E-Commerce Automotive AfterMarket Industry Market Size, Share, Trends, Growth and Forecast 2032

E-Commerce Automotive Aftermarket Industry: By Product Type (Parts & Components, Maintenance & Repair Products, Performance Parts, Accessories, And Car Care Products Segments), By Vehicle Type (Passenger Cars, Atvs & Utvs, Commercial Vehicles, And Motorcycle Segments. Apparently, The Passenger Cars Segment), By Customer Type (Do-it-yourself Enthusiasts, Oems, Professional Mechanics, And Fleet Owners Segments), And By Region: Global Industry Perspective, Market Size, Statistical Research, Comprehensive Analysis, Historical Trends, and Forecasts, 2024 - 2032

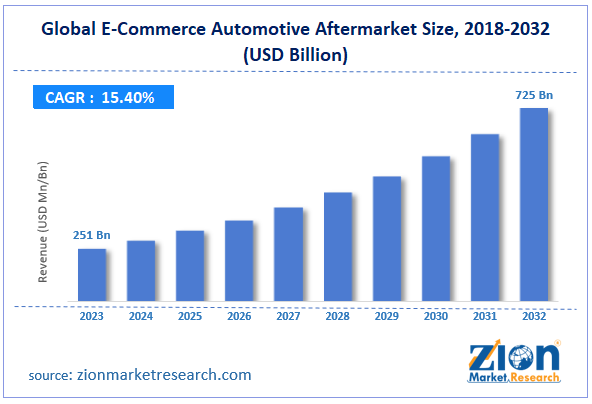

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 251 Billion | USD 725 Billion | 15.4% | 2023 |

E-Commerce Automotive Aftermarket Industry Prospective:

The global e-commerce automotive aftermarket size was evaluated at $251 billion in 2023 and is slated to hit $725 billion by the end of 2032 with a CAGR of nearly 15.4% between 2024 and 2032.

E-Commerce Automotive Aftermarket: Overview

The e-commerce automotive aftermarket sector includes selling automotive components, accessories, and after-sale services for vehicles that include servicing engine parts and car parts. Apart from this, eBay and Amazon are online market spaces offering a slew of products, customer reviews of automotive, and comparison of prices of different automotive. A large number of OEMs (Original Equipment Manufacturers) are making direct sales of automotive to customers.

Key Insights

- As per the analysis shared by our research analyst, the global e-commerce automotive aftermarket is projected to expand annually at the annual growth rate of around 15.4% over the forecast timespan (2024-2032)

- In terms of revenue, the global e-commerce automotive aftermarket size was evaluated at nearly $251 billion in 2023 and is expected to reach $725 billion by 2032.

- The global e-commerce automotive aftermarket is anticipated to grow rapidly over the forecast timespan owing to a prominent surge in the utilization of smartphones, leading to a thriving mobile commerce sector along with the introduction of new subscription service models in the automotive sector.

- In terms of product type, the performance parts segment is slated to register the highest CAGR over the forecast period.

- Based on vehicle type, the passenger car segment is predicted to contribute majorly towards segmental space in the upcoming years.

- Based on customer type, the do-it-yourself enthusiasts segment is predicted to dominate the segmental growth in the ensuing years.

- Region-wise, the European e-commerce automotive aftermarket is projected to register the fastest CAGR during the projected timespan.

Request Free Sample

Request Free Sample

E-Commerce Automotive Aftermarket: Growth Factors

A humongous popularity of iPhones and smartphones will scale up the global market expansion over analysis timeline

A prominent surge in the utilization of smartphones leading to a thriving mobile commerce sector along with the introduction of new subscription service models in the automotive sector are a few of the factors that will drive the global e-commerce automotive aftermarket trends. Apart from this, innovations in 3D printing systems leading to the production of customized automotive components are likely to augment the growth scope of the global market.

Moreover, an increase in the per capita income has transformed into an increment in the purchase of automotive aftermarket products by customers, thereby culminating in the humongous growth of the market globally. An increase in product promotions on social media along with a surge in influencer marketing activities will embellish the rate of growth for the global market.

E-Commerce Automotive Aftermarket: Restraints

Growing purchase of counterfeit components of vehicles can retard the global industry expansion over 2024-2032

Easy availability of duplicate automotive products from online purchase as well as tough competition from conventional brick-and-mortar retailers can restrict the expansion of the e-commerce automotive aftermarket. Apart from this, online shopping deprives consumers of physically inspecting the products, which can severely limit the online purchase of vehicle components.

E-Commerce Automotive Aftermarket: Opportunities

Huge utilization of data analytics for determining customer trends will generate new vistas of growth for the global market

Breakthroughs in additive manufacturing activities that facilitate the manufacture of personalized vehicle parts and automotive accessories on demand can open new growth avenues for the global e-commerce automotive aftermarket. Large-scale use of data analytics in automotive as well as e-commerce sectors to understand consumer preferences can help firms gain a competitive edge over competitors, thereby multiplying the expansion of the market globally.

E-Commerce Automotive Aftermarket Market: Challenges

Huge prices of automotive parts can deter the growth of the global industry over forecast period

Timely and effective delivery of automotive components, particularly heavy items, is projected to severely impact the expansion of the global e-commerce automotive aftermarket. Moreover, challenges faced by OEMs and retailers in returning, replacing, or exchanging automotive items can pose a huge threat to the growth path of the global industry.

E-Commerce Automotive Aftermarket Market: Segmentation

The global e-commerce automotive aftermarket is divided into product type, vehicle type, customer type, and region.

In terms of product type, the e-commerce automotive aftermarket across the globe is segmented into parts & components, maintenance & repair products, performance parts, accessories, and car care products segments. Apparently, the performance parts segment, which amassed nearly 66% of the global market revenue in 2023, is projected to register the highest gains within the next couple of years owing to an increase in the number of car enthusiasts eager to improve their vehicle performance.

Based on the vehicle type, the global e-commerce automotive aftermarket is segmented into passenger cars, ATVs & UTVs, commercial vehicles, and motorcycle segments. Apparently, the passenger cars segment, which led the global industry in 2023, is anticipated to account substantially toward the segmental surge in the forthcoming years. This can be ascribed to the growing purchase of passenger cars as they provide extensive personalization and performance upgrades as well as aesthetic advancements to customers. Moreover, owners of passenger cars make use of reputed e-commerce web portals for purchasing automotive aftermarket products.

On the basis of customer type, the global e-commerce automotive aftermarket is sectored into do-it-yourself enthusiasts, OEMs, professional mechanics, and fleet owners segments. Moreover, do-it-yourself enthusiasts segment, which led the deployment mode segment in 2023, is predicted to lead the segmental sphere in the forecast timeline. Moreover, the segmental expansion can be due to reduced costs and flexibility of cloud-based deployment mode of e-commerce automotive aftermarket systems.

E-Commerce Automotive Aftermarket: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | E-Commerce Automotive Aftermarket |

| Market Size in 2023 | USD 251 Billion |

| Market Forecast in 2032 | USD 725 Billion |

| Growth Rate | CAGR of 15.4% |

| Number of Pages | 217 |

| Key Companies Covered | Advance Auto Parts, RockAuto LLC, Amazon.com Inc., AutoZone Inc., Flipkart.com, Alibaba Group Holding Limited, CARiD.com, O’Reilly Auto Parts, eBay Inc., National Automotive Parts Association, U.S. Auto Parts Network Inc., and others. |

| Segments Covered | By Product Type, By Vehicle Type, By Customer Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

E-Commerce Automotive Aftermarket Market: Regional Insights

Asia-Pacific is likely to maintain leading status in the global market over the projected time interval

Asia-Pacific, which accounted for nearly 52% of the global e-commerce automotive aftermarket size in 2023, is likely to establish a number one position in the global market in the upcoming years. In addition, the regional market evolution in the next couple of years can be credited to favorable government laws promoting digitization and e-commerce activities.

Apart from this, the robust online presence of local retail firms offering proficient automotive products & services in countries such as India and China will propel the regional market growth. Automotive firms in Japan and South Korea are holding competitive advantage over their counterparts based in Europe and North America, thereby further contributing to the growth of the market in the region.

The European e-commerce automotive aftermarket is expected to account for the highest gains annually in the upcoming years. The progression of the industry in Europe can be owing to surging web penetration, an increase in per capita income, and altering customer tastes in countries such as Denmark, Italy, the UK, Sweden, and Germany.

Moreover, European OEMs, particularly those based in Sweden, manufacture premium cars such as Skoda and Mercedes-Benz, targeting high-income groups and this will add sizably to the market revenue in the continent.

Key Developments

- In September 2024, Continental AG declared that it is expanding its automotive aftermarket product portfolio by adding new products, such as spare components for steering & chassis and steering, along with radar sensors, high-pressure fuel pumps & cameras in automotive. These products are also available in online retail stores such as Amazon and eBay.

- In July 2024, Uno Minda, a key supplier of automotive components in India, introduced a new array of D-90 horns for Indian automotive aftermarkets. These horns are available from both online as well as physical retail stores in India.

- In December 2023, ZF Aftermarket increased its product line by launching over 770 new components for passenger cars in North America.

E-Commerce Automotive Aftermarket Market: Competitive Space

The global e-commerce automotive aftermarket profiles key players such as:

- Advance Auto Parts

- RockAuto LLC

- Amazon.com Inc.

- AutoZone Inc.

- Flipkart.com

- Alibaba Group Holding Limited

- CARiD.com

- O’Reilly Auto Parts

- eBay Inc.

- National Automotive Parts Association

- U.S. Auto Parts Network Inc.

The global e-commerce automotive aftermarket is segmented as follows:

By Product Type

- Parts & Components

- Maintenance & Repair Products

- Performance Parts

- Accessories

- Car Care Products

By Vehicle Type

- Passenger Cars

- ATV & UTV

- Commercial Vehicles

- Motorcycles

By Customer Type

- Do-It-Yourself Enthusiasts

- OEMs

- Professional Mechanics

- Fleet Owners

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The e-commerce automotive aftermarket sector includes the sale of automotive components, accessories, and after-sales services for vehicles, including servicing of engine parts and car parts.

The global e-commerce automotive aftermarket's growth over the forecast period can be attributed to an increase in per capita income, which has transformed into an increment in customers' purchases of automotive aftermarket products.

According to a study, the global e-commerce automotive aftermarket size was $251 billion in 2023 and is projected to reach $725 billion by the end of 2032.

The global e-commerce automotive aftermarket is anticipated to record a CAGR of nearly 15.4% from 2024 to 2032.

Which region will record the highest rate of growth in the global e-commerce automotive aftermarket?

European e-commerce automotive aftermarket is set to register the fastest CAGR over the forecasting timeframe owing to surging web penetration, increased per capita income, and altering customer tastes in countries such as Denmark, Italy, the UK, Sweden, and Germany. Moreover, European OEMs, particularly those based in Sweden, manufacture premium cars such as Skoda and Mercedes Benz, targeting high-income groups, and this will add sizably to the market revenue in the continent.

The global e-commerce automotive aftermarket is led by players such as Advance Auto Parts, RockAuto, LLC, Amazon.com, Inc., AutoZone Inc., Flipkart.com, Alibaba Group Holding Limited, CARiD.com, O’Reilly Auto Parts, eBay Inc., National Automotive Parts Association, and U.S. Auto Parts Network, Inc.

The global e-commerce automotive aftermarket report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, and value chain analysis.

Choose License Type

List of Contents

E-Commerce Automotive AftermarketIndustry Prospective:E-Commerce Automotive Aftermarket: OverviewKey InsightsE-Commerce Automotive Aftermarket: Growth FactorsE-Commerce Automotive Aftermarket: RestraintsE-Commerce Automotive Aftermarket: OpportunitiesE-Commerce Automotive Aftermarket ChallengesE-Commerce Automotive Aftermarket SegmentationE-Commerce Automotive Aftermarket: Report ScopeE-Commerce Automotive Aftermarket Regional InsightsKey DevelopmentsE-Commerce Automotive Aftermarket Competitive SpaceThe global e-commerce automotive aftermarket is segmented as follows:By RegionHappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed