Drone Camera Market Size, Share, Trends, Growth 2032

Drone Camera Market By Type (SD Camera and HD Camera), By Application (Thermal Imaging, Photography & Videography and Surveillance), By Resolution (12 MP, 12 to 20 MP, 20 to 32 MP and 32 MP and above), By End User (Military, Commercial and Homeland Security), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

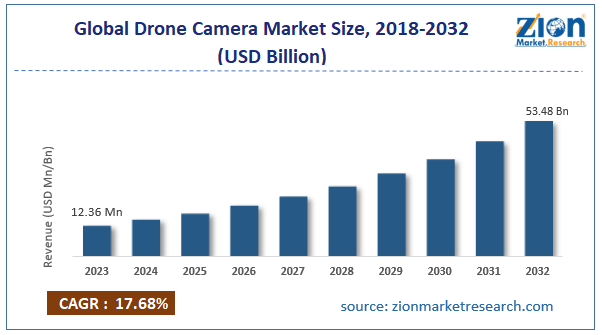

| USD 12.36 Billion | USD 53.48 Billion | 17.68% | 2023 |

Drone Camera Industry Perspective:

The global drone camera market size was worth around USD 12.36 billion in 2023 and is predicted to grow to around USD 53.48 billion by 2032 with a compound annual growth rate (CAGR) of roughly 17.68% between 2024 and 2032.

Drone Camera Market: Overview

An embedded device in a drone that records films or takes pictures while the drone is in flight is called a drone camera. Drone cameras are employed for several purposes, such as thermal imaging, product and food delivery, and area-specific surveillance. The need for high resolution cameras put in drone cameras that can capture high-quality images from a wider angle has increased due to the growing usage of drones in numerous industries. The governments of several nations have also been able to enter into collaborations with drone and component makers like DJI and GoPro Technologies Ltd. to offer better and more modern products, which has helped the drone camera market grow internationally, due to increases in defense spending.

Key Insights

- As per the analysis shared by our research analyst, the global drone camera market is estimated to grow annually at a CAGR of around 17.68% over the forecast period (2024-2032).

- In terms of revenue, the global drone camera market size was valued at around USD 12.36 billion in 2023 and is projected to reach USD 53.48 billion, by 2032.

- The growing integration of advanced technology is expected to drive market growth over the forecast period.

- Based on the type, the HD camera segment is expected to dominate the market during the forecast period.

- Based on the application, the photography & videography segment is expected to capture the largest market share over the forecast period.

- Based on the end user, the military segment is expected to grow at a significant rate over the forecast period.

- Based on region, North America is expected to dominate the market during the forecast period.

Request Free Sample

Request Free Sample

Drone Camera Market: Growth Drivers

Introduction of advanced technology drives market growth

Due to its advanced features, which include high-resolution cameras and sophisticated sensor systems, the drone business has experienced profitable expansion in recent years. Important industry companies have been further motivated by this to introduce cutting-edge technologies to expand their product offerings. With cutting-edge features like a voice control mechanism, a micro four-thirds system, and shortwave infrared (SWIR) sensors, some of the most well-known drone cameras with advanced sensors are the Aeryon HDZoom30 by Aeryon Labs Inc., the SAFIRE series by FLIR Systems, Inc., the Zenmuse Series by SZ DJI Technology Co., and the Hero Series by Go Pro, Inc. Additionally, businesses in the UAV segment with cutting-edge goods include Elbit Systems Ltd., GoPro, Inc., Israel Aerospace Industries Ltd., FLIR Systems, Inc., and Aeryon Labs, Inc. For instance, the Mantis i45 has an onboard image processor and high-definition video storage facility in addition to using the newest low-light camera, high-power illuminator, and ultra-high-resolution EO and IR imagers.

Drone Camera Market: Restraints

The development of superior satellite imagery hinders market growth

The market for drone cameras is expected to grow more slowly as satellite imagery becomes more widely used. This is because satellite images are more reliable and accurate than images from other sources. Official permits are an additional benefit of satellite imaging since most programs are funded by the government. Furthermore, compared to drone imaging, satellite imaging has a wider geographic coverage, offers more information, and generates photos with higher resolution. Furthermore, it is projected that further developments in satellite imaging and technologically sophisticated satellites would result in additional costs. As a result, it is predicted that satellite imaging will prevent market growth throughout the forecast.

Drone Camera Market: Opportunities

Decreasing the cost of drone cameras offers a lucrative opportunity for market growth

The swift growth and evolution of drone cameras have significantly reduced costs and impacted the pricing of drone cameras on the market. This trend has multiple contributing variables. The market's need for drone cameras has increased dramatically recently. The prices associated with producing drone cameras have decreased due to economies of scale and improved manufacturing techniques. To lower manufacturing costs, manufacturers employ bulk production strategies and concepts, which ultimately save money for customers. Furthermore, technological progress has resulted in the creation of novel components that maintain optimal quality and functionality. The producers have achieved affordability and efficiency through the use of creative designs. Because it provides more options, it is more reasonably priced and easily accessible for customers. The supply chain and distribution networks have rapidly improved, enabling efficient delivery to customers and thus lowering prices. The market for drone cameras has opened up to more consumers due to lower prices.

Drone Camera Market: Challenges

Limited battery and range pose a major challenge to market expansion

The majority of consumer and business drones have short flying times and small coverage areas due to their short battery life and range. Drone camera usability and efficiency are negatively impacted by short battery life and range restrictions, which limit the length and breadth of airborne missions. This is particularly true for applications that call for long-distance or extended flying lengths.

Drone Camera Market: Segmentation

The global drone camera industry is segmented based on type, application, resolution, end user and region.

Based on the type, the global drone camera market is bifurcated into SD Camera and HD Camera. The HD camera segment is expected to dominate the market during the forecast period. An image from a high-definition (HD) camera is of excellent quality and resolution. An HD camera's typical resolution is either 720p or 1080p. In the drone camera market, HD cameras are becoming more and more popular. This is a result of the sophisticated features that HD cameras provide, such as sharper aerial photography and higher-resolution video. Moreover, enhanced storage capability, precise image and video recording, and effortless deployment across all scenarios bolster the expansion of high-definition drone cameras in the worldwide marketplace.

Based on the application, the global drone camera industry is segmented into thermal imaging, photography & videography and surveillance. The photography & videography segment is expected to capture the largest market share over the forecast period. Drone camera demand is being driven by the growing popularity of aerial photography and videography for a variety of purposes, such as real estate marketing, event coverage, tourism promotion, and cinematography. Drones are being used by both consumers and businesses to take breathtaking aerial views and dynamic film, which is driving the market for drone photography and videography.

Based on the resolution, the global drone camera market is segmented into 12 MP, 12 to 20 MP, 20 to 32 MP and 32 MP and above.

Based on the end user, the global drone camera industry is segmented into military, commercial and homeland security. The military segment is expected to grow at a significant rate over the forecast period. An unmanned drone specifically created for military use is called a military drone. These drones are made to fly above the line of human vision to conduct thermal scanning over a predetermined area. The need for covert surveillance at dubious locations, rising defense budgets across the board, the heightened rivalry between neighbors, and the release of cutting-edge products like high-resolution cameras and GPS-enabled cameras that can perform a wide range of functions have all contributed to the rise in popularity of military drone cameras.

Drone Camera Market Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Drone Camera Market |

| Market Size in 2023 | USD 12.36 Billion |

| Market Forecast in 2032 | USD 53.48 Billion |

| Growth Rate | CAGR of 17.68% |

| Number of Pages | 216 |

| Key Companies Covered | Aerialtronics DV BV, GoPro Inc., Canon Inc., Garmin Ltd., DJI, Controp Precision Technologies Ltd., FLIR Systems Inc., Panasonic Corporation, DST Control, Sony Corporation, and others. |

| Segments Covered | By Type, By Application, By Resolution, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Regional Analysis

North America is expected to dominate the market during the forecast period

North America is expected to dominate the market over the forecast period. The area is home to a thriving drone industry, creative start-ups, and camera tech companies that promote a quick-paced environment for technological advancement and business expansion. Drone camera demand is fueled by a variety of end customers in North America, including amateurs, practitioners, and industrial players. Furthermore, the region is known for its robust R&D investments and high level of expertise in drone operations, which are factors contributing to the market's growth. Besides, the Asia Pacific is expected to grow at a rapid rate over the projected period. The demand for drones and related accessories like drone cameras is expected to be driven by an increase in research and development (R&D) initiatives for cutting-edge drones for military applications like border security and surveillance, as well as by rapid digitalization, particularly in rural areas.

Drone Camera Market: Competitive Analysis

The global drone camera market is dominated by players like:

- Aerialtronics DV BV

- GoPro Inc.

- Canon Inc.

- Garmin Ltd.

- DJI

- Controp Precision Technologies Ltd.

- FLIR Systems Inc.

- Panasonic Corporation

- DST Control

- Sony Corporation

The global drone camera market is segmented as follows:

By Type

- SD Camera

- HD Camera

By Application

- Thermal Imaging

- Photography & Videography

- Surveillance

By Resolution

- 12 MP

- 12 to 20 MP

- 20 to 32 MP

- 32 MP and above

By End User

- Military

- Commercial

- Homeland Security

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

An embedded device in a drone that records films or takes pictures while the drone is in flight is called a drone camera. Drone cameras are employed for several purposes, such as thermal imaging, product and food delivery, and area-specific surveillance. The need for high resolution cameras put in drones—cameras that can capture high-quality images from a wider angle—has increased due to the growing usage of drones in numerous industries. The governments of several nations have also been able to enter into collaborations with drone and component makers like DJI and GoPro Technologies Ltd. to offer better and more modern products, which has helped the drone camera market grow internationally, due to increases in defense spending.

The drone camera market is being driven by several factors including growing investment, technological advancements, rising government initiatives and many others.

According to the report, the global market size was worth around USD 12.36 billion in 2023 and is predicted to grow to around USD 53.48 billion by 2032.

The global drone camera market is expected to grow at a CAGR of 17.68% during the forecast period.

The global drone camera market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market due to the rising government initiatives.

The global drone camera market is dominated by players like Aerialtronics DV BV, GoPro, Inc., Canon Inc., Garmin Ltd., DJI, Controp Precision Technologies Ltd., FLIR Systems, Inc., Panasonic Corporation, DST Control and Sony Corporation among others.

The drone camera market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed