Construction Equipment Rental Market Size, Share Report, Analysis, Trends, Growth 2032

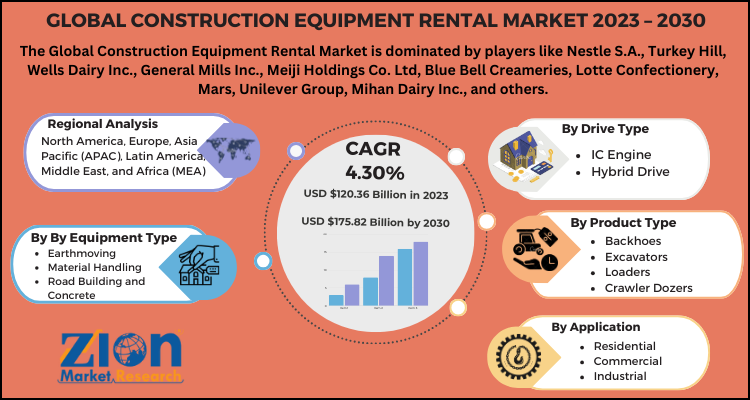

Construction Equipment Rental Market By Equipment Type (Earthmoving, Material Handling, Road Building and Concrete), By Drive Type (IC Engine, Hybrid Drive), By Product Type (Backhoes, Excavators, Loaders, Crawler Dozers, Cranes, Concrete Pumps, Compactors, Transit Mixers, Concrete Mixers, Others), By Application (Residential, Commercial, Industrial), and By Region: Global Industry Analysis, Size, Share, Growth, Trends, and Forecast 2024-2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 120.36 Billion | USD 175.82 Billion | 4.30% | 2023 |

Description

Global Construction Equipment Rental Market: Overview

The global Construction Equipment Rental market size accrued earnings worth approximately USD 120.36 Billion in 2023 and is predicted to gain revenue of about USD 175.82 Billion by 2032, is set to record a CAGR of nearly 4.30% over the period from 2024 to 2032

Construction equipment rental is the renting of construction equipment for a given period through the signing of contracts with terms and conditions regarding the usage of the equipment. Construction equipment is mainly used at construction sites to facilitate heavy work. Many industries require such equipment seasonally, which makes them costly and unaffordable. Rental equipment is preferred by companies due to its flexibility and ability to meet customized needs without requiring maintenance or insurance. Therefore, construction equipment rental has been considered the most preferable and effective option for construction companies, predominantly to minimize or reduce the influence of unforeseen financial downturns.

Global Construction Equipment Rental Market: Growth Factors

The global construction equipment rental market is growing at a lucrative rate as construction companies and contractors are shifting towards construction equipment rental owing to high initial purchase cost of new construction machines. Also, factors that are fueling the growth of the global market include large-scale infrastructure programs in the emerging market along with the presence of numerous established key players in countries such as China, Japan, and India.

However, material-handling equipment's efficiency depends on constant technical support and maintenance. High depreciation & maintenance cost, high taxes, equipment insurance required for the new construction equipment leads to renting construction equipment by the numerous end-user industries. The need for skilled personnel to operate, repairs, and maintain forklifts market further increases the cost of maintenance.

All such factors are encouraging construction companies to adopt construction equipment on a rental basis which in turn is driving the market growth. Moreover, the leading service providers are now also focusing on providing onsite services and support for equipment, which further enhances customer experience.

In addition, the rental companies are upgrading their fleet of equipment and types of machinery regularly, providing their customers with most advanced & upgraded equipment. However, an economic slump and recession in the construction industry will directly hinder the construction equipment rental market growth. On the other hand, favorable government funding for infrastructure development along with low rental penetration in emerging countries will offer lucrative opportunities for the growth of the global construction equipment rental market in the forecast period.

Key Insights

- As per the analysis shared by our research analyst, the global Construction Equipment Rental Market is estimated to grow annually at a CAGR of around 4.30% over the forecast period (2024-2032).

- In terms of revenue, the global Construction Equipment Rental Market size was valued at around USD 120.36 Billion in 2023 and is projected to reach USD 175.82 Billion by 2032.

- Based on the product type, the Earthmoving Machinery this segment holds a significant market share, accounting for over 55.76% in 2022. The extensive use of equipment such as excavators, loaders, backhoes, and graders in construction, mining, and agriculture contributes to its dominance.

- Based on the equipment type, the Earthmoving Equipment encompassing machinery like excavators, loaders, bulldozers, and graders, this segment dominates the market with over 40% share. Its widespread application across various construction sectors underpins its leading position.

- Based on the drive type, the Internal Combustion Engine (ICE) ICE-powered equipment, typically running on diesel or gasoline, holds the largest market share. Known for their robustness and high torque, these machines are favored for heavy-duty tasks in construction projects.

- Based on the applicaiton, Infrastructure Development this segment accounts for over 45% of the market, driven by large-scale government projects, smart city initiatives, and public transportation expansions. The demand for rented equipment like excavators and cranes is particularly high in infrastructure projects.

- Based on the region, Asia Pacific leading the market, this region's dominance is attributed to substantial infrastructure projects and favorable government initiatives in countries like China and India. The growing demand for cost-effective construction equipment rentals further supports this position.

Construction Equipment Rental Market: Dynamics

Key Growth Drivers

The construction equipment rental market is primarily driven by the growing construction activities across residential, commercial, and infrastructure sectors. Rapid urbanization and industrialization, particularly in developing regions, are fueling the demand for construction machinery. Renting equipment provides a cost-effective solution for construction companies, reducing the need for large capital investments and minimizing maintenance expenses. Additionally, the increasing trend of leasing advanced machinery equipped with modern technologies, such as telematics and automation, further supports market growth. Government investments in infrastructure development, including roads, bridges, and smart cities, also contribute significantly to the demand for rental equipment.

Restraints

Despite its advantages, the construction equipment rental market faces certain restraints. One major challenge is the high cost of maintaining and repairing heavy machinery, which can impact the profitability of rental companies. Fluctuations in construction activity due to economic uncertainties, geopolitical tensions, or regulatory changes may also reduce demand for rental equipment. Additionally, concerns over equipment availability and logistical challenges can hinder timely project completion. The lack of skilled operators to handle advanced machinery further limits market expansion, especially in developing regions.

Opportunities

The market presents ample opportunities with the increasing adoption of sustainable and eco-friendly construction practices. Rental companies can benefit from the growing preference for energy-efficient and low-emission machinery as governments impose stricter emission regulations. Technological advancements in equipment tracking, predictive maintenance, and fleet management offer rental companies opportunities to optimize operations and enhance customer satisfaction. Furthermore, the rise of construction activities in emerging economies, supported by foreign investments and public-private partnerships, creates a favorable environment for market growth. Expanding digital platforms that facilitate online equipment rental bookings also present new revenue opportunities.

Challenges

The construction equipment rental market faces several challenges, including the risk of equipment misuse, damage, and theft, which can result in financial losses for rental companies. Intense competition among rental providers often leads to pricing pressure, reducing profit margins. Additionally, fluctuating fuel prices and rising raw material costs can increase the overall operational expenses of rental businesses. Regulatory compliance, including safety standards and emission norms, further adds to operational complexities. Lastly, maintaining a diverse and modern fleet to meet the varying demands of customers while ensuring cost efficiency remains a constant challenge for market players.

Construction Equipment Rental Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Construction Equipment Rental Market |

| Market Size in 2023 | USD 120.36 Billion |

| Market Forecast in 2032 | USD 175.82 Billion |

| Growth Rate | CAGR of 4.30% |

| Number of Pages | 207 |

| Key Companies Covered | Nestle S.A., Turkey Hill, Wells Dairy Inc., General Mills Inc., Meiji Holdings Co. Ltd, Blue Bell Creameries, Lotte Confectionery, Mars, Unilever Group, Mihan Dairy Inc., and others. |

| Segments Covered | By Product Type, By Equipment Type, By Drive Type, By Applicaiton, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Construction Equipment Rental Market: Segmentation

The construction equipment rental market is divided based on equipment type, drive type, product type, and application. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

By equipment type segment, the Construction Equipment Rental Market is segmented into earthmoving, material handling and road building and concrete

The drive type segment includes IC engine and hybrid drive.

By product type segment includes backhoes, excavators, loaders, crawler dozers, cranes, concrete pumps, compactors, transit mixers, concrete mixers and others.

The application segment includes residential, commercial, industrial.

The regional segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

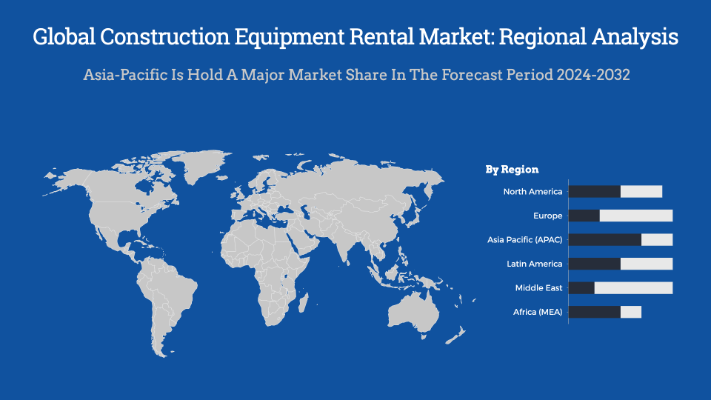

Global Construction Equipment Rental Market: Regional Analysis

The global construction equipment rental market demonstrates distinct regional dynamics influenced by factors such as infrastructure development, urbanization, and economic conditions.

North America

North America holds a significant share in the construction equipment rental market, driven by robust infrastructure projects and a preference for rental services over equipment ownership. The presence of major industry players like United Rentals and Ashtead Group enhances market maturity. Recent developments include United Rentals' acquisition of H&E Equipment Services for approximately $4.8 billion, aiming to expand its market presence and leverage synergies. However, companies like Ashtead have faced profit shortfalls attributed to a slowdown in U.S. commercial construction and high interest rates.

Europe

Europe represents a mature market with steady growth, supported by ongoing urbanization and renovation projects. Countries such as Germany, France, and the United Kingdom are notable contributors. The region's focus on environmental sustainability has led to increased demand for eco-friendly rental equipment. Companies like Speedy Hire have experienced profit warnings due to economic slowdowns affecting infrastructure spending. Additionally, Ashtead Group's consideration to shift its primary listing from London to New York reflects strategic moves within the industry.

Asia-Pacific

The Asia-Pacific region is experiencing rapid growth in the construction equipment rental market, fueled by urbanization, industrialization, and substantial infrastructure development in countries like China, India, and Japan. The demand for rental equipment is particularly high due to cost-effectiveness and flexibility. The region is projected to register a compound annual growth rate (CAGR) of 5.9%, with China holding a major market share.

Middle East and Africa

This region shows promising growth potential, driven by infrastructure projects and urban development initiatives. The Middle East, in particular, is witnessing substantial construction activities in countries like the UAE and Saudi Arabia. Africa's growth is propelled by new mining activities and infrastructural development, with South Africa identified as having significant market potential.

Latin America

Latin America is experiencing steady growth in the construction equipment rental market, supported by infrastructure projects and urban development initiatives. Countries such as Brazil, Mexico, and Argentina showcase robust demand for rental equipment. However, varying economic conditions and regulatory frameworks influence market dynamics across these regions.

Global Construction Equipment Rental Market: Competitive Players

The global construction equipment rental market is fragmented owing to the presence of domestic and multinational players.

- H&E Equipment Services Inc (U.S.)

- Cramo Group (Finland)

- Ramirent (Finland)

- Maxim Crane Works

- L.P. (U.S.)

- Kiloutou Group(France)

- Sarens NV (Belgium)

- Taiyokenki Rental Co. Ltd. (Japan)

- Boels Rentals (Netherlands)

- Speedy Hire Plc (UK)

- United Rentals Inc. (U.S.)

- Ashtead Group Plc (UK)

- Loxam (Paris)

- Herc Holdings Inc. (U.S.)

- Aktio Corporation (Japan)

- Nishio Rent All Co. Ltd. (Japan) Kanamoto Co. Ltd. (Japan)

- Nishio Rent All Co. Ltd (Japan)

- Mitsubishi Corporation (Japan)

- Ahern Rentals (U.S.)

These manufacturers are also focusing on improving their services along with diversifying their product portfolio.

Further, strategic collaboration helps market players to expand the scale of business, advance logistic services, and strengthen their position in the market. Key players are majorly investing in strategic partnerships and joint ventures with equipment manufacturing companies to gain major market share.

Global Construction Equipment Rental Market: Segments

By Equipment Type

- Earthmoving

- Material Handling

- Road Building and Concrete

By Drive Type

- IC Engine

- Hybrid Drive

By Product Type

- Backhoes

- Excavators

- Loaders

- Crawler Dozers

- Cranes

- Concrete Pumps

- Compactors

- Transit Mixers

- Concrete Mixers

- Others

By Application

- Residential

- Commercial

- Industrial

Global Construction Equipment Rental Market: Regional Segments

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

What Reports Provide

- Full in-depth analysis of the parent market

- Important changes in market dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional markets

- Testimonials to companies in order to fortify their foothold in the market.

Table Of Content

FrequentlyAsked Questions

The global construction equipment rental market is growing at a lucrative rate as construction companies and contractors are shifting towards construction equipment rental owing to high initial purchase cost of new construction machines. Furthermore, favorable government funding for infrastructure development along with low rental penetration in emerging countries will offer lucrative opportunities for the growth of the construction equipment rental market in the forecast period.

H&E Equipment Services, Inc (U.S.), Cramo Group (Finland), Ramirent (Finland), Maxim Crane Works, L.P. (U.S.), Kiloutou Group(France), Sarens NV (Belgium), Taiyokenki Rental Co., Ltd. (Japan), Boels Rentals (Netherlands), Speedy Hire Plc (UK), United Rentals Inc. (U.S.), Ashtead Group Plc (UK), Loxam (Paris), Herc Holdings Inc. (U.S.), Aktio Corporation (Japan), Nishio Rent All Co. Ltd. (Japan) Kanamoto Co. Ltd. (Japan), Nishio Rent All Co. Ltd (Japan), Mitsubishi Corporation (Japan), Ahern Rentals (U.S.)

Geographically, North America is estimated to hold the largest share in the global construction equipment rental market during the forecast period. Increasing infrastructure development and the rising need for cost-effective and customized equipment among end-users are improving the growth of the market in this region.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed