Crop Insurance Market Size, Share, Industry Analysis, Trends, Growth,Forecasts 2030

Crop Insurance Market By Coverage (Crop-Hail Insurance and Multi-Peril Crop Insurance (MPCI)), By Service Provider (Brokers/Agents, Insurance Companies, Banks, Government Bodies, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

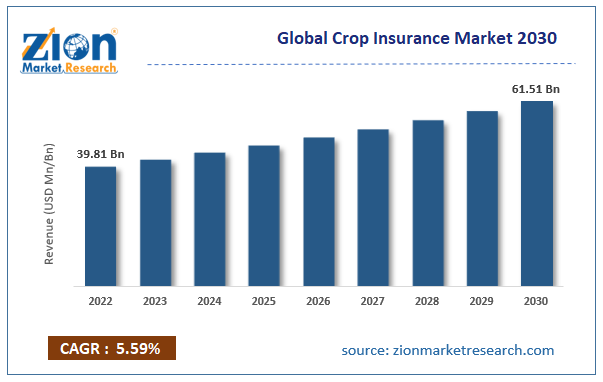

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 39.81 Billion | USD 61.51 Billion | 5.59% | 2022 |

Crop Insurance Industry Prospective:

The global crop insurance market size was worth around USD 39.81 billion in 2022 and is predicted to grow to around USD 61.51 billion by 2030 with a compound annual growth rate (CAGR) of roughly 5.59% between 2023 and 2030.

Crop Insurance Market: Overview

Crop insurance is a service that is specially dedicated to the agricultural industry. It deals with the buying and selling of insurance between service providers and owners of agricultural produce or land and in some cases ranchers. The insurance acts as a safety key as it helps agricultural producers gain compensation in the event of crop loss caused by natural disasters. Crop insurance also protects farmers and ranchers against loss of revenue that may be caused due to decreased crop prices. The two main categories of crop insurance include crop-hail insurance and multi-peril crop insurance (MPCI).

The former is mostly available in countries that record hail frequently. They are mostly sold by private companies while being regulated by state programs. MPCI, on the other hand, covers losses incurred due to natural disasters including crop diseases, floods, insect damage, drought, and destructive environmental conditions. The demand for crop insurance has surged in recent times with sudden and severe climate changes observed globally. During the forecast period, the market growth trend is expected to be positive.

Key Insights:

- As per the analysis shared by our research analyst, the global crop insurance market is estimated to grow annually at a CAGR of around 5.59% over the forecast period (2023-2030)

- In terms of revenue, the global crop insurance market size was valued at around USD 39.81 billion in 2022 and is projected to reach USD 61.51 billion, by 2030.

- The crop insurance market is projected to grow at a significant rate due to the rising loss of crops due to changes in climate conditions

- Based on coverage segmentation, the multi-peril crop insurance (MPCI) was predicted to show maximum market share in the year 2022

- Based on service provider segmentation, government bodies were the leading segment in 2022

- On the basis of region, Asia-Pacific was the leading revenue generator in 2022

Request Free Sample

Request Free Sample

Crop Insurance Market: Growth Drivers

Rising loss of crops due to changes in climate conditions may propel market growth

The global crop insurance market is expected to grow owing to the increasing change in climatic conditions across the globe. One of the leading reasons for sudden changes in environmental factors is global warming. As per reports by the National Oceanic and Atmospheric Administration (NOAA), the earth’s temperature has increased by 0.14° Fahrenheit every decade since 1880. The changes in climate conditions have become more evident in the last few decades. The primary effect of global warming can be seen with the increased number of floods globally along with a higher frequency of draughts and other pressing concerns that directly impact agricultural produce. Weather conditions are frequently changing and have become unpredictable in recent times.

For instance, several countries have reported out-of-season consistent rain or longer periods of summer or winter days. The crop cycle gets severely affected by these changes since crop yield is highly dependent on external weather conditions. As per projections made by the National Aeronautics and Space Administration (NASA), maize yields are expected to register a dip of 24% as early as 2030. Such fundamental shifts can greatly impact the supply chain industry for agricultural produce and pose severe financial threats to companies and people working in the agricultural industry. Crop insurance acts as a protection against financial loss and hence the threat of loss of revenue is significantly higher in modern times, the demand for efficient crop insurance policies is projected to gain momentum.

Crop Insurance Market: Restraints

High cost of crop insurance to restrict market growth

The demand for crop insurance is expected to be restricted due to the high cost of these policies. Farm owners with limited revenue from farm areas may find it difficult to pay crop insurance premiums thus restricting service adoption. Underdeveloped countries or nations that are currently struggling with social economic warfare may not be able to adopt crop insurance since their farm owners or crop producers are financially incapable of paying initial premium amounts.

Furthermore, increasing cases of crop insurance fraud and false claims may impede the global crop insurance market demand. For instance, in a recent incident, almost 8000 farmers claimed crop insurance without actually planting any crop. Some farmers were reported to make false claims purposely by obtaining higher insurance coverage benefits.

Crop Insurance Market: Opportunities

Introduction of technology to crop insurance schemes may deliver exceptional results

The global crop insurance industry is likely to benefit from the increasing investments in technology and crop insurance integration. New and advanced digital systems are expected to improve transparency for all parties involved and also expedite the process of insurance claims. Service providers will be able to better track any form of fraudulent activity. For instance, the Uttar Pradesh government of India has recently introduced 4 agencies that will leverage technologies such as Artificial Intelligence (AI) and Machine Learning (ML) to prevent more frauds in the coming years. The agencies will also use Remote Sensing (RS) technology for compiling important information such as crop health, land use, and yield estimates.

In July 2023, the Ministry of Agriculture and Farmers Welfare in India launched multiple technological initiatives under the guidance of the Pradhan Mantri Fasal Bima Yojana as the country aims to streamline the process of crop insurance enrollment and other operational activities.

Reformative changes in the crop insurance sector of emerging economies hold growth potential

The global crop insurance market is expected to succeed in achieving higher revenue since emerging economies across the globe, especially nations with higher dependence on agricultural produce, are launching reformative changes in the crop insurance sector. In May 2022, the Philippines witnessed the launch of its first public and private sector collaboration with the help of the Asian Development Bank (ADB).

The regional government has partnered with insurance provider CARD Pioneer Microinsurance Inc. The parties will jointly work toward providing crop insurance for specific crops with high value such as banana, coconut, pineapple, sugarcane, cacao, and coffee.

Crop Insurance Market: Challenges

Several limitations in terms of crop insurance to challenge market demand

The global crop insurance market demand will be impacted by several technical limitations of crop insurance policies. For instance, some of these risks are inherent to the nature of the service. For instance, basis risk is one of the most commonly occurring issues in which an insurance provider does not perform the role of dispersing reimbursements correctly thus leading to either wrong person receiving the payout. Other potential causes of concern include design risk, spatial risk, and other important factors of the farmland being ignored.

Crop Insurance Market: Segmentation

The global crop insurance market is segmented based on coverage, service provider, and region.

Based on coverage, the global market divisions are crop-hail insurance and multi-peril crop insurance (MPCI). In 2022 the highest growth was witnessed in the MPCI segment. The crop-hail insurance is mostly provided by private companies whereas MPCI is regulated by federal agencies and hence has more credibility. As per reports, almost 90.5% of all farmers who undertake crop insurance opt for MPCI. This format is currently prevalent in over 120 nations and hence higher buyers. Crop-hail insurance is sometimes bought in addition to MPCI in selected countries. Multi-peril crop insurance offers comprehensive coverage and greater flexibility. If executed correctly, it can be of great assistance to crop cultivators.

Based on service provider, the global market divisions are brokers/agents, insurance companies, banks, government bodies, and others. In 2022, the highest demand was observed in the government bodies segment. These entities are more reliable and since they are controlled by federal agencies, fraud activities are relatively less. The growing focus of the regional government on improving infrastructure surrounding crop insurance access and deliverables will aid segmental growth during the forecast period. In 2022, the US government spent nearly USD 17.3 billion on crop insurance.

Crop Insurance Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Crop Insurance Market |

| Market Size in 2022 | USD 39.81 Billion |

| Market Forecast in 2030 | USD 61.51 Billion |

| Growth Rate | CAGR of 5.59% |

| Number of Pages | 221 |

| Key Companies Covered | Zurich Insurance Group, Swiss Re, XL Catlin, Munich Re, Tokio Marine Holdings, Hannover Re, Arch Capital Group, Chubb Limited, American International Group (AIG), Aon plc, QBE Insurance Group, Willis Towers Watson, Farmers Insurance Group, Allianz SE, Sompo Holdings, and others. |

| Segments Covered | By Coverage, By Service Provider, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Crop Insurance Market: Regional Analysis

Asia-Pacific to lead with the highest growth rate during the forecast period

The global crop insurance market is expected to witness the highest growth in the Asia-Pacific. China and India are among the top three countries that boast of an extensive and comprehensive crop insurance ecosystem. Asian countries have large amounts of agricultural land. As per official data, over 54% of India’s land is arable. Almost 50% of the country’s labor market is employed by the agriculture industry. It is the largest exporter of rice. Between 2021 and 2022, the country produced over 19% of the global rice volume. Additionally, the country witnessed varying temperatures across regional territories. In recent times, India has become susceptible to sudden changes in weather conditions.

In 2022-2023, India recorded a loss of 68.56 lakh hectares of crop due to 4 major climate emergencies. These factors have led to increasing initiatives by the regional government toward crop protection. The country has launched new programs to educate farmers about the importance of crop insurance. It has also digitized the ecosystem surrounding crop insurance to ensure a higher penetration rate. China, on the other hand, also has an extensive range of arable land. The growing demand for food products and rising assistance from the regional government may aid higher growth in China.

Crop Insurance Market: Competitive Analysis

The global crop insurance market is led by players like:

- Zurich Insurance Group

- Swiss Re

- XL Catlin

- Munich Re

- Tokio Marine Holdings

- Hannover Re

- Arch Capital Group

- Chubb Limited

- American International Group (AIG)

- Aon plc

- QBE Insurance Group

- Willis Towers Watson

- Farmers Insurance Group

- Allianz SE

- Sompo Holdings

The global crop insurance market is segmented as follows:

By Coverage

- Crop-Hail Insurance

- Multi-Peril Crop Insurance (MPCI)

By Service Provider

- Brokers/Agents

- Insurance Companies

- Banks

- Government Bodies

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Crop insurance is a service that is specially dedicated to the agricultural industry.

The global crop insurance market is expected to grow owing to the increasing change in climatic conditions across the globe.

According to study, the global crop insurance market size was worth around USD 39.81 billion in 2022 and is predicted to grow to around USD 61.51 billion by 2030.

The CAGR value of crop insurance market is expected to be around 5.59% during 2023-2030.

The global crop insurance market is expected to witness the highest growth in the Asia-Pacific.

The global crop insurance market is led by players like Zurich Insurance Group, Swiss Re, XL Catlin, Munich Re, Tokio Marine Holdings, Hannover Re, Arch Capital Group, Chubb Limited, American International Group (AIG), Aon plc, QBE Insurance Group, Willis Towers Watson, Farmers Insurance Group, Allianz SE, Sompo Holdings.

The report explores crucial aspects of the crop insurance market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed