Cybersecurity for Critical Infrastructure in Financial Sector Market Size, Share, Trends, Growth and Forecast 2032

Cybersecurity for Critical Infrastructure in Financial Sector Market By Component (Solution and Service), By Deployment Mode (Cloud and On-Premise), By End-Use (Insurance, Fintech, and Banking), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 9 Billion | USD 18 Billion | 7% | 2023 |

Cybersecurity for Critical Infrastructure in Financial Sector Industry Prospective:

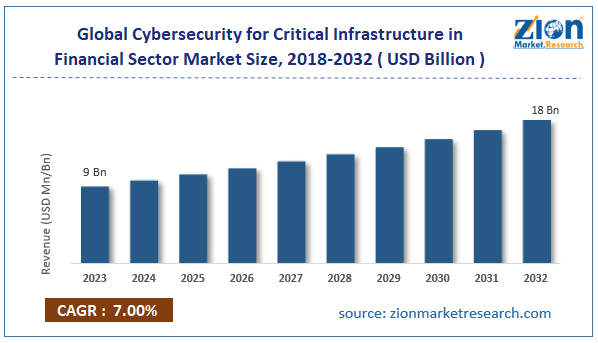

The global cybersecurity for critical infrastructure in financial sector market size was evaluated at $9 billion in 2023 and is slated to hit $18 billion by the end of 2032 with a CAGR of nearly 7% between 2024 and 2032.

Cybersecurity for Critical Infrastructure in Financial Sector Market: Overview

The financial sector across the globe is the backbone of the economy of any firm as well as a country. Moreover, the critical infrastructure is susceptible to cyber-attacks. Reportedly, the protection of infrastructure is a key to maintaining economic stability, thereby safeguarding national security and customer trust. Large-scale use of cybersecurity-as-a-service models along with its ease of deployment has enhanced the penetration of cybersecurity for critical infrastructure in the financial sector.

Key Insights

- As per the analysis shared by our research analyst, the global cybersecurity for critical infrastructure in financial sector market is projected to expand annually at the annual growth rate of around 7% over the forecast timespan (2024-2032)

- In terms of revenue, the global cybersecurity for critical infrastructure in financial sector market size was evaluated at nearly $9 billion in 2023 and is expected to reach $18 billion by 2032.

- The global cybersecurity for critical infrastructure in financial sector market is anticipated to grow rapidly over the forecast time span owing to a rise in the cyber-terrorism activities taking place across the globe and an increase in data violations.

- In terms of component, the solution segment is slated to register the highest CAGR over the forecast period.

- Based on end-use, the fintech segment is predicted to contribute majorly towards the global industry elevation in the upcoming years.

- On the basis of deployment mode, the on-premise segment is slated to register the fastest annual growth rate over the forecast timeline.

- Region-wise, the Asia-Pacific cybersecurity for critical infrastructure in financial sector industry is projected to register the fastest CAGR during the projected timeframe.

Request Free Sample

Request Free Sample

Cybersecurity for Critical Infrastructure in Financial Sector Market: Growth Factors

An increase in cyber-attacks & data breaches to boost the global market trends by 2032

A rise in the cyber-terrorism activities taking place across the globe and an increase in data violations will prompt the expansion of global cybersecurity for critical infrastructure in financial sector market. Furthermore, breakthroughs in cybersecurity systems and an increase in investment in creating strong firewalls will proliferate the size of the market globally. In addition to this, a surge in cross-border financial deals along with growing third-party transactions has posed huge risks, thereby translating into massive growth of the market globally. Moreover, governments across the globe have mandated firms to use cybersecurity tools for protecting customer data as well as financial systems from cyber-attacks, thereby scaling up the expansion of the market globally.

Cybersecurity for Critical Infrastructure in Financial Sector Market: Restraints

Necessity of high capital funding for deploying cybersecurity technologies to restrict the growth of the industry globally

Need for huge initial investments in cybersecurity tools and the lack of availability of expert professionals for handling these tools can hamper the growth of cybersecurity for critical infrastructure in financial sector industry across the globe. Apart from this, strict laws governing the use of cybersecurity systems and non-uniformity in jurisdictions related to the use of these systems globally can further impede the industry’s upsurge in the coming years.

Cybersecurity for Critical Infrastructure in Financial Sector Market: Opportunities

Launching of blockchain, AI, and quantum computing technologies to open new growth avenues for the global market

Onset of new technologies such as AI, quantum computing, and blockchain will contribute notably to the growth of global cybersecurity for critical infrastructure in financial sector market. Large-scale use of cloud-based security services for improving the scalability of cybersecurity systems will open new panoramas of growth for the global market.

Cybersecurity for Critical Infrastructure in Financial Sector Market: Challenges

Less adoption of cybersecurity systems by banks & other private financial firms can challenge the growth of the industry globally

Lack of acceptance of cybersecurity tools by financial institutions as the latter are becoming more risk-averse along with cost-cutting measures adopted by these institutions due to economic downturns can challenge global cybersecurity for critical infrastructure in financial sector industry in the coming years. Challenges regarding the interoperability of cybersecurity operations along with their time-complexity can create hurdles in the growth path of the industry across the globe.

Cybersecurity for Critical Infrastructure in Financial Sector Market: Segmentation

The global cybersecurity for critical infrastructure in financial sector market is divided into component, deployment mode, end-use, and region.

Based on the component, the cybersecurity for critical infrastructure in financial sector market across the globe is bifurcated into solution and service segments. Additionally, the solution segment, which gained nearly 45% of the global market share in 2023, is set to record the highest gains during the next few years due to a rise in the availability of cybersecurity service providers across the globe. Moreover, the need for improving security & firewalls in financial deals will boost the segmental growth.

On the basis of end-use, the global cybersecurity for critical infrastructure in financial sector industry is divided into insurance, fintech, and banking segments. Furthermore, the fintech segment, which accrued about two-thirds of the global industry earnings in 2023, is predicted to account notably for the global industry expansion in the coming few years. This can be a result of the rise in cyber terrorism & hacking of online fiscal transactions, end-user accounts, and baking infrastructure.

In terms of deployment mode, the cybersecurity for critical infrastructure in financial sector market across the globe is sectored into cloud and on-premise segments. In addition to this, the on-premise segment, which gained nearly 35% of the global market size in 2023, is likely to record the fastest growth rate during the coming eight years subject to strong security offered by deployment of cybersecurity tools in on-premise mode.

Cybersecurity for Critical Infrastructure in Financial Sector Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Cybersecurity for Critical Infrastructure in Financial Sector Market |

| Market Size in 2023 | USD 9 Billion |

| Market Forecast in 2032 | USD 18 Billion |

| Growth Rate | CAGR of 7% |

| Number of Pages | 224 |

| Key Companies Covered | L&T Technology Services Limited (LTTS), Zscaler, Broadcom Inc., HCL Technologies, Wipro Inc., Okta Inc., Rapid7, Accenture, Tata Consultancy Services (TCS), Infosys Limited, and others. |

| Segments Covered | By Deployment, By Component, By End-Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Cybersecurity for Critical Infrastructure in Financial Sector Market: Regional Insights

North America is forecast to maintain leadership status in the global market in the upcoming years

North America, which led the global cybersecurity for critical infrastructure in financial sector market share in 2023, is expected to establish a strong position in the global market in the ensuing years. In addition, the regional market surge in the next eight years can be credited to the large-scale presence of fintech firms in countries such as Canada and the U.S. In addition, an increase in cyber-attacks on the banking infrastructure will further enlarge the scope of the market growth in North America. Surging advanced persistent threats along with new threats, including ransomware and attacks on cloud security, can obstruct the market surge in the sub-continent. An increase in data violations leading to financial loss has led to the humungous need for strong cybersecurity tools, which has culminated in massive market demand in North America.

Asia-Pacific cybersecurity for critical infrastructure in financial sector industry is slated to register the highest gains annually in the coming few years. The surge of the industry in the APAC region can be due to the growing allocation of funds by the governments of China and Japan in cyber security. Moreover, huge adoption of cloud services and a surge in mobile banking activities for online payments has led to enhanced cyberattacks on banking & end-user online apps, thereby increasing the demand for cyber security tools. Apart from this, the synchronization of IoT equipment with financial solutions such as connected payment terminals and ATMs has led to a prominent increase in the security risks in the finance sector, thereby driving the growth of the industry in the region.

Key Developments

- In March 2023, Phoenix TechnoCyber launched AI-based IT auditing systems referred to as TechOwl GRC GAP Assessment Tool for improving accuracy of auditors as well as customers.

- In December 2023, Trustmi, a cyber-security startup firm, introduced bank account validating tool for protecting banks against vendor payment frauds.

Cybersecurity for Critical Infrastructure in Financial Sector Market: Competitive Space

The global cybersecurity for critical infrastructure in financial sector market profiles key players such as:

- L&T Technology Services Limited (LTTS)

- Zscaler

- Broadcom Inc.

- HCL Technologies

- Wipro Inc.

- Okta Inc.

- Rapid7

- Accenture

- Tata Consultancy Services (TCS)

- Infosys Limited

The global cybersecurity for critical infrastructure in financial sector market is segmented as follows:

By Deployment

- Cloud

- On-Premise

By Component

- Solution

- Service

By End-Use

- Insurance

- Fintech

- Banking

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The financial sector across the globe is a backbone of economy of any firm as well as a country. Moreover, critical infrastructure is susceptible to cyber-attacks.

The global cybersecurity for critical infrastructure in financial sector market growth over the forecast period can be owing to breakthroughs in cybersecurity systems and an increase in investment in creating strong firewalls.

According to a study, the global cybersecurity for critical infrastructure in financial sector industry size was $9 billion in 2023 and is projected to reach $18 billion by the end of 2032.

The global cybersecurity for critical infrastructure in financial sector market is anticipated to record a CAGR of nearly 7% from 2024 to 2032.

Asia-Pacific cybersecurity for critical infrastructure in financial sector industry is set to register the fastest CAGR over the forecasting timeline owing to the growing allocation of funds by the governments of China and Japan in cyber security. Moreover, huge adoption of cloud services and a surge in mobile banking activities for online payments has led to enhanced cyberattacks on banking & end-user online apps, thereby increasing the demand for cyber security tools.

The global cybersecurity for critical infrastructure in financial sector market is led by players such as L&T Technology Services Limited (LTTS), Zscaler, Broadcom Inc., HCL Technologies, Wipro Inc., Okta Inc., Rapid7, Accenture, Tata Consultancy Services (TCS), and Infosys Limited.

The global cybersecurity for critical infrastructure in financial sector market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market positioning, market penetration, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, and value chain analysis.

Choose License Type

List of Contents

Financial SectorIndustry Prospective: Financial Sector OverviewKey Insights Financial Sector Growth Factors Financial Sector Restraints Financial Sector Opportunities Financial Sector Challenges Financial Sector Segmentation Financial Sector Report Scope Financial Sector Regional InsightsKey Developments Financial Sector Competitive SpaceThe global cybersecurity for critical infrastructure in financial sector market is segmented as follows:By RegionHappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed