Electric Motorcycle Market Size, Share, Industry Analysis, Trends, Growth, Forecasts, 2032

Electric Motorcycle Market By Type (Lead-Acid, Lithium-Ion, and Others), By End-Use (Commercial and Personal), By Drive (Hub-Motor, Chain Drive, and Belt Drive), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

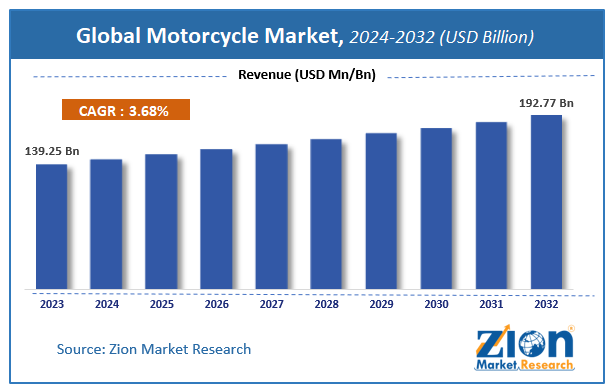

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 139.25 Billion | USD 192.77 Billion | 3.68% | 2023 |

Motorcycle Market Insights

According to Zion Market Research, the global Motorcycle Market was worth USD 139.25 Billion in 2023. The market is forecast to reach USD 192.77 Billion by 2032, growing at a compound annual growth rate (CAGR) of 3.68% during the forecast period 2024-2032. The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Motorcycle industry over the next decade.

Electric Motorcycle Market: Overview

Electric motorcycles are a part of the larger electric vehicle (EV) industry operating in the global automobile market. Electric motors are powered by electric batteries with two or three wheels. The batteries are rechargeable and can power the vehicle to cover significant distances without any assistance. Electric motorcycles are different from electric scooters since the latter have a step-through frame whereas the former has straddle vehicles.

In recent times, the demand for electric motorcycles has grown especially since the explosive surge in demand for EVs of all types. The market for electric motorcycles has several growth opportunities as new customers are actively seeking environmentally friendly solutions to fuel-powered automotive units. However, the market is relatively new and also faces specific challenges leading to a restricted growth rate.

Key Insights:

- As per the analysis shared by our research analyst, the global electric motorcycle market is estimated to grow annually at a CAGR of around 21.21% over the forecast period (2023-2030)

- In terms of revenue, the global electric motorcycle market size was valued at around USD 30.87 billion in 2022 and is projected to reach USD 143.83 billion by 2030.

- The electric motorcycle market is projected to grow at a significant rate due to the surging fuel prices and supply chain uncertainty

- Based on type segmentation, lithium-ion was predicted to show maximum market share in the year 2022

- Based on drive segmentation, hub-motor was the leading segment in 2022

- On the basis of region, Asia-Pacific was the leading revenue generator in 2022

Electric Motorcycle Market: Growth Drivers

Surging fuel prices and supply chain uncertainty could encourage more buyers to opt for electric motorcycle

The global electric motorcycle market is expected to grow owing to the increasing fuel prices globally as well as the rising uncertainty over the consistent supply of fuel such as petrol and diesel. Fuel prices are changing every day in some parts of the world while other regions are also showing similar trends. In addition to this, the inflation rate is reaching new levels leading to higher cost of living and other expenses. This has caused more people to seek products and services that are cost-efficient and offer excellent performance.

Electric motorcycles are powered using electricity and they have zero dependency on fuel. The batteries can be charged at regular intervals and also perform comparable to traditional motorcycles. In addition to this, consumer awareness about the environmental impact of fuel-powered vehicles is improving leading to higher demand for electric variants of existing automobile types. For instance, a recent report indicated that nearly 70.1% of all potential car buyers in India are open to investing in EVs in the coming years.

Growing government subsidies on EVs could act as growth drivers

The global pollution level has grown at an unprecedented level. As per ClientEarth, around 89% of carbon dioxide (CO2) emissions in 2018 were caused by the fossil fuel industry. Vehicle emissions are considered the largest contributor to environmental pollution, especially in urban areas. Most of the metropolitan cities globally have extremely high Air Quality Index (AQI).

In January 2023, several cities in India reported high levels of AQI for several months which was also associated with deteriorating health conditions of the general population. Governments and environmental agencies globally are launching initiatives such as consumer awareness programs, tax benefits, and subsidies to buyers of EVs including the products available in the global electric motorcycle market.

Electric Motorcycle Market: Restraints

High cost of electric motorcycles to restrict market expansion

The global industry for electric motorcycles is projected to be restricted due to the high cost of electric motorcycles. The average price of these electric vehicles is between USD 5000 to USD 10000 depending on the model and the brand. Fuel-powered vehicles are relatively cheaper and hence more affordable. Furthermore, one of the most concerning technical growth restrictions is the limited availability of electric motorcycle repair service providers.

Unlike traditional motorcycles that enjoy large-scale availability of skilled technicians and mechanics, electric motorcycles use novel technology and there is a significantly large gap between the demand and supply of skilled repair workers. This is prompting fewer people to buy electric motorcycles.

Electric Motorcycle Market: Opportunities

Lucrative lineup of new product launches in the coming years could push the market growth rate to new heights

The global electric motorcycle market is expected to gain more popularity due to the presence of an extensive and lucrative lineup of new electric motors in the coming years. EV manufacturers are rapidly adapting product diversification strategies. They are working toward tapping into every possible market segment including avid motorcyclists.

In December 2023, Honda Global, a leading player in the automotive industry, announced that it would launch a new electric motorcycle in the Indian market in 2024. The new motor vehicle will be equivalent to existing fuel-run bikes with 110-125 cubic centimeters (CC) engine power. The move is a result of the new electrification strategy adopted by Honda Motors and the company is expected to invest USD 3.4 billion by the end of 2030 to achieve the goal.

In November 2023, Orxa-Energies, an India-based electric mobility start-up, launched a Mantis performance electric motorcycle with a starting price of INR 3.6 lakhs. The motorcycle is coupled with a 1.3 kW charger and the first 10000 customers will be allowed to book the bike at a token price of INR 10,000. In August 2023, Ola Electric unveiled 4 new concept electric motorcycles under different brand names. The new bikes will be launched in 2024.

Ongoing innovations to improve EV battery technology will be helpful in pushing market growth statistics

The global electric motorcycle industry is projected to gain benefits due to the ongoing investment in EV battery innovation and advancement. In June 2023, multinational automotive company Toyota announced that it would introduce solid-state and highly advanced EV batteries that can significantly impact driving range and overall vehicle performance. Solid-state batteries replace liquid electrolytes with solid options thus improving battery safety features as well.

Electric Motorcycle Market: Challenges

Competition from electric scooters and lack of infrastructure challenge market expansion

The global electric motorcycle market is expected to be challenged by the increasing competition from the growing sale of electric scooters. They offer higher applications due to their unisex nature.

In addition to this, the lack of infrastructure in terms of charging stations and the growing incidence of vehicle fires especially in the EV segment may limit production adoption.

Electric Motorcycle Market: Segmentation

The global electric motorcycle market is segmented based on type, end-use, and region.

Based on type, the global market divisions are lead-acid, lithium-ion, and others. In 2022, the highest growth was observed in the lithium-ion segment. In 2022, it dominated more than 90.01% of the total market share. Lithium-ion batteries are most preferred in the EV segment since they offer exceptional results. Furthermore, the manufacturing ecosystem for lithium-ion batteries is well established leading to easier access to raw materials required for manufacturing electric motorcycles. Lead-acid batteries do not offer high performance as they discharge quickly and do not have high load-carrying capacity.

Based on end-use, the global electric motorcycle market is divided into commercial and personal.

Based on drive, the global market is divided into hub-motor, chain drive, and belt drive. In 2022, around 48.2% of the market share was led by the hub-motor segment since they offer several advantages. Some of them are lower cost and easier to install. During the forecast period hub motors are likely to continue the growth trend especially since they have relatively lower maintenance expenses. On the other hand, they can also be manufacturers using limited components which adds to the overall product appeal.

Motorcycle Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Motorcycle Market |

| Market Size in 2023 | USD 139.25 Billion |

| Market Forecast in 2032 | USD 192.77 Billion |

| Growth Rate | CAGR of 3.68% |

| Number of Pages | 110 |

| Key Companies Covered | Bajaj Auto Ltd., Dayun Group, Benelli QJ, Ducati Motor Holding S.p.A., Bayerische Motoren Werke (BMW) AG, Harley-Davidson, Inc., Eicher Motors Limited, Honda Motor Co., Ltd., Hero MotoCorp Ltd., Piaggio & C. SpA, KTM AG, Triumph Motorcycles Ltd., Suzuki Motor Corporation, Vmoto Limited, TVS Motor Company Ltd., Zero Motorcycles, Inc., and Yamaha Motors Co., Ltd |

| Segments Covered | By Types And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Electric Motorcycle Market: Regional Analysis

Asia-Pacific to dominate market growth rate during the projection period

The global electric motorcycle market is expected to witness the highest growth rate in Asia-Pacific. Around 82.5% of the global revenue in 2022 was registered in Asia-Pacific. The regional countries have a higher demand for vehicles with two or three wheels. The high population density in emerging Asian countries such as China and India leads to a higher preference for easy-to-navigate vehicles such as motorcycles. In addition to this, China has become the world’s leading producer and exporter of electric vehicles including motorcycles.

In December 2022, China-based Davinci, a prominent player in the electric motorcycle segment, announced the launch of the DC100 electric motorcycle. The company aims to compete with traditionally available 1000 CC motorbikes with its offering. In addition to this, Japanese automobile manufacturers are actively investing in improving EV battery technology which is expected to provide growth momentum to the regional market. Japan, South Korea, and China enjoy a well-established infrastructure that supports extensive adoption of EVs.

India, on the other hand, is one of the fastest-emerging markets with high demand for electric motorbikes. The regional government is focused on improving EV market investments by creating lucrative investment schemes for international players as well as domestic companies.

Electric Motorcycle Market: Competitive Analysis

The global electric motorcycle market is led by players like:

- Energica Motor Company

- Zero Motorcycles

- Cake

- Harley-Davidson (LiveWire)

- NIU Technologies

- Tacita

- Lightning Motorcycle

- Damon Motorcycles

- Sur-Ron

- Evoke Motorcycles

- Vespa Elettrica (Piaggio Group)

- Johammer

- Arcimoto

- Revolt Motors

- KTM (Freeride E-XC)

The global electric motorcycle market is segmented as follows:

By Type

- Lead-Acid

- Lithium-Ion

- Others

By End-Use

- Commercial

- Personal

By Drive

- Hub-Motor

- Chain Drive

- Belt Drive

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Electric motorcycles are a part of the larger electric vehicle (EV) industry operating in the global automobile market.

The global electric motorcycle market is expected to grow owing to the increasing fuel prices globally as well as the rising uncertainty over the consistent supply of fuel such as petrol and diesel.

According to study, the global electric motorcycle market size was worth around USD 30.87 billion in 2022 and is predicted to grow to around USD 143.83 billion by 2030.

The CAGR value of electric motorcycle market is expected to be around 21.21% during 2023-2030.

The global electric motorcycle market is expected to witness the highest growth rate in Asia-Pacific.

The global electric motorcycle market is led by players like Energica Motor Company, Zero Motorcycles, Cake, Harley-Davidson (LiveWire), NIU Technologies, Tacita, Lightning Motorcycle, Damon Motorcycles, Sur-Ron, Evoke Motorcycles, Vespa Elettrica (Piaggio Group), Johammer, Arcimoto, Revolt Motors, and KTM (Freeride E-XC) among others.

The report explores crucial aspects of the electric motorcycle market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed