Electric Vehicle Supply Equipment Market Size, Share, Trends, Growth and Forecast 2030

Electric Vehicle Supply Equipment Market By Power (DC Power and AC Power), By Station Type (Super Charging, Normal Charging, and Inductive Charging), By Application (Commercial Charging Systems and Residential), By Product (Onboard Charging Station, Portable Charger, EV Charging Kiosk, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

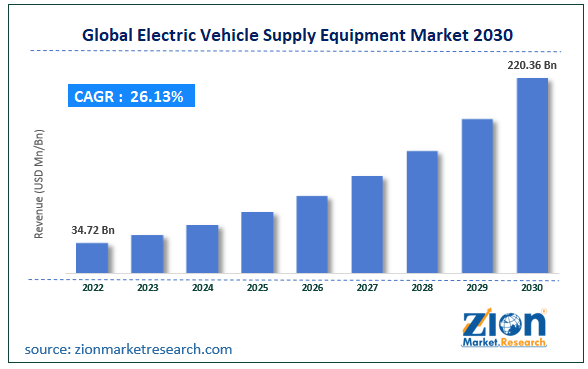

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 34.72 Billion | USD 220.36 Billion | 26.13% | 2022 |

Electric Vehicle Supply Equipment Industry Prospective:

The global electric vehicle supply equipment market size was worth around USD 34.72 billion in 2022 and is predicted to grow to around USD 220.36 billion by 2030 with a compound annual growth rate (CAGR) of roughly 26.13% between 2023 and 2030.

Electric Vehicle Supply Equipment Market: Overview

An electric vehicle supply equipment or EVSE is commonly known as an electric vehicle (EV) charging station. EVSE consists of two main components. In technical terms, EVSE is an electric charger and its primary function is to provide electric energy or charge to an electric vehicle. The charger consists of at least a single socket per electrical circuit and one or more electric circuits depending on the model. An EV can be charged using only one socket. On the other hand, EVSE also refers to the accessories or equipment necessary for charging an EV and includes the electrical circuit. In its true sense, an EVSE is the controlling unit responsible for supplying power to a vehicle when it is plugged into a charger or is undergoing charging. EVSEs are different from physical electric charging stations or spots where vehicle owners can charge an EV. Electric vehicle supply equipment is concerned more with the component parts that allow an electric vehicle to charge. It includes tools such as communication protocols, electrical conductors, software, and related equipment that ensure safe energy transfer from charging spots to the vehicle.

Key Insights:

- As per the analysis shared by our research analyst, the global electric vehicle supply equipment market is estimated to grow annually at a CAGR of around 26.13% over the forecast period (2023-2030)

- In terms of revenue, the global electric vehicle supply equipment market size was valued at around USD 34.72 billion in 2022 and is projected to reach USD 220.36 billion, by 2030.

- The electric vehicle supply equipment market is projected to grow at a significant rate due to the growing demand for electric vehicles

- Based on power segmentation, DC power was predicted to show maximum market share in the year 2022

- Based on application segmentation, commercial charging systems was the leading segment in 2022

- On the basis of region, Asia-Pacific as the leading revenue generator in 2022

Electric Vehicle Supply Equipment Market: Growth Drivers

Growing demand for electric vehicles to drive market growth

The global electric vehicle supply equipment market is projected to grow owing to the increasing demand for electric vehicles. There are several factors causing the higher popularity of electric vehicles especially for personal use in terms of electric cars and bikes. The recent ongoing geopolitical tension between Western countries and other nations has indirectly impacted fuel prices. Vehicles powered by combustion engines run on petrol, diesel, and gas. However, the supply of these essential fuels is currently limited. In addition to this, excessive consumption of petrol and diesel has a long-lasting impact on the environment. It is also regarded as the leading cause of global warming. Consumers are becoming more aware of the detrimental impact of burning fuel on the ecosystem. They are demanding more environmentally friendly solutions and EVs are the most appropriate solution in modern times. As per reports, Tesla, a leading EV manufacturer, sold more than 1.3 million EVs in 2022.

With the sale of EVs, providing EVSE becomes an undeniable obligation. Currently, the prices of EVs are considered on the high-end side and consumers expect better services and less hassle in charging EVs resulting in market players investing in the development of highly efficient electric vehicle supply equipment.

Electric Vehicle Supply Equipment Market: Restraints

Slow charging concerns and driver anxiety to restrict market growth

The global electric vehicle supply equipment market growth is likely to be restricted owing to the slow charging facilitated by EVSE. Even the most advanced EVs take significant time to charge completely. In addition to this, most EV drivers are known to have driver anxiety which is a term used to describe the consistent worry over vehicles running out of charge mid-journey. A survey conducted by the American Automobile Association (AAA) reported that nearly 58% of EV drivers persistently worried about the vehicle stopping before reaching their destination. Around 87% of the surveyed drivers stated that they suffered from anxiety over not finding a charging station while on the road. EVSE makers must invest in developing charging equipment that ensures fast charging which will allow them to gain higher confidence among the end-consumers.

Electric Vehicle Supply Equipment Market: Opportunities

Increasing government undertakings to promote the EV industry may create a higher demand

The electric vehicle supply equipment industry is expected to gain higher growth momentum owing to the rising government initiatives and undertakings to promote the EV sector in regional economies. This includes providing subsidies and tax redemptions in a bid to reduce carbon footprint. For instance, the Maharashtra government of India announced the EV Policy in 2021. As per the stated laws, the first 100,000 units of 2-wheeler EVs will qualify for subsidies. In Europe, France and Germany have similar government incentives. For instance, the German government provides a purchase bonus of €3,000 for buying used battery electric vehicles. Manufacturers on the other hand are liable to pay an additional incentive of €1,500. These favorable policies will create greater demand for EVs thus impacting the market share of EVSE.

Growing technological innovation in EVSE may generate more revenue

Manufacturers and suppliers of EVSE are focusing on technological growth. They are working toward developing more effective EVSEs with faster response time and bidirectional charging for maximum optimization of charging resources. Moreover, rising investments in renewable sources of energy to power electric vehicles and the construction of solar-powered charging stations are projected to work in the favor of EVSE industry players.

Electric Vehicle Supply Equipment Market: Challenges

High cost of EVs and EVSE to create growth barriers

The electric vehicle supply equipment industry faces challenges posed due to the high cost of electric vehicles and EV supply equipment. The starting price for a basic EV 4-wheeler is USD 1 million going upward. The vehicles remain unaffordable for a large part of the population. Moreover, the expense goes even higher when buying a new EVSE leading to greater obstacles. EVSE makers must invest in more affordable solutions to tap into a broader group of consumers.

Electric Vehicle Supply Equipment Market: Segmentation

The global electric vehicle supply equipment market is segmented based on power, station type, application, product, and region.

Based on power, the global market segments are DC power and AC power. In 2022, the highest growth was observed in the DC power segment driven by growing strategic partnerships between private companies and regional governments for the construction of an extensive DC charging power station infrastructure. EVs powered by direct current (DC) charge faster than the ones running on alternating current (AC). The market segment AC power may also witness higher growth since they are known to provide higher performance efficiency for longer distances. As EV makers invest in superior energy-efficient vehicles, the demand for the AC power segment is likely to grow further. Current EVs have varying charging times ranging between 30 minutes to 12 hours.

Based on station type, the electric vehicle supply equipment industry divisions are super charging, normal charging, and inductive charging.

Based on application, the global market divisions are commercial charging systems and residential. The former segment was the most dominant during 2022 due to higher investments in commercial charging systems. Large-scale government initiatives including the West Coast Electric Highway (WCEH), Norway to Italy Electric Highway, and Trans-Canada highway projects have played a crucial role in allowing the commercial segment to create higher revenue. EV makers are collaborating with public space owners such as hotels, malls, and entertainment centers to create EV charging infrastructure. The cost of building a Tesla supercharger station is between USD 60,000 and $350,000.

Based on product, the electric vehicle supply equipment industry divisions are onboard charging station, portable charger, EV charging kiosk, and others.

Electric Vehicle Supply Equipment Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Electric Vehicle Supply Equipment Market |

| Market Size in 2022 | USD 34.72 Billion |

| Market Forecast in 2030 | USD 220.36 Billion |

| Growth Rate | CAGR of 26.13% |

| Number of Pages | 227 |

| Key Companies Covered | EVBox Group, Tesla Inc., Siemens AG, ChargePoint Inc., ClipperCreek Inc., ABB, Schneider Electric, Blink Charging Co., Delta Electronics, Eaton Corporation, Tritium, Enel X, JuiceBar, EVgo Services LLC, Webasto Charging Systems Inc., and others. |

| Segments Covered | By Power, By Station Type, By Application, By Product, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Electric Vehicle Supply Equipment Market: Regional Analysis

Asia-Pacific to dominate the market during the forecast period

The global electric vehicle supply equipment market will be dominated by Asia-Pacific during the forecast period. The rising regional sales are owing to the high demand for electric vehicles in emerging economies of China, India, and other nations. China is currently the largest consumer of electric vehicles. In 2022, China sold nearly 7 million units of EVs in its domestic market. Additionally, it is home to over 100 EV producers with vehicles available across the price range. As per the latest, the massive economy with a population of over 1.3 billion has envisioned carbon neutrality by 2060 and the regional government is participating actively in achieving this vision. Japan, on the other hand, is one of the most dominant players in the global automotive sector. Last year, the country exported over 4.4 million cars to other countries. India has a growing middle-income group and with an increasing population, the demand for EVs is on the rise. North America has an extensive EV-supporting infrastructure. The growing investments in the deployment of new EVSE and EV charging stations could deliver a higher regional growth trend during the forecast period.

Electric Vehicle Supply Equipment Market: Competitive Analysis

The global electric vehicle supply equipment market is led by players like:

- EVBox Group

- Tesla Inc.

- Siemens AG

- ChargePoint Inc.

- ClipperCreek Inc.

- ABB

- Schneider Electric

- Blink Charging Co.

- Delta Electronics

- Eaton Corporation

- Tritium

- Enel X

- JuiceBar

- EVgo Services LLC

- Webasto Charging Systems Inc.

The global electric vehicle supply equipment market is segmented as follows:

By Power

- DC Power

- AC Power

By Station Type

- Super Charging

- Normal Charging

- Inductive Charging

By Application

- Commercial Charging Systems

- Residential

By Product

- Onboard Charging Station

- Portable Charger

- EV Charging Kiosk

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

An electric vehicle supply equipment or EVSE is commonly known as an electric vehicle (EV) charging station.

The global electric vehicle supply equipment market is projected to grow owing to the increasing demand for electric vehicles.

According to study, the global electric vehicle supply equipment market size was worth around USD 34.72 billion in 2022 and is predicted to grow to around USD 220.36 billion by 2030.

The CAGR value of the electric vehicle supply equipment market is expected to be around 26.13% during 2023-2030.

The global electric vehicle supply equipment market will be dominated by Asia-Pacific during the forecast period.

The global electric vehicle supply equipment market is led by players like EVBox Group, Tesla, Inc., Siemens AG, ChargePoint, Inc., ClipperCreek, Inc., ABB, Schneider Electric, Blink Charging Co., Delta Electronics, Eaton Corporation, Tritium, Enel X, JuiceBar, EVgo Services LLC, and Webasto Charging Systems, Inc.

The report explores crucial aspects of the electric vehicle supply equipment market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

Choose License Type

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed