Digital Insurance Platform Market Size, Share, Trends, Growth 2032

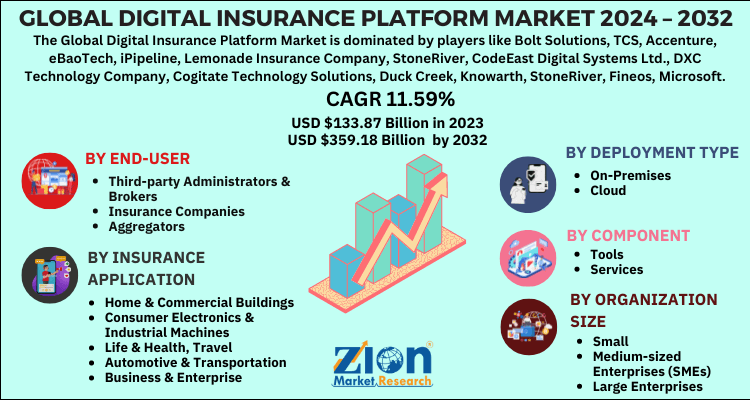

Digital Insurance Platform Market By service (managed services and professional services), By component (tools and services), By insurance application (home & commercial buildings, consumer electronics & industrial machines, life & health, travel, automotive & transportation, and business & enterprise), By organization size (small and medium-sized enterprises (SMEs) and large enterprises), By deployment type (on-premises and cloud), By end-user (third-party administrators & brokers, insurance companies, and aggregators) And By Region: - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts, 2024-2032

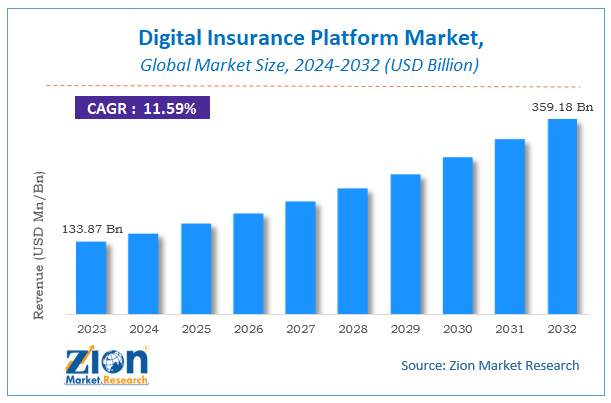

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 133.87 Billion | USD 359.18 Billion | 11.59% | 2023 |

Description

Digital Insurance Platform Market Insights

According to the report published by Zion Market Research, the global Digital Insurance Platform Market size was valued at USD 133.87 Billion in 2023 and is predicted to reach USD 359.18 Billion by the end of 2032. The market is expected to grow with a CAGR of 11.59% during the forecast period. The report analyzes the global Digital Insurance Platform Market's growth drivers, restraints, and impact on demand during the forecast period. It will also help navigate and explore the arising opportunities in the Digital Insurance Platform industry.

Global Digital Insurance Platform Market: Overview

A digital insurance platform is a tool or a service which allow insurance companies to regulate, design, control, and administer the digital insurance structure. Digital insurance platforms enable organizations to digitalize insurance processes. Such platforms merge several silos or modules present in the digital insurance structure.

The systems or modules comprise of claim management, billing & premium accounting, regulatory filing, policy implementation, and reinsurance management. Such platforms offer the policy holder a website or a portal which provides remote access to consumer databases which can be used with ease. Numerous organizations providing digital insurance platforms are targeting to deliver personalized digital insurance services or solutions coupled with end-to-end applications, digital networking of business functioning, and third-party services.

Global Digital Insurance Platform Market: Growth Factors

There has been a notable transition in the global insurance industry towards implementation of advanced digital technology in the past few years. Customer satisfaction is a key concern for insurance companies. This growth factor is predicted to affect the global digital insurance platform market in a positive way. Additionally, the utilization of AI (Artificial Intelligence) and other such enhanced systems is another factor that might drive the global digital insurance platform market growth.

With the onset of COVID-19, numerous insurance companies are focusing on providing health cover solutions that are specially designed for individuals concerned about the coronavirus disease infection. This factor is anticipated to drive for customers and create ample growth opportunities for the expansion of the global digital insurance platform market.

Global Digital Insurance Platform Market: Segmentation

The global digital insurance platform market has been categorized by service, component, insurance application, organization size, deployment type, end-user, and region.

On the basis of service, the market can be bifurcated into managed services and professional services. The managed services are predicted to exhibit a higher growth rate in the forthcoming timeframe. These services are offered by third-party insurance companies and comprise of maintenance and monitoring of networks, software, and computers. Managed services suppliers assist companies in ensuring smooth processing of business operations and improving work productivity with the help of effectual use of resources. Additionally, managed services help companies to create successful plans and strategies for solving various business-related issues. The professional services sub-segment is further divided into implementation, consulting, and support & maintenance.

By component, the global insurance platform market has been classified into tools and services.

On the basis of insurance application, the market can be segregated into home & commercial buildings, consumer electronics & industrial machines, life & health, travel, automotive & transportation, and business & enterprise.

Based on organization size, the global insurance platform market is segmented into small and medium-sized enterprises (SMEs) and large enterprises. The small and medium-sized enterprises (SMEs) sub-segment is projected to expand at a notable CAGR over the forecast period. Due to their restricted budgets, SMEs face many challenges in gaining popularity in the market. Digital insurance platforms can prove to be really profitable for insurance companies in creating new opportunities, meeting the demands of the various end-users, and generating revenue. SMEs majorly have a preference for cloud-based solutions instead of on-premises services.

By deployment type, the market can be divided into on-premises and cloud. The cloud-based solutions segment is anticipated to witness a remarkable expansion in the upcoming times due to the increased need for cost-effectiveness, scalability, and flexibility.

Based on end-user, the global digital insurance platform market has been segregated into third-party administrators & brokers, insurance companies, and aggregators.

Digital Insurance Platform Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Digital Insurance Platform Market |

| Market Size in 2023 | USD 133.87 Billion |

| Market Forecast in 2032 | USD 359.18 Billion |

| Growth Rate | CAGR of 11.59% |

| Number of Pages | 204 |

| Key Companies Covered | Bolt Solutions, TCS, Accenture, eBaoTech, iPipeline, Lemonade Insurance Company, StoneRiver, CodeEast Digital Systems Ltd., DXC Technology Company, Cogitate Technology Solutions, Duck Creek, Knowarth, StoneRiver, Fineos, Microsoft, Infosys, Inzura Ltd., Appian, Mindtree, Cognizant, EIS Group, RGI Group, and Pegasystems |

| Segments Covered | By service, By component, By insurance application, By organization size, By deployment type, By end-user and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Digital Insurance Platform Market: Regional Analysis

North America is predicted to dominate the global digital insurance platform market in the forthcoming timeframe. This is attributed to the presence of giant insurance companies in the major countries such as the United States.

Asia Pacific is anticipated to make available ample opportunities for the expansion of the digital insurance platform market. Such lucrative growth opportunities are attributable to the substantial increment in investments and expenditures by numerous establishments in Asia Pacific region. Furthermore, the increment in the utilization of mobile and cloud-based technologies by the large populace of nations including China and India will indirectly augment the development of the digital insurance platforms market in the region.

Global Digital Insurance Platform Market: Competitive Players

Some of the major names dominating the global digital insurance platform market include:

- Bolt Solutions

- TCS

- Accenture

- eBaoTech

- iPipeline

- Lemonade Insurance Company

- StoneRiver

- CodeEast Digital Systems Ltd.

- DXC Technology Company

- Cogitate Technology Solutions

- Duck Creek, Knowarth

- StoneRiver

- Fineos

- Microsoft

- Infosys

- Inzura Ltd.

- Appian

- Mindtree

- Cognizant

- EIS Group

- RGI Group

- Pegasystems.

The Global Digital Insurance Platform Market is segmented as follows:

By service

- managed services

- professional services

By component

- tools

- services

By insurance application

- home & commercial buildings

- consumer electronics & industrial machines

- life & health, travel

- automotive & transportation

- business & enterprise

By organization size

- small

- medium-sized enterprises (SMEs)

- large enterprises

By deployment type

- on-premises

- cloud

By end-user

- third-party administrators & brokers

- insurance companies

- aggregators

Global Digital Insurance Platform Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

What Reports Provides

- Full in-depth analysis of the parent market

- Important changes in market dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional markets

- Testimonials to companies in order to fortify their foothold in the market.

Table Of Content

Choose License Type

FrequentlyAsked Questions

There has been a notable transition in the global insurance industry towards implementation of advanced digital technology in the past few years. Customer satisfaction is a key concern for insurance companies. This growth factor is predicted to affect the global digital insurance platform market in a positive way.

Asia Pacific is anticipated to make available ample opportunities for the expansion of the digital insurance platform market. Such lucrative growth opportunities are attributable to the substantial increment in investments and expenditures by numerous establishments in Asia Pacific region.

Some of the major names dominating the global digital insurance platform market include Bolt Solutions, TCS, Accenture, eBaoTech, iPipeline, Lemonade Insurance Company, StoneRiver, CodeEast Digital Systems Ltd., DXC Technology Company, Cogitate Technology Solutions, Duck Creek, Knowarth, StoneRiver, Fineos, Microsoft, Infosys, Inzura Ltd., Appian, Mindtree, Cognizant, EIS Group, RGI Group, and Pegasystems.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed