Diatomite Market Trend, Share, Growth, Size and Forecast 2030

Diatomite Market By Application (Cement Additive, Filtration, Absorbent, Filler, and Others), By Type (Calcined, Natural, and Flux Calcined), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

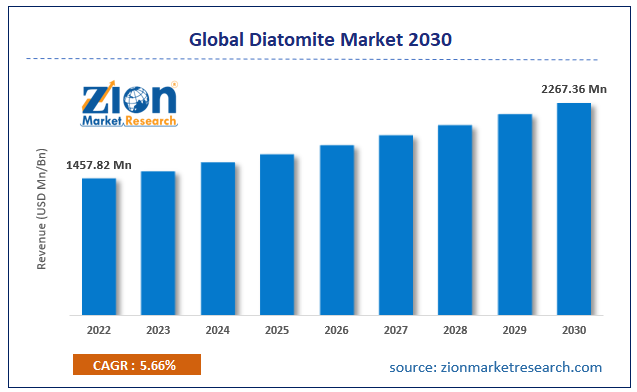

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1457.82 million | USD 2267.36 million | 5.66% | 2022 |

Diatomite Industry Prospective:

The global diatomite market size was worth around USD 1457.82 million in 2022 and is predicted to grow to around USD 2267.36 million by 2030 with a compound annual growth rate (CAGR) of roughly 5.66% between 2023 and 2030.

Diatomite Market: Overview

Diatomite, also known as diatomaceous earth or celite, occurs naturally. It is a soft sedimentary rock with silica (SiO2) as its principal constituent making it a siliceous rock. It can be converted into finely crumbled white to off-white powder. The particle size for diatomite ranges from 3 millimeters and may go as small as 1 micrometer. The granularity of the rock determines if it will have an abrasive feel and owing to high porosity, diatomite is known to have low density. The several applications of diatomite in the modern world include use as a filtration aid, mechanical insecticide, mild abrasive in items such as toothpaste and metal polishes, matting agents in coating material, absorbent for liquids, anti-block in plastic films, reinforcing filler in rubber and plastic, soil for potted plants, and thermal insulator. It is also applied in gas chromatography. For commercial applications, diatomite is available in granulated, micronized, and calcined forms. Specific varieties of the rock are found in specific areas such as Tripolite is found in Libya.

Key Insights:

- As per the analysis shared by our research analyst, the global diatomite market is estimated to grow annually at a CAGR of around 5.66% over the forecast period (2023-2030)

- In terms of revenue, the global diatomite market size was valued at around USD 1457.82 million in 2022 and is projected to reach USD 2267.36 million, by 2030.

- The diatomite market is projected to grow at a significant rate due to the growing application in the construction industry

- Based on application segmentation, filtration was predicted to show maximum market share in the year 2022

- Based on type segmentation, natural was the leading type in 2022

- On the basis of region, North America was the leading revenue generator in 2022

Request Free Sample

Request Free Sample

Diatomite Market: Growth Drivers

Growing application in the construction industry to drive market growth

The global diatomite market is projected to grow owing to the increasing application of the advanced material in the construction & building industry. The siliceous rock is used in the production of red bricks consisting of high open porosity. Red bricks are used extensively in the construction industry for building residential, commercial, and infrastructure development projects. They have applications in laying the foundation on which major architectural units are built. Red bricks are crucial to the construction of bridges, pavements, and arches. With the increasing number of residential homes being built in all major developing and developed nations with the growing population and rampant urbanization, the demand for red bricks is likely to surge during the forecast period. In May 2023, the Desford Forterra factory, the biggest brick-producing facility in Europe, sent out its first batch of bricks. The factory was built with an investment of £95 million and is capable of producing 185 million bricks annually. It can help in building around 24000 homes with its production capacity.

Growing consumption in wastewater treatment units to push market demand further

Diatomite is used extensively in wastewater treatment where the material is used to separate liquids and solids. It helps in reducing insoluble content and total suspended solids (TSS). When the wastewater content is passed through the porous and intricate structure of diatomite, the clarified liquid passes through it but solids get trapped in the diatomite precoat helping in purifying the water. Growing investments in wastewater treatment projects could create higher demand in the global diatomite market. In September 2022, Evac announced the launch of a new generation wastewater treatment plant for different types of vessels. It will filter up to 99% microplastic particles and comes with an option to remove nutrients. Such developments are likely to promote higher investments in wastewater projects leading to greater consumption of diatomite.

Diatomite Market: Restraints

Non-renewability of diatomite to restrict market growth

One of the key restrictions faced by the diatomite industry players is the non-renewability of diatomic since these are sedimentary rocks built over decades. Diatomaceous earth is made of fossilized remains of diatoms. It is a type of microalgae with hard shells. The world is witnessing the impact of excessive consumption of non-renewable sources of energy. Events including global warming and sudden climate changes are a result of increasing consumption of depletable resources. Hence the priority should be recycling diatomite and depending less on freshly extracted diatomaceous earth. The excessive mining of diatomite deposits should be controlled since it also has a long-term impact on the surrounding ecosystem. These activities should be controlled which could pose a threat for the diatomite suppliers and consumers.

Diatomite Market: Opportunities

Increasing consumption in the growing agricultural sector to create growth opportunities

Diatomite is considered highly effective in terms of its application as a natural insecticide. Some variants are approved as a biocide by regional regulatory authorities. For instance, the United Kingdom has allowed the use of InsectoSec by Andermatt as a natural insecticide. The product is also approved by the British Egg Industry Council (BEIC) and can be used for Lion Mark poultry production. Diatomite insecticides are known to prevent pest infestation from numerous species of pests including ants, silverfish, fleas, poultry mites, and many more. The surge in the number of pest infestations reported across the globe and the demand for versatile, safe, and effective insecticides is likely to promote global diatomite market growth. As per reports by the United States Department of Agriculture, around 20% to 40% of the global crop production is lost to pest infestation every year. Plant diseases are known to cost the global economy over USD 220 billion.

Diatomite Market: Challenges

Price volatility and competition from alternate solutions to challenge market growth

Due to the limited availability of diatomite, these products are susceptible or vulnerable to price fluctuations caused by a serious gap in the demand and supply of sedimentary rocks. Additionally, diatomite across end-user applications faces challenges from alternate solutions that are equally effective. For instance, activated charcoal is a popular option for treating wastewater and it is currently used in multiple facilities. The diatomite industry players do not enjoy the benefits of niche product providers since other options to replace diatomite are easily available.

Diatomite Market: Segmentation

The global diatomite market is segmented based on application, type, and region.

Based on application, the global market segments are cement additive, filtration, absorbent, filler, and others. In 2022, the highest growth was observed in the filtration segment due to higher applications of the sedimentary rock in filtering activities across verticals such as food & beverages, wastewater management, and pharmaceuticals. A high porosity index is a major reason for higher consumption as a filter. Diatomite also has higher demand as a cement additive since it is used in the construction business because it has high amorphous silica content and helps in developing concrete strength. The porosity of diatomite is around 61–63%.

Based on type, the diatomite industry divisions are calcined, natural, and flux calcined. In 2022, the demand for natural form was higher and the same trend is expected in the future. The material is highly effective for several end-user applications in its raw form and does not typically need processing for more applications. For instance, calcines diatomite is produced by subjecting the original form to extremely high temperatures which can go to 1000°C and results in altered properties which can reduce its adsorption capability but improve the overall hardness. The final form of diatomite being used depends on the intended end application.

Diatomite Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Diatomite Market |

| Market Size in 2022 | USD 1457.82 Million |

| Market Forecast in 2030 | USD 2267.36 Million |

| Growth Rate | CAGR of 5.66% |

| Number of Pages | 229 |

| Key Companies Covered | Dicalite Management Group, Imerys SA, Silica Holdings Inc., EP Minerals LLC, Diafil Inc., Showa Chemical Industry Co. Ltd., Diatomaceous Earth.com Inc., Maidenwell Diatomite Australia Pty Ltd., Celite Corporation, Guangzhou Sallin Sanitary Ware Co. Ltd., Diatomite Direct, Perma-Guard Inc., Qingdao Best diatomite Co. Ltd., Imerys Filtration Minerals Inc., Earth & Water Resources, CECA, Shengzhou Huali Diatomite Products Co. Ltd., Jilin Yuantong Mineral Co. Ltd., GNA Naturals, Clay Silicates Corporation., and others. |

| Segments Covered | By Application, By Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Diatomite Market: Regional Analysis

North America to witness the highest growth rate during the forecast period

The global diatomite market will be dominated by North America during the forecast period. The US is known to have the largest reserve of popular material. The total reserves in the US stand at 250 million tonnes and are found in several states of the country. In recent times, marine and fresh lake deposits of diatomite were also located in areas such as Virginia, Maryland, California, Washington, and some more areas. In addition to this, the US has a huge demand for diatomite as its end-user verticals are growing rapidly including the construction, wastewater, and agriculture industry. Moreover, diatomite is an important part of the regional consumer goods segment as it is used as an abrasive in toothpaste and certain facial scrubs.

Asia-Pacific is projected to grow at a significant rate driven by the large reserves of diatomite in China that totals 100 million tonnes as per the Indian Bureau of Mines. China is investing heavily in infrastructure development projects along with the growing construction of commercial and residential buildings as the country is working toward becoming a global leader. By 2028, China’s construction sector is expected to cross the USD 7.1 trillion mark.

Diatomite Market: Competitive Analysis

The global diatomite market is led by players like:

- Dicalite Management Group

- Imerys SA

- Silica Holdings Inc.

- EP Minerals LLC

- Diafil Inc.

- Showa Chemical Industry Co. Ltd.

- Diatomaceous Earth.com Inc.

- Maidenwell Diatomite Australia Pty Ltd.

- Celite Corporation

- Guangzhou Sallin Sanitary Ware Co. Ltd.

- Diatomite Direct

- Perma-Guard Inc.

- Qingdao Best diatomite Co. Ltd.

- Imerys Filtration Minerals Inc.

- Earth & Water Resources

- CECA

- Shengzhou Huali Diatomite Products Co. Ltd.

- Jilin Yuantong Mineral Co. Ltd.

- GNA Naturals

- Clay Silicates Corporation.

The global diatomite market is segmented as follows:

By Application

- Cement Additive

- Filtration

- Absorbent

- Filler

- Others

By Type

- Calcined

- Natural

- Flux Calcined

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Diatomite, also known as diatomaceous earth or celite, occurs naturally. It is a soft sedimentary rock with silica (SiO2) as its principal constituent making it a siliceous rock.

The global diatomite market is projected to grow owing to the increasing application of the advanced material in the construction & building industry.

According to study, the global diatomite market size was worth around USD 1457.82 million in 2022 and is predicted to grow to around USD 2267.36 million by 2030.

The CAGR value of the diatomite market is expected to be around 5.66% during 2023-2030.

The global diatomite market will be dominated by North America during the forecast period. The US is known to have the largest reserve of popular material.

The global diatomite market is led by players like Dicalite Management Group, Imerys SA, Silica Holdings Inc., EP Minerals, LLC, Diafil, Inc., Showa Chemical Industry Co., Ltd., Diatomaceous Earth.com, Inc., Maidenwell Diatomite Australia Pty Ltd., Celite Corporation, Guangzhou Sallin Sanitary Ware Co., Ltd., Diatomite Direct, Perma-Guard, Inc., Qingdao Best diatomite Co. Ltd., Imerys Filtration Minerals Inc., Earth & Water Resources, CECA, Shengzhou Huali Diatomite Products Co., Ltd., Jilin Yuantong Mineral Co., Ltd., GNA Naturals, and Clay Silicates Corporation.

The report explores crucial aspects of the diatomite market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed