Data Center Fire Detection and Suppression Market Size, Share, Trends, Growth and Forecast 2032

Data Center Fire Detection and Suppression Market By Fire Safety Systems (Fire Detection and Fire Suppression), By Deployment Location (Technical Space/Room Level and Other Space/Building Level), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

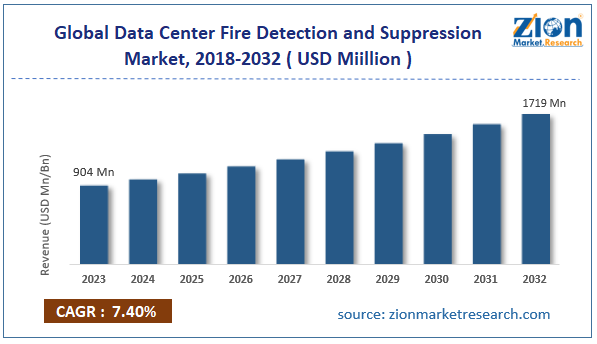

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 904 Million | USD 1719 Million | 7.4% | 2023 |

Data Center Fire Detection and Suppression Industry Perspective:

The global data center fire detection and suppression market size was worth around USD 904 million in 2023 and is predicted to grow to around USD 1719 million by 2032, with a compound annual growth rate (CAGR) of roughly 7.4% between 2024 and 2032.

Data Center Fire Detection and Suppression Market: Overview

Data centers are mission-critical facilities designed to handle the data generated by consumers and commercial end users. Fiber optic cables that are connected to satellites or telecommunication broadband access are used to connect consumers and companies to data centers. They are made up of network infrastructure, servers, and storage to process and store user data. Data centers are also equipped with power and cooling systems to offer scalable, reliable, and highly available services to end users.

Depending on its size, capacity, and location, the cost of constructing a data center can vary from millions to billions of dollars. Data centers are outfitted with fire detection and suppression systems to stop a fire from spreading to the technical areas, support plant, and data floor area of the facility. Due to fire-related mishaps that resulted in data center outages and downtime, investments in these systems in data centers have increased recently.

Key Insights

- As per the analysis shared by our research analyst, the global data center fire detection and suppression market is estimated to grow annually at a CAGR of around 7.4% over the forecast period (2024-2032).

- In terms of revenue, the global data center fire detection and suppression market size was valued at around USD 904 million in 2023 and is projected to reach USD 1719 million by 2032.

- The growing number of data centers is expected to drive the data center fire detection and suppression market over the forecast period.

- Based on the fire safety systems, the fire detection segment is expected to hold the largest market share over the forecast period.

- Based on the deployment location, the technical space/room level segment is expected to dominate the market over the forecast period.

- Based on region, North America is expected to dominate the market during the forecast period.

Data Center Fire Detection and Suppression Market: Growth Drivers

Rise in fire breakouts due to equipment failure drives market growth

To prevent fire outbreaks and safeguard the IT infrastructure, it is now more important than ever to implement extremely sensitive smoke detection systems and quick-fire suppression systems in data center sites across the globe. For instance, a false alert that triggered the data center's fire suppression and detection systems caused a power outage at Global Switch's Sydney data center. Data center operators must concentrate on implementing the appropriate fire suppression and detection system based on the needs of the facility to prevent such occurrences.

To lower the likelihood of equipment failure, several vendors that provide safety and fire systems are also constantly improving their products. Remote control of the fire systems is simple for the operators. The data center fire detection and suppression market is expanding as a result of industry needs for increasingly sophisticated fire suppression and detection systems brought on by the surge in the development of hyperscale data centers.

Data Center Fire Detection and Suppression Market: Restraints

Smoke detection systems concern hinders market growth

The ability of spot smoke detectors to detect smoke and notify the fire suppression system when installed on ceilings to prevent an outage or major service disruption has made smoke detection more challenging. This is because spot detectors wait for the smoke to build up in their sensing chamber, whereas the majority of data centers use significant air volumes to cool IT hardware.

Due to a lack of heat, fire smoke in its early stages has very little buoyancy. The airflow from the cooling system mixes with this smoke, reducing its strength and preventing it from reaching the ceiling. Additionally, smoke cannot reach the smoke detection system located on the ceiling due to structural obstructions like HVAC ducts and fully laden cable trays. The detection of smoke has become a significant problem in these situations. To safeguard IT infrastructure and other important assets, data center operators are now implementing regulations and standards. These constraints limit the growth of the data center fire detection and suppression industry.

Data Center Fire Detection and Suppression Market: Opportunities

Growing product innovation offers a lucrative opportunity for market growth

The growing product innovation is expected to flourish the data center fire detection and suppression market expansion during the projected period. For instance, in February 2023, Thermocable (Flexible Elements) Ltd (Thermocable) was bought by Halma, a global group of life-saving technology firms, for Apollo Fire Detectors Limited (Apollo), a fire detection company in the safety sector.

Based in Bradford, UK, Thermocable is a top manufacturer and developer of linear heat detectors (LHDs). Installed in locations susceptible to fire and overheating, LHDs are temperature-sensitive cables that sound an alarm when they sense a temperature shift. By adding Thermocable's specialized sensing technologies to Apollo's lineup of devices, more people can be protected from the dangers of fire.

Data Center Fire Detection and Suppression Market: Challenges

Compatibility issues with existing infrastructure pose a major challenge to market expansion

There are various obstacles to overcome when integrating contemporary fire detection and suppression systems with the data center's current architecture. Costs, complexity, and downtime risks can all rise as a result of these compatibility problems. Modern fire suppression technologies were not initially incorporated into the architecture of older data centers.

To support advanced technologies, structural changes might be required, which would raise the cost of implementation. Large fire suppression equipment may not be able to be installed due to space constraints.

Additionally, for fire suppression products like FM-200 or Novec 1230 to work, the space must be properly sealed. Inefficiencies may result from existing HVAC systems interfering with the appropriate distribution of fire suppression gasses. Inadequate airflow control can impact the precision of smoke detection, resulting in a delayed fire response.

Request Free Sample

Request Free Sample

Data Center Fire Detection and Suppression Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Data Center Fire Detection and Suppression Market |

| Market Size in 2023 | USD 904 Million |

| Market Forecast in 2032 | USD 1719 Million |

| Growth Rate | CAGR of 7.4% |

| Number of Pages | 221 |

| Key Companies Covered | Siemens, Advanced Safety System Integrators, 3M, Johnson Controls, Minimax, Cannon Fire Protection, Carrier, Danfoss Group, Firetrace, Honeywell, Fike, Instor Marioff, Pro Delta Fire Safety Systems (DELTA), Encore Fire Protection, Kidde, and others. |

| Segments Covered | By Fire Safety Systems, By Deployment Location, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Data Center Fire Detection and Suppression Market: Segmentation

The global data center fire detection and suppression industry is segmented based on fire safety systems, deployment location, and region.

Based on the fire safety systems, the global data center fire detection and suppression market is bifurcated into fire detection and fire suppression. The fire detection segment is expected to hold the largest market share over the forecast period. The proliferation of data centers globally, driven by the surge in cloud computing, big data analytics, and IoT applications, necessitates advanced fire detection and suppression systems to ensure operational continuity.

Based on the deployment location, the global data center fire detection and suppression industry is segmented into technical space/room level and other space/building level. The technical space/room level segment is expected to dominate the market over the forecast period. An essential component of guaranteeing infrastructure safety is the detection and suppression of fires in data center technical areas and rooms. Effective fire safety is crucial in these areas because they house important IT equipment such as servers, networking devices, power distribution units (PDUs), and battery backup systems (UPS).

Data Center Fire Detection And Suppression Market: Regional Analysis

North America dominates the market over the projected period

North America is expected to dominate the global data center fire detection and suppression market during the forecast period. Data centers are connected to clients and businesses via fiber optic cables linked to satellites or communication broadband connectivity.

In the field of data centers, the region is a major force behind and an incumbent for any new technical advancement. Facebook, Google, Microsoft, AWS, Equinix, Digital Realty, Compass Datacenters, Cologix, Vantage Data Centers, NTT Global Data Centers, QTS Realty Trust, CoreSite Realty, CyrusOne, and Switch are the main drivers of the market expansion in North America.

In addition, the United States is the dominant country in North America. The need for fire suppression systems has increased in tandem with the growing need for data centers across large corporations.

Data Center Fire Detection and Suppression Market: Competitive Analysis

The global data center fire detection and suppression market is dominated by players like:

- Siemens

- Advanced Safety System Integrators

- 3M

- Johnson Controls

- Minimax

- Cannon Fire Protection

- Carrier

- Danfoss Group

- Firetrace

- Honeywell

- Fike

- Instor Marioff

- Pro Delta Fire Safety Systems (DELTA)

- Encore Fire Protection

- Kidde

The global data center fire detection and suppression market is segmented as follows:

By Fire Safety Systems

- Fire Detection

- Fire Suppression

By Deployment Location

- Technical Space/Room Level

- Other Space/Building Level

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Data centers are mission-critical facilities designed to handle the data generated by consumers and commercial end users. Fiber optic cables that are connected to satellites or telecommunication broadband access are used to connect consumers and companies to data centers.

The data center fire detection and suppression market is driven by an increasing number of data centers, technological advancements, growing product innovation, and others.

According to the report, the global data center fire detection and suppression market size was worth around USD 904 million in 2023 and is predicted to grow to around USD 1719 million by 2032.

The global data center fire detection and suppression market is expected to grow at a CAGR of 7.4% during the forecast period.

The global data center fire detection and suppression market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market due to the presence of major players and the increasing number of data centers.

Which are the major players leveraging the data center fire detection and suppression market growth?

The global data center fire detection and suppression market is dominated by players like Siemens, Advanced Safety System Integrators, 3M, Johnson Controls, Minimax, Cannon Fire Protection, Carrier, Danfoss Group, Firetrace, Honeywell, Fike, Instor Marioff, Pro Delta Fire Safety Systems (DELTA), Encore Fire Protection and Kidde among others.

The data center fire detection and suppression market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed