Colocation Providers Green Data Center Market Size, Share, Trends, Growth and Forecast 2032

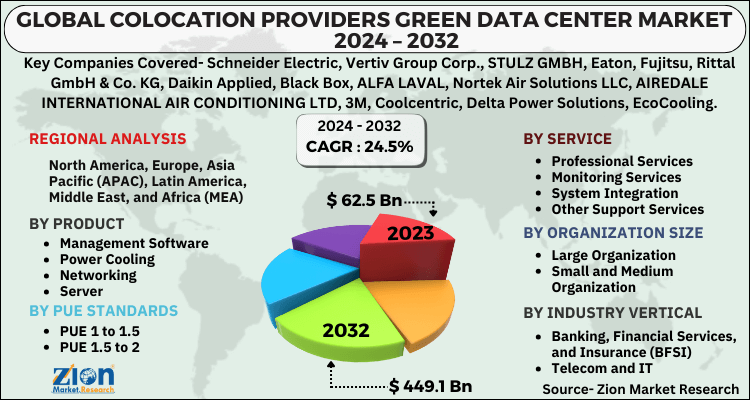

Colocation Providers Green Data Center Market By Solution (Management Software, Power Cooling, Networking, Server, and Green Solutions), By PUE Standards (PUE 1 to 1.5, PUE 1.5 to 2, and PUE Greater than 2), By Service (Professional Services, Monitoring Services, System Integration, and Other Support Services), By Organization Size (Large Organization and Small and Medium Organization), By Industry Vertical (Banking, Financial Services, and Insurance (BFSI), Telecom and IT, Healthcare, Government and Public, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

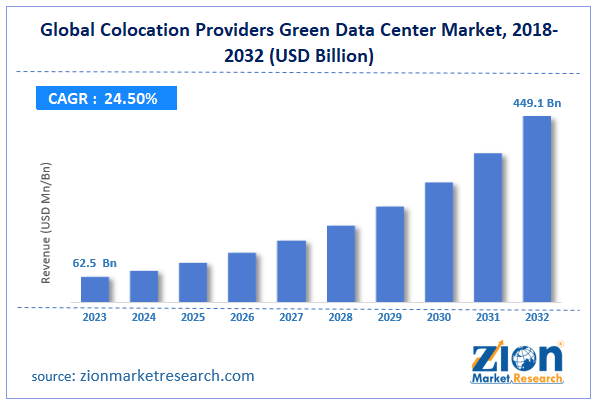

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 62.5 Billion | USD 449.1 Billion | 24.5% | 2023 |

Colocation Providers Green Data Center Industry Prospective:

The global colocation providers green data center market size was worth around USD 62.5 billion in 2023 and is predicted to grow to around USD 449.1 billion by 2032, with a compound annual growth rate (CAGR) of roughly 24.5% between 2024 and 2032.

Colocation Providers Green Data Center Market: Overview

Data center services from a colocation provider let businesses lease space for servers and other computer equipment in a shared facility. While the consumer oversees and maintains the equipment placed within the provider's building, the provider is in charge of managing the physical infrastructure, which includes power, cooling, physical security, and internet connection.

Design, construction, and operation-wise, a facility lowering its environmental effect is called a "green data center." Using sustainable practices, renewable energy sources, and energy-efficient technologies helps lower greenhouse gas emissions, power consumption, and waste while preserving constant performance.

Key Insights

- As per the analysis shared by our research analyst, the global colocation providers green data center market is estimated to grow annually at a CAGR of around 24.5% over the forecast period (2024-2032).

- In terms of revenue, the global colocation providers green data center market size was valued at around USD 62.5 billion in 2023 and is projected to reach USD 449.1 billion by 2032.

- The increasing product launch is expected to drive the colocation providers green data center market over the forecast period.

- Based on the solution, the power cooling segment is expected to dominate the market over the forecast period.

- Based on the PUE standards, the PUE 1 to 1.5 segment is expected to hold the largest market share over the forecast period.

- Based on the service, the professional services segment is expected to capture a significant market share during the forecast period.

- Based on the organization size, the large organization is expected to dominate the market over the forecast period.

- Based on the industry vertical, the Banking, Financial Services, and Insurance (BFSI) segment is expected to hold the largest market share over the forecast period.

- Based on region, North America is expected to dominate the market during the forecast period.

Colocation Providers Green Data Center Market: Growth Drivers

Increasing government push for green data center development drives market growth

To reduce emissions and data center electricity use, governments around the world have started some projects. For instance, the Canadian government launched a USD 960 million investment plan in 2021. To lower carbon emissions, the government plans to invest in smart renewable energy projects and improve grid infrastructure. Similarly, India has set a goal to produce 450 MW of renewable energy by 2030, according to the State Ministry for Chemical and Fertilizers, New Renewable Energy. In Karnataka, four solar power facilities with a combined 1,200 MW generating capacity will be established.

The adoption of renewable energy sources to power data centers in new sites will expand due to the government's and operators' increased interest in reducing carbon emissions and electricity usage. Throughout the projected period, the trend is anticipated to generate growth prospects for the colocation providers green data center market.

Colocation Providers Green Data Center Market: Restraints

High initial investment cost hinders market growth

One major obstacle to the expansion of the green data center sector is the high upfront investment expenses. These expenses result from the requirement for cutting-edge technologies, sophisticated infrastructure, and adherence to environmental guidelines—all of which demand a sizable initial investment. The process of creating a green data center entails using eco-friendly materials and energy-efficient designs, which are usually more costly than traditional building methods.

Adding sophisticated cooling systems like geothermal, liquid, or free air cooling raises the initial costs. Capital expenses are also greatly increased by the use of AI-driven energy management systems, real-time monitoring tools, and energy-efficient hardware. Green technology retrofitting of older buildings frequently necessitates costly upgrades to make room for new equipment.

Colocation Providers Green Data Center Market: Opportunities

Growing initiatives by the key players through innovative product launches offer a lucrative opportunity for market growth

The rising initiatives by the key players through innovative product launches are expected to offer a lucrative opportunity for the colocation providers green data center market growth over the forecast period. For instance, in January 2023, one of the top three data center service providers in the world, NTT Ltd., is dedicated to making the data center environment green. Its most recent effort to this end is the innovative implementation of Direct Contact Liquid Cooling (DCLC) and Liquid Immersion Cooling (LIC) technologies.

At its Navi Mumbai Data Center, the business just celebrated the largest deployment of its kind in Asia. Located on its Mahape site, the unique building spans 13,740 square feet and has a 4.8 MW capacity. Up to four data centers and a maximum IT load of 150 MW are planned for the facility. India is the first nation to implement these alternate cooling solutions across NTT's global data center platform.

Colocation Providers Green Data Center Market: Challenges

Technological complexity poses a major challenge to market expansion

Energy-efficient technology implementation can be challenging and demand for qualified staff. Some instances of these technologies include liquid cooling, AI-based optimization, and sophisticated monitoring systems. Adoption may be delayed by a steep learning curve and a lack of knowledge about green technologies. Therefore, technological complexity poses a major challenge for the colocation providers green data center industry.

Request Free Sample

Request Free Sample

Colocation Providers Green Data Center Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Colocation Providers Green Data Center Market |

| Market Size in 2023 | USD 62.5 Billion |

| Market Forecast in 2032 | USD 449.1 Billion |

| Growth Rate | CAGR of 24.5% |

| Number of Pages | 216 |

| Key Companies Covered | Schneider Electric, Vertiv Group Corp., STULZ GMBH, Eaton, Fujitsu, Rittal GmbH & Co. KG, Daikin Applied, Black Box, ALFA LAVAL, Nortek Air Solutions LLC, AIREDALE INTERNATIONAL AIR CONDITIONING LTD, 3M, Coolcentric, Delta Power Solutions, EcoCooling, and others. |

| Segments Covered | By Product, By PUE Standards, By Service, By Organization Size, By Industry Vertical, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Colocation Providers Green Data Center Market: Segmentation

The global colocation providers green data center industry is segmented based on solution, PUE standards, service, organization size, industry vertical, and region.

Based on solution, the global colocation providers green data center market is segmented into management software, power cooling, networking, server, and green solutions. The power cooling segment is expected to dominate the market over the forecast period. The demand for scalable and energy-efficient colocation services has expanded as a result of the growth of IoT, AI, and 5G technologies, which have raised the requirement for data processing and storage. High-density server environments require availability and dependability, which advanced cooling systems deliver, allowing providers to charge premium prices.

Based on PUE standards, the global colocation providers green data center industry is bifurcated into PUE 1 to 1.5, PUE 1.5 to 2, and PUE Greater than 2. The PUE 1 to 1.5 segment is expected to hold the largest market share over the forecast period. Lower PUE values can be attained by the use of modular data center designs, airflow-optimized layouts, and green construction materials. The move from PUE 1 to 1.5 is facilitated by retrofitting older buildings with contemporary, energy-efficient components.

Based on service, the global colocation providers green data center market is bifurcated into professional services, monitoring services, system integration, and other support services. The professional services segment is expected to capture a significant market share during the forecast period. Professional services that offer knowledge and assistance reduce the entry barriers for companies switching to green data centers. Consulting services and customized solutions draw in a wider range of customers, including small and medium-sized businesses (SMEs).

Based on the organization size, the global colocation providers green data center industry is bifurcated into large organizations and small & medium organizations. The large organization is expected to dominate the market over the forecast period. There is growing pressure on large companies to comply with environmental, social, and governance (ESG) programs and reduce their carbon footprint. Using green data centers improves a company's reputation while helping it comply with regulations.

Based on industry vertical, the global colocation providers green data center market is bifurcated into Banking, Financial Services, and Insurance (BFSI), Telecom and IT, Healthcare, Government and Public, and Others. The Banking, Financial Services, and Insurance (BFSI) segment is expected to hold the largest market share over the forecast period. Data processing and storage requirements have grown dramatically as a result of the BFSI sector's transition to online banking, mobile applications, AI-powered financial services, and blockchain technology. Scalable solutions are provided by colocation green data centers to satisfy these changing needs.

Colocation Providers Green Data Center Market: Regional Analysis

North America dominates the market over the projected period

North America is expected to dominate the global colocation providers green data center market. The need for green colocation services is driven by North American businesses' growing emphasis on Environmental, Social, and Governance (ESG) objectives. Major large companies like Google, Amazon, and Microsoft are pledging to adopt sustainable practices and become carbon neutral. Green data centers, which offer substantial cost savings through lower power use, are also being adopted by enterprises as a result of rising energy costs in North America. Energy-efficient equipment and cutting-edge cooling technology reduce operating costs.

Colocation Providers Green Data Center Market: Competitive Analysis

The global colocation providers green data center market is dominated by players like:

- Schneider Electric

- Vertiv Group Corp.

- STULZ GMBH

- Eaton

- Fujitsu

- Rittal GmbH & Co. KG

- Daikin Applied

- Black Box

- ALFA LAVAL

- Nortek Air Solutions LLC

- AIREDALE INTERNATIONAL AIR CONDITIONING LTD

- 3M

- Coolcentric

- Delta Power Solutions

- EcoCooling

The global colocation providers green data center market is segmented as follows:

By Product

- Management Software

- Power Cooling

- Networking

- Server

- Green Solutions

By PUE Standards

- PUE 1 to 1.5

- PUE 1.5 to 2

- PUE Greater than 2

By Service

- Professional Services

- Monitoring Services

- System Integration

- Other Support Services

By Organization Size

- Large Organization

- Small and Medium Organization

By Industry Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Telecom and IT

- Healthcare

- Government and Public

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Data center services from a colocation provider let businesses lease space for servers and other computer equipment in a shared facility. While the consumer oversees and maintains the equipment placed within the provider's building, the provider is in charge of managing the physical infrastructure, which includes power, cooling, physical security, and internet connection.

The colocation providers green data center market is driven by rising government efforts, technological advancements, increasing product launches, expanding data centers, and others.

According to the report, the global colocation providers green data center market size was worth around USD 62.5 billion in 2023 and is predicted to grow to around USD 449.1 billion by 2032.

The global colocation providers green data center market is expected to grow at a CAGR of 24.5% during the forecast period.

The global colocation providers green data center market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market due to the growing sustainability initiatives by large organizations and the increasing expansion of data centers.

The global colocation providers green data center market is dominated by players like Schneider Electric, Vertiv Group Corp., STULZ GMBH, Eaton, Fujitsu, Rittal GmbH & Co. KG, Daikin Applied, Black Box, ALFA LAVAL, Nortek Air Solutions, LLC, AIREDALE INTERNATIONAL AIR CONDITIONING LTD, 3M, Coolcentric, Delta Power Solutions, and EcoCooling among others.

The colocation providers green data center market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed