Engine Component Market Growth, Size, Share, Trends, and Forecast 2030

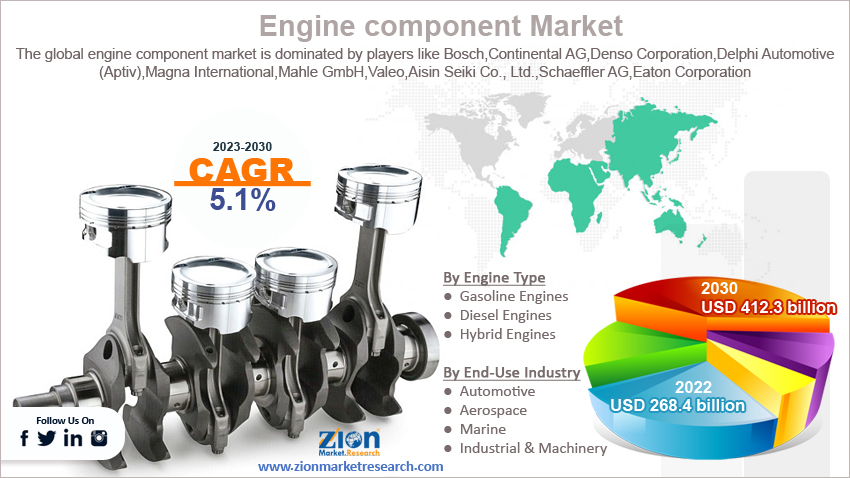

Engine Component Market By Component Type (Internal Components and External Components), By Engine type (Gasoline Engines, Diesel Engines, and Hybrid Engines), By End Use Industry (Automotive, Aerospace, Marine, and Industrial & Machinery), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2023 - 2030

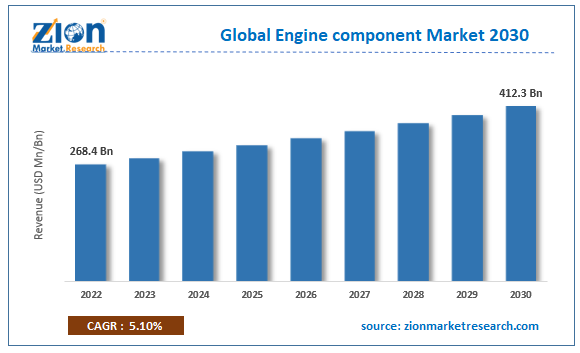

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 268.4 Billion | USD 412.3 billion | 5.1% | 2022 |

Engine component Industry Prospective:

The global engine component market size was worth around USD 268.4 billion in 2022 and is predicted to grow to around USD 412.3 billion million by 2030 with a compound annual growth rate (CAGR) of roughly 5.1% between 2023 and 2030.

Request Free Sample

Request Free Sample

Engine component Market: Overview

Engine components are the essential parts that constitute the internal combustion engine of a vehicle or machinery, working together to convert fuel into mechanical energy. Common components include the engine block, pistons, crankshaft, camshaft, valves, fuel injectors, spark plugs, and auxiliary parts. They collectively contribute to power generation, fuel efficiency, and emissions control in various applications.

Key Insights

- As per the analysis shared by our research analyst, the global engine component industry is estimated to grow annually at a CAGR of around 5.1% over the forecast period (2023-2030).

- In terms of revenue, the global engine component market size was valued at around USD 268.4 billion in 2022 and is projected to reach USD 412.3 billion, by 2030.

- The global engine component market is projected to grow at a significant rate due to increasing demand for fuel efficiency and emission reduction.

- Based on component type segmentation, internal components was predicted to hold maximum market share in the year 2022.

- Based on engine type segmentation, gasoline engines was the leading revenue generator in 2022.

- Based on end use industry segmentation, automotive was the leading revenue generator in 2022.

- On the basis of region, Asia Pacific was the leading revenue generator in 2022.

Request Free Sample

Request Free Sample

Engine component Market: Growth Drivers

Increasing demand for fuel efficiency and emission reduction propel market growth

The global engine components industry is undergoing a significant surge, primarily propelled by the increasing global focus on fuel efficiency and the imperative to reduce vehicle emissions. Governments worldwide are enacting stringent regulations to address environmental concerns, compelling manufacturers to invest substantially in advanced engine technologies. This heightened demand for fuel-efficient solutions is driving innovation among engine component providers, who are actively exploring areas such as combustion efficiency, lightweight materials, and precision engineering. As automakers strive to meet progressively strict emission standards, the engine components industry is witnessing remarkable growth. With companies dedicated to developing products that not only align with regulatory requirements but also contribute to overall improvements in vehicle performance and sustainability. This dynamic landscape positions engine component manufacturers at the forefront of addressing crucial environmental challenges while meeting the evolving needs of the automotive industry.

For Instance, the European Union has set ambitious targets for reducing CO2 emissions from cars and vans. It has instructed auto makers, that by 2030, new cars must produce an average of 37.5% less CO2 than in 2021, and new vans must produce an average of 31% less CO2. This is forcing automakers to invest heavily in new engine technologies, which is benefiting the engine component market.

Engine component Market: Restraints

Rising adoption of electric vehicles may restrain the market growth.

The engine components market confronts a substantial restraint with the rapid adoption of electric vehicles (EVs). The automotive industry is undergoing a profound transformation towards sustainable transportation, posing a threat to the demand for traditional internal combustion engine components. The pervasive shift towards EVs requires engine component manufacturers to undergo a strategic reassessment of their long-term viability and contemplate diversification into electric propulsion technologies. Although opportunities emerge in the form of hybrid solutions, the overarching trend towards electric mobility presents a formidable challenge for companies deeply entrenched in conventional engine components. This paradigm shift necessitates a proactive response from manufacturers to stay relevant and competitive in a rapidly evolving automotive landscape dominated by electrification.

Moreover, Governments around the world are promoting the adoption of EVs in order to reduce emissions and improve air quality. This is being done through a variety of incentives, such as tax breaks, subsidies, and access to HOV lanes. For instance, the United States government offers a federal tax credit of up to USD 7,500 for the purchase of a new EV. Many states also offer their own incentives, such as rebates and tax breaks.

Engine component Market: Opportunities

Advancements in engine technology, including hybrid solutions to provide growth opportunities

Amidst the challenges arising from the increasing prevalence of electric vehicles (EVs), the engine components market identifies a strategic opportunity in the continual evolution of engine technology, notably in the realm of hybrid solutions. Hybrid vehicles, which amalgamate internal combustion engines with electric power, represent a substantial market prospect. Engine component manufacturers are well-positioned to leverage this trend by dedicating efforts to the development of components that seamlessly integrate with hybrid systems, thereby enhancing overall vehicle efficiency. The pursuit of hybridization not only addresses the current market dynamics but also positions companies to align with shifting consumer preferences, offering a viable pathway for sustained growth and adaptation within the dynamically evolving automotive landscape.

This emphasis on hybrid solutions allows engine component manufacturers to cater to a transitional market, offering consumers the benefits of both conventional and electric power sources. By fostering innovation in components that optimize the synergy between internal combustion engines and electric systems, companies can play a pivotal role in shaping the future of automotive propulsion and remain at the forefront of technological advancements within the industry.

Engine component Market: Challenges

Supply chain disruptions and raw material costs to challenge market growth

A critical challenge facing the engine components market is its susceptibility to supply chain disruptions and the volatility of raw material costs. The intricate global supply network for engine components renders the industry vulnerable to disruptions arising from geopolitical tensions, natural disasters, or unforeseen economic downturns. Moreover, the fluctuation in prices of raw materials, including metals and rare-earth elements, poses a persistent challenge for manufacturers, directly impacting production costs and overall profitability. In response to these challenges, engine component providers are compelled to implement robust and resilient supply chain strategies. Diversification of suppliers, geographic locations, and transportation routes becomes imperative to reduce dependency on a single source and enhance overall supply chain resilience. Additionally, proactive risk mitigation measures, such as strategic inventory management and close collaboration with suppliers, are essential to navigate the unpredictable nature of global events. Successfully addressing these challenges ensures that engine component manufacturers can effectively navigate uncertainties, maintain a competitive edge in the market, and uphold consistent product delivery to meet the demands of the dynamic automotive sector.

Engine component Market: Segmentation

The global engine component market is segmented based on component type, engine type, end use industry, and region.

Based on component type, the global market segments are internal components and external components. At present, the global market is dominated by the internal components segment. This dominance can be attributed to its critical role in the core functionality of internal combustion engines. Internal components such as pistons, crankshafts, and camshafts are integral to the combustion process, directly impacting the engine's performance, efficiency, and overall power generation. As advancements in engine technology continue to focus on enhancing combustion efficiency and reducing emissions, the demand for innovations in internal components remains high. Additionally, the increasing emphasis on lightweight materials and precision engineering further propels the internal components segment, solidifying its current prominence in the market.

Based on engine type the global engine component industry categorized as gasoline engines, diesel engines, and hybrid engines. In 2022, gasoline engines was the largest shareholding segment in the global industry. This dominance attributed to several factors. Firstly, gasoline engines have traditionally been the primary choice for passenger vehicles, which constitute a significant portion of the automotive market. The widespread use of gasoline engines in cars and light-duty vehicles contributes to their dominant market share. Secondly, advancements in gasoline engine technology, including improved fuel efficiency and reduced emissions, have sustained their popularity. Additionally, the global emphasis on environmental regulations and the increasing consumer preference for gasoline-powered vehicles, particularly in regions like Asia-Pacific, further bolster the demand for gasoline engine components, solidifying their position as the leading segment in the market.

Based on end use industry the global engine component industry categorized as automotive, aerospace, marine, and industrial & machinery. Out of these, automotive was the largest shareholding segment in the global market. This is primarily driven by the extensive demand for internal combustion engines in passenger and commercial vehicles. The sheer volume of automobiles on the road, coupled with continuous advancements in automotive technology, underscores the significance of the automotive industry. Engine components play a pivotal role in ensuring the performance, efficiency, and compliance of vehicles with stringent emissions standards. The ongoing global emphasis on sustainable transportation further amplifies the demand for engine components in the automotive sector, reinforcing its status as the leading segment in the market.

The global automotive industry is expected to grow at a CAGR of 3.5% from 2023 to 2030, driven by factors such as rising urbanization, increasing disposable incomes, and growing demand for personal transportation.

Engine component Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Engine component Market |

| Market Size in 2022 | USD 268.4 Billion |

| Market Forecast in 2030 | USD 412.3 Billion |

| Growth Rate | CAGR of 5.1% |

| Number of Pages | 205 |

| Key Companies Covered | Bosch, Continental AG, Denso Corporation, Delphi Automotive (Aptiv), Magna International, Mahle GmbH, Valeo, Aisin Seiki Co. Ltd., Schaeffler AG, Eaton Corporation., and others. |

| Segments Covered | By Component Type, By Engine Type, End-Use Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Engine component Market: Regional Analysis

Asia Pacific to lead the market during the forecast period

Asia Pacific is poised to lead the engine component market during the forecast period, fueled by robust economic growth, increasing industrialization, and a burgeoning automotive sector. The region's rapid urbanization and rising disposable incomes are driving a surge in demand for vehicles, placing a substantial emphasis on engine components. Moreover, Asia Pacific is a key manufacturing hub, attracting global automotive players to establish production facilities, further boosting the demand for engine components. As countries like China, India, and Japan continue to experience significant automotive growth and technological advancements, the engine component market in Asia Pacific is anticipated to witness sustained expansion, with the region cementing its position as a major contributor to the global automotive industry. Additionally, the region's proactive approach toward adopting and investing in green technologies aligns with the global shift towards sustainable transportation. Governments in Asia Pacific are implementing stringent emission norms, fostering a demand for advanced engine components that enhance fuel efficiency and reduce environmental impact. This dual emphasis on economic development and environmental sustainability positions Asia Pacific as a frontrunner in driving innovations and growth within the engine component market throughout the forecast period.

The Chinese government has implemented a number of policies to support the growth of the automotive industry, including providing subsidies for the purchase of new vehicles, offering tax breaks for the production of electric vehicles, and establishing industrial parks specifically for the automotive industry. For example, the government's "Made in China 2025" initiative aims to make China a global leader in high-tech manufacturing, including the production of advanced engine components.

The Japanese government has implemented a number of programs to support the development of the engine component industry, including providing funding for research and development into new engine technologies, offering tax breaks for companies that invest in environmental protection measures, and establishing industry-academia collaboration programs to promote the development of innovative engine solutions. For instance, the government's "Cool Earth Partners" initiative aims to reduce greenhouse gas emissions by promoting the development of fuel-efficient engine technologies.

Key Developments

2023: Mahle is investing USD 65 million in its plant in Neuenstadt am Kocher, Germany, to expand production of pistons and piston pins for electric vehicles. The investment is expected to create 200 new jobs.

2023: Cummins is partnering with Tata Power to develop and manufacture electric powertrains for commercial vehicles in India. The partnership will leverage Cummins' expertise in powertrain technology and Tata Power's expertise in electric vehicle infrastructure.

2023: Automotive Components Europe (ACE) is acquiring Hutchinson's fuel system business for USD 1.31 billion. The acquisition will expand ACE's product portfolio and give it access to Hutchinson's expertise in fuel system technology.

2023: Bosch has developed a new component type of fuel injector that is designed to improve emissions control. The company claims that the new injector can reduce nitrogen oxide emissions by up to 50%.

2023: Schaeffler has developed a new component type of engine bearing that is designed to reduce friction and improve fuel efficiency. The company claims that the new bearing can reduce fuel consumption by up to 2%.

Engine component Market: Competitive Analysis

The global engine component market is dominated by players like:

- Bosch

- Continental AG

- Denso Corporation

- Delphi Automotive (Aptiv)

- Magna International

- Mahle GmbH

- Valeo

- Aisin Seiki Co., Ltd.

- Schaeffler AG

- Eaton Corporation

The global engine component market is segmented as follows:

By Component Type

- Internal Components

- External Components

By Engine Type

- Gasoline Engines

- Diesel Engines

- Hybrid Engines

By End-Use Industry

- Automotive

- Aerospace

- Marine

- Industrial & Machinery

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Engine components are the essential parts that constitute the internal combustion engine of a vehicle or machinery, working together to convert fuel into mechanical energy. Common components include the engine block, pistons, crankshaft, camshaft, valves, fuel injectors, spark plugs, and auxiliary parts. They collectively contribute to power generation, fuel efficiency, and emissions control in various applications.

The global engine component market cap may grow owing to the due to increasing demand for fuel efficiency and emission reduction.

According to study, the global engine component market size was worth around USD 268.4 billion in 2022 and is predicted to grow to around USD 412.3 billion by 2030.

The CAGR value of the engine component market is expected to be around 5.1% during 2023-2030.

The global engine component market growth is expected to be driven by Asia Pacific. It is currently the world’s highest revenue-generating market owing to the growing automotive sector and booming industrial growth sector.

The global engine component market is led by players like Bosch, Continental AG, Denso Corporation, Delphi Automotive (Aptiv), Magna International, Mahle GmbH, Valeo, Aisin Seiki Co., Ltd., Schaeffler AG, and Eaton Corporation.

The report analyzes the global engine component market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the engine component industry.

Choose License Type

List of Contents

Engine componentIndustry Prospective:Engine component OverviewKey InsightsEngine component Growth DriversEngine component RestraintsEngine component OpportunitiesEngine component ChallengesEngine component SegmentationEngine component Report ScopeEngine component Regional AnalysisKey DevelopmentsEngine component Competitive AnalysisThe global engine component market is segmented as follows:By RegionHappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed