Data Center Cooling Market Size, Share, Trends, Growth and Forecast 2032

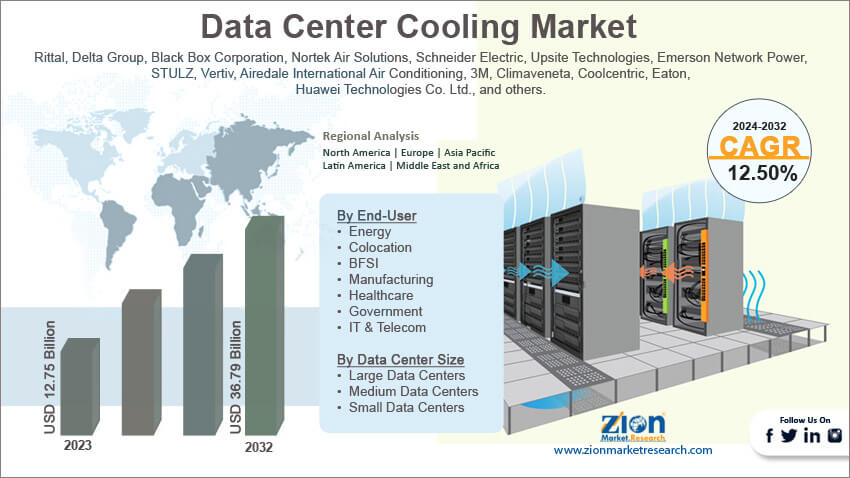

Data Center Cooling Market By End-User (Energy, Colocation, BFSI, Manufacturing, Healthcare, Government, IT & Telecom, and Others), By Data Center Size (Large Data Centers, Medium Data Centers, and Small Data Centers), By Cooling Technique (Room-based and Rack/Row-Based), By Component (Service and Solution), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

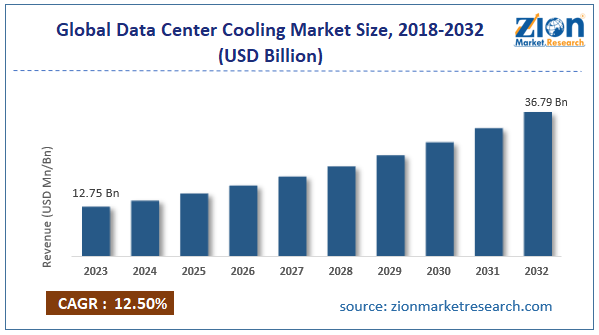

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 12.75 Billion | USD 36.79 Billion | 12.50% | 2023 |

Data Center Cooling Industry Prospective:

The global data center cooling market size was worth around USD 12.75 billion in 2023 and is predicted to grow to around USD 36.79 billion by 2032 with a compound annual growth rate (CAGR) of roughly 12.50% between 2024 and 2032.

Data Center Cooling Market: Overview

Data center cooling refers to the process of managing ideal temperature in data centers. Several types of cooling techniques are used to reduce the overall heat generated by data centers and control the heat within the facility. Data centers are facilities that store all types of computer systems and associated technologies required for the digital world to run smoothly. It acts as a home to all computing machines and hardware tools required for the machines to function such as network equipment, data storage drives, servers, and other tools that help in delivering desired output. All electronic machines generate some amount of heat when they are running. A business setup that deals with multiple computer systems running at capacity leads to the generation of a significantly high quantity of heat which must be managed to ensure the components or the environment do not overheat and lead to serious damages.

As per official research, the combined value of energy consumption across data centers is around 3% of the total global electricity capacity. As per the recent Thermal Guidelines for Data Processing Environments, the American Society of Heating, Refrigerating, and Air-Conditioning Engineers recommends that the ideal temperature range of a data center should be between 18-27°C and the allowable range is around 15-32°C for small to medium density servers. The forecast period will deliver exceptional growth opportunities for the data center cooling market.

Key Insights:

- As per the analysis shared by our research analyst, the global data center cooling market is estimated to grow annually at a CAGR of around 12.50% over the forecast period (2024-2032)

- In terms of revenue, the global data center cooling market size was valued at around USD 12.75 billion in 2023 and is projected to reach USD 36.79 billion, by 2032.

- The market is projected to grow at a significant rate due to the rising launch of new data center cooling tools and solutions

- Based on the end-user, the IT & telecom segment is growing at a high rate and will continue to dominate the global market as per industry projection

- Based on the cooling technique, the rack/row-based segment is anticipated to command the largest market share

- Based on region, North America is projected to dominate the global market during the forecast period

Request Free Sample

Request Free Sample

Data Center Cooling Market: Growth Drivers

Rising launch of new data center cooling tools and solutions will drive the market demand

The global data center cooling market is expected to generate high growth opportunities due to the increasing launch of new data center cooling solutions. In January 2024, Aligned, a leading data center firm, announced the launch of a new system for data center cooling called DeltaFlow. The novel innovation is a form of liquid cooling technology and can support extremely high-density computer requirements including supercomputers. It can cool densities up to 300kW per rack. As per company claims, DeltaFlow is equipped to handle all types of future and current liquid cooling technologies including rear-door heat exchangers, direct-to-chip, and immersion cooling. In February 2024, researchers at the Indian Institute of Technology (IIT) based in the Madras region of India developed a new heat sink meant for data center server cooling. Such turnkey projects will promote the region’s growth in the data center industry. In addition to this, in October 2023, ThermalWorks, an Endeavour subsidiary dedicated to developing sustainable data infrastructure launched a waterless cooling system. The state-of-the-art technology is expected to help eliminate the need for water in data center cooling operations while also reducing energy consumption in these facilities.

Growing use of advanced technologies such as Artificial Intelligence (AI) and Internet of Things (IoT) with cooling systems will prove beneficial for the industry

The global technology giants worldwide are currently focusing on leveraging the latest modern technologies such as AI and IoT across industries including the data center cooling sector. Integrating AI in the global data cooling market can help companies achieve improved energy efficiency and higher performance. In addition to this, the AI or the IoT technologies are registering significant growth in investments thus paving ways to further advance these systems.

Data Center Cooling Market: Restraints

Need to develop specialized infrastructure to support data center cooling will restrict the market expansion rate

The global industry for data center cooling is projected to be restricted due to the need to develop a specially designed infrastructure to support the deployment of data center cooling solutions. Typically, large or mid-sized server facilities require extensive area, and creating space for cooling systems can be complicated in regions with limited space availability. Moreover, companies may be unable to correctly estimate their cooling requirements leading to either overestimation or underestimation thus leading to poor business-related decisions. Hence, companies must thoroughly invest in understanding cooling requirements before investing in the technology.

Data Center Cooling Market: Opportunities

Surging investments in the development of new data centers will generate higher growth opportunities

The global data center cooling market will generate high growth opportunities due to the increasing construction of new data centers across the globe. As the world aggressively moves toward complete digital transformation, the pressure on technology companies to support the shift is rising at an excessive rate. Furthermore, demand for digital tools and applications at a more commercial level is equally high leading to further investments in the development of a robust data center infrastructure. In February 2024, Azora, a leading real asset investment company, announced the launch of a new Edge data center platform in Europe. The company will invest USD 538.5 million for the construction of 6 Edge data centers spread across Portugal and Spain and a total capacity of 60 MW. Google, in January 2024, announced that it will spend USD 1 billion to build a new data center in the UK. In December 2023, Airtel Africa launched a new data center business called Nxtra in Africa. In March 2024, the government of the Republic of the Congo launched an advanced data center facility for 2Africa cable. Such investments can be observed globally and at a mass scale thus simultaneously impacting the demand for data center cooling solutions.

Surging interest in exploring new ways of data center cooling will deliver high-growth avenues

The global data center cooling market is expected to be positively impacted by the surging interest of researchers in developing novel methods of cooling. In April 2024, Carrier Global Corporation entered a partnership with Strategic Thermal Labs. The former is a provider of intelligent climate and energy solutions and through the new deal, it will leverage the latter’s novel technology for a liquid cooling innovation for data centers.

Data Center Cooling Market: Challenges

Increasing the heat density of data centers will challenge the market growth rate

The global data center cooling industry is projected to be challenged due to modern servers becoming more powerful. This in turn leads to a sharp rise in the heat density of the servers and contemporary data center cooling systems may be unable to deliver in the backdrop of rising heat per square foot. Additionally, the cost of advanced cooling systems is exceptionally high, limiting the number of adopters in the market.

Data Center Cooling Market: Segmentation

The global data center cooling market is segmented based on end-user, data center size, cooling technique, component, and region.

Based on end-user, the global market segments are energy, colocation, BFSI, manufacturing, healthcare, government, IT & telecom, and others. In 2023, the highest demand was observed in the IT & telecom segment due to the growing number of digital transformations globally and increasing demand for high-functioning servers. The thriving cloud industry is further pushing the demand for data center cooling solutions in the IT & telecom industry. The global cloud market was valued at over USD 500 billion in 2023.

Based on data center size, the global data center cooling market is divided into large data centers, medium data centers, and small data centers.

Based on cooling technique, the global data center cooling industry is divided into room-based and rack/row-based. In 2023, the highest demand was observed in the rack/row-based segment due to the lower electrical cost of the latter type. This form of cooling reduces unnecessary airflow and can save up to 50% of fan power consumption when compared to the former type.

Based on component, the global market divisions are service and solution.

Data Center Cooling Market Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Data Center Cooling Market |

| Market Size in 2023 | USD 12.75 Billion |

| Market Forecast in 2032 | USD 36.79 Billion |

| Growth Rate | CAGR of 12.50% |

| Number of Pages | 227 |

| Key Companies Covered | Rittal, Delta Group, Black Box Corporation, Nortek Air Solutions, Schneider Electric, Upsite Technologies, Emerson Network Power, STULZ, Vertiv, Airedale International Air Conditioning, 3M, Climaveneta, Coolcentric, Eaton, Huawei Technologies Co. Ltd., and others. |

| Segments Covered | By End-User, By Data Center Size, By Cooling Technique, By Component, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Data Center Cooling Market: Regional Analysis

North America to lead the market growth rate during the projection period

The global data center cooling market will be dominated by North America. In 2023, it held control over 35.01% of the total market share. The region is a dominant force in the global technology sector with the presence of several tech giants such as Google, Microsoft, Meta, and Amazon among others. These companies have played a pivotal role in introducing advanced technologies to the world. The increasing penetration of cloud-based solutions in North America has fueled the growing demand for data centers subsequently impacting the consumption rate of cooling systems. As per company reports, Amazon Web Services, a cloud computing firm, has multiple data centers spread across the US and one of the largest centers in Virginia is spread across 700,000 square feet. Additionally, the US and Canadian governments have been working consistently toward improving energy efficiency across commercial centers and industrial settings thus encouraging data center companies to incorporate cooling systems to optimize energy consumption. Asia-Pacific is projected to become the second-highest revenue-generating region due to the growing sector for data center solutions across India, China, Japan, and other Asian countries. In April 2024, Microsoft announced an investment of USD 2.9 billion in Japan to expand data center facilities in the country by 2025.

Data Center Cooling Market: Competitive Analysis

The global data center cooling market is led by players like:

- Rittal

- Delta Group

- Black Box Corporation

- Nortek Air Solutions

- Schneider Electric

- Upsite Technologies

- Emerson Network Power

- STULZ

- Vertiv

- Airedale International Air Conditioning

- 3M

- Climaveneta

- Coolcentric

- Eaton

- Huawei Technologies Co. Ltd.

The global data center cooling market is segmented as follows:

By End-User

- Energy

- Colocation

- BFSI

- Manufacturing

- Healthcare

- Government

- IT & Telecom

By Data Center Size

- Large Data Centers

- Medium Data Centers

- Small Data Centers

By Cooling Technique

- Room-based

- Rack/Row-Based

By Component

- Service

- Solution

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Data center cooling refers to the process of managing ideal temperature in data centers.

The global data center cooling market is expected to generate high growth opportunities due to the increasing launch of new data center cooling solutions.

According to study, the global data center cooling market size was worth around USD 12.75 billion in 2023 and is predicted to grow to around USD 36.79 billion by 2032.

The CAGR value of data center cooling market is expected to be around 12.50% during 2024-2032.

The global data center cooling market will be dominated by North America.

The global data center cooling market is led by players like Rittal, Delta Group, Black Box Corporation, Nortek Air Solutions, Schneider Electric, Upsite Technologies, Emerson Network Power, STULZ, Vertiv, Airedale International Air Conditioning, 3M, Climaveneta, Coolcentric, Eaton and Huawei Technologies Co., Ltd.

The report explores crucial aspects of the data center cooling market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed