Dairy-free Yogurt Market Size, Growth, Global Trends, Forecast 2034

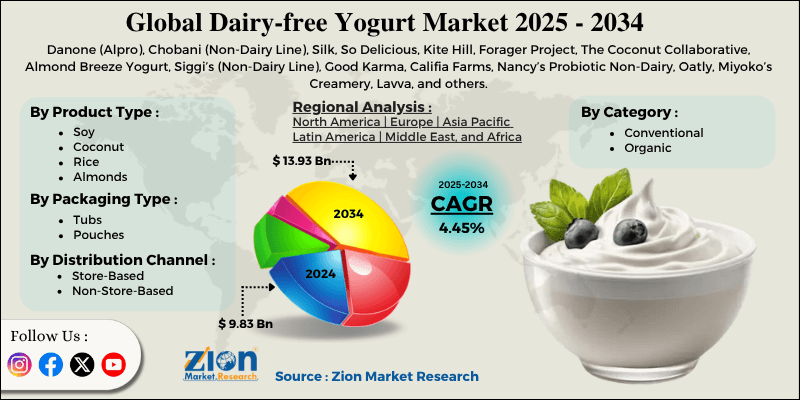

Dairy-free Yogurt Market By Product Type (Soy, Coconut, Rice, Almonds, and Others), By Packaging Type (Tubs, Pouches), By Category (Conventional, Organic), By Distribution Channel (Store-Based, Non-Store-Based), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

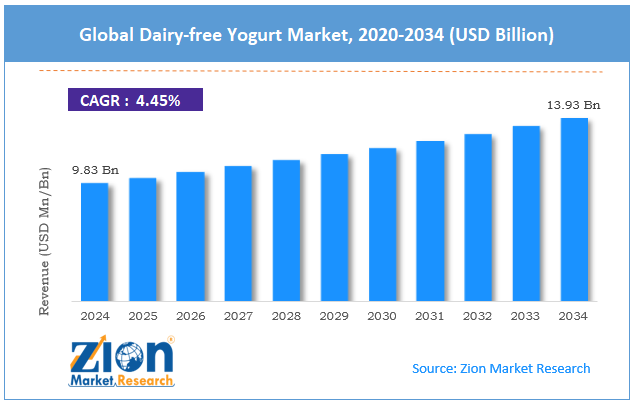

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 9.83 Billion | USD 13.93 Billion | 4.45% | 2024 |

Dairy-free Yogurt Industry Perspective:

The global dairy-free yogurt market size was approximately USD 9.83 billion in 2024 and is projected to reach around USD 13.93 billion by 2034, with a compound annual growth rate (CAGR) of approximately 4.45% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global dairy-free yogurt market is estimated to grow annually at a CAGR of around 4.45% over the forecast period (2025-2034)

- In terms of revenue, the global dairy-free yogurt market size was valued at around USD 9.83 billion in 2024 and is projected to reach USD 13.93 billion by 2034.

- The dairy-free yogurt market is projected to grow significantly due to the increasing adoption of plant-based and vegan lifestyles, the expansion of product flavors and varieties, and the rise in e-commerce and retail distribution channels.

- Based on product type, the soy segment is expected to lead the market, while the coconut segment is anticipated to experience significant growth.

- Based on packaging type, the tubs segment is the largest, while the pouches segment is projected to experience substantial revenue growth over the forecast period.

- Based on category, the conventional segment dominates the market, while the organic segment holds a second position.

- Based on the distribution channel, the store-based segment is expected to lead the market compared to the non-store-based segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Dairy-free Yogurt Market: Overview

Dairy-free yogurt is a plant-based substitute for traditional yogurt, made with ingredients like coconut, oat, cashew, almond, or soy. It caters to consumers with dairy allergies, lactose intolerance, or those following vegan diets, while also appealing to environmentally aware and health-conscious individuals. The global dairy-free yogurt market is expected to expand rapidly, driven by growing health and wellness awareness, rising dairy allergies and lactose intolerance, as well as the increasing popularity of plant-based and vegan diets. Consumers are progressively adopting healthier lifestyles, emphasizing low-cholesterol, lactose-free, and low-fat options. Dairy-free yogurt, being plant-based and rich in probiotics, supports the rising focus on immunity and digestive health, fueling the industry growth.

Moreover, a significant portion of the population suffers from dairy allergies and lactose intolerance. Dairy-free yogurt offers an ideal substitute, allowing these consumers to enjoy yogurt without side effects, driving the demand. Furthermore, the growing adoption of plant-based diets and veganism is a central propeller. Consumers seeking sustainable and ethical food options are increasingly opting for dairy-free yogurt over traditional dairy products, driving growth in the industry.

Despite its growth, the global market is hindered by factors such as higher costs compared to conventional yogurt and challenges related to taste and texture. Dairy-free yogurts have a higher price point because of processing costs and premium plant-based ingredients. This notably restricts the adoption among price-sensitive consumers in the developing regions. Likewise, some plant-based yogurts struggle to imitate the creamy flavor and texture of dairy yogurt, which may dampen conventional yogurt consumers from switching.

Nonetheless, the global dairy-free yogurt industry stands to benefit from several key opportunities, including product advancements, flavor expansions, and collaborations with retail and foodservice chains. Manufacturers can advance by introducing new flavors, fortified options, and textures, such as calcium-enriched, probiotic-rich variants, and high-protein options, to appeal to different consumer groups and increase industry penetration.

Additionally, associating with restaurants, cafes, and large retail chains to offer dairy-free yogurt-based products may fuel visibility, consumption, and trial. The growth of subscription-based models and online grocery shopping presents an opportunity for brands to expand their geographic reach and introduce niche products.

Dairy-free Yogurt Market Dynamics

Growth Drivers

How are environmental sustainability and ethical concerns driving the dairy-free yogurt market?

Environmental awareness is shifting consumers towards plant-based yogurts as a lower-impact alternative to dairy. The production of dairy-free yogurt typically results in nearly 70% lower GHG emissions compared to conventional dairy yogurt, according to the FAO 2024 reports. Gen Z and millennials are particularly influenced by sustainability messaging, opting for products with plant-based ingredients and environmentally friendly packaging. News outlets have recently highlighted that leading retailers, such as Whole Foods and Tesco, are expanding their dairy-free sections to meet the growing demand for environmentally responsible products. The focus on ethical sourcing for oats and almonds also drives consumer trust.

How do product innovation and flavor diversification fuel the dairy-free yogurt market?

Advancements in textures, flavors, and formulations are propelling the growth of the dairy-free yogurt market by appealing to a broader consumer base. Manufacturers are launching unique flavors like coconut & mango, almond & berry, and oat & vanilla to cater to taste-conscious users.

According to reports, more than 30% of novel product launches in dairy-free yogurt over the past year were functional variants or flavored. Advancements also comprise fortified yogurts with added probiotics, vitamins, and proteins, which received broader media traction for blending health benefits with indulgent flavors.

Restraints

Taste and texture challenges unfavorably impact the market progress

Achieving the tangy flavor and creamy texture of dairy yogurt is still a key formulation challenge. Users generally mention chalky textures or off-flavors as obstacles to repeat purchase. According to Mintel's 2025 research, 27% of consumers who tried dairy-free yogurt avoided repurchase due to dissatisfaction with the taste. Balancing plant-based proteins with probiotics while maintaining a pleasant mouthfeel requires advanced processing technology. Despite advancements such as enhancing product quality and fermentation optimization, inconsistent sensory experiences in brands hinder broader adoption. Negative user reviews regarding taste continue to impact brand loyalty in competitive regions.

Opportunities

How can carbon-neutral branding and sustainable packaging open up lucrative opportunities for the advancement of the dairy-free yogurt market?

Eco-conscious consumers are rewarding companies with packaging that is both recyclable and sustainable. According to the 2024 reports, global consumers prefer brands that present themselves as environmentally responsible. This presents opportunities for manufacturers in the dairy-free yogurt industry to adopt carbon-neutral production methods and utilize biodegradable containers.

Alpro’s 2024 introduction of plant-based yogurts in 100% recycled PET packaging gained strong, favorable media coverage. Sustainability-driven product positioning can serve as a robust differentiator, particularly in Europe, where eco-label certifications are influencing purchase decisions.

Challenges

High market competition and brand saturation restrict the market growth

The market is becoming progressively crowded, with multinational giants and progressing startups competing for share. According to reports, there has been a 35% rise in new brand entries in the plant-based yogurt domain over the past few years. While competition fuels advancements, it also leads to price wars and campaign fatigue. Smaller brands struggle to secure shelf space against established players like Danone, Chobani, and Silk. Differentiation through unique ingredients and niche positioning is becoming vital for survival.

Dairy-free Yogurt Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Dairy-free Yogurt Market |

| Market Size in 2024 | USD 9.83 Billion |

| Market Forecast in 2034 | USD 13.93 Billion |

| Growth Rate | CAGR of 4.45% |

| Number of Pages | 215 |

| Key Companies Covered | Danone (Alpro), Chobani (Non-Dairy Line), Silk, So Delicious, Kite Hill, Forager Project, The Coconut Collaborative, Almond Breeze Yogurt, Siggi’s (Non-Dairy Line), Good Karma, Califia Farms, Nancy’s Probiotic Non-Dairy, Oatly, Miyoko’s Creamery, Lavva, and others. |

| Segments Covered | By Product Type, By Packaging Type, By Category, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Dairy-free Yogurt Market: Segmentation

The global dairy-free yogurt market is segmented based on product type, packaging type, category, distribution channel, and region.

Based on product type, the global dairy-free yogurt industry is divided into soy, coconut, rice, almond, and others. The soy segment registers a leading market share due to its long-standing consumer acceptance and high protein content.

On the other hand, the coconut segment holds a second-leading share due to its appealing taste, creamy texture, and growing prominence in plant-based diets.

Based on packaging type, the global market is segmented into tubs and pouches. The tubs segment holds a dominant share of the market due to their convenience for home consumption and large serving sizes.

Conversely, the pouches segment holds a second rank due to the portability and appeal to on-the-go users, mainly children.

Based on category, the global dairy-free yogurt market is segmented into conventional and organic. The traditional segment holds a leading share due to its broader availability and lower price.

However, the organic segment holds second position, fueled by growing consumer preference for natural and chemical-free products.

Based on the distribution channel, the global market is segmented into store-based and non-store-based. The store-based segment holds leadership due to improved accessibility through hypermarkets, supermarkets, and specialty stores.

Nonetheless, the non-store-based segment ranks second, fueled by the convenience and rising trend of online grocery shopping.

Dairy-free Yogurt Market: Regional Analysis

What gives North America a competitive edge in the global Dairy-free Yogurt Market?

North America is expected to maintain its leading position in the global dairy-free yogurt market due to the high incidence of dairy allergies and lactose intolerance, strong consumer inclination toward plant-based diets, and the availability of products and advanced retail infrastructure. North America holds a growing population impacted by lactose intolerance, with an estimated 36% of the regional adults suffering from lactose malabsorption, as per NIH. The broader condition has led consumers to seek plant-based dietary substitutes, such as dairy-free yogurt. The availability of different lactose-free yogurt options helps meet dietary demand, propelling industry dominance.

Moreover, the region is experiencing a shift towards plant-based eating, with more than 65% of United States users trying plant-based items at least once a month, according to the Plant-Based Foods Association (PBFA). The growing health consciousness and surging adoption of the vegan lifestyle have increased demand for dairy-free yogurt. Consumers now prefer cruelty-free and sustainable food choices that support ethical consumption patterns.

Furthermore, North America boasts a well-established retail network, comprising hypermarkets, supermarkets, and specialty health-focused stores. Major retailers, such as Kroger, Walmart, and Whole Foods, offer a broader range of dairy-free yogurt brands. This robust distribution infrastructure ensures product visibility and availability, enabling consumers to easily access a wider range of plant-based yogurts.

Europe ranks as the second-largest region in the global dairy-free yogurt industry, driven by the increasing adoption of flexitarian and vegan diets, strong government support for sustainable food systems, and growing awareness of lactose intolerance. Europe holds the leading concentration of flexitarians and vegans, with more than 10% of Europeans preferring reduced-meat and plant-based diets. This growing shift towards ethical and sustainable consumption is driving the demand for dairy-free substitutes. Hence, yogurt has become a mainstream option among eco-aware and health-conscious consumers.

Furthermore, European Union policies that encourage reduced carbon emissions and sustainable agriculture promote the adoption of plant-based products. Initiatives under the Farm to Fork Strategy and EU Green Deal focus on eco-friendly food production. This policy environment backs the growth of dairy-free yogurt as a low-impact and sustainable alternative to conventional dairy.

Additionally, an increasing portion of the European population is becoming aware of lactose intolerance, with 15-20% of individuals affected in Western and Northern Europe, and higher rates in Southern regions. This growing awareness fuels consumers' move towards dairy-free alternatives that offer digestive comfort. The availability of fortified plant-based yogurts promises nutritional adequacy, thus driving regional consumption.

Dairy-free Yogurt Market: Competitive Analysis

The leading players in the global dairy-free yogurt market are:

- Danone (Alpro)

- Chobani (Non-Dairy Line)

- Silk

- So Delicious

- Kite Hill

- Forager Project

- The Coconut Collaborative

- Almond Breeze Yogurt

- Siggi’s (Non-Dairy Line)

- Good Karma

- Califia Farms

- Nancy’s Probiotic Non-Dairy

- Oatly

- Miyoko’s Creamery

- Lavva

Dairy-free Yogurt Market: Key Market Trends

Surge in Almond- and Oat-based Yogurts:

Consumers are increasingly shifting from coconut and soy-based yogurts to almond-based ones due to their mild flavor, creamy texture, and allergen-friendly profile. Oat-based variants, especially, have experienced a double-digit rise in North America and Europe, as they align with sustainable and gluten-free food trends. Manufacturers are increasingly investing in oat fermentation solutions to enhance the nutrition and taste of their products, thereby gaining prominence among health-conscious consumers.

Clean-label and organic product expansion:

Organic-certified and clean-label dairy-free yogurts are gaining prominence as consumers steadily seek transparency in ingredients. Products made with natural sweeteners, minimal additives, and non-GMO ingredients are becoming standard offerings. This trend is particularly prominent in North America and Europe, where organic plant-based food sales increased by 12% in 2024, reflecting strong trust in natural formulations.

The global dairy-free yogurt market is segmented as follows:

By Product Type

- Soy

- Coconut

- Rice

- Almonds

- Others

By Packaging Type

- Tubs

- Pouches

By Category

- Conventional

- Organic

By Distribution Channel

- Store-Based

- Non-Store-Based

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Dairy-free yogurt is a plant-based substitute for traditional yogurt, made with ingredients like coconut, oat, cashew, almond, or soy. It caters to consumers with dairy allergies, lactose intolerance, or those following vegan diets, while also appealing to environmentally aware and health-conscious individuals.

The global dairy-free yogurt market is projected to grow due to the increasing prevalence of lactose intolerance and dairy allergies, growing health-conscious consumer trends, and technological advancements in plant-based formulations.

According to study, the global dairy-free yogurt market size was worth around USD 9.83 billion in 2024 and is predicted to grow to around USD 13.93 billion by 2034.

The CAGR value of the dairy-free yogurt market is expected to be approximately 4.45% from 2025 to 2034.

Macroeconomic factors such as urbanization, rising disposable incomes, inflation-driven shifts toward affordable plant-based options, and growing health awareness will collectively drive steady growth in the dairy-free yogurt market.

North America is expected to lead the global dairy-free yogurt market during the forecast period.

The key players profiled in the global dairy-free yogurt market include Danone (Alpro), Chobani (Non-Dairy Line), Silk, So Delicious, Kite Hill, Forager Project, The Coconut Collaborative, Almond Breeze Yogurt, Siggi’s (Non-Dairy Line), Good Karma, Califia Farms, Nancy’s Probiotic Non-Dairy, Oatly, Miyoko’s Creamery, and Lavva.

Stakeholders should focus on clean-label formulations, product innovation, sustainable packaging, strategic partnerships, and expanding online and emerging market presence to stay competitive in the market.

The dairy-free yogurt market is witnessing premium pricing driven by high-quality plant-based fortification and ingredients, alongside a growing shift toward affordable value-pack and private-label options to attract price-conscious consumers.

The report examines key aspects of the dairy-free yogurt market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed