Cryptocurrency Investment Services Market Size, Share, Analysis, Trends, Growth, Forecasts, 2032

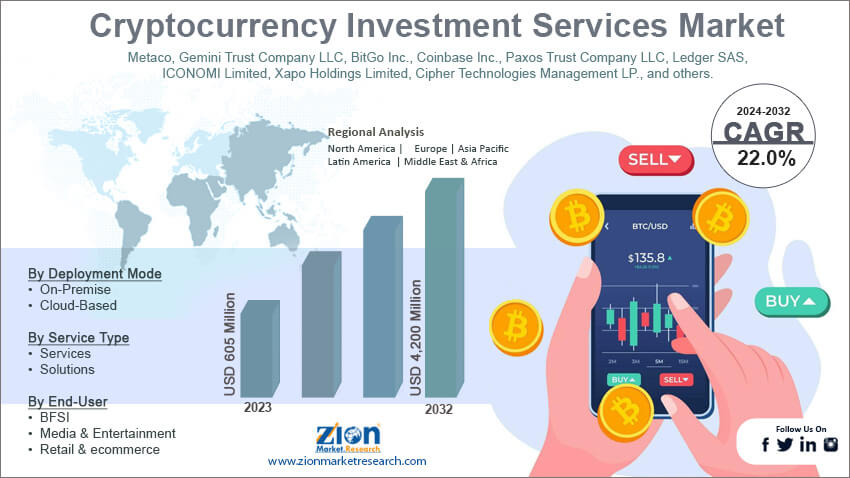

Cryptocurrency Investment Services Market By Deployment Mode (On-Premise and Cloud-Based), By Service Type (Services and Solutions), By End-User (BFSI, Media & Entertainment, and Retail & eCommerce), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

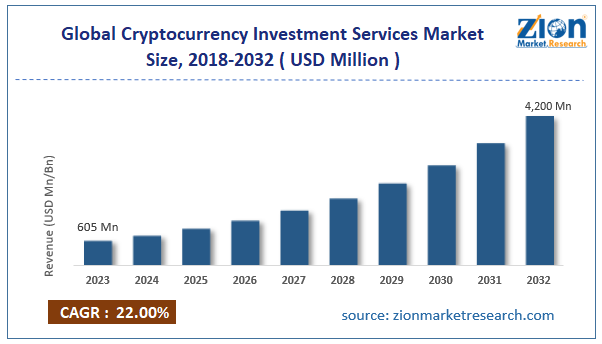

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 605 Million | USD 4,200 Million | 22% | 2023 |

Cryptocurrency Investment Services Industry Prospective:

The global cryptocurrency investment services market size was evaluated at $605 million in 2023 and is slated to hit $4,200 million by the end of 2032 with a CAGR of nearly 22% between 2024 and 2032.

Cryptocurrency Investment Services Market: Overview

Cryptocurrency investment services have emerged notably, thereby providing a variety of alternatives for institutional and individual investors. Reportedly, these services encompass direct investments in cryptocurrency for structured investment tools including managed funds and exchange traded funds. Major cryptocurrency investment tools include Mudrex, Antier Solutions, Charles Schwab, and Crypto Finance.

Key Insights

- As per the analysis shared by our research analyst, the global cryptocurrency investment services market is projected to expand annually at the annual growth rate of around 22% over the forecast timespan (2024-2032)

- In terms of revenue, the global cryptocurrency investment services market size was evaluated at nearly $605 million in 2023 and is expected to reach $4,200 million by 2032.

- The global cryptocurrency investment services market is anticipated to grow rapidly over the forecast timespan owing to the escalating acceptance of cryptocurrencies as means of payment and speculative assets.

- In terms of deployment mode, the on-premise segment is slated to register the highest CAGR over the forecast period.

- Based on enterprise size, the large enterprises segment is predicted to contribute majorly towards the global industry growth in the upcoming years.

- Based on service type, the solutions segment is predicted to lead the segmental landscape in the forecasting timeline.

- Based on end-user, the retail & e-commerce segment is predicted to contribute lucratively toward segmental growth in the forecasting timeframe.

- Region-wise, the European cryptocurrency investment services industry is projected to register the fastest CAGR during the projected timespan.

Request Free Sample

Request Free Sample

Cryptocurrency Investment Services Market: Growth Factors

Large-scale acceptance of cryptocurrencies as a mode of payment can boost global market trends

Escalating acceptance of cryptocurrencies as a means of payment and speculative assets is projected to enhance the need for investment services, thereby steering the expansion of the global cryptocurrency investment services market. Furthermore, surging demand for decentralized finance apps is expected to help boost the growth of the global market. Breakthroughs in blockchain systems and the massive use of cryptocurrency as an alternate payment option will proliferate the expansion of the market globally. Growing shift of countries in Europe, Asia, and member countries of BRICS towards the use of digital currency will promote the elevation of the market globally. Integrating cryptocurrency with banking solutions can drive global market trends.

Cryptocurrency Investment Services Market: Restraints

Lack of standardization in the laws regulating cryptocurrency use has impacted global industry growth

Non-uniform regulations associated with cryptocurrency investment services along with the risk of financial losses due to security glitches can pose a huge threat to the expansion of the global cryptocurrency investment services industry. Moreover, oscillations in the costs of cryptocurrencies and less availability of experts can pose a huge hindrance to the growth of the global industry.

Cryptocurrency Investment Services Market: Opportunities

Need for improving service encounters & service quality is likely to open new market growth avenues

An increase in the number of investments in pension funds, hedge funds, and various corporations for increasing revenue streams is projected to create new growth avenues for the global cryptocurrency investment services market. A prominent increment in the service offerings and launching of new technologies for overcoming labor shortages & reducing costs of factor advantages benefitting firms with a strong global currency can prop up the demand for cryptocurrency investment services.

Cryptocurrency Investment Services Market: Challenges

An increment in fraudulent activities and counterfeit services can challenge the global industry expansion

A rise in the number of frauds occurring due to the use of cryptocurrency and the lack of strict laws regulating the use of cryptocurrency to curb fraud can challenge the progression of the global cryptocurrency investment services industry. Moreover, issues related to the scalability of cryptocurrencies can deter the global industry's surge in the upcoming years.

Cryptocurrency Investment Services Market: Segmentation

The global cryptocurrency investment services market is divided into deployment mode, service type, end-user, and region.

In terms of deployment mode, the cryptocurrency investment services market across the globe is segmented into on-premise and cloud-based segments. Apparently, the on-premise segment, which accumulated nearly 59% of the global market share in 2023, is anticipated to register the fastest CAGR during the coming years as a result of the growing preference for on-premise deployment mode by large enterprises.

Based on the service type, the global cryptocurrency investment services industry is segmented into services and solutions segments. Apparently, the solutions segment, which dominated the global industry share in 2023, is predicted to account markedly toward the expansion of the industry globally in the ensuing years. This can be due to a rise in the demand for custodian solutions owing to an increase in the investments in these solutions by firms as they require effective & safe management of digital assets.

On the basis of end-user, the global cryptocurrency investment services market is bifurcated into BFSI, media & entertainment, and retail & e-commerce segments. Moreover, the retail & e-commerce segment, which led the segmental growth in 2023, is projected to contribute notably towards the segmental space in the coming years. The growth can be credited to the large-scale penetration of cryptocurrency activities in retail and e-commerce activities.

Cryptocurrency Investment Services Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Cryptocurrency Investment Services Market |

| Market Size in 2023 | USD 605 Million |

| Market Forecast in 2032 | USD 4,200 Million |

| Growth Rate | CAGR of 22% |

| Number of Pages | 216 |

| Key Companies Covered | Metaco, Gemini Trust Company LLC, BitGo Inc., Coinbase Inc., Paxos Trust Company LLC, Ledger SAS, ICONOMI Limited, Xapo Holdings Limited, Cipher Technologies Management LP., and others. |

| Segments Covered | By Deployment Mode, By Service Type, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Cryptocurrency Investment Services Market: Regional Insights

Asia-Pacific is forecast to maintain leadership status in the global market over the stipulated timeline

Asia-Pacific, which contributed about half of the global cryptocurrency investment services market share in 2023, is slated to establish a number one position in the global market in the coming few years. In addition to this, the regional market upsurge in the coming eight years can be credited to an increase in the rate of adopting cryptocurrencies in South Korea, Japan, and China. Additionally, supportive government laws enabling the use of blockchain technology and NFT’s use can proliferate the size of the market in the APAC region.

The European cryptocurrency investment services industry is slated to register the highest annual gains in the coming eight years. The expansion of the industry on the European continent can be subject to the implementation of favorable laws, such as markets in crypto-assets by the EU. Additionally, an increase in retail investment in blockchain technologies in European countries will provide impetus to the expansion of the industry in Europe.

Key Developments

- In September 2024, PayPal introduced cryptocurrency solutions for its business account holders in the U.S. These solutions help users purchase, hold, and sell digital assets through their accounts.

Cryptocurrency Investment Services Market: Competitive Space

The global cryptocurrency investment services market profiles key players such as:

- Metaco

- Gemini Trust Company LLC

- BitGo Inc.

- Coinbase Inc.

- Paxos Trust Company LLC

- Ledger SAS

- ICONOMI Limited

- Xapo Holdings Limited

- Cipher Technologies Management LP.

The global cryptocurrency investment services market is segmented as follows:

By Deployment Mode

- On-Premise

- Cloud-Based

By Service Type

- Services

- Solutions

By End-User

- BFSI

- Media & Entertainment

- Retail & ecommerce

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Cryptocurrency investment services have emerged notably, providing various alternatives for institutional and individual investors.

The global cryptocurrency investment services market's growth over the forecast period can be attributed to breakthroughs in blockchain systems and the massive use of cryptocurrency as alternate payment options.

According to a study, the global cryptocurrency investment services industry size was $605 million in 2023 and is projected to reach $4,200 million by the end of 2032.

The global cryptocurrency investment services market is anticipated to record a CAGR of nearly 22% from 2024 to 2032.

The European cryptocurrency investment services industry is set to register the fastest CAGR over the forecasting timeline owing to the implementation of favorable laws, such as markets in crypto-assets by the EU. Additionally, an increase in retail investment in blockchain technologies in European countries will provide impetus to the industry's expansion in Europe.

The global cryptocurrency investment services market is led by players such as Metaco, Gemini Trust Company, LLC, BitGo, Inc., Coinbase, Inc., Paxos Trust Company, LLC, Ledger SAS, ICONOMI Limited, Xapo Holdings Limited, and Cipher Technologies Management LP.

The global cryptocurrency investment services market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, and value chain analysis.

Choose License Type

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed