Cold Chain Logistics Market Size, Share, Analysis, Trends, Growth, 2032

Cold Chain Logistics Market By Type (Refrigerated Warehouses and Refrigerated Transportation), By Application (Fruits and Vegetables, Bakery and Confectionary, Dairy and Frozen Desserts, Meat, Fish, and Seafood, Drugs and Pharmaceuticals, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

| Market Size in 2021 | Market Forecast in 2028 | CAGR (in %) | Base Year |

|---|---|---|---|

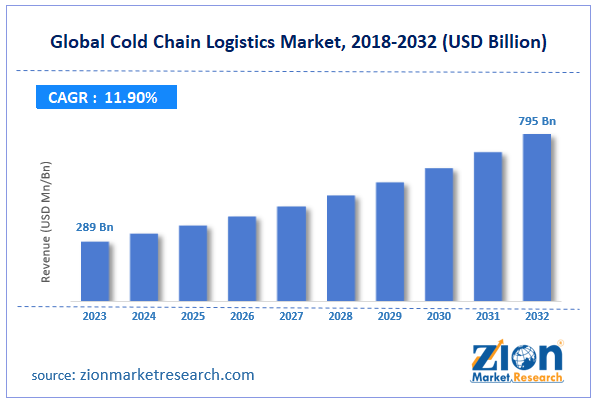

| USD 289 Billion | USD 795 Billion | 11.9% | 2021 |

Cold Chain Logistics Industry Prospective:

The global cold chain logistics market size was worth around USD 289 billion in 2023 and is predicted to grow to around USD 795 billion by 2032, with a compound annual growth rate (CAGR) of roughly 11.9% between 2024 and 2032.

Cold Chain Logistics Market: Overview

Fresh produce, meat, dairy, seafood, chemicals, pharmaceuticals, flowers, wine, and other perishable, temperature-sensitive commodities are all part of a cold chain, often known as cool cargo. To preserve the quality and integrity of perishable items, a particular low-temperature range must typically be maintained; that is, certain product groups must be refrigerated, some must be frozen, and still others require severe circumstances (also known as an ultralow chain or deep freeze). Product spoiling and, eventually, monetary losses result from improper temperature maintenance. The handling and safe delivery of such goods from the producer or supplier to the customer is the goal of cold chain logistics.

Key Insights

- As per the analysis shared by our research analyst, the global cold chain logistics market is estimated to grow annually at a CAGR of around 7.9% over the forecast period (2024-2032).

- In terms of revenue, the global cold chain logistics market size was valued at around USD 289 billion in 2023 and is projected to reach USD 795 billion by 2032.

- The increasing food & beverages industry is expected to drive the cold chain logistics market over the forecast period.

- Based on type, the refrigerated warehouses segment is expected to dominate the market over the forecast period.

- Based on application, the dairy and frozen desserts segment is expected to hold the largest market share over the forecast period.

- Based on region, North America is expected to dominate the market during the forecast period.

Cold Chain Logistics Market: Growth Drivers

Rising international food trade drives market growth

The global trade in goods has grown dramatically over the last three decades. The global food system's immense complexity and interdependencies, as well as the annual agricultural trade of over USD 1.1 trillion, demonstrate that the food industry is not an exception. Every country in the world relies on trade to meet its food needs to varying degrees. Through the import and export of food products, nations depend on one another to ensure a sufficient and diverse food supply; as a result, the global food trade is expanding.

Additionally, increased rivalry and the requirement to guarantee food supply safety will accompany better access to export markets. It is difficult to ensure the safety of the food supply, especially in developing nations where the food industry and control systems need to improve their quality assurance procedures. The need for cold chain logistics is growing in these nations to make use of each nation's unique advantages and create a range of food items at a reasonable cost while paying attention to better food safety and quality.

Cold Chain Logistics Market: Restraints

High cost associated with cold chain systems hinders market growth

Cost optimization, risk management, and regulatory compliance are the inherent difficulties in the cold chain transportation of medications and food. Each organization also has its own set of operational and technical limitations. Despite the advancements in cold chain technology, the most dependable solutions are still too costly to be easily accessible. Purchasing property, constructing buildings, securing permits and licenses, and setting up utilities like electricity and water are all part of the investment in cold chain systems.

Additionally, purchasing the cooling equipment requires a substantial initial investment from the producer. The manufacturer has to take working capital costs into account in addition to the fixed costs listed above. The cold chain logistics market's expansion is hampered by the high cost of the cold storage required to store frozen goods and the subsequent maintenance of the cold storage's temperatures.

Cold Chain Logistics Market: Opportunities

Rising product launches offer a lucrative opportunity for market growth

The growing product launch is expected to offer a lucrative opportunity for the growth of the cold chain logistics market over the forecast period. For instance, in June 2024, the world leader in active supply chain intelligence and risk management, Overhaul, announced the release of its state-of-the-art Cold Chain Quality Solution.

For time- and temperature-sensitive cargo, this cutting-edge software solution offers unmatched risk and quality management, guaranteeing ideal conditions across the supply chain for the high-value food and beverage, pharmaceutical, and healthcare industries.

To meet the urgent requirement for reliable cold chain logistics, Overhaul's Cold Chain Quality Solution makes use of proactive risk management, real-time global visibility, and sophisticated quality control. This approach reduces large financial losses and protects patient safety in healthcare supply chains, where an estimated 20% of temperature-sensitive products are damaged during transport as a result of supply chain disruptions. It offers comprehensive monitoring tools and device-agnostic capabilities while integrating smoothly with current systems.

Cold Chain Logistics Market: Challenges

Lack of standardization poses a major challenge to market expansion

In the cold chain logistics industry, a major problem is the absence of standardization, which can result in inefficiencies, higher expenses, and compromised product integrity. There is no uniform standard for the temperature ranges needed by many businesses, such as food, chemicals, and medicines. Service providers face challenges because, for example, vaccine storage frequently requires a precise range (-70°C to -20°C for some), while frozen goods require -18°C.

Compatibility problems are also caused by the lack of standardization in cold chain technology, including monitoring systems and equipment standards. Supply chain integration is hampered by fragmented IoT and tracking solution adoption. Thus, the lack of standardization poses a major challenge for the cold chain logistics market.

Cold Chain Logistics Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Cold Chain Logistics Market |

| Market Size in 2023 | USD 289 Billion |

| Market Forecast in 2032 | USD 795 Billion |

| Growth Rate | CAGR of 11.9% |

| Number of Pages | 222 |

| Key Companies Covered | Americold Logistics LLC, Burris Logistics, Cold Box, Conestoga Cold Storage, Congebec, Lineage Logistics Holding LLC, Nichirei Corporation, Tippmann Group, United States Cold Storage, VersaCold Logistics Services, and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Cold Chain Logistics Market: Segmentation

The global cold chain logistics industry is segmented based on type, application, and region.

Based on the type, the global cold chain logistics market is segmented into refrigerated warehouses and refrigerated transportation. The refrigerated warehouses segment is expected to dominate the market over the forecast period. Refrigerated warehouses are cold storage establishments with temperature-controlled areas that prevent spoiling a variety of goods, such as dairy, meat, and prescription medications. The need for refrigerated warehouses to maintain product quality and reduce waste has increased due to the rise in the import and export of temperature-sensitive commodities as well as the varying demand for such perishable items.

Additionally, this segment's growth is being positively impacted by the growing demand for safe and effective distribution of temperature-sensitive items.

Based on the application, the global cold chain logistics industry is bifurcated into fruits and vegetables, bakery and confectionary, dairy and frozen desserts, meat, fish, and seafood, drugs and pharmaceuticals, and others. The dairy and frozen desserts segment is expected to hold the largest market share over the forecast period. Customers generally favor dairy and frozen sweets because of their longer shelf life, ease of preparation, and increased convenience.

Moreover, these goods typically have a rich flavor and texture and high concentrations of vital nutrients. Additionally, as people's awareness of fitness and health increases, they are adding more dairy products to their daily meals to increase their nutrient consumption. This is contributing to a positive outlook for this market, as does the growing customer preference for packaged foods and the requirement for rigorous temperature control when dairy and frozen desserts are being stored and transported.

Cold Chain Logistics Market: Regional Analysis

North America dominates the market over the projected period

North America is expected to dominate the global cold chain logistics market during the forecast period. The increasing demand for organic food brought on by fast urbanization and a rise in the adoption of healthy eating habits are the main causes of regional growth. The market for cold chain logistics is expected to increase throughout the forecast period due to Canada's substantial fishing zones in the North American region.

Due to the strict government regulations and rising demand for packaged foods, the United States is anticipated to contribute the most to the North American industry.

Additionally, e-commerce is expanding quickly in the US market and is primarily utilized for the delivery of packaged foods, fresh food, and groceries. As a result, cold warehousing and shipping are increasingly being outsourced to outside service providers, which is probably going to improve e-commerce for packaged perishable commodities.

Furthermore, one of the key elements anticipated to drive the need for cold chain vehicles is the existence of major beverage firms in the US, which are heavily reliant on cold storage transportation facilities to distribute goods.

Cold Chain Logistics Market: Competitive Analysis

The global cold chain logistics market is dominated by players like:

- Americold Logistics LLC

- Burris Logistics

- Cold Box

- Conestoga Cold Storage

- Congebec

- Lineage Logistics Holding LLC

- Nichirei Corporation

- Tippmann Group

- United States Cold Storage

- VersaCold Logistics Services

The global cold chain logistics market is segmented as follows:

By Type

- Refrigerated Warehouses

- Refrigerated Transportation

By Application

- Fruits and Vegetables

- Bakery and Confectionary

- Dairy and Frozen Desserts

- Meat, Fish, and Sea Food

- Drugs and Pharmaceuticals

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Cold chain logistics refers to the transportation, storage, and handling of temperature-sensitive products while maintaining a specified temperature range throughout the supply chain.

The cold chain logistics market is driven by several variables, such as the growing international food trade, rising product launches, technological advancements, and others.

According to the report, the global cold chain logistics market size was worth around USD 289 billion in 2023 and is predicted to grow to around USD 795 billion by 2032.

The global cold chain logistics market is expected to grow at a CAGR of 11.9% during the forecast period.

The global cold chain logistics market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market due to the growing food & beverage industry and the presence of major players.

The global cold chain logistics market is dominated by players like Americold Logistics, LLC, Burris Logistics, Cold Box, Conestoga Cold Storage, Congebec, Lineage Logistics Holding, LLC, Nichirei Corporation, Tippmann Group, United States Cold Storage and VersaCold Logistics Services among others.

The cold chain logistics market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed