Companion Animal Pharmaceuticals Market Size, Share Report, DemandAnalysis, Trends, Growth 2032

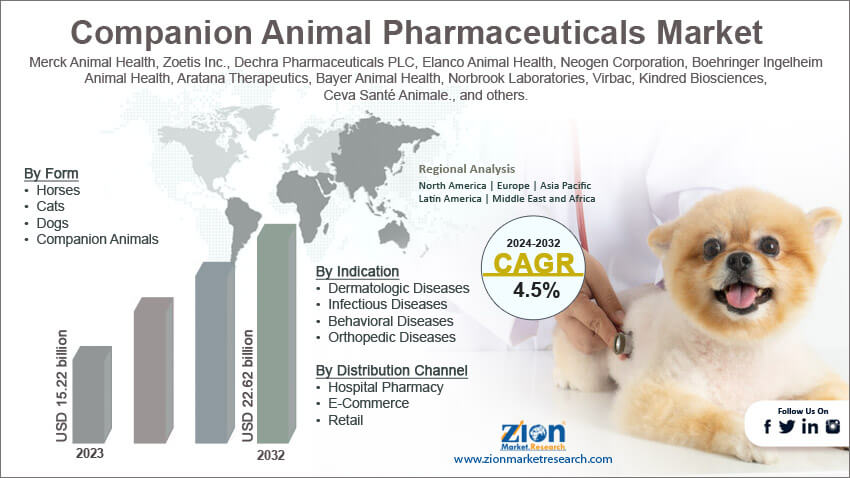

Companion Animal Pharmaceuticals Market By Form (Horses, Cats, Dogs, and Other Companion Animals), By Indication (Dermatologic Diseases, Infectious Diseases, Behavioral Diseases, Orthopedic Diseases, and Others), By Distribution Channel (Hospital Pharmacy, E-Commerce, and Retail), By Product (Vaccine and Biologics), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

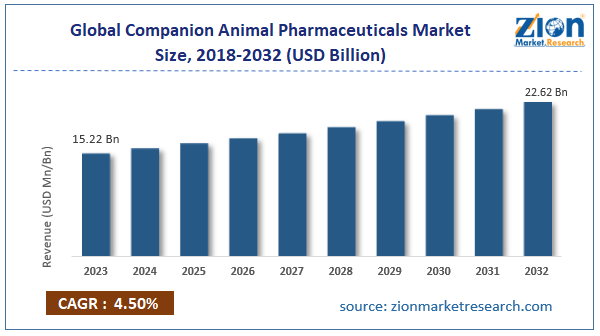

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 15.22 billion | USD 22.62 billion | 4.5% | 2023 |

Companion Animal Pharmaceuticals Industry Perspective:

The global companion animal pharmaceuticals market size was worth around USD 15.22 billion in 2023 and is predicted to grow to around USD 22.62 billion by 2032 with a compound annual growth rate (CAGR) of roughly 4.50% between 2024 and 2032.

Companion Animal Pharmaceuticals Market: Overview

The pharmaceutical sector dedicated specially toward taking care of the medical needs of pet animals is the companion animal pharmaceutical market. Pet animals are kept by people for companionship or for entertainment purposes. These domesticated animals steadily become a part of the family owning the pets. Companion animals are different from other animals since the former are owned specifically for the purpose of providing some form of companionship to the owners unlike other livestock or working animals. The demand for medical care for pets is growing at a rapid rate during present times. The growing importance of pet animals within family dynamics is the primary driver for pet care. The most common companion animals across the globe are dogs and cats.

However, every person has a specific preference in certain cases, pet animals may comprise reptiles or rodents. Additionally, the pet industry is widely regulated with certain countries banning the keeping of certain animals as pets. For instance, certain species of snakes are allowed in Germany to be domesticated as pets. However, Hawaii and New Zealand have completely banned snakes as pets. Hence the drug developers for companion pets must ensure compliance with regional laws when entering new markets.

Key Insights:

- As per the analysis shared by our research analyst, the global companion animal pharmaceuticals market is estimated to grow annually at a CAGR of around 4.50% over the forecast period (2024-2032)

- In terms of revenue, the global companion animal pharmaceuticals market size was valued at around USD 15.22 billion in 2023 and is projected to reach USD 22.62 billion, by 2032.

- The market is projected to grow at a significant rate due to the rising number of companion pet owners

- Based on form segmentation, the dog segment is growing at a high rate and is projected to dominate the global market.

- Based on distribution channel segmentation, the hospital pharmacy segment is projected to swipe the largest market share.

- On the basis of region, North America is expected to dominate the global market during the forecast period.

Request Free Sample

Request Free Sample

Companion Animal Pharmaceuticals Market: Growth Drivers

Rising number of companion pet owners may drive the market demand

The global companion animal pharmaceutical market is expected to witness a high growth rate due to the increasing number of companion pet owners across the globe. As per January 2024 findings, more than 2.17 million dogs were adopted in 2023. The number of cat adoptions was also over 2.5 million in the same year. People worldwide are actively seeking companionship among animals. There are multiple reasons for the high growth rate. For instance, urbanization has led to many people living alone in urban areas. Companion animals provide the necessary comfort to their owners. Additionally, more people are willing to adopt pets instead of reproducing biological children. Market research suggests that millennials are becoming increasingly keen on adopting pets as the major milestones of traditional lifestyle continue to get delayed. Companion pets are known to offer several health benefits.

As per the Centers for Disease Control and Prevention (CDC), the bond between pets and animals is known to help reduce triglyceride levels, blood pressure, feelings of loneliness, cholesterol levels, and anxiety. Moreover, keeping companion pets creates more opportunities for owners or caretakers to participate in outdoor activities which can be helpful for older people and children. The rise in the number of pet owners directly impacts the demand for medical care for these animals. In 2021, US pet owners spent around USD 110 billion on their pets as per Dogster. The growing disposable income of the general population further allows them to spend heavily on the medical care of their pets.

Rising interest in improving veterinary care infrastructure may aid in higher demand for medicines for companion animals

The animal care industry is thriving at a rapid rate driven by multiple factors. In September 2022, Southfields Veterinary Specialists in Basildon, UK witnessed the launch of the region’s one-of-its-kind state-of-the-art veterinary hospital spread across 42,000 sq ft. The center is one of Europe's most prestigious and largest multi-disciplinary veterinary referral centers thus fueling the revenue in the global companion animal pharmaceutical market.

Companion Animal Pharmaceuticals Market: Restraints

Complexities in obtaining approval for pet medicines may restrict the market expansion rate

The global industry for companion animal pharmaceuticals is expected to be restricted due to the high complexities associated with obtaining approvals for the commercial sale of pet medicines. The regulatory framework governing the animal drug industry is highly complex.

For instance, in July 2023, India banned the sale of two additional animal drugs sold under the names Aceclofenac and Ketoprofen. The ban came after regional animal welfare agencies Bombay Natural History Society (BNHS) worked for 10 years with other agencies and government officials to ban the sale and production of the drugs in the country as it was linked to vulture deaths in the country. The animal drug sector is highly regulated and complex. Companies cannot risk ignoring the regulatory rules and must comply with the laws.

Companion Animal Pharmaceuticals Market: Opportunities

Increasing research and development for novel therapies may generate high-growth opportunities

The global companion animal pharmaceuticals market is expected to generate growth opportunities due to the increasing research work for the development of novel therapies and medicines that show greater efficiency and treat serious medical conditions associated with pet animals. In March 2024, a researcher at Yale University developed a new vaccine that can effectively halt or slow certain types of cancers in dogs. The future scope of the medicine suggests that it can be used for human health as well. The treatment is a form of immunotherapy and it is currently under review by the U.S. Department of Agriculture (USDA).

In January 2023, in another such move, research published in the Stem Cell Research & Therapy suggested that a novel cancer treatment research was underway that could potentially extend the lives of terminally ill dogs suffering from cancer. In 2022, Vetbiolix, an animal biotechnology company, raised €2.5 million in funds. The company launched the clinical development of first-in-class drug candidates for osteoarthritis and periodontal diseases in cats and dogs.

Rising understanding of the importance of pet care could lead to higher revenue in the coming years

The awareness rate among pet owners is on the rise. The growing access to technology as well as the rising number of conversations around the best ways of pet care has contributed to increased awareness among pet owners. Such initiatives that aim to help pet owners deliver better care to patients could drive the demand in the global companion animal pharmaceuticals market.

Companion Animal Pharmaceuticals Market: Challenges

High cost of vaccines and the rising cost of pet care may challenge the market expansion rate

The global industry for companion animal pharmaceuticals is expected to be challenged by the growing cost of animal vaccines. For instance, dog vaccines can cost around USD 20 to USD 60 on average. In addition to this, the cost of pet care is increasing at a sharp rate driven by factors such as shortage of medicines, limited number of service providers, and the rising cost of the raw materials used for drug development and manufacturing.

Companion Animal Pharmaceuticals Market: Segmentation

The global companion animal pharmaceuticals market is segmented based on form, indication, distribution channel, product, and region.

Based on form, the global market segments are horses, cats, dogs, and other companion animals. In 2023, the highest demand was witnessed in the dogs segment. It dominated over 45.01% of the total market share. The cats segment was also highly lucrative in 2023 and during the projection period, it is expected to grow at a CAGR of over 10.32%. Cats and dogs enjoy the highest rate of pet adoptions. Dogs are often recommended as companions to patients with specific medical conditions such as depression, post-traumatic stress disorder, and anxiety.

Based on indication, the global companion animal pharmaceuticals industry is divided into dermatologic diseases, infectious diseases, behavioral diseases, orthopedic diseases, and others.

Based on distribution channels, the global market is divided into hospital pharmacy, e-commerce, and retail. In 2023, the hospital segment was the highest revenue-generating. It held control over 48.01% of the total segmental revenue. The rising number of pet hospitals across the globe and growing pet care expenditure were the leading reasons for high growth in the segment. During the projection period, the e-commerce sector is expected to grow at a CAGR of 14.02%.

Based on product, the global market segments are vaccines and biologics.

Companion Animal Pharmaceuticals Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Companion Animal Pharmaceuticals Market |

| Market Size in 2023 | USD 15.22 Billion |

| Market Forecast in 2032 | USD 22.62 Billion |

| Growth Rate | CAGR of 4.50% |

| Number of Pages | 212 |

| Key Companies Covered | Merck Animal Health, Zoetis Inc., Dechra Pharmaceuticals PLC, Elanco Animal Health, Neogen Corporation, Boehringer Ingelheim Animal Health, Aratana Therapeutics, Bayer Animal Health, Norbrook Laboratories, Virbac, Kindred Biosciences, Ceva Santé Animale., and others. |

| Segments Covered | By Form, By Indication, By Distribution Channel, By Product, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Companion Animal Pharmaceuticals Market: Regional Analysis

North America to generate the highest revenue during the projection period

The global companion animal pharmaceuticals market is expected to witness the highest growth in North America during the projection period. The presence of a high number of pet owners as well as the accessibility of pet medical care facilities are the essential growth drivers. In September 2023, retail giant Walmart made an entry into the pet care segment with the launch of a new pet service center that will also include several types of veterinary care.

In December 2023, a US-based leading retailer of animal care products, Chewy, forayed into the pet care segment. The company announced its 2024 expansion plans with the launch of veterinary services starting from Florida. Pet owners can access the medical services offered by the company through their Chewy Vet Care centers. The rising investments in the development of novel medicines and treatments will further promote the market expansion rate.

In 2020, Merck Animal Health announced an investment of USD 100 million to be used for the technological expansion of its vaccine production facility. Asia-Pacific is projected to register a high growth rate. China, India, Japan, and South Korea are expected to become the leading regional market propellers. The rise in the number of pet owners in these countries will drive the demand for companion animal pharmaceuticals

Companion Animal Pharmaceuticals Market: Competitive Analysis

The global companion animal pharmaceuticals market is led by players like:

- Merck Animal Health

- Zoetis Inc.

- Dechra Pharmaceuticals PLC

- Elanco Animal Health

- Neogen Corporation

- Boehringer Ingelheim Animal Health

- Aratana Therapeutics

- Bayer Animal Health

- Norbrook Laboratories

- Virbac

- Kindred Biosciences

- Ceva Santé Animale.

The global companion animal pharmaceuticals market is segmented as follows:

By Form

- Horses

- Cats

- Dogs

- Companion Animals

By Indication

- Dermatologic Diseases

- Infectious Diseases

- Behavioral Diseases

- Orthopedic Diseases

By Distribution Channel

- Hospital Pharmacy

- E-Commerce

- Retail

By Product

- Vaccine

- Biologics

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The pharmaceutical sector dedicated specially toward taking care of the medical needs of pet animals is the companion animal pharmaceutical market.

The global companion animal pharmaceutical market is expected to witness a high growth rate due to the increasing number of companion pet owners across the globe.

According to study, the global companion animal pharmaceuticals market size was worth around USD 15.22 billion in 2023 and is predicted to grow to around USD 22.62 billion by 2032.

The CAGR value of companion animal pharmaceuticals market is expected to be around 4.50% during 2024-2032.

The global companion animal pharmaceuticals market is expected to witness the highest growth in North America during the projection period.

The global companion animal pharmaceuticals market is led by players like Merck Animal Health, Zoetis Inc., Dechra Pharmaceuticals PLC, Elanco Animal Health, Neogen Corporation, Boehringer Ingelheim Animal Health, Aratana Therapeutics, Bayer Animal Health, Norbrook Laboratories, Virbac, Kindred Biosciences, and Ceva Santé Animale

The report explores crucial aspects of the companion animal pharmaceuticals market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed