Enterprise Governance, Risk and Compliance Software Market Size, Share, Growth 2034

Enterprise Governance, Risk and Compliance Software Market By Offering (Software and Services), By Software (Usage and Type), By Deployment Mode (Cloud and On-premises), By Organization Size (Large Enterprises and SMEs), By Business Function (Finance, IT, Legal and Operation), By End user (BFSI, Telecommunication, Energy and Utility, Government, Healthcare, Manufacturing, Mining and Natural Resources, Retail and Consumer Goods, IT, Transportation and Logistics and Others) and By Region - Global Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data and Forecasts 2025 - 2034

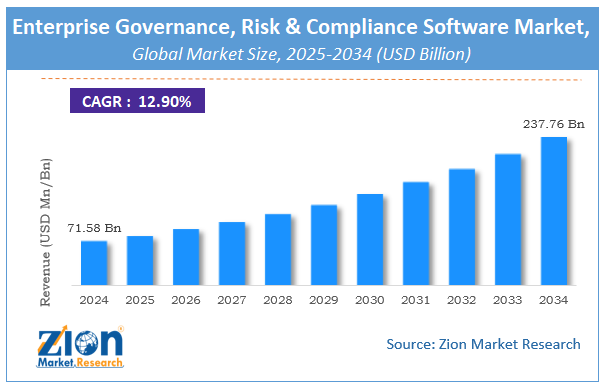

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 71.58 Billion | USD 237.76 Billion | 12.9% | 2024 |

Enterprise Governance, Risk and Compliance Software Market: Industry Perspective

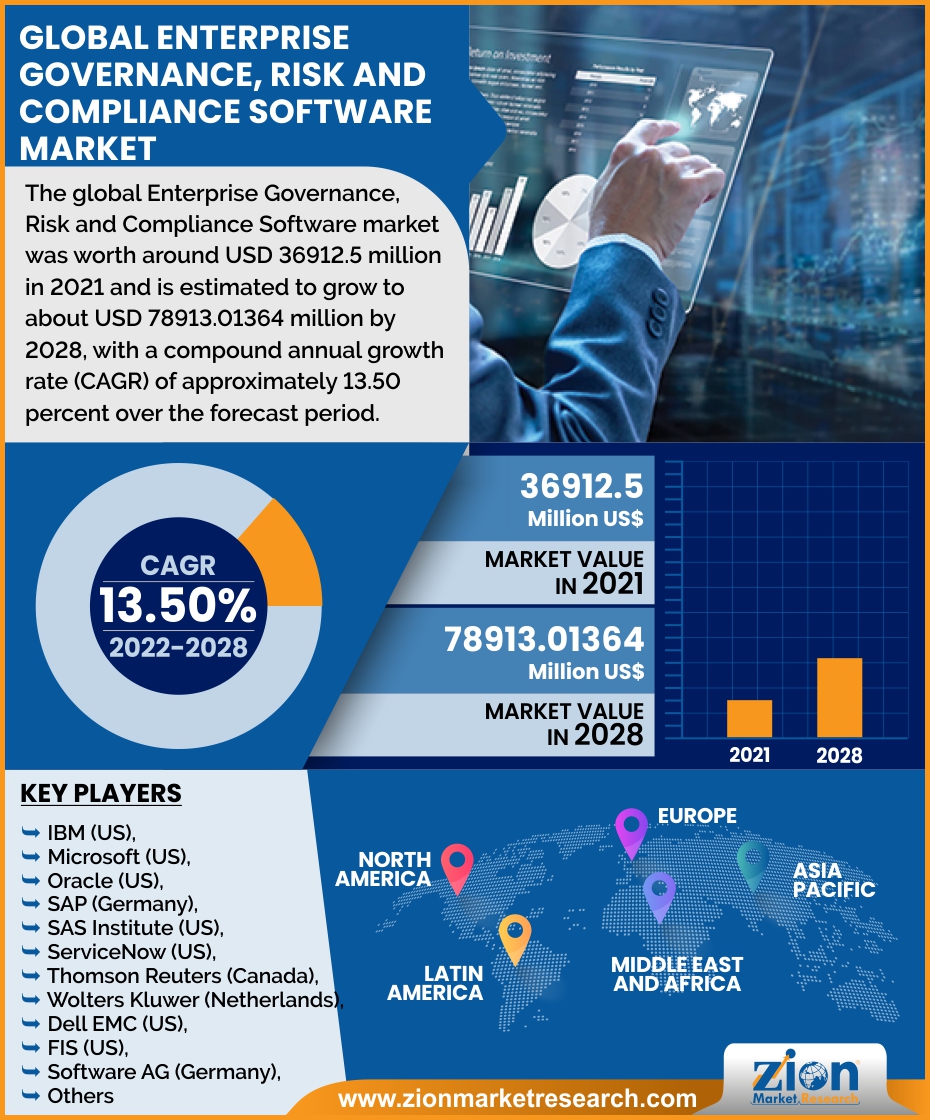

The global enterprise governance, risk and compliance software market size was worth around USD 71.58 Billion in 2024 and is predicted to grow to around USD 237.76 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 12.9% between 2025 and 2034. The report analyzes the global enterprise governance, risk and compliance software market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the enterprise governance, risk and compliance software industry.

The report analyzes the Enterprise Governance, Risk and Compliance Software market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the Enterprise Governance, Risk and Compliance Software market.

Global Enterprise Governance, Risk and Compliance Software Market: Overview

Global Enterprise Governance, Risk and Compliance Software Market Report, GRC solutions have emerged as a result of the increasingly complex regulatory, compliance, and risk management environment in businesses. Enterprise governance, risk, and compliance (EGRC) enable risk and compliance management teams to analyze and share data to gain a 360-degree view of the organization's risk landscape, allowing executives and boards to develop informed business strategies. Market growth is being driven by the increased deployment of EGRC software systems across companies to reduce monetary and reputational costs associated with non-compliance.

Rapid globalization and commercialization have prompted governments to develop new policies to promote fair trade. The EGRC plays a critical role in addressing the complexities of adhering to stringent regulatory policies. Furthermore, changes in a country's economy resulting in the implementation of new policies or revisions to existing ones. As a result, to avoid non-compliance, businesses must keep up with these changes and update their existing EGRC systems.

Key Insights

- As per the analysis shared by our research analyst, the global enterprise governance, risk and compliance software market is estimated to grow annually at a CAGR of around 12.9% over the forecast period (2025-2034).

- Regarding revenue, the global enterprise governance, risk and compliance software market size was valued at around USD 71.58 Billion in 2024 and is projected to reach USD 237.76 Billion by 2034.

- The enterprise governance, risk and compliance software market is projected to grow at a significant rate due to increasing complexity of regulatory mandates and the growing need for organizations to mitigate rising cybersecurity threats.

- Based on Offering, the Software segment is expected to lead the global market.

- On the basis of Software, the Usage segment is growing at a high rate and will continue to dominate the global market.

- Based on the Deployment Mode, the Cloud segment is projected to swipe the largest market share.

- By Organization Size, the Large Enterprises segment is expected to dominate the global market.

- In terms of Business Function, the Finance segment is anticipated to command the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Enterprise Governance, Risk and Compliance Software Market: Growth Drivers

Driver: Increase in stringent compliance mandates

The requirement to comply with numerous rules imposed by governing bodies, as well as the increasingly complicated regulatory environment, is projected to drive demand for EGRC solutions. Failure to comply with compliance rules and laws can result in significant financial losses, which are usually in the form of penalties.

Restraint: Varying structure of regulatory policies

Regulatory policies differ in structure from country to country and from business to business. Various countries lack a governing body to oversee these regulations, which must be controlled and implemented while taking into account a variety of elements, including microeconomic risk considerations and commercial requirements. One of the restricting factors for the growth of the EGRC market is the lack of a defined standard that must be followed.

Opportunity: Integration of AI and blockchain technologies into EGRC solutions

The expanding volume of data presents a variety of options for business professionals in areas such as audit, risk, and compliance to improve their performance. Furthermore, the growing necessity to evaluate data silos in order to identify risk and deliver it to stakeholders at the appropriate moment has become critical. As a result, a number of companies have begun to offer AI-powered solutions to help businesses meet various regulatory and compliance needs.

Challenge: Providing a comprehensive EGRC solution

The majority of the businesses cater to a variety of industries, including banking, financial services, and insurance (BFSI), healthcare, legal, retail, and eCommerce, among others. As a result, businesses concentrate on building solutions that can meet the needs of these industry sectors, resulting in a desire for diverse solutions that can suit the needs of each business segment. Delivering an integrated EGRC solution that can fulfill the diverse business requirements of BFSI, healthcare, and other industries is a big problem that could stymie industry progress.

Enterprise Governance, Risk and Compliance Software Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Enterprise Governance, Risk and Compliance Software Market |

| Market Size in 2024 | USD 71.58 Billion |

| Market Forecast in 2034 | USD 237.76 Billion |

| Growth Rate | CAGR of 12.9% |

| Number of Pages | 187 |

| Key Companies Covered | IBM (US), Microsoft (US), Oracle (US), SAP (Germany), SAS Institute (US), ServiceNow (US), Thomson Reuters (Canada), Wolters Kluwer (Netherlands), Dell EMC (US), FIS (US), Software AG (Germany), RSA Security (US), MEGA International (France), Ideagen (UK), Mphasis (India), MetricStream (US), Protiviti (US), SAI Global (US), ProcessGene (Israel), LogicManager (US), Quantivate (US), Riskonnect (US), NAVEX Global (US), Alyne(Germany), Lexcomply (India), StandardFusion (Canada), and others. |

| Segments Covered | By Offering, By Software, By Deployment Mode, By Organization Size, By Business Function, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Enterprise Governance, Risk and Compliance Software Market: Segmentation Analysis

The global enterprise governance, risk and compliance software market is segmented based on Offering, Software, Deployment Mode, Organization Size, Business Function, and region.

Based on Offering, the global enterprise governance, risk and compliance software market is divided into Software and Services.

On the basis of Software, the global enterprise governance, risk and compliance software market is bifurcated into Usage and Type.

By Deployment Mode, the global enterprise governance, risk and compliance software market is split into Cloud and On-premises.

In terms of Organization Size, the global enterprise governance, risk and compliance software market is categorized into Large Enterprises and SMEs.

By Business Function, the global Enterprise Governance, Risk and Compliance Software market is divided into Finance, IT, Legal and Operation.

Recent Developments

- In April 2021 CherryRoad Technologies and Oracle teamed up (CherryRoad). CherryRoad is known for developing and executing unique and innovative solutions leveraging Oracle's Governance, Risk, and Compliance (GRC) suite of products.

- In March 2021, IBM has announced IBM OpenPages Data Privacy Management, a new module for the OpenPages platform that helps businesses address emerging data privacy problems. This module will provide users with a unified view of all private data assets stored across their organization, as well as the ability to run privacy assessments on them.

Enterprise Governance, Risk and Compliance Software Market: Regional Landscape

North America accounts for a sizable portion of global demand for enterprise governance, risk, and compliance solutions, because of the disappearing boundaries in hyper-extended enterprises. The security risks associated with hyper-extended enterprises are also increasing. This factor has resulted in a greater emphasis on identity and access management, for which the country's government is developing stricter regulations.

During the projection period, Asia Pacific is expected to grow at an exponential rate. The increased demand for solutions across industries such as manufacturing, government, and healthcare is driving the region's growth. To strengthen their market position, key market players are focusing on completing various business methods such as acquisition, partnership, merger, and others.

Enterprise Governance, Risk and Compliance Software Market Competitive Landscape

Some of the main competitors dominating the global hybrid aircraft market include -

- IBM (US)

- Microsoft (US)

- Oracle (US)

- SAP (Germany)

- SAS Institute (US)

- ServiceNow (US)

- Thomson Reuters (Canada)

- Wolters Kluwer (Netherlands)

- Dell EMC (US)

- FIS (US)

- Software AG (Germany)

- RSA Security (US)

- MEGA International (France)

- Ideagen (UK)

- Mphasis (India)

- MetricStream (US)

- Protiviti (US)

- SAI Global (US)

- ProcessGene (Israel)

- LogicManager (US)

- Quantivate (US)

- Riskonnect (US)

- NAVEX Global (US)

- Alyne(Germany)

- Lexcomply (India)

- StandardFusion (Canada)

Global Enterprise Governance, Risk and Compliance Software Market is segmented as follows:

Based on Offering:

- Software

- Services

Based on Software:

- Usage

- Type

Based on Deployment Mode:

- Cloud

- On-premises

Based on Organization Size:

- Large Enterprises

- SMEs

Based on Business Function:

- Finance

- IT

- Legal

- Operation

Based on End User:

- BFSI

- Telecommunication

- Energy and Utility

- Government

- Healthcare

- Manufacturing

- Mining and Natural Resources

- Retail and Consumer Goods

- IT

- Transportation and Logistics

- Others (Construction and Engineering, Academia, Media and Entertainment, Oil and Gas, and Tourism and Hospitality)

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

Enterprise Governance, Risk, and Compliance (GRC) software is a suite of tools that helps organizations manage three key areas across the entire business

The global enterprise governance, risk and compliance software market is expected to grow due to rising cybersecurity threats, increasing regulatory requirements, growing adoption of cloud-based solutions, and the need for improved risk management and compliance automation.

According to a study, the global enterprise governance, risk and compliance software market size was worth around USD 71.58 Billion in 2024 and is expected to reach USD 237.76 Billion by 2034.

The global enterprise governance, risk and compliance software market is expected to grow at a CAGR of 12.9% during the forecast period.

North America is expected to dominate the enterprise governance, risk and compliance software market over the forecast period.

Leading players in the global enterprise governance, risk and compliance software market include IBM (US), Microsoft (US), Oracle (US), SAP (Germany), SAS Institute (US), ServiceNow (US), Thomson Reuters (Canada), Wolters Kluwer (Netherlands), Dell EMC (US), FIS (US), Software AG (Germany), RSA Security (US), MEGA International (France), Ideagen (UK), Mphasis (India), MetricStream (US), Protiviti (US), SAI Global (US), ProcessGene (Israel), LogicManager (US), Quantivate (US), Riskonnect (US), NAVEX Global (US), Alyne(Germany), Lexcomply (India), StandardFusion (Canada), among others.

The report explores crucial aspects of the enterprise governance, risk and compliance software market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

Choose License Type

List of Contents

Software Industry PerspectiveGlobal Software OverviewKey Insights Software Growth DriversChallenge: Providing a comprehensive EGRC solution Software Report Scope Software Segmentation AnalysisRecent Developments Software Regional Landscape Software Market Competitive LandscapeGlobal Software Market is segmented as follows:RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed