Diesel Exhaust Fluid Market Trend, Share, Growth, Size and Forecast 2030

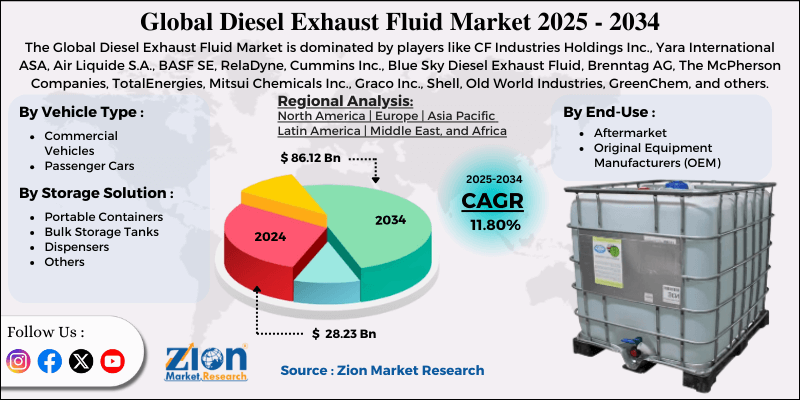

Diesel Exhaust Fluid Market By Vehicle Type (Commercial Vehicles and Passenger Cars), By Storage Solution (Portable Containers, Bulk Storage Tanks, Dispensers, and Others), By End-Use (Aftermarket and Original Equipment Manufacturers (OEM)), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

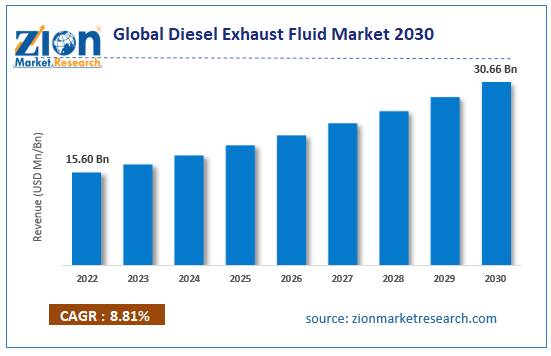

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 15.60 Billion | USD 30.66 Billion | 8.81% | 2022 |

Diesel Exhaust Fluid Industry Prospective:

The global diesel exhaust fluid market size was worth around USD 15.60 billion in 2022 and is predicted to grow to around USD 30.66 billion by 2030 with a compound annual growth rate (CAGR) of roughly 8.81% between 2023 and 2030.

Diesel Exhaust Fluid Market: Overview

Diesel exhaust fluid (DEF) is an essential component of the chemical industry. It is used for controlling air pollution caused by diesel engines. DEF is a part of the selective catalytic reduction (SCR) process during diesel burning. The procedure helps to control and reduce the amount of nitrogen oxides released into the environment when a diesel engine is in use. DEF is currently sold under several names.

For instance, in Germany, it is available under the name of AdBlue which is a trademark associated with the German Association of the Automotive Industry. The excess air released when diesel engines are in use leads to the generation of nitrogen oxide. It is a highly toxic gas and a severe environmental pollutant. Through the SCR process, diesel exhaust fluid is externally added to the exhaust pipelines which helps in transforming nitrogen oxide into two separate non-toxic components that are nitrogen and water. The exhaust then releases these non-polluting components into the air. The demand for diesel exhaust fluid is likely to reach new heights during the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global diesel exhaust fluid market is estimated to grow annually at a CAGR of around 8.81% over the forecast period (2023-2030)

- In terms of revenue, the global diesel exhaust fluid market size was valued at around USD 15.60 billion in 2022 and is projected to reach USD 30.66 billion, by 2030.

- The diesel exhaust fluid market is projected to grow at a significant rate due to the growing environmental pollution by diesel engines

- Based on vehicle type segmentation, passenger vehicles were predicted to show maximum market share in the year 2022

- Based on end-use segmentation, aftermarket was the leading segment in 2022

- On the basis of region, North America was the leading revenue generator in 2022

Request Free SampleDiesel Exhaust Fluid Market: Growth Drivers

Request Free SampleDiesel Exhaust Fluid Market: Growth Drivers

Growing environmental pollution by diesel engines will drive market demand

The global diesel exhaust fluid market is projected to grow owing to the increasing rate of environmental pollution with diesel engines acting as key contributors. As per the Union of Concerned Scientists, heavy-duty diesel vehicles contribute to almost 20% of all nitrogen oxide and 25% of particulate matter 2.5 in the US alone. Diesel exhaust is known as the carrier of several harmful gasses including volatile organic compounds (VOCs) that not only impact the environment but lead to severe health impacts on all living species.

As per the World Health Organization (WHO), around 7 million people globally are killed due to air pollution every year. The report also claims that 9 out of 10 people worldwide breathe air containing high levels of toxic components. Some of the most widely occurring health impacts of air pollution include accelerated aging of the lungs and the development of long-term diseases such as emphysema, bronchitis, asthma, and cancer at least in some cases. Diesel exhaust fluid can help significantly reduce the emission of toxic components leading to higher demand.

Rising research toward improving DEF performance will generate more confidence among users about product efficiency

The demand in the global diesel exhaust fluid industry may be positively impacted by the increasing research toward an improved understanding of DEF applications and performance. A 2022 study by the engineers at the Southwest Research Institute concluded that the patented technology developed by the researchers under the brand name CAT-DEF™ could be used to significantly reduce nitrogen oxide emissions thus meeting 2027 standard guidelines laid down by the California Air Resources Board (CARB). CAT-DEF represents catalyzed DEF and is a surfactant-modified diesel exhaust fluid solution with a SwRI-developed catalyst.

Diesel Exhaust Fluid Market: Restraints

Increasing demand for electric vehicles across commercial and passenger segments may restrict market growth

The global diesel exhaust fluid market growth is expected to be restricted due to the rising demand and consumption of electric vehicles (EVs) that do not require diesel engines to function. Countries across the globe are registering higher sales of EVs, especially at present times since the cost of EVs has reduced significantly. In addition to this, market players are investing in more affordable compact EVs.

Governments and regional heads are also promoting the use of electric vehicles in the public sector domain. Between 2021 and 2022, China witnessed an increase of 84% in the demand for electric vehicles. Governments are providing more subsidies along with investing in supporting infrastructure which will further promote EV adoption thus affecting demand for diesel vehicles and subsequently DEF.

Diesel Exhaust Fluid Market: Opportunities

Rising market for pre-owned cars could provide growth opportunities for DEF manufacturers

Since the cost of automobiles has increased in recent times, there is a thriving market for pre-owned cars. Many people globally are adopting used cars since they offer higher investment value. A large percentage of the cars in the secondhand car market run on diesel engines thus creating more demand for diesel engine fluid.

By 2030, as per projections, the user car market is expected to reach over USD 2800 billion. Additionally, these vehicles are at a higher risk of releasing toxic gases. Since government standards and regulations surrounding vehicle emissions have become more stringent, the demand for DEF will grow at a rapid rate.

Public transport systems hold high growth potential due to greater adoption of diesel-powered vehicles

The ongoing war between Russia and Ukraine has significantly impacted the global fuel supply chain. Additionally, every region globally is witnessing a sharp rise in petrol prices. Furthermore, since diesel engines have higher power, most non-electric vehicles operating in public transport systems are powered using diesel. As the demand for improvements in public transport infrastructure is growing, the consumption of diesel exhaust fuel is simultaneously rising.

In November 2023, the Delhi government of India announced that only vehicles powered using compressed natural gas (CNG) and Bharat stage VI diesel along with electric buses will be allowed to operate in the regional public transport ecosystem.

Diesel Exhaust Fluid Market: Challenges

Reducing incidences of DEF contamination is a challenge for many users and suppliers

The global diesel exhaust fluid market is challenged by the increasing cases of DEF contamination. It can be caused by several factors which eventually lead to poor performance of the vehicle.

For instance, cross-contamination is an extremely common way in which DEF can be polluted. It results from improper cleaning of transfer tanks before DEF is stored in the container. Developing ways to reduce such incidents could be a challenge for industry players.

Diesel Exhaust Fluid Market: Segmentation

The global diesel exhaust fluid market is segmented based on vehicle type, storage, end-use, and region.

Based on vehicle type, the global market is divided into commercial vehicles and passenger cars. In 2022, the highest growth was witnessed in the passenger cars vehicles. The rising sale of diesel-engine cars as well as the higher prevalence of diesel-powered vehicles in certain parts of the role were the primary reasons for segmental dominance. The commercial vehicles segment is also a significant contributor since several vehicles operating in the public transport sector run on diesel. The growing government stringency and regulations on environmental pollution may encourage more consumers to use diesel fuel exhaust. As per the National Oceanic and Atmospheric Administration, nitrogen oxide content in the air at present times is around 0.31 parts per million.

Based on solution, the global diesel exhaust fluid industry is divided into portable containers, bulk storage tanks, dispensers, and others.

Based on end-use, the global market is divided into aftermarket and original equipment manufacturers (OEM). The highest revenue generator was the aftermarket segment. Consumers who own vehicles equipped with SCR technology are required to use DEF to prevent pollution caused by diesel exhaust. The changing global standards and regulations are facilitating research & development in terms of improved DEF which is a mixture of 67.5% deionized water and 32.5% urea.

Diesel Exhaust Fluid Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Diesel Exhaust Fluid Market |

| Market Size in 2022 | USD 15.60 Billion |

| Market Forecast in 2030 | USD 30.66 Billion |

| Growth Rate | CAGR of 8.81% |

| Number of Pages | 228 |

| Key Companies Covered | CF Industries Holdings Inc., Yara International ASA, Air Liquide S.A., BASF SE, RelaDyne, Cummins Inc., Blue Sky Diesel Exhaust Fluid, Brenntag AG, The McPherson Companies, TotalEnergies, Mitsui Chemicals Inc., Graco Inc., Shell, Old World Industries, GreenChem, and others. |

| Segments Covered | By Vehicle Type, By Storage Solution, By End-Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Diesel Exhaust Fluid Market: Regional Analysis

North America to deliver the highest results during the forecast period

The global diesel exhaust fluid market will be led by North America during the projection period. In 2022, almost 44.5% of the global revenue was associated with growth in North America. Since it is home to two of the world’s leading economies, the use rate of diesel vehicles especially in public transport systems is significantly higher. Additionally, the US and Canada regions are increasingly emphasizing reducing the burden on the environment caused by industrial, commercial, and residential operations including the use of diesel engines.

The growing infrastructure development projects along with existing industrialized regions have resulted in higher use of heavy-duty diesel vehicles across North American countries. Europe is projected to deliver at a consistent growth rate. Europe has a huge market for diesel-powered vehicles. Additionally, the growing need to reduce air pollution along with stringent government policies is likely to work in favor of the regional growth trends. However, Europe is also witnessing a rising demand for electric vehicles which will translate to lower demand for diesel-engine vehicles.

Diesel Exhaust Fluid Market: Competitive Analysis

The global diesel exhaust fluid market is led by players like:

- CF Industries Holdings Inc.

- Yara International ASA

- Air Liquide S.A.

- BASF SE

- RelaDyne

- Cummins Inc.

- Blue Sky Diesel Exhaust Fluid

- Brenntag AG

- The McPherson Companies

- TotalEnergies

- Mitsui Chemicals Inc.

- Graco Inc.

- Shell

- Old World Industries

- GreenChem

The global diesel exhaust fluid market is segmented as follows:

By Vehicle Type

- Commercial Vehicles

- Passenger Cars

By Storage Solution

- Portable Containers

- Bulk Storage Tanks

- Dispensers

- Others

By End-Use

- Aftermarket

- Original Equipment Manufacturers (OEM)

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Diesel exhaust fluid (DEF) is an essential component of the chemical industry. It is used for controlling air pollution caused by diesel engines.

The global diesel exhaust fluid market is projected to grow owing to the increasing rate of environmental pollution with diesel engines acting as key contributors.

According to study, the global diesel exhaust fluid market size was worth around USD 15.60 billion in 2022 and is predicted to grow to around USD 30.66 billion by 2030.

The CAGR value of diesel exhaust fluid market is expected to be around 8.81% during 2023-2030.

The global diesel exhaust fluid market will be led by North America during the projection period.

The global diesel exhaust fluid market is led by players like CF Industries Holdings, Inc., Yara International ASA, Air Liquide S.A., BASF SE, RelaDyne, Cummins Inc., Blue Sky Diesel Exhaust Fluid, Brenntag AG, The McPherson Companies, TotalEnergies, Mitsui Chemicals, Inc., Graco Inc., Shell, Old World Industries, and GreenChem among others.

The report explores crucial aspects of the diesel exhaust fluid market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed