Commercial Real Estate Market Size, Share, Trends, Growth and Forecast 2034

Commercial Real Estate Market By Type (Multifamily, Industrial, Retail, Office, Hospitality, Healthcare, Mixed-Use, Warehouses, and Others), By Investment Type (Government-Owned, Public, Private, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

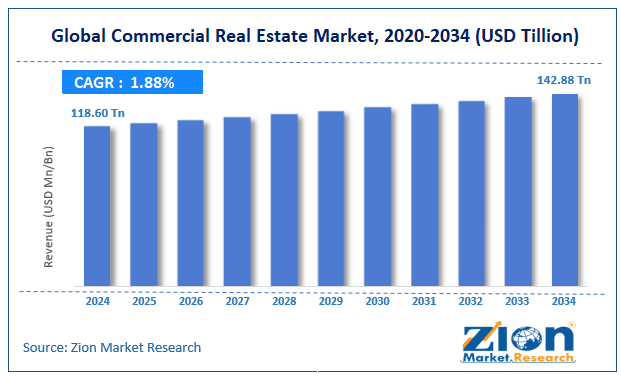

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 118.60 Trillion | USD 142.88 Trillion | 1.88% | 2024 |

Commercial Real Estate Industry Prospective:

The global commercial real estate market size was worth around USD 118.60 trillion in 2024 and is predicted to grow to around USD 142.88 trillion by 2034, with a compound annual growth rate (CAGR) of roughly 1.88% between 2025 and 2034.

Commercial Real Estate Market: Overview

Commercial real estate is a special category of the real estate industry that deals with land and properties used for commercial purposes only. The industry includes properties used for warehousing products, stores, industrial units, office spaces, and others.

Some of the most common types of commercial real estate centers constructed worldwide include shopping centers, hospitality facilities, healthcare premises, residential properties, factories, restaurants, and office buildings. One of the primary goals of commercial real estate properties is obtaining regular income from the facilities.

For instance, shopping center owners may rent individual shops to different brands in exchange for monthly rent. However, commercial real estate properties can also be constructed and sold for profits over time. According to market research, financial funding obtained for constructing a commercial real estate center is more extensive compared to loans for residential purposes.

During the forecast period, the outlook for commercial real estate is showing promising signs of growth, especially due to the emergence of several warehouses worldwide. The office market is likely to register a steady growth pace as employees return to offices. However, the industry will be plagued with several challenges and growth limitations.

Key Insights:

- As per the analysis shared by our research analyst, the global commercial real estate market is estimated to grow annually at a CAGR of around 1.88% over the forecast period (2025-2034)

- In terms of revenue, the global commercial real estate market size was valued at around USD 118.60 trillion in 2024 and is projected to reach USD 142.88 trillion by 2034.

- The commercial real estate market is projected to grow at a significant rate due to the growing demand for robotic warehousing facilities worldwide.

- Based on the type, the warehouse segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the investment type, the private segment is anticipated to command the largest market share.

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period.

Commercial Real Estate Market: Growth Drivers

Growing demand for robotic warehousing facilities worldwide to drive market expansion rate

The global commercial real estate market is expected to be driven by rising investments in the e-commerce industry. In recent times, the number of warehouses, including smaller and larger facilities, has grown rapidly. The quick expansion of warehouses is a result of increased investments in the e-commerce sector, and online sales of goods and services have skyrocketed since the pandemic in 2020.

In addition, government support for the e-commerce business has been tremendous across the globe, further facilitating the smooth expansion of its several forms, such as online shopping for clothes & accessories, medical items, and grocery shopping.

Furthermore, modern warehouses are being built using highly advanced technologies, including robots and sophisticated automation systems, to ensure the smooth functioning of warehouse operations, especially in the backdrop of growing end-user demands.

In September 2024, Warehow, a leading e-commerce fulfillment company providing assistance for homeware and fashion retailers in the UK, announced that it had raised a funding of EUR 2.5 million as the demand for fulfillment centers in the region continues to grow.

Retail industry to continue providing excellent opportunities for market growth trends

According to industry research, retail is one of the key and most promising segments expected to fuel demand for commercial real estate properties in the coming years. The emergence of grocery-oriented shopping stores, especially in urban areas and densely populated regions, has shown exceptionally positive signs of growth even during the peak COVID-19 lockdown impositions worldwide.

In addition, fashion retail centers, especially fast fashion brands such as Zara, H&M, and others, are currently adopting strategic global expansion policies, creating demand for real estate properties in prime locations. The global commercial real estate market will continue to benefit from the growth in the retail industry worldwide.

Commercial Real Estate Market: Restraints

Higher cost of constructing commercial properties to limit market expansion rate

The global commercial real estate industry is expected to be affected by the high investments associated with constructing such properties. For instance, at present, the US has a commercial mortgage rate of over 5.1%, which is subject to changes depending on several external conditions.

In addition to this, according to market research, the real estate sector globally is currently witnessing unaffordability due to the surging prices of the properties putting commercial property owners at a risk of limited return on investment (ROI) for long durations.

Commercial Real Estate Market: Opportunities

Increased partnerships between private companies and governments to generate growth opportunities

The global commercial real estate market is expected to benefit in the long run due to the growing rate of partnerships between government entities and private construction companies.

For instance, several local governments are providing tax subsidies and other forms of monetary assistance to building developers to encourage infrastructure development projects.

Furthermore, developing clearer guidelines regarding construction zones, loan policies, and other regulations governing the building & construction sector can help industry players navigate the otherwise complicated red tape associated with developing commercial properties.

Rising advancements in construction technology pave the way for future expansion

The building & construction industry is increasingly investing in new building development tools that can not only help curb the extra cost of construction but also deliver higher building development efficiency.

For instance, the rising introduction of Artificial Intelligence (AI) and Machine Learning (ML) powered applications that can monitor construction sites and provide insights on probable hazards have become widely popular among construction companies.

Similarly, tools developed for designing building layouts, accounting purposes, and inventory control will further help the industry thrive.

Commercial Real Estate Market: Challenges

Legal implications in the industry and cyber security concerns to challenge market expansion

The global industry for commercial real estate is expected to be challenged by the presence of a highly complex and dynamic legal environment for commercial space developers worldwide. The lack of clear and transparent legal regulations can put companies at tremendous risk of non-compliance. Additionally, rising concerns over cyber security and growing fraud can further dilute the market growth rate.

Commercial Real Estate Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Commercial Real Estate Market |

| Market Size in 2024 | USD 118.60 Trillion |

| Market Forecast in 2034 | USD 142.88 Trillion |

| Growth Rate | CAGR of 1.88% |

| Number of Pages | 214 |

| Key Companies Covered | Blue Owl Real Estate, Brookfield Asset Management, Colliers International, Cerberus Capital Management, Prologis, GLP Capital Partners, ESR Group, Newmark Group, Blackstone Inc., Ares Management, Unibail-Rodamco-Westfield, TPG Inc., Hines, CBRE Group, BGO, and others. |

| Segments Covered | By Type, By Investment Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Commercial Real Estate Market: Segmentation

The global commercial real estate market is segmented based on type, investment type, and region.

Based on the type, the global market segments are multifamily, industrial, retail, office, hospitality, healthcare, mixed-use, warehouses, and others. In 2024, the highest growth was listed in the warehouses segment. The growing proliferation of the global e-commerce industry, as well as increasing investments in the development of modernized fulfillment centers, is fueling the segmental revenue. According to official statistics, Amazon has more than 175 fulfillment centers across the globe as of recent news.

Based on the investment type, the commercial real estate industry segments are government-owned, public, private, and others. In 2024, the private segment was the leading revenue generator. The rising development of modern and affordable housing facilities, along with increased demand for entertainment centers such as shopping malls, has helped the segment thrive in the last few years. In 2024, China State Construction Engineering Corporation (CSCEC), one of the world’s largest construction companies, made a revenue of over USD 320 billion.

Commercial Real Estate Market: Regional Analysis

Asia-Pacific to be led by Chinese companies during the forecast period

The global commercial real estate market will be dominated by Asia-Pacific during the forecast period. China is anticipated to emerge as the highest revenue generator in the regional market. The country is home to some of the most significant commercial property developers operating in the domestic as well as international markets.

In March 2025, New World Development (NWD), a leading building developer from Hong Kong, announced that it would launch a new commercial property in the Hangzhou region as the company plans to leverage the increasing investments in tech-fueled growth in the construction sector. The company is planning to develop a grade-A office building called Front Tower at an estimated cost of USD 137 million.

On the other hand, CSCEC is experiencing tremendous growth in international markets such as Egypt and Madagascar. The company scored a new project worth 11 billion Yuan in February 2025. Other Asian countries such as India, Japan, South Korea, and Singapore, among others, will also play a crucial role in shaping the regional market.

India, for instance, is registering higher government support for the development of fully functional large warehouses as the regional e-commerce sector continues to rise.

Commercial Real Estate Market: Competitive Analysis

The global commercial real estate market is led by players like:

- Blue Owl Real Estate

- Brookfield Asset Management

- Colliers International

- Cerberus Capital Management

- Prologis

- GLP Capital Partners

- ESR Group

- Newmark Group

- Blackstone Inc.

- Ares Management

- Unibail-Rodamco-Westfield

- TPG Inc.

- Hines

- CBRE Group

- BGO

The global commercial real estate market is segmented as follows:

By Type

- Multifamily

- Industrial

- Retail

- Office

- Hospitality

- Healthcare

- Mixed-Use

- Warehouses

- Others

By Investment Type

- Government-Owned

- Public

- Private

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Commercial real estate is a special category of the real estate industry that deals with land and properties used for commercial purposes only.

The global commercial real estate market is expected to be driven by rising investments in the e-commerce industry.

According to study, the global commercial real estate market size was worth around USD 118.60 trillion in 2024 and is predicted to grow to around USD 142.88 trillion by 2034.

The CAGR value of the commercial real estate market is expected to be around 1.88% during 2025-2034.

The global commercial real estate market will be dominated by Asia-Pacific during the forecast period.

The global commercial real estate market is led by players like Blue Owl Real Estate, Brookfield Asset Management, Colliers International, Cerberus Capital Management, Prologis, GLP Capital Partners, ESR Group, Newmark Group, Blackstone Inc., Ares Management, Unibail-Rodamco-Westfield, TPG Inc., Hines, CBRE Group, and BGO.

The report explores crucial aspects of the commercial real estate market, including a detailed discussion of existing growth factors and restraints while browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed