Digital Lending Platforms Market Size, Share, Trends, Growth and Forecast 2032

Digital Lending Platforms Market By component (solution, decision automation, services, consulting, loan origination, design & implementation, support & maintenance, loan management, and others), By deployment (cloud and on-premises), By industry (consumer goods & retail, banking, financial services, & insurance (BFSI), healthcare, aerospace & defense, energy & utilities, telecommunication, manufacturing, and others) And By Region: - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts, 2024-2032

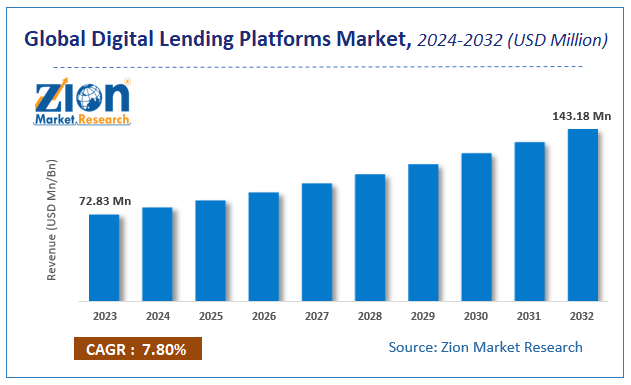

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 72.83 Million | USD 143.18 Million | 7.8% | 2023 |

Description

Digital Lending Platforms Market Insights

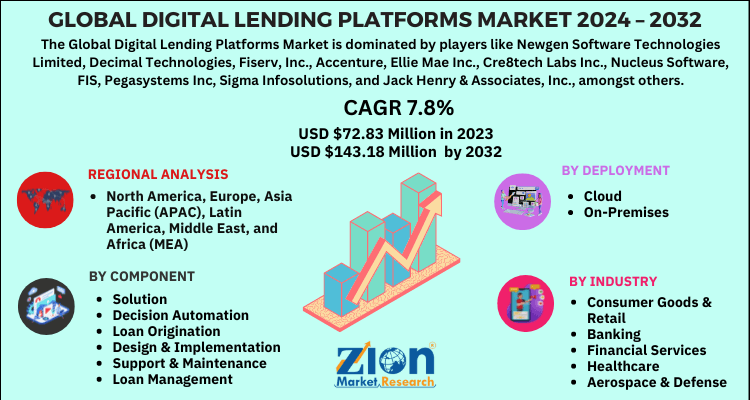

According to the report published by Zion Market Research, the global Digital Lending Platforms Market size was valued at USD 72.83 Million in 2023 and is predicted to reach USD 143.18 Million by the end of 2032. The market is expected to grow with a CAGR of 7.8% during the forecast period. The report analyzes the global Digital Lending Platforms Market's growth drivers, restraints, and impact on demand during the forecast period. It will also help navigate and explore the arising opportunities in the Digital Lending Platforms industry.

Global Digital Lending Platforms Market: Overview

Digital lending platforms have revolutionized the financial landscape across the world. Digital lending platforms offer a strong impetus to financial inclusions. Digital lending platforms provide and renew loans using online technology so that quick access to capital can be gained by the business and the individuals. It usually relies on technology entirely to validate business loans as well as implement credit evaluations via digital apps and online platforms. The process of digital lending is similar to the process of face-to-face traditional lending with the major difference of reduction of waiting time as credit and financial statements can be obtained in a few minutes by use of technology.

Global Digital Lending Platforms Market: Growth Factors

The increasing trend of digitalization in financial organizations, the rising number of initiatives undertaken by the government, and an increasing number of smartphone users are some of the major factors spurring the growth of the global digital lending platforms market. Moreover, the rapid adoption of advanced technologies such as blockchain, machine learning, and the artificial intelligence-based digital lending platform is also contributing to the growth of the market. Additionally, digital lending platforms have several benefits including easy capture of applicant's information, optimization of the process of loan underwriting, enables fast decision making, and does not rely on credit scores for disbursing loans.

Moreover, one of the distinct advantages of digital lending is quicker approval of credit, especially, for small-ticket credits. Owing to all these benefits of digital lending platforms, there is an upsurge in the growth of the market. In addition to this, novel business models, lean organizations, and responsive processes are fostering the growth of the market. Furthermore, huge investments by fintech companies will fuel the growth of the market during the forecast period. However, major concerns regarding security and compliances will restrain the growth of the global digital lending platforms market.

Like many other industries, the lending industry also was severely hit by the covid-19 pandemic. It resulted in a global standstill with a drastic dropdown in the economy. This was attributed to the strict rules and regulations enforced by the government. The loan portfolios of NBFCs and banks are facing huge challenges due to disruption in salaries, economy, and businesses ultimately affecting the cash flow. However, with the unfolding of the impact of the pandemic on the lending industry, financial institutes, and banks are expected to observe a spike in non-performing assets ratio and credit costs. The fintech industries are leveraging automation, cloud-based processes, and tech solutions to improve the services and offer e-cards for credit or debit money and end-to-end contactless transactions. Thus, during the post-covid-19 era, the global digital lending platforms market will grow at a significant rate.

Digital Lending Platforms Market: Segmentation

The global digital lending platforms market is bifurcated based on component, deployment, industry, and region.

Based on component, the market is segmented into solution, decision automation, services, consulting, loan origination, design & implementation, support & maintenance, loan management, and others.

The deployment segment is divided into cloud and on-premises.

The industry segment is bifurcated into consumer goods & retail, banking, financial services, & insurance (BFSI), healthcare, aerospace & defense, energy & utilities, telecommunication, manufacturing, and others.

Digital Lending Platforms Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Digital Lending Platforms Market |

| Market Size in 2023 | USD 72.83 Million |

| Market Forecast in 2032 | USD 143.18 Million |

| Growth Rate | CAGR of 7.8% |

| Number of Pages | 193 |

| Key Companies Covered | Newgen Software Technologies Limited, Decimal Technologies, Fiserv, Inc., Accenture, Ellie Mae Inc., Cre8tech Labs Inc., Nucleus Software, FIS, Pegasystems Inc, Sigma Infosolutions, and Jack Henry & Associates, Inc., amongst others |

| Segments Covered | By component, By deployment, By industry and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Digital Lending Platforms Market: Regional Analysis

North America is expected to hold a major market share in the global digital lending platforms market over the forecast period. Factors such as the early adoption of digital lending platforms, the increasing digitalization of organizations, and the presence of a large number of vendors in this region are expected to contribute to the growth of this region. On the other side, the digital lending platforms market in the Asia Pacific region is anticipated to register rapid growth over the forecast period.

Global Digital Lending Platforms Market: Competitive Players

The key players operating in the global digital lending platforms market are:

- Newgen Software Technologies Limited

- Decimal Technologies, Fiserv, Inc.

- Accenture, Ellie Mae Inc.

- Cre8tech Labs Inc.

- Nucleus Software, FIS

- Pegasystems Inc

- Sigma Infosolutions

- Jack Henry & Associates, Inc., amongst others.

The Global Digital Lending Platforms Market is segmented as follows:

By component

- solution

- decision automation

- services

- consulting

- loan origination

- design & implementation

- support & maintenance

- loan management

- and others

By deployment

- cloud

- on-premises

By industry

- consumer goods & retail

- banking

- financial services

- insurance (BFSI)

- healthcare

- aerospace & defense

- energy & utilities

- telecommunication

- manufacturing, and others

Global Digital Lending Platforms Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

What Reports Provides

- Full in-depth analysis of the parent market

- Important changes in market dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional markets

- Testimonials to companies in order to fortify their foothold in the market.

Table Of Content

Choose License Type

FrequentlyAsked Questions

The increasing trend of digitalization in financial organizations, the rising number of initiatives undertaken by the government, and an increasing number of smartphone users are some of the major factors spurring the growth of the global digital lending platforms market. Moreover, the rapid adoption of advanced technologies such as blockchain, machine learning, and artificial based digital lending platform are also contributing to the growth of the market. Additionally, digital lending platforms have several benefits including easy capture of applicant's information, optimization of the process of loan underwriting, enables fast decision making, and does not rely on credit scores for disbursing loans. Moreover, one of the distinct advantages of digital lending is quicker approval of credit, especially for small –ticket credits. Owing to all these benefits of digital lending platforms, there is an upsurge in the growth of the global digital lending platforms market. In addition to this, novel business models, lean organizations, and responsive processes are fostering the growth of the market. Furthermore, huge investments by fintech companies will fuel the growth of the market during the forecast period.

The key players operating in the global digital lending platforms market are Newgen Software Technologies Limited, Decimal Technologies, Fiserv, Inc., Accenture, Ellie Mae Inc., Cre8tech Labs Inc., Nucleus Software, FIS, Pegasystems Inc, Sigma Infosolutions, and Jack Henry & Associates, Inc., amongst others.

North America is expected to hold a major market share in the global digital lending platforms market over the forecast period. Factors such as the early adoption of digital lending platforms, the increasing digitalization of organizations, and the presence of a large number of vendors in this region are expected to contribute to the growth of this region.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed