Electric Vehicle Transmission Market Size, Share, Trends, Growth and Forecast 2032

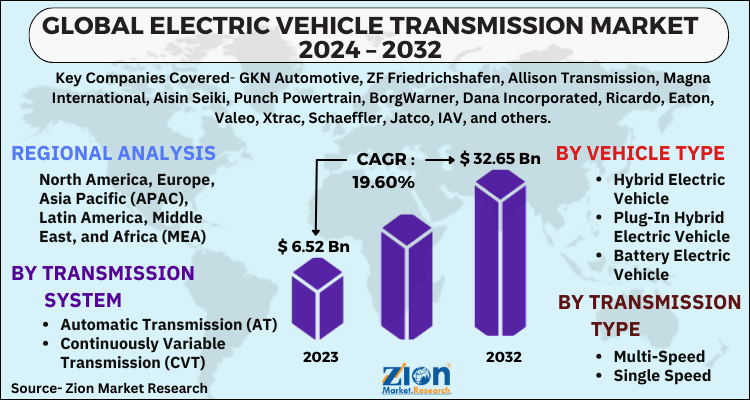

Electric Vehicle Transmission Market By Transmission System (Automatic Transmission (AT), Continuously Variable Transmission (CVT), Automated Manual Transmission (AMT), and Others), By Vehicle Type (Hybrid Electric Vehicle, Plug-In Hybrid Electric Vehicle, and Battery Electric Vehicle), By Transmission Type (Multi-Speed and Single Speed), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024-2032

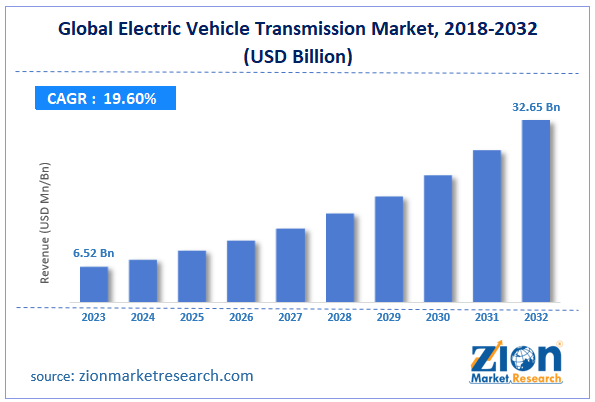

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6.52 Billion | USD 32.6 Billion | 19.60% | 2023 |

Electric Vehicle Transmission Industry Prospective:

The global electric vehicle transmission market size was worth around USD 6.52 billion in 2023 and is predicted to grow to around USD 32.65 billion by 2032 with a compound annual growth rate (CAGR) of roughly 19.60% between 2024 and 2032.

Electric Vehicle Transmission Market: Overview

An electric vehicle (EV) transmission system is responsible for transferring power generated from the EV motor to the drive wheel through the gearbox. The system consists of battery, inverter, and motor thus playing a crucial role in the overall operations of the vehicle. EV transmission is relatively simpler in design and performance as compared to the transmission systems for traditional internal combustion (IC) engines.

Most EVs are powered by single-speed transmission; however, certain EV manufacturers also provide multiple-speed transmission solutions. The use of a single-speed gearbox is facilitated by the ability of electric motors to deliver excellent efficiency over varying speeds using a single transmission system.

The demand in the industry for EV transmission is expected to grow due to the growing demand for power-efficient electric vehicles. Furthermore, the surging incorporation of EVs in public transport infrastructure along with government subsidies and incentives for adopters of electric automotives will further impact overall revenue in the industry. EV transmission may be impacted by the competition the industry faces from IC vehicles during the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global electric vehicle transmission market is estimated to grow annually at a CAGR of around 19.60% over the forecast period (2024-2032)

- In terms of revenue, the global electric vehicle transmission market size was valued at around USD 6.52 billion in 2023 and is projected to reach USD 32.65 billion, by 2032.

- The market is projected to grow at a significant rate due to the rising demand for EVs worldwide.

- Based on the transmission system, the automatic transmission (AT) segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the transmission type, the single-speed segment is anticipated to command the largest market share.

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period.

Electric Vehicle Transmission Market: Growth Drivers

Rising demand for EVs worldwide will drive market demand rate over the forecast period

The global electric vehicle transmission market is expected to grow due to the growing demand for electric vehicles across the globe. Consumers are becoming actively aware of the environmental impact of excessive use of internal combustion engines. In addition to this, prices of petrol, diesel, and gas have been registering high volatility.

Between 2022 and 2023, fuel prices skyrocketed in several parts of the world influenced by the Russia-Ukraine war. Electric vehicles offer several advantages over traditional IC engine-powered vehicles. For instance, EVs provide energy resilience since the functioning of these vehicles does not depend on the availability and price of non-renewable fuel.

In addition to this, EVs are environmentally friendly. They do not disrupt the harmony in the ecosystem. Consumer awareness has improved regarding the use of EVs in all formats including two-wheelers and three-wheelers. For instance, in November 2024, Royal Enfield, one of the world’s most popular two-wheeler brands, announced its plans for expansion in the EV segment. The company is expected to introduce an electric bike in the US and European markets by 2026. The product will be available under the brand ‘Flying Flea C6’.

Growing government support toward the EV sector will be critical to overall revenue in the future

Regional governments are actively participating in new initiatives aimed at improving the infrastructure supporting EV research, development, and production. These initiatives are likely to impact the demand in the global electric vehicle transmission market in the long run.

For instance, in October 2023, reports emerged suggesting that Germany will launch bidirectional charging of electric vehicles. From 1st January 2026, German users of electric vehicles will be able to withdraw grid power for charging the vehicles while also being equipped to supply the energy back to the grid if the vehicle is idle.

In April 2024, the European Union and India announced intentions to promote start-ups working on EV battery recycling under the India-EU Trade and Technology Council (TTC). Similarly, the Indian M Electric Drive Revolution in Innovative Vehicle Enhancement (PM E-DRIVE)' scheme came into action on 1st October 2024 built around a financial scheme of INR 10,900 crore.

Electric Vehicle Transmission Market: Restraints

Limited battery charging infrastructure and the high cost of the vehicles limit the industry’s expansion rate

The global industry for electric vehicle transmission is projected to be restricted by the existence of a limited battery charging infrastructure. Although EV sales have improved in the last few years, countries are lagging in terms of developing an ancillary infrastructure consisting of robust battery charging facilities. Furthermore, the high level of EVs and their crucial parts including transmission systems will further impact the overall revenue in the industry.

Electric Vehicle Transmission Market: Opportunities

Ongoing investments in improving EV performance will generate growth opportunities

The global electric vehicle transmission market is projected to benefit from the rising investments in making electric vehicles more powerful with superior performance. For instance, the keen interest of EV makers in improving battery life, safety features, and infotainment systems in the vehicle will be critical to the industry’s growth trajectory in the future.

In October 2024, Stellantis NV, a giant in the EV industry, announced that it will soon operate a test fleet of EVs powered with solid-state batteries. The company is expected to fulfill this vision in the next two years. Stellantis will demonstrate the performance of the Dodge Charger Daytona vehicles using batteries made by Factorial Energy.

In a recent event, BYD USA launched Blade Battery. The new solution is expected to counteract the concerns associated with the safety of EV batteries. Blade Battery is made by arranging singular cells in an array followed by being inserted in a battery pack. The novel structure allows the utilization of the battery to be improved by over 50%.

In November 2024, the Innovation Business Machine (IoBM) firm in India launched a new EV model focusing on elevating cybersecurity and transportation standards. The electric vehicle developed by IoBM is built using state-of-the-art technology and addresses concerns about the cybersecurity of EVs.

Electric Vehicle Transmission Market: Challenges

Development of alternate technologies and regulatory hurdles to impact overall revenue

The global industry for electric vehicle transmission is expected to be challenged by the increasing investments in the development of alternate technologies. For instance, solutions such as in-wheel motors, direct-drive systems, and axle-mounted motors are becoming readily popular among EV developers. Regulatory complexities in terms of EVs and their parts will also limit the overall industry adoption rate.

Electric Vehicle Transmission Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Electric Vehicle Transmission Market |

| Market Size in 2023 | USD 6.52 Billion |

| Market Forecast in 2032 | USD 32.65 Billion |

| Growth Rate | CAGR of 19.60% |

| Number of Pages | 218 |

| Key Companies Covered | GKN Automotive, ZF Friedrichshafen, Allison Transmission, Magna International, Aisin Seiki, Punch Powertrain, BorgWarner, Dana Incorporated, Ricardo, Eaton, Valeo, Xtrac, Schaeffler, Jatco, IAV, and others. |

| Segments Covered | By Transmission System, By Vehicle Type, By Transmission Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Electric Vehicle Transmission Market: Segmentation

The global electric vehicle transmission market is segmented based on transmission system, vehicle type, transmission type, and region.

Based on the transmission system, the global market segments are automatic transmission (AT), continuously variable transmission (CVT), and automated manual transmission (AMT). In 2023, the highest growth was listed in the automatic transmission (AT) segment. The greater adoption rate was a result of several advantages offered by EVs equipped with automatic transmission. During the forecast period, the AT segment will continue to dominate the overall revenue influenced by the presence of dual transmission modes that are manual and automatic. In 2023, the AT segment was responsible for generating around 21% of the total revenue.

Based on vehicle type, the global electric vehicle transmission industry is divided into hybrid electric vehicles, plug-in hybrid electric vehicles, and battery electric vehicles.

Based on the transmission type, the global market segments are multi-speed and single-speed. In 2023, the highest demand was listed in the single-speed segment. The majority of EV makers use single-speed transmission with only a limited number of players operating in the multi-speed segment. According to market research, the cost and performance efficiency of single-speed transmission are driving forces in the segment. Moreover, they also offer smoother power delivery and improved energy efficiency. More than 90% of EVs currently available in the market have single-speed transmissions.

Electric Vehicle Transmission Market: Regional Analysis

Asia-Pacific to emerge as the highest revenue generator during the projection period

The global electric vehicle transmission market is projected to be led by Asia-Pacific during the forecast period. China will dominate the regional market primarily due to the presence of a robust EV manufacturing infrastructure in the country. According to official statistics, China is the largest producer and exporter of electric vehicles across formats including passenger cars, heavy trucks, and autonomous vehicles.

In November 2024, Nio, one of China’s largest EV makers, announced its plan to launch hybrid models by 2026 for the overseas market including North Africa, the Middle East, and Europe. Currently, Nio manufactures pure electric vehicles. In June 2024, BYD, another Chinese influential player in the EV segment, launched its third electric vehicle in Japan. The newly launched product is BYD's most expensive automobile so far.

Similarly, other Chinese companies are focusing on developing new EVs with extended battery life and improved safety features. They are also targeting international regions for global dominance. Other countries such as India, Japan, and South Korea are expected to also emerge as significant revenue generators fueled by increased government initiatives and overall escalating investment rates.

Electric Vehicle Transmission Market: Competitive Analysis

The global electric vehicle transmission market is led by players like:

- GKN Automotive

- ZF Friedrichshafen

- Allison Transmission

- Magna International

- Aisin Seiki

- Punch Powertrain

- BorgWarner

- Dana Incorporated

- Ricardo

- Eaton

- Valeo

- Xtrac

- Schaeffler

- Jatco

- IAV

The global electric vehicle transmission market is segmented as follows:

By Transmission System

- Automatic Transmission (AT)

- Continuously Variable Transmission (CVT)

- Automated Manual Transmission (AMT)

- Others

By Vehicle Type

- Hybrid Electric Vehicle

- Plug-In Hybrid Electric Vehicle

- Battery Electric Vehicle

By Transmission Type

- Multi-Speed

- Single Speed

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

An electric vehicle (EV) transmission system is responsible for transferring power generated from the EV motor to the drive wheel through the gearbox.

The global electric vehicle transmission market is expected to grow due to the growing demand for electric vehicles across the globe.

According to study, the global electric vehicle transmission market size was worth around USD 6.52 billion in 2023 and is predicted to grow to around USD 32.65 billion by 2032.

The CAGR value of the electric vehicle transmission market is expected to be around 19.60% during 2024-2032.

The global electric vehicle transmission market is projected to be led by Asia-Pacific during the forecast period.

The global electric vehicle transmission market is led by players like GKN Automotive, ZF Friedrichshafen, Allison Transmission, Magna International, Aisin Seiki, Punch Powertrain, BorgWarner, Dana Incorporated, Ricardo, Eaton, Valeo, Xtrac, Schaeffler, Jatco and IAV.

The report explores crucial aspects of the electric vehicle transmission market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed