Commercial Aircraft Market Trend, Share, Growth, Size, Analysis and Forecast 2032

Commercial Aircraft Market By Size (Wide Body, Narrow Body, Freighter, Regional & Business Jet, and Others), By Application (Cargo and Passenger), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

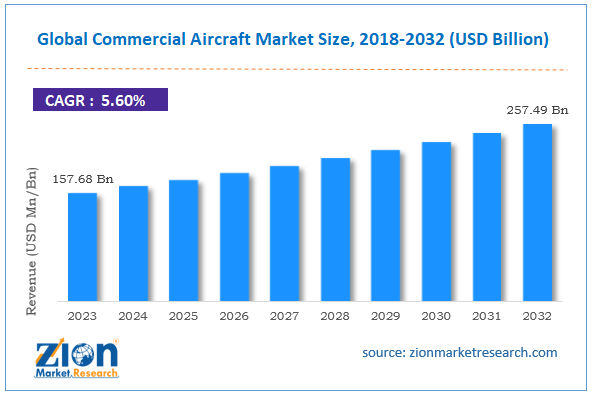

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 157.68 billion | USD 257.49 billion | 5.60% | 2023 |

Commercial Aircraft Industry Perspective:

The global commercial aircraft market size was worth around USD 157.68 billion in 2023 and is predicted to grow to around USD 257.49 billion by 2032 with a compound annual growth rate (CAGR) of roughly 5.60% between 2024 and 2032.

Commercial Aircraft Market: Overview

Commercial aircrafts are used in the commercial aviation industry. It is a form of civil aviation and includes the use of aircrafts in exchange for remuneration, unlike private aviation. Commercial aircrafts are also known as airliners. They are used for the safe transportation of cargo and passengers. Mostly, these aircrafts are operated by large corporations known as airlines. A typical modern commercial aircraft is tube-shaped and powered by jet engines. Aircrafts that move in cross-border networks are generally wide-bodied and consist of two aisles as opposed to narrow-body aircrafts. The latter type is used in medium-distance flights and does not have the capacity to carry more passengers as compared to wide-body aircrafts. Wright brothers are credited for the modern aviation industry which has become a major transport sector carrying commodities and people from one region to another and across all areas on the planet. The commercial aircrafts have undergone further development with the launch of airliners meant for luxury travel or corporate use. These aircrafts are generally owned by an organization to be used for business purposes only. There is a growing market for private aircrafts owned by high-net-worth individuals. Almost all commercial aircrafts are lifted off the ground using the air that flows across the wings. The aviation industry has been accused of causing higher pollution and excessive consumption of fuel.

Key Insights:

- As per the analysis shared by our research analyst, the global commercial aircraft market is estimated to grow annually at a CAGR of around 5.60% over the forecast period (2024-2032)

- In terms of revenue, the global commercial aircraft market size was valued at around USD 157.68 billion in 2023 and is projected to reach USD 257.49 billion, by 2032.

- The market is projected to grow at a significant rate due to the growing investments in improving regional and global community

- Based on the size, the narrow body segment is growing at a high rate and will continue to dominate the global market as per industry projection

- Based on the application, the passenger segment is anticipated to command the largest market share

- Based on region, Europe is projected to dominate the global market during the forecast period

Request Free Sample

Request Free Sample

Commercial Aircraft Market: Growth Drivers

Growing investments in improving regional and global communities will drive the market demand

The global commercial aircraft market is expected to grow due to the increasing investments toward improving the regional and global community. Governments across the globe are seeking solutions that can effectively connect remote regions with urban or main cities. Higher regional connectivity is an important indication of overall regional economic growth. Transportation accessibility is crucial for overall regional development. It promotes spatial integration, economic growth, overall quality of living, and balanced regional planning. Aviation is an integral part of modern transportation as it is more time-saving and can efficiently carry goods and personnel across geographical borders including longer distances. Other means of transportation including roadways, railways, and waterways cannot deliver these advantages. In May 2024, India’s leading airline Indigo announced that it will invest in developing a more comprehensive and stronger regional network. To achieve this goal, the company has already ordered 100 smaller aircraft. The company is considering E175 and A220 jets to be added to its fleet of aircraft. In September 2023, Lufthansa (LH) Group announced that it would be making a major investment in its North American network by launching more flight routes with increased capacity. The new flight routes include continuous flights between Raleigh-Durham, Frankfurt, and Minneapolis-St. Paul, and Washington-Zürich route.

Rising international partnerships for aircraft designing and procurement may impact the market growth rate

The demand for commercial aircraft is expected to further gain from the increasing international partnerships between market players. These collaborations are multi-faceted. For instance, certain collaborations are expected to result in greater innovation in the field of commercial aircrafts while others aim toward procurement of raw materials and final goods. In March 2024, Japan Airlines announced its plans to buy 42 aircrafts from Airbus and Boeing since the country aims to accelerate its domestic and international operations thus contributing to the global commercial aircraft market.

Commercial Aircraft Market: Restraints

High cost of investment in the industry could restrict the market expansion rate

The global industry for commercial aircraft is projected to be restricted due to the high cost of investment. The aircraft industry is highly resource-intensive. Manufacturing commercial aircraft requires billions of dollars as a starting investment. Moreover, the long-term survival of aircraft manufacturing is further facilitated by exhaustive resource investments. The cost of starting and operating a commercial airliner can cost between USD 80 million to USD 200 million thus limiting the industry’s growth rate.

Commercial Aircraft Market: Opportunities

Rising demand for luxury private jets will generate high growth opportunities for the industry

The global commercial aircraft market is expected to generate growth opportunities in the growing segment of luxury private jets. This type of commercial aircraft is mainly used for business purposes or by individuals of high net worth. For instance, large corporations generally have in-house private jets used by high-ranking business employees for carrying out business-related tasks. Private jets are owned by individuals such as celebrities, sports personnel, and politicians for hassle-free transport from one location to another. For instance, recent reports indicate that the current most expensive private jet is worth USD 500 million. Originally, it was a long-haul aircraft that was further modified to meet the personal taste and needs of the owner. The aircraft offers extensive features including a grand piano area, a dining room for over 10 people, and an entertainment stadium among other offerings. As per official data, currently, there are more than 21000 business aircrafts that are in operation and the number continues to grow every year. This segment holds exceptional growth avenues as the demand for easy and quick transport of personnel and goods is on the rise.

Growing investments in fuel-efficient commercial aircrafts may promote the market expansion trajectory

Commercial aircraft are some of the largest fuel consumers. As per research, a typical Boeing 747 consumes around 12 liters of fuel for every kilometer. The dwindling access to nonrenewable fuel has resulted in increased demand for more fuel-efficient commercial aircraft in addition to the growing pressure from regional governments to reduce carbon emissions and achieve respective net zero visions. In August 2023, reports emerged as Airbus and Boeing were experimenting with blended wing body aircraft which is expected to reduce fuel burn and emissions by 50% of the current rate. The growing shift toward hydrogen-fueled aircraft will deliver exceptional growth opportunities for the global commercial aircraft market.

Commercial Aircraft Market: Challenges

Surge in aircraft-related incidents globally may challenge the market expansion rate

The global industry for commercial aircraft is expected to be challenged by the increasing cases of aircraft-related incidents across the globe. Such incidents represent the dwindling quality of modern aircraft. In May 2024, a Boeing airplane, at one of the airports in Senegal, caught fire and skidded off the runway. The aircraft was carrying around 85 passengers causing injury to 10 of them. In January 2024, a chartered flight from India heading to Moscow crashed in Afghanistan. Such incidents have been reported globally with the sudden spike in aircraft accidents in the last decade.

Commercial Aircraft Market: Segmentation

The global commercial aircraft market is segmented based on size, application, and region.

Based on the size, the global market segments are wide body, narrow body, freighter, regional & business jet, and others. In 2023, the highest growth was observed in the narrow body segment. These aircraft have single ailes and have a seating capacity for 100 to 200 passengers. Narrow-body commercial aircraft are generally deployed for medium-haul flights. The growing investments in developing regional connectivity across emerging countries are resulting in higher segmental demand. In May 2024, Zambia Airways, the national aircraft carrier for Zambia announced the launch of a new regional service connecting Kenya’s Nairobi and Dar es Salaam in Tanzania to Lusaka.

Based on the application, the global market divisions are cargo and passenger. In 2023, the highest demand was observed in the passenger segment. The growth rate observed in the national tourism industry is driving the segmental revenue. Factors such as a rise in leisure, medical, or business-related travel are causing the passive spike in the passenger segment. Europe registered more than 695 million tourists in 2023 as per official data. The cargo segment is also an essential contributor; however, a large percentage of global cargo is mainly transported through waterways.

Commercial Aircraft Market Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Commercial Aircraft Market |

| Market Size in 2023 | USD 157.68 Billion |

| Market Forecast in 2032 | USD 257.49 Billion |

| Growth Rate | CAGR of 5.60% |

| Number of Pages | 209 |

| Key Companies Covered | Sukhoi Civil Aircraft Company, Bombardier Aerospace, Mitsubishi Aircraft Corporation, Irkut Corporation, Piaggio Aerospace, Saab Group, COMAC (Commercial Aircraft Corporation of China), Boeing, Lockheed Martin, Kawasaki Heavy Industries, Airbus, ATR (Aerei da Trasporto Regionale), Tupolev, Embraer, Antonov., and others. |

| Segments Covered | By Size, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Commercial Aircraft Market: Regional Analysis

Europe to continue leading the market growth rate during the forecast period

The global commercial aircraft market is dominated by Europe. The region is home to one of the world’s largest commercial aircraft makers in the world. Headquartered in France, Airbus is a leading producer of most modern commercial aircraft that are used by countries across the globe. Since 2019, the company has dominated the aircraft manufacturing sector delivering over 700 aircraft in 2023 alone. In December 2023, Air India borrowed a loan of USD 120 million from Sumitomo Mitsui Banking Corporation India. The Indian airline company will use the money to buy A350-900 aircraft from Airbus as per official information. In January 2024, Airbus announced the launch of a new ZEROe Development Center located in Stade. The facility will focus on research & development concerning hydrogen technologies. The company is investing heavily in global expansion by collaborating with international partners. For instance, in January 2024, vying for the growth potential in the Indian market, the company doubled its investment in the region. As per the company’s forecast, the Indian market can raise a request for around 2840 aircraft by 2035. In addition to this, Airbus has been at the forefront of developing commercial aircrafts powered by green technology such as hydrogen fuel. North America will emerge as a significant contributor to the global industry. The presence of Airbus competitors in the form of the Boeing brand will help the region thrive in the coming years.

Commercial Aircraft Market: Competitive Analysis

The global commercial aircraft market is led by players like:

- Sukhoi Civil Aircraft Company

- Bombardier Aerospace

- Mitsubishi Aircraft Corporation

- Irkut Corporation

- Piaggio Aerospace

- Saab Group

- COMAC (Commercial Aircraft Corporation of China)

- Boeing

- Lockheed Martin

- Kawasaki Heavy Industries

- Airbus

- ATR (Aerei da Trasporto Regionale)

- Tupolev

- Embraer

- Antonov.

The global commercial aircraft market is segmented as follows:

By Size

- Wide Body

- Narrow Body

- Freighter

- Regional & Business Jet

By Application

- Cargo

- Passenger

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Commercial aircrafts are used in the commercial aviation industry.

The global commercial aircraft market is expected to grow due to the increasing investments toward improving the regional and global community.

According to study, the global commercial aircraft market size was worth around USD 157.68 billion in 2023 and is predicted to grow to around USD 257.49 billion by 2032.

The CAGR value of commercial aircraft market is expected to be around 5.60% during 2024-2032.

The global commercial aircraft market is dominated by Europe.

The global commercial aircraft market is led by players like Sukhoi Civil Aircraft Company, Bombardier Aerospace, Mitsubishi Aircraft Corporation, Irkut Corporation, Piaggio Aerospace, Saab Group, COMAC (Commercial Aircraft Corporation of China), Boeing, Lockheed Martin, Kawasaki Heavy Industries, Airbus, ATR (Aerei da Trasporto Regionale), Tupolev, Embraer and Antonov.

The report explores crucial aspects of the commercial aircraft market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed