Commercial Aircraft Seating Market Size, Share, Trends, Growth 2032

Commercial Aircraft Seating Market By Aircraft Type (Narrowbody Aircraft, Widebody Aircraft, Business Jets, and Regional Aircraft), By Cabin Class (Economy Class, Business Class, Premium Economy Class, and First Class), By Components (Seat Frames, Seat Actuators, Seat Covers, Cushions, Seat Belts, and Others), By Material (Foam, Fabric, Leather, and Other Materials), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

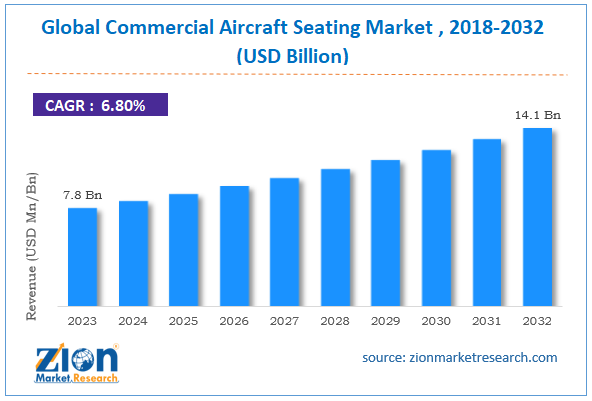

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 7.8 Billion | USD 14.1 Billion | 6.8% | 2023 |

Commercial Aircraft Seating Industry Prospective:

The global commercial aircraft seating market size was worth around USD 7.8 billion in 2023 and is predicted to grow to around USD 14.1 billion by 2032, with a compound annual growth rate (CAGR) of roughly 6.8% between 2024 and 2032.

Commercial Aircraft Seating Market: Overview

The seats found in passenger airplanes operated by commercial airlines are referred to as commercial aircraft seating. These seats are made to accommodate several classes, including business, first class, premium economy, and economy while maximizing space, comfort, and safety.

Usually, they are constructed from sturdy, lightweight materials to improve fuel economy and adhere to aviation laws. Ergonomic designs, adjustable features, in-flight entertainment, and networking choices are all part of contemporary airplane seating. The growth of airline fleets, passenger comfort preferences, and technological developments in seat materials and designs all have an impact on the commercial aviation seating business.

Key Insights

- As per the analysis shared by our research analyst, the global commercial aircraft seating market is estimated to grow annually at a CAGR of around 6.8% over the forecast period (2024-2032).

- In terms of revenue, the global commercial aircraft seating market size was valued at around USD 7.8 billion in 2023 and is projected to reach USD 14.1 billion by 2032.

- The increasing air travel is expected to drive the commercial aircraft seating market over the forecast period.

- Based on the aircraft type, the narrowbody aircraft segment is expected to hold the largest market share over the forecast period.

- Based on the cabin class, the economy class segment is expected to dominate the market over the forecast period.

- Based on the components, the seat frames segment is expected to hold the largest market share over the forecast period.

- Based on the material, the leather segment is expected to capture the largest market share over the forecast period.

- Based on region, North America is expected to dominate the market during the forecast period.

Commercial Aircraft Seating Market: Growth Drivers

Rising air travel drives market growth

The general increase in air travel, driven by growing middle classes in emerging nations, corporate travel, and increased international tourism, is boosting the need for new aircraft and, by extension, aircraft seating. Airlines make investments in new aircraft and seating configurations to accommodate more passengers, which raises the demand for creative seating solutions.

Revenue passenger kilometers (RPKs) increased to 52.4% in March 2022, according to the IATA, suggesting a significant surge in demand for air travel in March 2023. RPKs increased 40.1% a year to 92.9% of their pre-pandemic levels by September 2023. In 2023, the IATA anticipates that all regions—aside from Asia Pacific—will either reach or exceed their 2019 traffic levels. Global passenger traffic is predicted to triple by 2040.

Commercial Aircraft Seating Market: Restraints

High production and certification costs hinder market growth

The process of creating and testing new airplane seating arrangements can be expensive and time-consuming. During the certification and testing processes, certain safety rules must be adhered to. The cost of developing and certifying new aircraft seating can vary depending on the materials used, the level of technical innovation, and the design's complexity.

According to a study conducted by the Airplane Owners and Pilots Association (AOPA), allowing extra interior elements like seats can significantly increase the overall cost of manufacturing an airplane. A primary category aircraft (three seats or fewer) requires about USD 1 million to be certified. A general aviation aircraft costs around $25 million, whereas a commercial aircraft can cost hundreds of millions. The cost of developing a new airliner might range from USD 5 billion to USD 15 billion, depending on the project's complexity and the size of the aircraft.

Furthermore, according to Simple Flying, an airline seat will cost roughly USD 4,000. The price of first-class suites and other more costly seats can reach USD 250,000 each. High development costs may be a barrier to entry for smaller companies. The lengthy certification process may delay the introduction of innovative seating options to the market.

To ensure the dependability and safety of airplane parts, including seats, the FAA and other international regulatory agencies have strict certification criteria. These requirements are non-negotiable, even though fulfilling them calls for a difficult and drawn-out certification process. Because of this, startups or smaller manufacturers entering the airline seat industry have difficulties due to the high expenses of development and certification. Financial constraints that limit their ability to invest in R&D may reduce their competitiveness.

Commercial Aircraft Seating Market: Opportunities

Expansion in the product portfolio by the key market players offers a lucrative opportunity for market growth

The expansion in the product portfolio by the key market players is expected to flourish the commercial aircraft seating market expansion over the forecast period.

For instance, in June 2023, at AIX 2023, RECARO Aircraft Seating (RECARO) will be exhibiting its most recent innovation and sustainability projects in addition to the PL3810 premium class seat, the company's newest product. The new seat raises the standard for high-end travel. The AIX booth will also showcase the whole range of RECARO products, front-row monument improvements for business class, and customer service solutions.

Commercial Aircraft Seating Market: Challenges

Stringent regulatory compliance poses a major challenge to market expansion

The market for seats on commercial aircraft is strictly controlled because of the need for passenger comfort, safety, and operational effectiveness. Strict compliance requirements affect the certification, manufacturing, materials, and seat design processes. FAA regulations, for example, require all aircraft seats to be crashworthy, fire-resistant, flammable, and subject to dynamic impact testing. TSO-C127a and other FAA Technical Standard Orders (TSO) specify minimum performance requirements for seats in transport category aircraft. Therefore, stringent regulatory compliance hampers the commercial aircraft seating market growth.

Commercial Aircraft Seating Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Commercial Aircraft Seating Market |

| Market Size in 2023 | USD 7.8 Billion |

| Market Forecast in 2032 | USD 14.1 Billion |

| Growth Rate | CAGR of 6.8% |

| Number of Pages | 207 |

| Key Companies Covered | Zodiac Aerospace, Recaro Aircraft Seating GmbH & Co. KG, B/E Aerospace Inc., Aviointeriors S.p.A., Geven S.p.A., Thompson Aero Seating Ltd., STELIA Aerospace (a subsidiary of Airbus), Acro Aircraft Seating Ltd., HAECO Cabin Solutions (a division of HAECO Group), Mirus Aircraft Seating Ltd., Expliseat SAS, ZIM Flugsitz GmbH, Optimares S.p.A., Jamco Corporation, Airgo Design Pte Ltd., and others. |

| Segments Covered | By Aircraft Type, By Cabin Class, By Components, By Material, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Commercial Aircraft Seating Market: Segmentation

The global commercial aircraft seating industry is segmented based on aircraft type, cabin class, components, material, and region.

Based on the aircraft type, the global commercial aircraft seating market is bifurcated into narrowbody aircraft, widebody aircraft, business jets, and regional aircraft. The narrowbody aircraft segment is expected to hold the largest market share over the forecast period. Increasing orders for narrowbody aircraft (Airbus A320neo, Boeing 737 MAX, COMAC C919) are driving demand for modern, fuel-efficient seating solutions.

Based on the cabin class, the global commercial aircraft seating industry is segmented into economy class, business class, premium economy class, and first class. The economy class segment is expected to dominate the market over the forecast period. Economy class seats are crucial for airlines looking to maximize passenger capacity, particularly for low-cost carriers (LCCs), due to their high-density arrangements and affordability.

Based on the components, the global commercial aircraft seating market is bifurcated into seat frames, seat actuators, seat covers, cushions, seat belts, and others. The seat frames segment is expected to hold the largest market share over the forecast period. More roomy and comfortable sitting alternatives are the result of advancements in seat frame design, such as the incorporation of elements influenced by the car racing sector. For instance, JPA Design, Williams Advanced Engineering, and SWS collaborated to create a futuristic seat that unites all parts around the seat, giving passengers more storage space and legroom.

Based on the materials, the global commercial aircraft seating industry is bifurcated into foam, fabric, leather, and other materials. The leather segment is expected to capture the largest market share over the forecast period. Synthetic leathers are becoming more and more popular for airline seat covers because they strike a mix between luxury and functionality. In addition to improving passenger comfort, these materials also prolong the aircraft's lifespan and improve its visual appeal.

Commercial Aircraft Seating Market: Regional Analysis

North America dominates the market over the projected period

North America is expected to dominate the global commercial aircraft seating market during the forecast period. Due to the region's well-established air travel infrastructure and high local and international flight frequencies, there is a constant need for new and improved airplane seats.

Additionally, several significant airlines in the area are starting fleet replacement initiatives and implementing contemporary seating that complies with the most recent industry standards, which include improved passenger comfort and safety features. These elements highlight the North American market's dominance.

Commercial Aircraft Seating Market: Competitive Analysis

The global commercial aircraft seating market is dominated by players like:

- Zodiac Aerospace

- Recaro Aircraft Seating GmbH & Co. KG

- B/E Aerospace Inc.

- Aviointeriors S.p.A.

- Geven S.p.A.

- Thompson Aero Seating Ltd.

- STELIA Aerospace (a subsidiary of Airbus)

- Acro Aircraft Seating Ltd.

- HAECO Cabin Solutions (a division of HAECO Group)

- Mirus Aircraft Seating Ltd.

- Expliseat SAS

- ZIM Flugsitz GmbH

- Optimares S.p.A.

- Jamco Corporation

- Airgo Design Pte Ltd.

The global commercial aircraft seating market is segmented as follows:

By Aircraft Type

- Narrowbody Aircraft

- Widebody Aircraft

- Business Jets

- Regional Aircraft

By Cabin Class

- Economy Class

- Business Class

- Premium Economy Class

- First Class

By Components

- Seat Frames

- Seat Actuators

- Seat Covers

- Cushions

- Seat Belts

- Others

By Material

- Foam

- Fabric

- Leather

- Other Materials

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The seats found in passenger airplanes operated by commercial airlines are referred to as commercial aircraft seating. These seats are made to accommodate several classes, including business, first class, premium economy, and economy while maximizing space, comfort, and safety.

The commercial aircraft seating market is driven by rising air travel, technological advancements, increasing investment by the market players, growing product launches, and many others.

According to the report, the global commercial aircraft seating market size was worth around USD 7.8 billion in 2023 and is predicted to grow to around USD 14.1 billion by 2032.

The global commercial aircraft seating market is expected to grow at a CAGR of 6.8% during the forecast period.

The global commercial aircraft seating market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market due to the rising air travel and the presence of major players.

The global commercial aircraft seating market is dominated by players like Zodiac Aerospace, Recaro Aircraft Seating GmbH & Co. KG, B/E Aerospace Inc., Aviointeriors S.p.A., Geven S.p.A., Thompson Aero Seating Ltd., STELIA Aerospace (a subsidiary of Airbus), Acro Aircraft Seating Ltd., HAECO Cabin Solutions (a division of HAECO Group), Mirus Aircraft Seating Ltd., Expliseat SAS, ZIM Flugsitz GmbH, Optimares S.p.A., Jamco Corporation and Airgo Design Pte Ltd. among others.

The commercial aircraft seating market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed