Commercial Property Insurance Market Size, Share, Trends, Growth and Forecast 2032

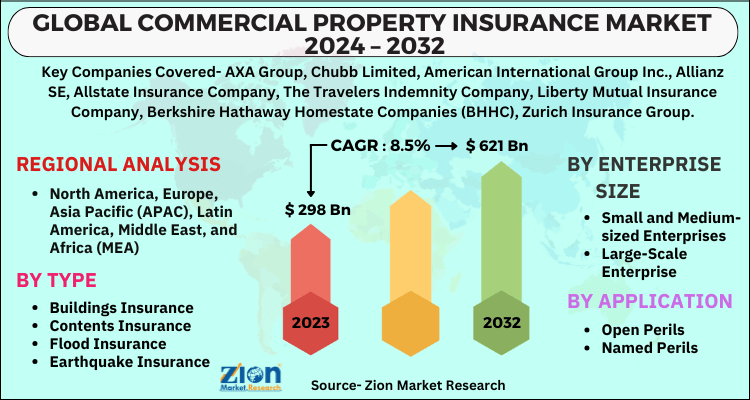

Commercial Property Insurance Market By Type (Buildings Insurance, Contents Insurance, Flood Insurance, Earthquake Insurance, and Others), By Enterprise Size (Small & Medium-sized Enterprises and Large-Scale Enterprise), By Application (Open Perils and Named Perils), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 298 Billion | USD 621 Billion | 8.5% | 2023 |

Commercial Property Insurance Industry Prospective:

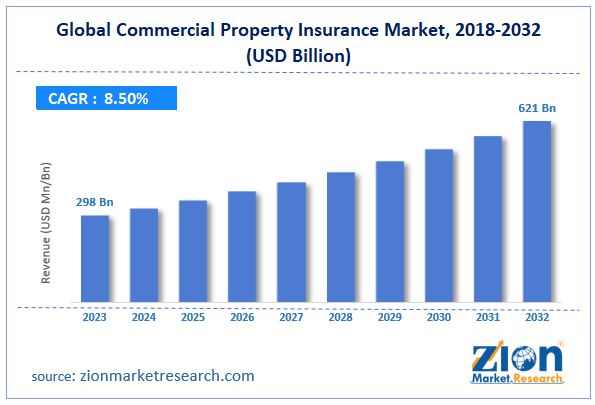

The global commercial property insurance market size was worth around USD 298 billion in 2023 and is predicted to grow to around USD 621 billion by 2032, with a compound annual growth rate (CAGR) of roughly 8.5% between 2024 and 2032.

Commercial Property Insurance Market: Overview

Commercial property insurance is a term that describes a type of insurance scheme designed to protect businesses against financial losses or damage to their physical assets, including buildings, machinery, supplies, furniture, and others. The primary objective of commercial property insurance is to protect businesses against unanticipated financial losses resulting from asset loss or physical damage, thereby allowing them to recover and continue with regular operations after an incident.

From startups to multinational conglomerates, many types of businesses need this kind of insurance; it is often required to get loans or leases. The commercial property insurance market is driven by several factors, such as increasing business establishments, rising awareness of risk management, growing incidents of natural disasters, and others. However, the high premium costs are expected to hamper the industry expansion.

Key Insights

- As per the analysis shared by our research analyst, the global commercial property insurance market is estimated to grow annually at a CAGR of around 8.5% over the forecast period (2024-2032).

- In terms of revenue, the global commercial property insurance market size was valued at around USD 298 billion in 2023 and is projected to reach USD 621 billion by 2032.

- The increasing product launch is expected to drive the commercial property insurance market over the forecast period.

- Based on type, the buildings insurance segment is expected to dominate the commercial property insurance market over the forecast period.

- Based on enterprise size, the large-scale enterprise segment is expected to hold the largest market share over the forecast period.

- Based on application, the open perils segment is expected to hold the largest market share over the forecast period.

- Based on region, North America is expected to dominate the market during the forecast period.

Commercial Property Insurance Market: Growth Drivers

Expanding customer base and risk diversification through international presence drives market growth

To expand and fortify their market positions, commercial property insurance companies employ crucial strategies, including client expansion and risk diversification through global presence. Additionally, commercial property insurers use a global network of offices, subsidiaries, and partners to reach clients across the globe. They provide businesses all over the world with specialized insurance solutions by utilizing local knowledge and distribution networks.

Furthermore, many businesses prefer insurance plans that cover all their locations under a single policy because they operate in multiple countries. Internationally based commercial property insurance providers offer transnational coverage, which provides simplicity and consistency to such multinational corporations.

In addition, international commercial property insurers usually focus on providing help to industries having a global presence. This allows them to draw in international clientele in those industries while simultaneously managing risks unique to those businesses. Therefore, through the international presence in the commercial property insurance market, industry expertise, multinational coverage, and global networks & distribution channels have increased client base and risk diversification.

Commercial Property Insurance Market: Restraints

A high premium of commercial insurance hinders market growth

As rates rise, commercial property insurance coverage costs are higher for firms, especially small and medium-sized enterprises (SMEs). Businesses with limited funds begin to worry a lot about affordability, which leads some to choose lower coverage levels or refuse insurance completely, making them more susceptible to risks.

Additionally, companies may choose to accept larger deductibles or self-insure to save money when premiums become unaffordable. The market's growth may stall or perhaps drop as a result of the lower demand for commercial property insurance. Furthermore, businesses operating in industries or places with high insurance premiums could find it challenging to compete with rivals in areas with lower premiums. This disparity limits the growth potential of businesses in more affluent locations by creating an uneven playing field.

In addition, there's a potential that high commercial property insurance rates will deter businesses from getting coverage, which would lower market penetration. As a result, insurers might have fewer clients, which is anticipated to affect market share and revenue growth. Therefore, the expansion of the commercial property insurance industry is constrained by affordability, lower demand, and restricted market penetration of high commercial insurance premiums.

Commercial Property Insurance Market: Opportunities

Growing product launch offers a lucrative opportunity for market growth

In response to changing consumer demands and market conditions, commercial property insurance companies are broadening their range of products. Additionally, insurance companies are providing coverage for new risks such as environmental harm, cyber threats, and pandemic-related business interruption, which is expected to increase the market share of commercial property insurance. Insurers hope to give businesses more value and protection by providing comprehensive and customizable plans, strengthening customer connections, and giving them a competitive edge in the market. To transform business insurance, for instance, Janover introduced a new insurtech in May 2024. Janover Insurance, a new insurance subsidiary for commercial property insurance and other services, was introduced by Janover, an AI-enabled platform for commercial real estate transactions.

In addition, DUAL Australia declared the same month that it will use its dedicated title insurance team, DUAL Asset, to introduce a new business line in the Asia Pacific area. The product line includes securities title insurance (shares, units, etc.) that also offers coverage for detected issues or defects, as well as real estate title insurance that offers the option to fix identified issues or flaws. Basic warranty top-up insurance is also included in the portfolio. In the upcoming years, it is projected that the inclusion of such assets in a commercial real estate insurance policy will increase market revenue.

Commercial Property Insurance Market: Challenges

Economic instability poses a major challenge to market expansion

During economic downturns, businesses curtail operations, which lowers demand for commercial property insurance. As firms close or downsize, the need for insurance coverage decreases, which limits insurers' growth opportunities. Additionally, during recessions, the value of real estate, notably commercial real estate, declines. As property values decline, insured values might as well, which would result in reduced premiums and less money for insurers.

Additionally, to generate extra income, commercial property insurance companies usually spend on premiums. During a recession, interest rates and investment returns are often lower, which reduces the total amount of money made from investments. Furthermore, commercial properties are more susceptible to risks like theft, fire, and vandalism during economic downturns because of higher vacancy rates. For insurers, this increased risk exposure resulted in greater claims costs. The expansion of the commercial real estate sector is thus hampered by economic recessions or downturns, which are largely caused by decreased business activity, falling property values, and increasing risk exposure.

Request Free Sample

Request Free Sample

Commercial Property Insurance Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Commercial Property Insurance Market |

| Market Size in 2023 | USD 298 Billion |

| Market Forecast in 2032 | USD 621 Billion |

| Growth Rate | CAGR of 8.5% |

| Number of Pages | 223 |

| Key Companies Covered | AXA Group, Chubb Limited, American International Group Inc., Allianz SE, Allstate Insurance Company, The Travelers Indemnity Company, Liberty Mutual Insurance Company, Berkshire Hathaway Homestate Companies (BHHC), Zurich Insurance Group, Progressive, and others. |

| Segments Covered | By Type, By Enterprise Size, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Commercial Property Insurance Market: Segmentation

The global commercial property insurance industry is segmented based on type, enterprise size, application, and region.

Based on type, the global commercial property insurance market is segmented into buildings insurance, contents insurance, flood insurance, earthquake insurance, and others. The buildings insurance segment is expected to dominate the commercial property insurance market over the forecast period. The number of commercial properties has expanded due to rapid infrastructure projects and urban growth, which has raised the demand for insurance coverage. Additionally, the use of technology in claims processing and underwriting has improved efficiency, drawn in more clients, and boosted market expansion.

Based on enterprise size, the global commercial property insurance industry is bifurcated into small and medium-sized enterprises and large-scale enterprises. The large-scale enterprise segment is expected to hold the largest market share over the forecast period. Large businesses need comprehensive insurance coverage to reduce potential risks because they have a lot of assets, such as inventory, equipment, and several properties.

Based on application, the global commercial property insurance market is bifurcated into open perils and named perils. The open perils segment is expected to hold the largest market share over the forecast period. Open perils coverage, sometimes referred to as "all-risk" coverage, provides insurance against all losses other than those specifically stated in the policy. Named hazard coverage, on the other hand, only covers particular risks specified in the policy. Open perils coverage offers businesses more comprehensive protection, guaranteeing that unanticipated circumstances that result in property damage are probably covered unless expressly excluded.

Commercial Property Insurance Market: Regional Analysis

North America dominates the market over the projected period

North America is expected to dominate the global commercial property insurance market. This is ascribed to a confluence of technological, regulatory, and economic factors. The region's strong and varied economy, which is marked by a vast number of businesses across numerous industries, has significantly increased demand for commercial property insurance. Commercial property insurance coverage is becoming more and more popular as industries expand and business operations grow because of the growing necessity to safeguard valuable assets from potential risks and disasters.

Commercial Property Insurance Market: Competitive Analysis

The global commercial property insurance market is dominated by players like:

- AXA Group

- Chubb Limited

- American International Group Inc.

- Allianz SE

- Allstate Insurance Company

- The Travelers Indemnity Company

- Liberty Mutual Insurance Company

- Berkshire Hathaway Homestate Companies (BHHC)

- Zurich Insurance Group

- Progressive

The global commercial property insurance market is segmented as follows:

By Type

- Buildings Insurance

- Contents Insurance

- Flood Insurance

- Earthquake Insurance

- Others

By Enterprise Size

- Small and Medium-sized Enterprises

- Large-Scale Enterprise

By Application

- Open Perils

- Named Perils

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Commercial property insurance is a term that describes a type of insurance scheme designed to protect businesses against financial losses or damage to their physical assets, including buildings, machinery, supplies, furniture, and others.

The commercial property insurance market is being driven by several factors, such as increasing business establishments, rising awareness of risk management, growing incidents of natural disasters, and others.

According to the report, the global commercial property insurance market size was worth around USD 298 billion in 2023 and is predicted to grow to around USD 621 billion by 2032.

The global commercial property insurance market is expected to grow at a CAGR of 8.5% during the forecast period

The global commercial property insurance market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market due to the increasing number of industries.

The global commercial property insurance market is dominated by players like AXA Group, Chubb Limited, American International Group, Inc., Allianz SE, Allstate Insurance Company, The Travelers Indemnity Company, Liberty Mutual Insurance Company, Berkshire Hathaway Homestate Companies (BHHC), Zurich Insurance Group and Progressive among others.

The commercial property insurance market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed