Commercial Plastic Drinkware Market Growth, Size, Share, Trends, and Forecast 2030

Commercial Plastic Drinkware Market By Material Type (Polypropylene, Polycarbonate, PET, and Others Materials), By Product Type (Cups, Tumblers, Pitchers, Mugs, and Specialized Items), By End Use Industry (Restaurants, Bars, Hotels, Catering Services, and Event Venues), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 14 billion | USD 23 billion | 10.4% | 2022 |

Commercial Plastic Drinkware Industry Prospective:

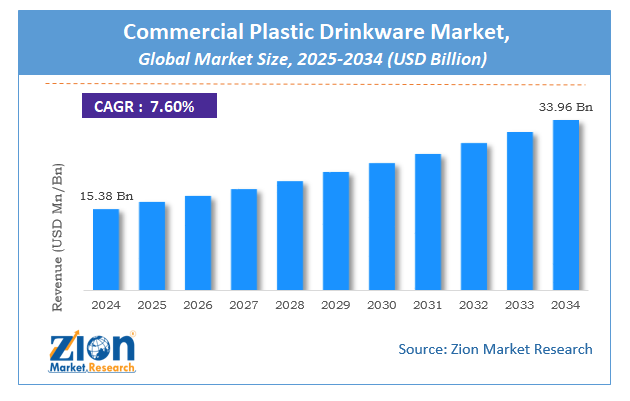

The global commercial plastic drinkware market size was worth around USD 14 billion in 2022 and is predicted to grow to around USD 23 billion by 2030 with a compound annual growth rate (CAGR) of roughly 10.4% between 2023 and 2030.

Commercial Plastic Drinkware Market: Overview

Commercial plastic drinkware has become a ubiquitous and versatile choice in the hospitality industry. Designed for durability, convenience, and cost-effectiveness, these items cater to a wide range of establishments such as restaurants, bars, and event venues. Manufactured from various types of plastics, including polypropylene and polycarbonate, these drinkware options offer shatterproof qualities, making them ideal for outdoor and high-traffic settings. One significant advantage of commercial plastic drinkware lies in its lightweight nature, facilitating easy handling for both staff and customers. Additionally, these items are often dishwasher-safe, simplifying the cleaning process and ensuring efficient reuse. Many designs mimic the appearance of traditional glassware, providing an aesthetically pleasing presentation without the fragility. In response to environmental concerns, there is a growing trend towards eco-friendly alternatives, with some commercial plastic drinkware being recyclable or made from recycled materials. However, this industry faces challenges in addressing the environmental impact of single-use plastics. Despite environmental considerations, the practicality, cost-efficiency, and safety features of commercial plastic drinkware continue to make it a prevalent choice for businesses seeking reliable and versatile options for serving beverages.

Key Insights

- As per the analysis shared by our research analyst, the global commercial plastic drinkware industry is estimated to grow annually at a CAGR of around 10.4% over the forecast period (2023-2030).

- In terms of revenue, the global commercial plastic drinkware market size was valued at around USD 14 billion in 2022 and is projected to reach USD 23 billion, by 2030.

- The global commercial plastic drinkware market is projected to grow at a significant rate due to in unparalleled durability and longevity of plastic drinkware.

- Based on material type segmentation, polypropylene type was predicted to hold maximum market share in the year 2022.

- Based on product type segmentation, cups were the leading revenue generator in 2022.

- Based on end use industry segmentation, restaurants were the leading revenue generator in 2022.

- On the basis of region, Asia Pacific was the leading revenue generator in 2022.

Request Free Sample

Request Free Sample

Commercial Plastic Drinkware Market: Growth Drivers

Unparalleled durability and longevity of plastic drinkware fuels the market growth.

One of the primary drivers fueling the growth of the commercial plastic drinkware market is its unparalleled durability and longevity. Businesses in the hospitality sector, such as restaurants and bars, are increasingly turning to plastic drinkware due to its resistance to breakage and shattering. Unlike traditional glassware, commercial plastic drinkware can withstand accidental drops and rough handling, reducing replacement costs and minimizing the risk of injuries associated with broken glass. This durability not only enhances operational efficiency by lowering maintenance expenses but also ensures a safer environment for both staff and customers.

Moreover, the versatility of commercial plastic drinkware is another key driver propelling its market expansion. These items are available in a myriad of shapes, sizes, and designs, allowing businesses to cater to diverse preferences and thematic requirements. The customization options enable establishments to create a unique and branded experience for their customers, contributing to brand recognition and customer loyalty. The adaptability of plastic drinkware to various settings, including outdoor events and poolside service, further enhances its market appeal, making it a preferred choice for businesses seeking functional and aesthetically pleasing beverage serving solutions.

Solo Cup Company, one of the leading manufacturers of plastic drinkware, reported that its sales of plastic cups grew by 5% in 2021. This growth is likely due in part to the durability and longevity of plastic drinkware.

Dart Container Corporation, another leading manufacturer of plastic drinkware, reported that its sales of plastic cups grew by 6% in 2022. This growth is also likely due in part to the durability and longevity of plastic drinkware.

Commercial Plastic Drinkware Market: Restraints

Growing global concern over environmental sustainability may restrain the market expansion.

Despite the advantages of commercial plastic drinkware, one significant restraint facing the market is the growing global concern over environmental sustainability. The widespread use of plastic products, including drinkware, has raised environmental issues due to their non-biodegradable nature. Increased awareness of plastic pollution and its impact on ecosystems has led to a shift in consumer preferences towards more eco-friendly alternatives. This environmental consciousness has prompted businesses to explore sustainable options and adopt greener practices, potentially limiting the demand for traditional plastic drinkware. In addition to environmental concerns, regulatory measures and government initiatives aimed at reducing single-use plastics pose another restraint on the commercial plastic drinkware market. Many regions are implementing or considering legislation to restrict or ban certain types of single-use plastics, which could include the plastic drinkware commonly used in the hospitality industry. Compliance with these regulations may require businesses to invest in alternative materials or face potential restrictions on the use of commercial plastic drinkware, creating a challenge for manufacturers and businesses heavily reliant on these products.

Commercial Plastic Drinkware Market: Opportunities

Innovation and development of sustainable and eco-friendly alternatives to provide growth opportunities

An exciting opportunity within the commercial plastic drinkware market lies in the innovation and development of sustainable and eco-friendly alternatives. With increasing awareness of environmental issues, there is a growing demand for plastic drinkware that aligns with sustainable practices. Manufacturers have the opportunity to invest in research and development to create products made from biodegradable or recyclable materials. By offering environmentally friendly options, businesses can tap into a market segment seeking sustainable alternatives, thereby expanding their customer base and meeting evolving consumer preferences.

Furthermore, the customization and branding potential of commercial plastic drinkware present another opportunity for market growth. Businesses can leverage the versatility of plastic materials to create unique and eye-catching designs that align with their brand identity. Customized drinkware can enhance the overall customer experience, create brand recognition, and differentiate products in a competitive market. This opportunity encourages manufacturers to collaborate with businesses to develop exclusive designs and create a niche market for personalized and branded plastic drinkware solutions. Additionally, the continued expansion of the hospitality and events industry globally provides a fertile ground for the growth of the commercial plastic drinkware market. As new restaurants, bars, and event venues emerge, there is an increased demand for cost-effective, durable, and versatile drinkware solutions. Manufacturers have the opportunity to tap into this expanding market by providing a wide range of plastic drinkware options that cater to the diverse needs of businesses within the hospitality sector.

Commercial Plastic Drinkware Market: Challenges

Increasing global scrutiny and regulatory focus on single-use plastics to challenge market growth

A significant challenge confronting the global commercial plastic drinkware industry is the increasing global scrutiny and regulatory focus on single-use plastics. Governments and environmental organizations are advocating for reduced plastic consumption to mitigate environmental impact, particularly in terms of pollution and waste. This has led to the implementation of stricter regulations and bans on certain types of single-use plastics in various regions. As a result, the commercial plastic drinkware industry faces the challenge of adapting to these changing regulatory landscapes, which may involve transitioning to more sustainable materials or navigating restrictions on the use of traditional plastic products.

Moreover, consumer awareness and preferences are shifting towards eco-friendly alternatives, driven by concerns about environmental sustainability. As more consumers prioritize environmentally conscious choices, businesses in the commercial plastic drinkware sector must address this demand for greener options. This presents a challenge for manufacturers to innovate and invest in the development of sustainable plastic alternatives or explore other materials that align with environmental goals while maintaining the practical benefits that make plastic drinkware popular in commercial settings. Balancing the need for functionality and durability with environmental considerations poses a complex challenge for the industry's ongoing growth and sustainability. For instance:

The European Union has implemented a number of directives aimed at reducing the use of single-use plastics, including a ban on single-use plastic bags and a target to recycle 90% of all plastic packaging by 2030.

China has implemented a ban on the import of solid plastic waste, which has significantly impacted the supply of plastic materials for the production of disposable drinkware.

California has implemented a statewide ban on single-use plastic straws and stirrers, and a number of other cities and states in the United States have implemented similar bans.

McDonald's has committed to phasing out single-use plastic cutlery and straws from all of its restaurants by 2025.

Commercial Plastic Drinkware Market: Segmentation

The global commercial plastic drinkware market is segmented based on material type, product type, end use industry, and region.

Based on material type, the global market segments are polypropylene, polycarbonate, pet, and others material types. At present, the global industry is dominated by the polypropylene type segment. Polypropylene offers a compelling combination of characteristics, including durability, lightweight construction, and cost-effectiveness. It is known for its high resistance to heat, chemicals, and impact, making it well-suited for the rigorous demands of the hospitality industry. Polypropylene drinkware is shatterproof, reducing the risk of breakage in high-traffic settings, and its affordability makes it an attractive choice for businesses aiming to balance functionality and cost savings. Additionally, polypropylene's versatility allows for the creation of a wide range of drinkware designs, contributing to its popularity and widespread adoption in various establishments such as restaurants, bars, and event venues.

Based on product type the global commercial plastic drinkware market categorized as cups, tumblers, pitchers, mugs, and specialized items. Out of these, cups was the largest shareholding segment in the global market in 2022. Cups have emerged as the largest shareholding segment in the global commercial plastic drinkware market due to their widespread use and versatility across diverse settings. Cups are fundamental in serving a variety of beverages, ranging from soft drinks to hot beverages like coffee. Their universal applicability in both casual and formal dining, as well as takeaway services, contributes to their dominance. Moreover, the adaptability of plastic materials allows for the creation of innovative and customized cup designs, meeting the aesthetic and functional preferences of businesses in the hospitality sector. The prevalence of cups in everyday beverage service contributes significantly to their substantial market share, making them a cornerstone of the commercial plastic drinkware market.

Based on end use industry the global commercial plastic drinkware industry categorized as restaurants, bars, hotels, catering services, and event venues. Out of these, restaurants was the largest shareholding segment in the global market in 2022. Restaurants require a reliable and cost-effective solution for serving a variety of beverages to their customers, and plastic drinkware offers the ideal combination of durability, affordability, and versatility. Plastic drinkware is well-suited for the fast-paced and high-traffic environment of restaurants, where factors such as breakage resistance and ease of handling are crucial. Additionally, the customizable nature of plastic materials allows restaurants to align their drinkware with branding efforts and create a cohesive visual experience for customers. As a result, the restaurants segment holds the largest share in the market, reflecting the integral role of plastic drinkware in the day-to-day operations of dining establishments globally.

Commercial Plastic Drinkware Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Commercial Plastic Drinkware Market |

| Market Size in 2022 | USD 14 Billion |

| Market Forecast in 2030 | USD 23 billion |

| Growth Rate | CAGR of 10.4% |

| Number of Pages | 215 |

| Key Companies Covered | Libbey Inc., Carlisle FoodService Products, Cambro Manufacturing Company, Arc International, Genpak LLC, Anchor Hocking Company, Dart Container Corporation, GET Enterprises, Strahl Beverageware, Tupperware Brands Corporation, and others. |

| Segments Covered | By Material Type, By Product Type, By End Use Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Commercial Plastic Drinkware Market: Regional Analysis

Asia Pacific to lead the market during the forecast period

The Asia Pacific region is poised to lead the commercial plastic drinkware market during the forecast period due to several key factors. Firstly, the region's rapid economic growth has led to a flourishing hospitality industry, including a surge in the number of restaurants, bars, and event venues. As these establishments seek cost-effective and versatile solutions for serving beverages, the demand for commercial plastic drinkware has witnessed a significant uptick. The affordability and durability of plastic drinkware make it particularly attractive for businesses in emerging economies across Asia Pacific. Secondly, the Asia Pacific region has a large and diverse population, contributing to a high demand for food and beverage services. The scalability of plastic drinkware production allows manufacturers to meet the substantial volume requirements of the region's bustling hospitality sector efficiently. Additionally, the versatility of plastic drinkware aligns well with the diverse cultural preferences and outdoor dining trends prevalent in many Asia Pacific countries. This adaptability to regional needs positions commercial plastic drinkware as a favored choice, further supporting the anticipated leadership of the Asia Pacific market during the forecast period.

Key Developments

2023: Newell Brands Inc., an American consumer goods company, acquired Sistema Plastics do Brasil Ltda., a Brazilian manufacturer of plastic drinkware and food storage containers. This acquisition is expected to expand Newell Brands' presence in the Latin American market.

2023: S'well, an American reusable water bottle brand, partnered with Target Corporation, an American retail corporation, to launch a limited-edition collection of water bottles. This partnership is expected to increase S'well's brand awareness and reach a wider audience.

2022: Contigo Brands, an American drinkware company, acquired Tervis Tumbler Company, an American drinkware company known for its insulated tumblers.

2022: Tupperware Brands Corporation, an American multinational cookware and home products company, partnered with Coca-Cola Company, an American multinational beverage corporation, to develop a line of reusable drinkware featuring Coca-Cola's iconic logo. This partnership is expected to leverage Coca-Cola's brand recognition to promote sustainable drinkware solutions.

Commercial Plastic Drinkware Market: Competitive Analysis

The global commercial plastic drinkware market is dominated by players like:

- Libbey Inc.

- Carlisle FoodService Products

- Cambro Manufacturing Company

- Arc International

- Genpak LLC

- Anchor Hocking Company

- Dart Container Corporation

- GET Enterprises

- Strahl Beverageware

- Tupperware Brands Corporation

The global commercial plastic drinkware market is segmented as follows:

By Material Type

- Polypropylene

- Polycarbonate

- PET

- Others Material Types

By Product Type

- Cups

- Tumblers

- Pitchers

- Mugs

- Specialized Items

By End Use Industry

- Restaurants

- Bars

- Hotels

- Catering Services

- Event Venues

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Commercial plastic drinkware has become a ubiquitous and versatile choice in the hospitality industry. Designed for durability, convenience, and cost-effectiveness, these items cater to a wide range of establishments such as restaurants, bars, and event venues. Manufactured from various types of plastics, including polypropylene and polycarbonate, these drinkware options offer shatterproof qualities, making them ideal for outdoor and high-traffic settings.

The global commercial plastic drinkware market cap may grow owing to the due to unparalleled durability and longevity of plastic drinkware.

According to study, the global commercial plastic drinkware market size was worth around USD 14 billion in 2022 and is predicted to grow to around USD 23 billion by 2030.

The CAGR value of the commercial plastic drinkware market is expected to be around 10.4% during 2023-2030.

The global commercial plastic drinkware market growth is expected to be driven by Asia Pacific. It is currently the world’s highest revenue-generating market owing to region's rapid economic growth has led to a flourishing hospitality industry, including a surge in the number of restaurants, bars, and event venues.

The global commercial plastic drinkware market is led by players like Libbey Inc., Carlisle FoodService Products, Cambro Manufacturing Company, Arc International, Genpak LLC, Anchor Hocking Company, Dart Container Corporation, GET Enterprises, Strahl Beverageware, Tupperware Brands Corporation

The report analyzes the global commercial plastic drinkware market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the commercial plastic drinkware industry.

Choose License Type

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed