Global E-KYB Market Size, Share, Growth Analysis Report - Forecast 2034

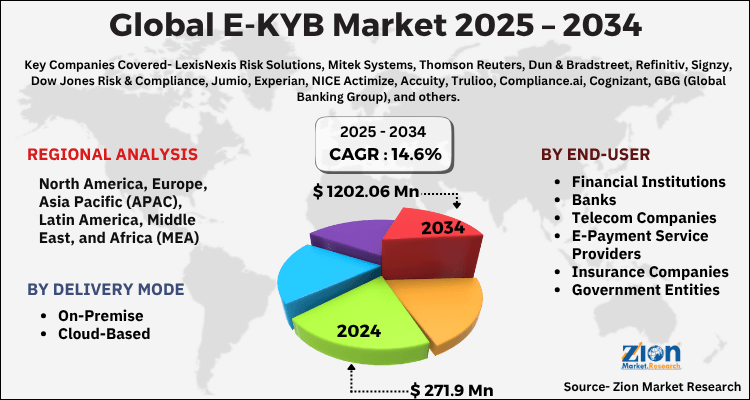

E-KYB Market By End-User (Financial Institutions, Banks, Telecom Companies, E-Payment Service Providers, Insurance Companies, Government Entities, Others), By Delivery Mode (On-Premise, Cloud-Based), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 271.9 Million | USD 1202.06 Million | 14.6% | 2024 |

E-KYB Market: Industry Perspective

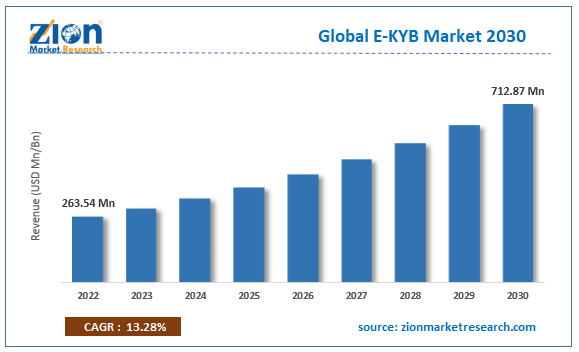

The global E-KYB market size was worth around USD 271.9 Million in 2024 and is predicted to grow to around USD 1202.06 Million by 2034 with a compound annual growth rate (CAGR) of roughly 14.6% between 2025 and 2034. The report analyzes the global E-KYB market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the E-KYB industry.

E-KYB Market: Overview

E-KYB is the abbreviated form for the electronic Know Your Business ((KYB) model. In general, the KYB process is part of a larger regime that focuses on counter-terrorist financing (CTF) and anti-money laundering (AML) activities. KYB is designed to thwart any attempt at financing or undertaking services from entities that are harmful to the social and economic benefit of the general population and work against national security. KYB, when compared to the know-your-customer (KYC) policy, is relatively new since governments have started realizing that companies and financial institutes are also used by terrorist and extremist groups to finance their activities.

e-KYB is the digitization of the Know Your Business model that helps to ensure that a certain business entity is legitimate business following regional laws and business guidelines. Additionally, the process is also used to ascertain the exact beneficial ownership of the companies participating in the transaction. The process of e-KYB typically entails submitting official company documents along with relevant licenses and registered addresses. The complete names of owners and managers. The data collected is checked with other connected institutes such as banks along with cross-checking company registers. Other important attributes are considered to determine a company’s risk profile before going ahead with the business dealing or transaction.

Key Insights

- As per the analysis shared by our research analyst, the global E-KYB market is estimated to grow annually at a CAGR of around 14.6% over the forecast period (2025-2034).

- Regarding revenue, the global E-KYB market size was valued at around USD 271.9 Million in 2024 and is projected to reach USD 1202.06 Million by 2034.

- The E-KYB market is projected to grow at a significant rate due to rising digital transformation in banking, increasing regulatory compliance requirements, growing demand for fraud prevention, and expanding adoption of AI-driven verification solutions.

- Based on End-User, the Financial Institutions segment is expected to lead the global market.

- On the basis of Delivery Mode, the On-Premise segment is growing at a high rate and will continue to dominate the global market.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

E-KYB Market: Growth Drivers

Increasing incidences of money laundering activities to drive market growth

The global e-KYB market is projected to grow owing to the increasing number of cases registered worldwide related to illegal financial transactions and money laundering. These illicit financial transactions are one of the greatest threats to the global economy as dealings worth billions of dollars take place without any informing official governing bodies. Since there is no official data or record of such dealings, the money exchanged can be used for illegal activities such as smuggling and terrorism. As per official reports, the Indian economy loses over USD 15 billion every year due to money laundering. The European Union Agency for Criminal Justice Cooperation (Eurojust) has recorded more than 3000 cross-border money laundering cases in the last 6 years. In 2021, around 600 cases were reported. In July 2023, Saudi official authorities wrapped up a case involving illegal monetary transactions worth USD 1.07 million in cash. The officials have arrested 23 people in this case. Money laundering is not specific to a certain region. It is spread across the globe and in most cases involves cross-border dealings.

The impact of money laundering goes beyond one dimension since it impacts national growth and security at the same time. Illegal or unjustified money becoming pumped into an economy can lead to economic distortion. It also impacts regional credibility and is known to be a leading cause of bureaucratic or political corruption. As the number of currency-washing cases is on the rise, several governments have taken up essential programs to curb such incidents. e-KYB is a crucial part of these programs where no transactions are allowed before following due diligence in terms of knowing the exact origins of the parties involved in financial dealings.

E-KYB Market: Restraints

Concerns over the risk of being exposed to cybercrimes may limit market growth

E-KYB involves the use of digital systems to share company-related information. The data shared includes confidential information related to business personnel and financial standing such as profit and loss and other data. With any digital technology, the risk of cybercrime is always high, and e-KYB systems are no exception. This could impact the e-KYB industry growth. However, the risk is even higher in electronic-Know Your Business due to the higher sensitivity of data involved in these conversations. Hackers are becoming exceedingly technologically advanced. They are steadily evolving to counteract all technology-based developments and systems meant to help regulatory bodies. As per official reports, more than 494 million ransomware attacks were reported in 2024 alone across global organizations.

E-KYB Market: Opportunities

Increased bank transactions to create higher growth opportunities

Banks are the most vulnerable to money laundering and terrorist financing activities. Banks across the globe deal with multiple clients every day and transactions worth over a billion dollars take place every hour. With globalization and surging cross-border financial dealings, banks form the backbone of a national economy. With the increasing number of bank-led transactions ranging from a few thousand dollars to multi-billion dollars, the scope of the e-KYB market is expanding rapidly. Banks have to consistently work toward mitigating any form of financial risk. They also have to invest in detecting and reporting fraudulent activities along with ensuring complete compliance with regional laws and regulations. e-KYB can help businesses make the right decisions in optimum time. The digital method to ensure business credibility has the potential to improve the overall operational efficiency of a bank.

Growing awareness and strategic partnerships between companies to promote further growth

With the growing awareness of the benefits of e-KYB for all the parties involved in business transactions, the demand for e-KYB is likely to reach new heights. In December 2020, SEON, a company that fights against fraud, announced a partnership with TruNarrative, a UK-based RegTech platform. The latter can now use extensive data collected by SEON to make informed onboarding-related decisions. TruNarrative conducts extensive transactional monitoring, customer onboarding, financial crime detection, and other compliance processes.

E-KYB Market: Challenges

Providing efficient results in emerging countries could be a challenge

The global e-KYB market players are expected to face challenges when entering new markets, especially emerging economies. Most of the countries with volatile political structures do not have accurate data related to company ownership and financial recording. Moreover, in cases where governments are corrupt with no proper implementation policies for businesses to record accurate company information, e-KYB may not be as effective as expected.

E-KYB Market: Segmentation

The global e-KYB market is segmented based on end-user, delivery mode, and region.

Based on End-User, the global market segments are financial institutions, banks, telecom companies, e-payment service providers, insurance companies, government entities, and others. In 2024, the highest-performing segment was banks mainly due to the institutes being the hub for all forms of small and large-scale transactions. Major national banks work with some of the largest business corporations putting them at a higher risk of fraudulent activities. In the financial year 2021 to 2022, Indian banks registered around 229 frauds per day.

Based on Delivery Mode, the e-KYB industry segments are on-premise and cloud-based. In 2024, the highest growth was observed in the cloud-based segment since most of the participating companies generally tend to collaborate with e-KYB service providers to leverage the benefits of their systems. Taking assistance from third parties has higher benefits as companies do not have to invest in developing and maintaining in-house systems. Moreover, e-KYB service providers work with the aid of skilled professionals and experts in the field of information technology and regional laws. Around 90% of the companies in the world use some form of cloud services.

E-KYB Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | E-KYB Market |

| Market Size in 2024 | USD 271.9 Million |

| Market Forecast in 2034 | USD 1202.06 Million |

| Growth Rate | CAGR of 14.6% |

| Number of Pages | 226 |

| Key Companies Covered | LexisNexis Risk Solutions, Mitek Systems, Thomson Reuters, Dun & Bradstreet, Refinitiv, Signzy, Dow Jones Risk & Compliance, Jumio, Experian, NICE Actimize, Accuity, Trulioo, Compliance.ai, Cognizant, GBG (Global Banking Group), and others. |

| Segments Covered | By End-User, By Delivery Mode, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

E-KYB Market: Regional Analysis

North America to witness the highest growth rate during the upcoming period

The global e-KYB market will witness the highest growth rate in North America with the US contributing the highest regional share. The principal reason behind higher growth is the presence of major private banks and financial institutions in New York. This includes entities such as JPMorgan Chase, Bank of America, Capital One, Well Fargo, Goldman Sachs, and many more. These banks cater to the needs of the majority of businesses across the globe. The US, on the other hand, is one of the most dominant global leaders. The US economy currently stands at USD 27 trillion making it one of the most targeted countries in terms of bank fraud and money laundering.

The world’s biggest bank at the time, Wachovia Bank allowed the Mexico cartel to launder money worth USD 390 billion between 2004 and 2007. This incident is considered one of the world’s most shocking money laundering cases in the world. These factors have led to more promptness among financial institutions and banks to adopt e-KYB measures to protect themselves, their companies, and the regional economy in general against fraudulent monetary transactions. Asia-Pacific is expected to grow at a rapid rate. It is home to some of the fastest growing economies and as foreign investments continue to rise, regional governments and companies must mitigate their risks to prevent harmful financial dealings.

E-KYB Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the E-KYB market on a global and regional basis.

The global E-KYB market is dominated by players like:

- LexisNexis Risk Solutions

- Mitek Systems

- Thomson Reuters

- Dun & Bradstreet

- Refinitiv

- Signzy

- Dow Jones Risk & Compliance

- Jumio

- Experian

- NICE Actimize

- Accuity

- Trulioo

- Compliance.ai

- Cognizant

- GBG (Global Banking Group)

The global E-KYB market is segmented as follows;

By End-User

- Financial Institutions

- Banks

- Telecom Companies

- E-Payment Service Providers

- Insurance Companies

- Government Entities

- Others

By Delivery Mode

- On-Premise

- Cloud-Based

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

E-KYB is the abbreviated form for the electronic Know Your Business ((KYB) model. In general, the KYB process is part of a larger regime that focuses on counter-terrorist financing (CTF) and anti-money laundering (AML) activities.

The global E-KYB market is expected to grow due to increasing incidences of money laundering activities, rising demand for digital banking services, and the need for enhanced fraud prevention measures.

According to a study, the global E-KYB market size was worth around USD 271.9 Million in 2024 and is expected to reach USD 1202.06 Million by 2034.

The global E-KYB market is expected to grow at a CAGR of 14.6% during the forecast period.

Asia-Pacific is expected to dominate the E-KYB market over the forecast period.

Leading players in the global E-KYB market include LexisNexis Risk Solutions, Mitek Systems, Thomson Reuters, Dun & Bradstreet, Refinitiv, Signzy, Dow Jones Risk & Compliance, Jumio, Experian, NICE Actimize, Accuity, Trulioo, Compliance.ai, Cognizant, GBG (Global Banking Group), among others.

The report explores crucial aspects of the E-KYB market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed