clinical trial outsourcing market is segmented into interventional, observational, and expanded access. The interventional segment is expected to capture a significant market share during the projected period because CROs offer specialized knowledge in conducting complex interventional trials, ensuring adherence to regulatory standards.

Based on the application, the global clinical trial outsourcing industry is segmented into cancer, cardiovascular diseases, nervous system diseases, infectious diseases, musculoskeletal diseases, gastroenterology diseases, and others. The cancer segment is expected to hold the largest market share over the forecast period with the increasing prevalence of cancer.

Based on the end user, the global clinical trial outsourcing market is segmented into pharmaceutical & biopharmaceutical companies, medical device companies, and others. The pharmaceutical & biopharmaceutical companies segment is expected to capture the largest revenue share over the forecast period.

As pharmaceutical and biotech businesses look to maximize resources, acquire specialist expertise, and manage the intricacies of contemporary clinical trials, the market for clinical trial outsourcing is growing. The demand for cost-effectiveness and the strategic benefits of outsourcing partnerships are projected to fuel this trend going forward.

Clinical Trial Outsourcing Market: Regional Analysis

North America dominates the market over the projected period

North America is expected to dominate the global clinical trial outsourcing market during the projected timeframe. The region's sophisticated healthcare system, strict yet encouraging regulations, and thriving pharmaceutical and biopharmaceutical sectors are the main drivers of the market.

Numerous seasoned Contract Research Organizations (CROs) with experience in all stages of clinical trials, from trial design to regulatory filings, can be found in the area. This concentration of CROs and a high density of clinical trial locations, especially in the US, improve trial management efficiency, speed, and general efficacy.

Clinical Trial Outsourcing Market: Competitive Analysis

The global clinical trial outsourcing market is dominated by players like:

- ICON plc

- IQVIA

- Thermo Fisher Scientific Inc.

- SGS Life Sciences

- Charles River Laboratories

- Parexel

- Syneos Health

- Medpace

- LabCorp

- KCR

- PRA Health Sciences

- WuXi AppTec

- Avance Clinical

- Pharmaron

The global clinical trial outsourcing market is segmented as follows:

By Services

- Protocol Designing

- Site Identification

- Patient Recruitment

- Laboratory Services

- Bioanalytical Testing Services

- Clinical Trial Data Management Services

- Others

By Phase

- Phase I

- Phase II

- Phase III

- Phase IV

By Study Design

- Interventional

- Observational

- Expanded Access

By Application

- Cancer

- Cardiovascular Diseases

- Nervous System Diseases

- Infectious Diseases

- Musculoskeletal Disease

- Gastroenterology Diseases

- Others

By End User

- Pharmaceutical & Biopharmaceutical Companies

- Medical Device Companies

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Clinical trial outsourcing is the process of allocating some aspects of clinical trial administration to outside companies, such as Contract Research Organizations (CROs) or specialized service providers.

The clinical trial outsourcing market is influenced by several factors, such as the rising complexity of clinical trials, stringent regulatory requirements, expanding therapeutic areas and drug pipelines, and many others.

According to the report, the global clinical trial outsourcing market size was worth around USD 46.5 billion in 2023 and is predicted to grow to around USD 84.7 billion by 2032.

The global clinical trial outsourcing market is expected to grow at a CAGR of 6.9% during the forecast period.

The global clinical trial outsourcing market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market due to the presence of major players and the growing pharmaceutical industry.

The global clinical trial outsourcing market is dominated by players like ICON plc, IQVIA, Thermo Fisher Scientific Inc., SGS Life Sciences, Charles River Laboratories, Parexel, Syneos Health, Medpace, LabCorp, KCR, PRA Health Sciences, WuXi AppTec, Pharmaron, Avance Clinical, among others.

The clinical trial outsourcing market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed