Commercial Real Estate Software Market Size, Share, Trends, Growth and Forecast 2034

Commercial Real Estate Software Market By Functionality (Risk Management, Portfolio Management, Transaction Management, and Operations Management, and Others), By End-User (Real Estate Agents/Brokers, Property Owners/Investors, and Property Managers), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

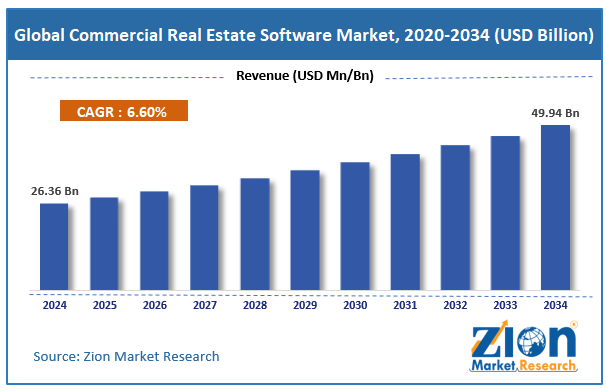

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 26.36 Billion | USD 49.94 Billion | 6.60% | 2024 |

Commercial Real Estate Software Industry Prospective:

The global commercial real estate software market size was worth around USD 26.36 billion in 2024 and is predicted to grow to around USD 49.94 billion by 2034 with a compound annual growth rate (CAGR) of roughly 6.60% between 2025 and 2034.

Commercial Real Estate Software Market: Overview

Commercial real estate (CRE) software is an application used by professionals to develop or manage commercial properties and handle different facility operations. Applications designed for commercial real estate professionals are witnessing increased demand among end-users due to several advantages associated with the tools.

For instance, efficient real estate software for commercial properties can reduce business risk and help property owners navigate complex challenges such as evolving lease agreements and automating offsets or breakpoints.

Furthermore, commercial property marketing is an added benefit offered by most programs designed for managing commercial real estate. During the forecast period, the growing number of citizens moving into rented apartments in urban cities is likely to fuel higher adoption of commercial real estate digital tools.

In addition, increased office rental rates along with the emergence of spaces offering flexible working environments or coworking spaces will also promote market expansion rates in the future. A major limiting factor for the industry will emerge in the form of cybersecurity threats and the high cost of initial investment, according to research.

Key Insights:

- As per the analysis shared by our research analyst, the global commercial real estate software market is estimated to grow annually at a CAGR of around 6.60% over the forecast period (2025-2034)

- In terms of revenue, the global commercial real estate software market size was valued at around USD 26.36 billion in 2024 and is projected to reach USD 49.94 billion by 2034.

- The commercial real estate software market is projected to grow at a significant rate due to the growing number of people shifting to rented houses.

- Based on the functionality, the portfolio management segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the end-user, the property owners/investors segment is anticipated to command the largest market share.

- Based on region, North America is projected to dominate the global market during the forecast period.

Commercial Real Estate Software Market: Growth Drivers

Growing number of people shifting to rented houses will drive the market demand rate

The global commercial real estate software market is expected to gain momentum due to the rising number of people living in rented homes across the globe. Residential property prices are on the rise globally due to rising inflation. This has resulted in a growing density of ordinary citizens living in rented apartments, especially in urban areas.

According to market research, apartment complexes, multi-family homes, student housing solutions, co-living spaces, and portfolios related to built-to-rent (BTR) homes are categorized as commercial real estate. Managing such a large complex with utmost accuracy without the use of digital tools can be exhausting, and most often it will result in manual errors, such as lapse of lease agreement or missed payments.

The rising number of large multi-family homes in urban areas, especially smart cities, along with apartment complexes, will fuel the use of commercial real estate software among property owners and managers to ensure optimal use of the facility.

Increased demand for co-working spaces and office rentals to curate higher market revenue

Co-working spaces are a form of modern offices that allow individuals or teams to work from a space shared by professionals from other companies. Co-working spaces gained traction during and post-COVID-19 when most permanent offices were shut. Co-working spaces provide key infrastructure such as a stable internet connection, meeting rooms, and other facilities required to perform job-related duties.

In addition, recently, companies have started calling employees back to the office and limiting work-from-home culture. It has resulted in a leasing boom as companies continue to seek modern commercial properties to establish workspaces for their employees. These trends in collaboration will fuel demand in the global commercial real estate software market in the coming years.

Commercial Real Estate Software Market: Restraints

High initial cost of investment limits market expansion trends in the future

The global commercial real estate software industry is projected to be restricted by the high cost of initial investment required to build and implement the programs. Companies providing commercial real estate application services may have different charging models. For instance, companies that charge per user can cost over USD 100 per account.

Furthermore, the cost may increase due to expenses associated with training employees to use the programs optimally, along with other ongoing expenses, making the tool unaffordable for new commercial property owners or managers.

Commercial Real Estate Software Market: Opportunities

Integration of blockchain technology in payment gateways of CRE software to instill growth opportunities

The global commercial real estate software market is projected to generate more growth opportunities as industry players continue to integrate blockchain technology in their applications. CRE software providers are increasingly focusing on using the next-generation decentralized engineering solution across multiple tool features, with a special focus on payment gateways.

The use of blockchain technology facilitates transparent, error-free, and concrete transactions that cannot be modified, thus significantly reducing cases of fraud.

Furthermore, blockchain also provides access to smart contract features. These self-executing contracts limit the involvement of intermediaries, keeping the terms of contracts secure between authorized stakeholders. The ongoing advancements in blockchain technology and its end-user applications will fuel market expansion for CRE software in the coming years.

Rapid expansion of cloud-based technological solutions to prove beneficial for the industry players

Software-as-a-service (SaaS) is an emerging market expected to further escalate the adoption of commercial real estate applications. Cloud-based programs are easy to access and offer several advantages, such as scalability depending on end demand, limited investments in developing ancillary infrastructure, accessibility from remote locations, and automatic tool maintenance. The expansion of cloud-based solutions is also linked to the growing use of commercial real estate programs through SaaS models.

Commercial Real Estate Software Market: Challenges

Prevalent risk-related data security and privacy breaches to challenge market expansion

The global commercial real estate software industry is projected to be challenged by the growing concerns over data breaches, especially concerning confidential information of involved parties.

In addition, commercial real estate programs, like other digital tools, are vulnerable to privacy breaches, especially as the number of digital crimes and thefts is on the rise across the globe.

Additionally, the market adoption rate may also be impacted by the hesitancy of potential end-users toward shifting to digital solutions.

Commercial Real Estate Software Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Commercial Real Estate Software Market |

| Market Size in 2024 | USD 26.36 Billion |

| Market Forecast in 2034 | USD 49.94 Billion |

| Growth Rate | CAGR of 6.60% |

| Number of Pages | 213 |

| Key Companies Covered | SharpLaunch, Yardi, Rent Manager, AppFolio, ARGUS Enterprise, Innago, RealPage, Quarem, MRI Software, Sell.Do, Buildout, AscendixRE, VTS, Reonomy, and others. |

| Segments Covered | By Functionality, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Commercial Real Estate Software Market: Segmentation

The global commercial real estate software market is segmented based on functionality, end-user, and region.

Based on the functionality, the global market segments are risk management, portfolio management, transaction management, and others. In 2023, the highest growth was listed in the portfolio management segment.

The feature allows owners of multiple properties to manage their assets and obtain maximum revenue effectively. Portfolio management further allows improved financial performance along with effective management of lease agreements. New York is reported to be home to more than 730 million square feet of office space.

Based on the end-user, the commercial real estate software industry divisions are real estate agents/brokers, property owners/investors, and property managers.

In 2023, the highest demand was listed in the property owners/investors segment. In most cases, CRE software is widely used by private equity firms owning large commercial spaces, institutional investors, and real estate investment trusts.

The growing complexities in owning and operating commercial spaces will fuel segmental expansion. Blackstone, one of the leading commercial property owners in the world, was reported to manage over 730 assets across Europe in 2024.

Commercial Real Estate Software Market: Regional Analysis

North America to dominate the market growth rate during the forecast period

The global commercial real estate software market is expected to be dominated by North America during the forecast period. The region was responsible for generating over 35% of the global revenue in 2024 and will continue the same trend during the forecast period.

The presence of a massive commercial real estate landscape in regions such as the US and Canada is a major reason for higher regional revenue. Cities in the US, such as New York, Boston, Los Angeles, California, and others, are home to some of the largest office and commercial spaces.

For instance, the state of Florida, US, is known to house several hotels and resorts due to the growing number of tourists in the region. Similarly, New York is the financial capital of the US, and major companies from several industries are headquartered in the region.

Europe is a growing market for commercial real estate software. Due to an increase in international tourism, major housing facilities across Europe are being converted into accommodation facilities such as Airbnb. Managing several properties, including leasing, renting, or maintenance, can be difficult without the aid of digital solutions such as software applications. The growing introduction of new CRE software in the regional market will promote higher revenue.

Commercial Real Estate Software Market: Competitive Analysis

The global commercial real estate software market is led by players like:

- SharpLaunch

- Yardi

- Rent Manager

- AppFolio

- ARGUS Enterprise

- Innago

- RealPage

- Quarem

- MRI Software

- Sell.Do

- Buildout

- AscendixRE

- VTS

- Reonomy

The global commercial real estate software market is segmented as follows:

By Functionality

- Risk Management

- Portfolio Management

- Transaction Management

- Operations Management

- Others

By End-User

- Real Estate Agents/Brokers

- Property Owners/Investors

- Property Managers

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Commercial real estate (CRE) software is an application used by professionals developing or managing commercial properties to handle different facility operations.

The global commercial real estate software market is expected to gain momentum due to the rising number of people living in rented homes across the globe.

According to study, the global commercial real estate software market size was worth around USD 26.36 billion in 2024 and is predicted to grow to around USD 49.94 billion by 2034.

The CAGR value of the commercial real estate software market is expected to be around 6.60% during 2025-2034.

The global commercial real estate software market is expected to be dominated by North America during the forecast period.

The global commercial real estate software market is led by players like SharpLaunch, Yardi, Rent Manager, AppFolio, ARGUS Enterprise, Innago, RealPage, Quarem, MRI Software, Sell.Do, Buildout, AscendixRE, VTS, and Reonomy.

The report explores crucial aspects of the commercial real estate software market, including a detailed discussion of existing growth factors and restraints, while examining future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed