Electric Stacker Market Size, Share, Analysis, Trends, Growth Report, 2032

Electric Stacker Market By Application (Large Supermarket and Warehouses), By Type (Without the Pilot Platform and With the Pilot Platform), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

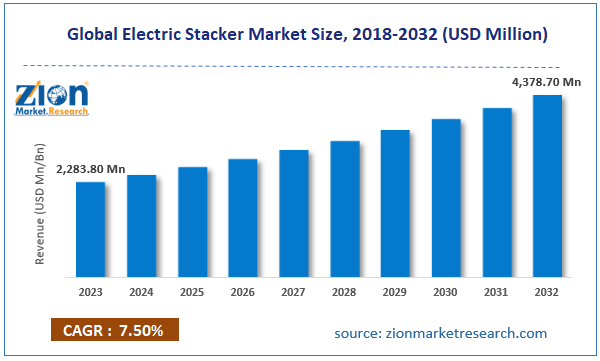

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2,283.80 Million | USD 4,378.70 Million | 7.50% | 2023 |

Electric Stacker Industry Prospective:

The global electric stacker market size was worth around USD 2,283.80 million in 2023 and is predicted to grow to around USD 4,378.70 million by 2032 with a compound annual growth rate (CAGR) of roughly 7.50% between 2024 and 2032.

Electric Stacker Market: Overview

An electric stacker is a battery-operated material handling tool. It is also known as an electric pallet stacker since it is used for uplifting and storing pallet loads with minimal human intervention. Electric stackers are considered as a replacement or substitute for forklifts since the electric form of the latter unit can be expensive. Electric stackers have become extremely common in large warehouses and expansive shopping centers. They have proven beneficial in reducing human stress since manual labor can be eliminated when electric stackers are used. This allows companies to make better use of human resources as mundane tasks such as pallet lifting and placing can be taken care of by the electric stacker.

Warehouse safety is greatly improved with the implementation of electric stackers as the risk of accidents is greatly reduced. Apart from the several associated advantages, the tool is also prone to malfunctions and thus associated with specific disadvantages. For instance, since the stackers are battery operated, they have to be duly charged or there is an involved risk of the tool becoming non-operational during a certain activity. Moreover, electric stackers can be expensive, especially for companies with limited budgets. The industry for electric stackers faces tough competition from other more functional alternatives.

Key Insights:

- As per the analysis shared by our research analyst, the global electric stacker market is estimated to grow annually at a CAGR of around 7.50% over the forecast period (2024-2032)

- In terms of revenue, the global electric stacker market size was valued at around USD 2,283.80 million in 2023 and is projected to reach USD 4,378.70 million, by 2032.

- The market is projected to grow at a significant rate due to the rising number of supermarkets and hypermarkets

- Based on application segmentation, large warehouses were predicted to show maximum market share in the year 2023

- Based on type segmentation, the pilot platform was the leading segment in 2023

- On the basis of region, Asia-Pacific was the leading revenue generator in 2023

Request Free Sample

Request Free Sample

Electric Stacker Market: Growth Drivers

Rising number of supermarkets and hypermarkets across the globe will aid in market growth

The global electric stacker market is expected to grow due to the growing number of supermarkets and hypermarkets across the globe. Supermarkets are large goods storing units where customers can view and select all forms of everyday products from a large range of options. Supermarkets house almost all categories of items that a person may need for comfortable living including food, clothing, shoes, accessories, home decor, furniture, pet items, and other essentials. The urban population is heavily reliant on all-product stores such as supermarkets for basic needs and wants. In addition to this, since the number of product options is extensive in supermarkets, customers have a better chance of grabbing product discounts and other forms of monetary or nonmonetary benefits. Supermarkets are also beneficial for the sellers as they can tap into a broader group of customers under one roof. The last decade has witnessed a steady increase in the number of supermarkets across the globe. Apart from the regional players, the international supermarket brands are also undertaking expansion opportunities by collaborating with domestic players or building supermarket retail chains in emerging economies.

In September 2023, US-based furniture retail company, IKEA, announced that it plans to increase the number of stores in China. In the next three years, the company will invest 6.3 billion yuan in the Chinese economy as per official sources. Supermarkets and retail giants are working on incorporating automated solutions to improve product outflow and deliver better customer experience. Electric stackers are efficient automated tools that can easily manage tasks such as the movement of objects within a confined space. As per the Food Industry Association (FMI), 2022 witnessed a total technological investment of USD 13 billion by food retailers thus indicating the popularity of automated solutions among large-scale retail firms.

Electric Stacker Market: Restraints

Risk of the battery dying out in between activities may lead to hesitancy among potential buyers

The global electric stacker market is expected to be restricted due to the volatile nature of the electric tool. Stackers that operate on stored energies in the form of electric batteries are at risk of failure because of insufficient battery charge. While companies working with electric stackers have protocols that ensure the stackers are routinely charged, there is always a scope for human error.

In addition to this, the electric vehicles market does not enjoy the existence of a well-established ecosystem, unlike the alternate solutions. For example, a lack of access to continuous electricity in a large part of the world, particularly in underdeveloped economies. In such situations, electric stackers may not perform as per expectations thus leading to a limited market growth rate.

Electric Stacker Market: Opportunities

Solution providers offering new and improved products to the customers may attract more consumers

The global electric stacker industry is expected to benefit from the ongoing innovation strategy adopted by the market players. Companies are offering new and improved products to the customers including options to customize solutions. Consumers using electric stackers may have specific needs and are looking for solutions that are not only cost-efficient but also offer higher performance efficiency.

In December 2023, Kalmar Global, a Finnish cargo handling solutions provider, announced the launch of new electric reach stackers. The production of the new offerings commenced at the Shanghai-based manufacturing unit. The new electric reach stackers are multifunctional and can carry heavy weights.

Growing research & development (R&D) in the electric battery capacity will shift future market trends

The prospects of the global electric stacker market are expected to be brighter owing to the rise in the number of R&D activities related to electric battery power. Companies are working on delivering improved battery capacities. As per official reports Europe is projected to invest large amounts in battery storage solutions in the coming years with Italy, Ireland, and the UK leading the investments.

In March 2024, China-based EV producer Nio announced a partnership with Contemporary Amperex Technology Ltd (CATL) to develop reasonably priced electric batteries with longer shelf life.

Electric Stacker Market: Challenges

Competition from electric forklifts and the risk of human job replacement are key challenges existing in the industry

The global industry for electric stacker is expected to be challenged by the tough competition it faces from the existence of a mature competitor in the form of electric forklifts. In November 2023, Toyota Material Handling announced the launch of three novel electric forklifts showcasing that the alternate solutions enjoy equal or more consumers.

Additionally, electric stackers may not be accepted by employees since they pose the threat of replacing human job opportunities. Companies planning to invest in electric stackers must work on creating a balance between automation and human employment for the successful acceptance of automated solutions.

Electric Stacker Market: Segmentation

The global electric stacker market is segmented based on application, type, and region.

Based on application, the global market segments are large supermarkets and large warehouses. In 2023, the highest growth rate was observed in the large warehouses segment. These facilities expand over large areas that can be difficult for human resources to cover when carrying heavy loads. Electric stackers offer convenience and higher productivity. They also allow the human resources to be used for quality work. Moreover, electric stackers are known to reduce the risk of workplace accidents. However, electric stackers are expensive. The price range for the solutions is around USD 5000 to USD 8000.

Based on type, the global market segments are without the pilot platform and with the pilot platform. In 2023, the demand was higher for the pilot platform type of electric stackers. This type of solution offers space for a human to stand while the tool stacks the load. Electric stackers without the pilot platform are more automated and may cost more than their counterparts. The choice of the stacker type depends on the needs of the consumers. Stackers with higher weight capacity can carry a load of more than 5000 lbs.

Electric Stacker Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Electric Stacker Market |

| Market Size in 2023 | USD 2,283.80 Million |

| Market Forecast in 2032 | USD 4,378.70 Million |

| Growth Rate | CAGR of 7.50% |

| Number of Pages | 218 |

| Key Companies Covered | Crown Equipment Corporation, Toyota Material Handling, Linde Material Handling, Doosan Industrial Vehicle, Jungheinrich, Manitou Group, Hyster-Yale Group, Clark Material Handling Company, Nichiyu Electric Forklift, Mitsubishi Logisnext, Komatsu Ltd., EP Equipment, Hangcha Group Co. Ltd., Caterpillar Inc., Yale Materials Handling Corporation., and others. |

| Segments Covered | By Application, By Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Electric Stacker Market: Regional Analysis

Asia-Pacific to lead the way during the forecast period

The global electric stacker market is expected to witness the highest growth in Asia-Pacific during the projection period. China and India along with some other Asian countries such as Japan have been influential in placing Asia-Pacific at the number one position in terms of electric stacker production, supply, and consumption. As per official data, the total number of electric stacker shipments from China in 2023 was over 13,500. The country is the largest EV producer and seller in the world. It is also known for the advanced automation observed across facilities and industries in the country, especially the manufacturing sector.

On the other hand, China is also home to large warehouses that are used for storing inventory and final goods. In 2020, China was reported to have over 1144 million square meters of general warehouses. In June 2021, Alibaba, the country’s largest e-commerce firm, announced that it would open 10 more warehouses in the country under its fresh-food chain Freshippo. India, on the other hand, is an emerging market. The region is currently enjoying a sharp rise in the e-commerce sector along with higher demand for supermarkets and other large-scale retail chains thus contributing to the regional market growth rate.

Electric Stacker Market: Competitive Analysis

The global electric stacker market is led by players like:

- Crown Equipment Corporation

- Toyota Material Handling

- Linde Material Handling

- Doosan Industrial Vehicle

- Jungheinrich

- Manitou Group

- Hyster-Yale Group

- Clark Material Handling Company

- Nichiyu Electric Forklift

- Mitsubishi Logisnext

- Komatsu Ltd.

- EP Equipment

- Hangcha Group Co. Ltd.

- Caterpillar Inc.

- Yale Materials Handling Corporation.

The global electric stacker market is segmented as follows:

By Application

- Large Supermarket

- Warehouses

By Type

- Without the Pilot Platform

- With the Pilot Platform

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

An electric stacker is a battery-operated material handling tool. It is also known as an electric pallet stacker since it is used for uplifting and storing pallet loads with minimal human intervention.

The global electric stacker market is expected to grow due to the growing number of supermarkets and hypermarkets across the globe.

According to study, the global electric stacker market size was worth around USD 2,283.80 million in 2023 and is predicted to grow to around USD 4,378.70 million by 2032.

The CAGR value of electric stacker market is expected to be around 7.50% during 2024-2032.

The global electric stacker market is expected to witness the highest growth in Asia-Pacific during the projection period.

The global electric stacker market is led by players like Crown Equipment Corporation, Toyota Material Handling, Linde Material Handling, Doosan Industrial Vehicle, Jungheinrich, Manitou Group, Hyster-Yale Group, Clark Material Handling Company, Nichiyu Electric Forklift, Mitsubishi Logisnext, Komatsu Ltd., EP Equipment, Hangcha Group Co., Ltd., Caterpillar Inc., and Yale Materials Handling Corporation.

The report explores crucial aspects of the electric stacker market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed