Cyber Insurance Market Size, Share, Growth, Trends, and Forecast, 2032

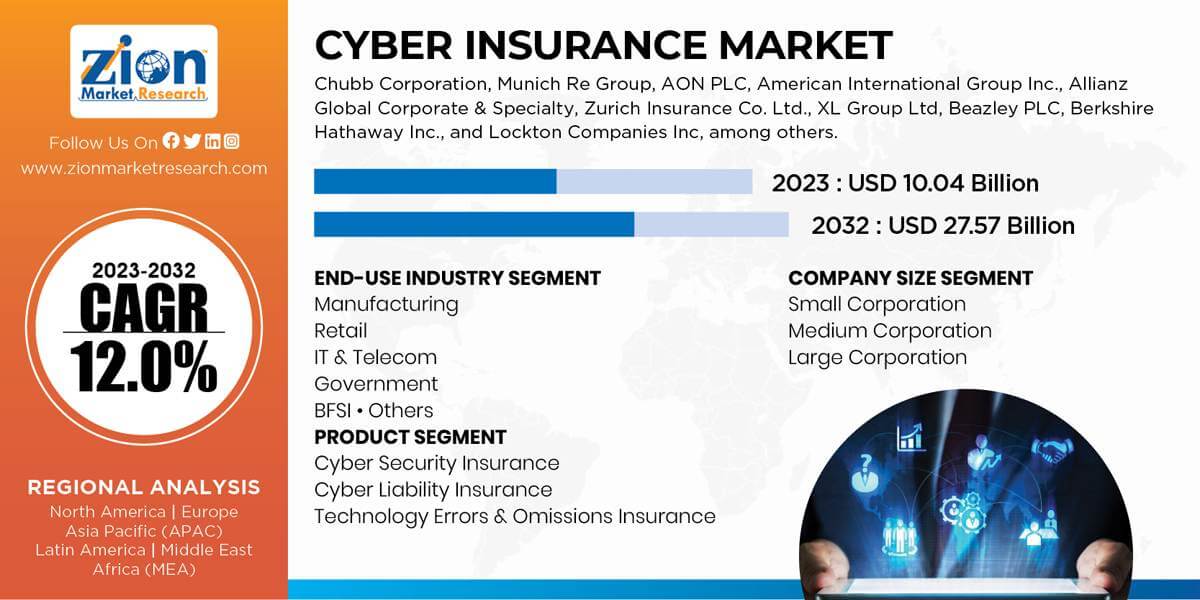

Cyber Insurance Market by End use Industry (Manufacturing, Retail, IT & Telecom, Government, BFSI, and Others), by Product (Cyber Security Insurance, Cyber Liability Insurance, and Technology Errors & Omissions Insurance), by Company Size (Small Corporation, Medium Corporation, and Large Corporation): Global Industry Perspective, Comprehensive Analysis and Forecast 2024-2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

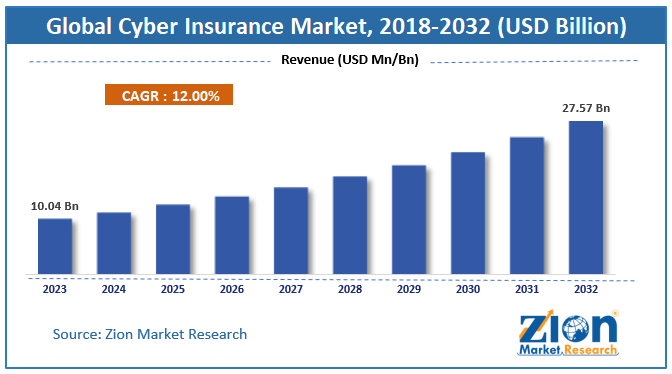

| USD 10.04 Billion | USD 27.57 Billion | 12.0% | 2023 |

The global Cyber Insurance market size accrued earnings worth approximately USD 10.04 Billion in 2023 and is predicted to gain revenue of about USD 27.57 Billion by 2032, is set to record a CAGR of nearly 12.0% over the period from 2024 to 2032.

The report gives a transparent view of the cyber insurance market. We have included a detailed competitive scenario and portfolio of leading vendors operative in the cyber insurance market. To understand the competitive landscape in the cyber insurance market, an analysis of Porter’s Five Forces model for the cyber insurance market has also been included. The report also covers patent analysis with bifurcation into a patent trend, patent by the company, and patent by region. The study encompasses a market attractiveness analysis, wherein product, company size, end-user industry, and regional segments are benchmarked based on their market size, growth rate, and general attractiveness.

The study provides a crucial view of the cyber insurance by segmenting the market based on end-use industry, product, company size, and region. All the segments of the cyber insurance market have been analyzed based on present and the future trends and the market is estimated from 2024 to 2032.

Based on product, the global cyber insurance market is categorized into cybersecurity insurance, cyber liability insurance, and technology errors & omissions insurance. The cybersecurity insurance segment is expected to hold a significant market share during the timeframe. Manufacturing, retail, IT & telecom, government, BFSI, and others are the prominent end-user industries for the cyber insurance market. BFSI segment is projected to grow at a substantial rate during the forecast period.

Cyber insurance is a kind of insurance in any business firm to reduce the risk of data breach. The insurance is used to prevent data loss, secure privacy, hacking, and theft & extortion. For an organization, cyber insurance covers the legal fees & expense, recovers data, repairs damaged computer systems, and notifies the user of any kind of threat.

Technological advancement in the manufacturing sector is preliminarily driving the cyber insurance market. Global manufacturing output increased by 3.2% in 2017 from 2016. Top manufacturing countries such as the U.S., the UK, Germany, China, and others contributed almost 40% of the global industrial growth. Major factors contributing to this growth are increasing the adoption of automation and artificial intelligence (AI) in various manufacturing processes. Usage of technology in the manufacturing sector to gain a competitive edge has increased the risk of cyber attacks. Major cyber threats for manufacturers exist in supply chain management, theft of intellectual property, physical damage to products & machinery. Thus, the manufacturing sector will contribute significantly to the growth of the cyber insurance market during the forecast period.

Cyber insurance helps financial institutes to detect and prevent cyber attacks. As of 2017, almost 35% of all the cyber attacks were targeted towards the banking sector as compared to 20% in 2016. Financial institutions such as Lloyds, Halifax, and the Bank of Scotland along with others have opted for cyber insurance to secure their data. Thus, the global cyber insurance market is expected to propel during the forecast time frame. However, a lengthy and tedious procedure of claiming for data theft can affect the cyber insurance market growth. However, advancements in technology along with government norms for companies to have cyber insurance policies may open new avenues for the market in the near future.

Cyber Insurance Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Cyber Insurance Market |

| Market Size in 2023 | USD 10.04 Billion |

| Market Forecast in 2032 | USD 27.57 Billion |

| Growth Rate | CAGR of 12.0% |

| Number of Pages | 204 |

| Key Companies Covered | Chubb Corporation, Munich Re Group, AON PLC, American International Group Inc., Allianz Global Corporate & Specialty, Zurich Insurance Co. Ltd., XL Group Ltd, Beazley PLC, Berkshire Hathaway Inc., and Lockton Companies Inc, among others. |

| Segments Covered | By Product Type, By Company Size, By End-Use, By Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

North America holds a substantial share in the global cyber insurance market and will maintain its dominance in the near future. Increasing usage of artificial intelligence in manufacturing sector along with the rapid advancements in technology are the major drivers for the market growth in this region. Further, the presence of significant market players in the region is projected to propel the cyber insurance market. Rising digitalization along with increasing cyber attacks are the major driving factors for the growth of the cyber insurance market in the Asia Pacific. The Asia Pacific is expected to grow at a significant rate during the analysis period.

The competitive profiling of noticeable players of cyber insurance market includes company and financial overview, business strategies adopted by them, their recent developments and product offered by them which can help in assessing competition in the market.

Noticeable players included in the report are

- Chubb Corporation

- Munich Re Group

- AON PLC

- American International Group Inc.

- Allianz Global Corporate & Specialty

- Zurich Insurance Co. Ltd.

- XL Group Ltd

- Beazley PLC

- Berkshire Hathaway Inc.

- and Lockton Companies Inc, among others.

Most of the companies are concentrating on upgrading their products in accordance with the advanced technology.

The report segments the global cyber insurance market as follows:

Global Cyber Insurance Market: End-use Industry Segment Analysis

- Manufacturing

- Retail

- IT & Telecom

- Government

- BFSI

- Others

Global Cyber Insurance Market: Product Segment Analysis

- Cyber Security Insurance

- Cyber Liability Insurance

- Technology Errors & Omissions Insurance

Global Cyber Insurance Market: Company Size Segment Analysis

- Small Corporation

- Medium Corporation

- Large Corporation

Global Cyber Insurance Market: Regional Segment Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

Table Of Content

Methodology

Choose License Type

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed