Global Equity Management Software Market Size, Share, Growth Analysis Report - Forecast 2034

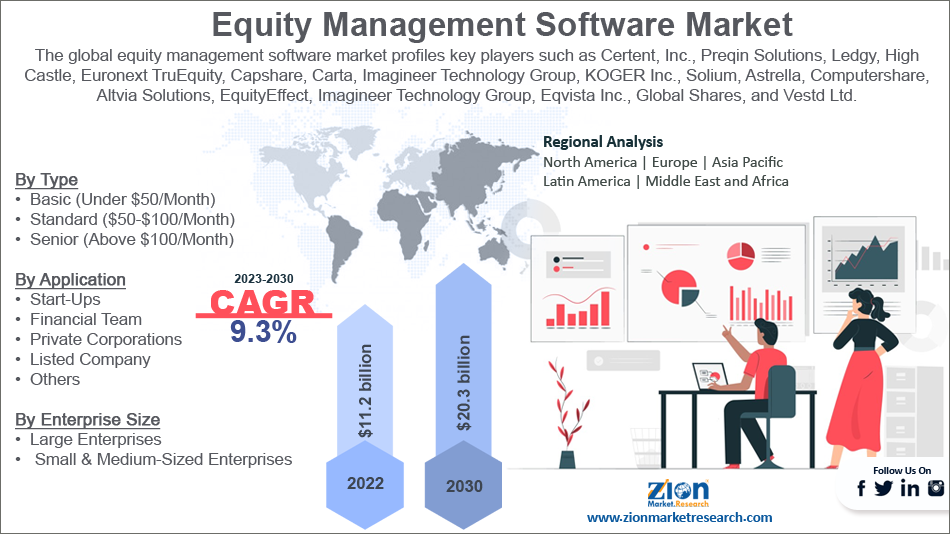

Equity Management Software Market By Type (Basic ($Under 50/Month), Standard ($50-100/Month), Senior ($Above 100/Month)), By Enterprise Size (Large Enterprises, Small and Medium-sized Enterprises), By Application (Private Corporation, Start-ups, Listed Company, Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 800.34 Million | USD 2485.73 Million | 12% | 2024 |

Equity Management Software Market: Industry Size

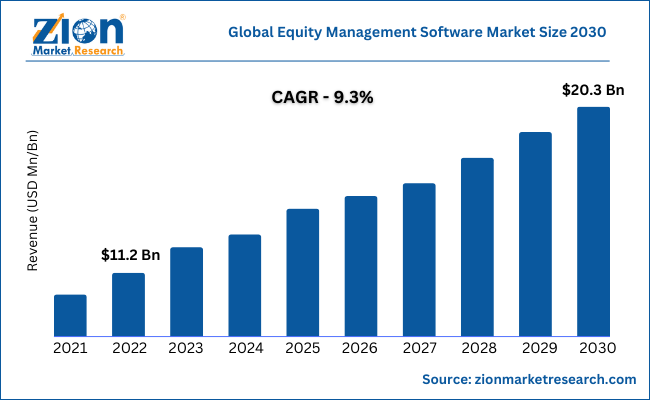

The global equity management software market size was worth around USD 800.34 Million in 2024 and is predicted to grow to around USD 2485.73 Million by 2034 with a compound annual growth rate (CAGR) of roughly 12% between 2025 and 2034. The report analyzes the global equity management software market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the equity management software industry.

Equity Management Software Market: Overview

Equity management software helps end-users in providing their stakeholders with routine updates. It also helps the custom investor portal memorize the ownership of stakeholders along with promoting the growth of the firm. In addition to this, the product helps in the effective management of equity of the firm. The software is also referred to as cap table software and can accurately track the firm’s shares. The equity management software also assists the end-users in maintaining compliance and gaining valuations along with helping the end-users in achieving the top spot on the capitalization table. The product also helps management in taking effective business decisions pertaining to new capital investments and business expansion.

Key Insights

- As per the analysis shared by our research analyst, the global equity management software market is estimated to grow annually at a CAGR of around 12% over the forecast period (2025-2034).

- Regarding revenue, the global equity management software market size was valued at around USD 800.34 Million in 2024 and is projected to reach USD 2485.73 Million by 2034.

- The equity management software market is projected to grow at a significant rate due to increasing complexity of equity structures in companies, the growing need for regulatory compliance and transparency, the surge in private market investments and employee stock option (ESOP) adoption, and the rising demand for cloud-based solutions and AI.

- Based on Type, the Basic ($Under 50/Month) segment is expected to lead the global market.

- On the basis of Enterprise Size, the Large Enterprises segment is growing at a high rate and will continue to dominate the global market.

- Based on the Application, the Private Corporation segment is projected to swipe the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Equity Management Software Market: Growth Factors

Huge product penetration in giant, medium, and small-sized firms to expedite the global market surge by 2030

Equity management software assists firms in automating and streamlining equity management processes. This will contribute notably to the growth of the equity management software market across the globe. The rise in the use of the product in big and medium-sized firms for effective management of firm’s equity will expand the scope of growth of the global market in the forthcoming years. Furthermore, the surging requirement for paperless procedures owing to the growing trend of eliminating manual processes will boost the global equity management software market trends. The market expansion across the globe can be attributed to other factors such as the need for upgraded software for effectively managing complex equity issues, investor & employee access problems, and auditing procedures.

Furthermore, the software helps in easing the equity compensation administrative activities of the firms. Large-scale utilization of equity management software helps in eliminating the need for hiring legal professionals by the firms. Such moves can also help the firms in gaining a thorough understanding of their cap table at any particular period, further fostering the global market growth.

Equity Management Software Market: Hindrances

High initial costs to hinder the global industry demand over 2025-2034

The equity management software industry growth globally can be hampered due to a plethora of factors. Huge preliminary costs of software integration for small businesses and low awareness about the benefits of the use of the software are likely to decimate the global market expansion substantially. Moreover, the easy availability of counterfeit products can further impede global industry expansion.

Equity Management Software Market: Opportunities

Urbanization and globalization to open new growth avenues for the global market

Favorable product features is expected to open up lucrative business growth opportunities for key market players as well as new growth entrants in the global market. Furthermore, rapid industrialization across the globe and massive use of equity management software in the new firms as well as the focus of these firms on exploring the growth potential of untapped regions are some of the factors that will create new growth avenues for the equity management software market across the globe.

Equity Management Software Market: Challenges

Huge costs of the product have proved to be the highest challenge in the growth path of the industry in the emerging economies

Small-scale firms in emerging economies cannot afford the deployment of equity management software and this can pose a huge challenge to the expansion of the global equity management software industry.

Equity Management Software Market: Segmentation

The global equity management software market is sectored into type, application, end-user, and region.

In terms of type, the global equity management software market is divided into basic (under $50/month), standard ($50-$100/month), and senior (above $100/month) segments. Furthermore, the basic (under $50/month) segment, which dominated the type segment in 2022, is anticipated to lead the segmental surge over the anticipated timeline. The segmental growth during the forecast timeline is subject to the huge demand for the basic type of equity management software by small-scale businesses as it is cost-effective and fulfills their business requirements.

Based on the application, the global equity management software industry is bifurcated into start-ups, financial teams, private corporations, listed companies, and others. Furthermore, the start-ups segment, which accounted for approximately half of the global industry share in 2022, is projected to lead the application segment during the assessment period. Additionally, the growth of the segment over the forecasting period can be owing to a rise in the number of start-up establishments due to favorable government policies along with the need of these start-ups to effectively maintain the management of equity among the owners, investors, and stakeholders.

In terms of enterprise size, the global equity management software market is sectored into large enterprises and small & medium-sized enterprises segments. Moreover, the large enterprises segment is prognosed to register the highest CAGR over the forecast period owing to the increase in the use of equity management software in large-scale & giant firms across the globe.

Recent Breakthroughs

- In the second half of 2021, Ledgy AG, a Swiss-based firm that provides strong equity management software for high-growth startups for effectively managing their equity, raised nearly $10 million in a series A round of funding. Reportedly, the amount is likely to be utilized in developing new software features to enable it in enhancing workflow automation and offering proficient public company administration services along with bringing an improvement in fund & portfolio management activities. The initiative will boost the demand for equity management software in Europe.

- In September 2022, Carta, a U.S.-based firm offering equity management services to end-users, acquired Capdesk, a UK-based equity management firm offering new equity schemes to various businesses. The move will boost the growth of the equity management software business in North America and Europe.

- In the last quarter of 2021, Altvia, a key player providing flexible & cloud-based private equity software for fund managers, partnered with Preqin, a UK-based investment data firm providing financial data & insights on alternative assets to customers. The move is aimed at the integration of data of Preqin with CRM and the investment management tool of Altivia. The move is aimed at helping the end-users have a seamless experience through the integration of their Altvia CRM with Preqin's private equity & venture capital data. It will also help in saving end-users time apart from bringing visibility to the investment lifecycle along with improving workflow efficiency. The strategic move will drive the equity management software market trends in the UK.

Equity Management Software Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Equity Management Software Market |

| Market Size in 2024 | USD 800.34 Million |

| Market Forecast in 2034 | USD 2485.73 Million |

| Growth Rate | CAGR of 12% |

| Number of Pages | 216 |

| Key Companies Covered | Capdesk, Euronext, Gust, Preqin Solutions, Carta, Eqvista, Certent, Ledgy, DEEP POOL Financial Solutions Limited, ALTVIA SOLUTIONS, LLC, and others. |

| Segments Covered | By Type, By Enterprise Size, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Equity Management Software Market: Regional Insights

North America to make lucrative contributions towards the global equity management software market size by 2034

The North American region, which accounted for a major share of the global equity management software market in 2024, will maintain its market domination even in foreseeable future. The growth of the equity management software market in North America during the projected timeline can be owing to a rise in the adoptions of the product by various large-scale and small & medium-sized firms in the countries such as the U.S. and Canada.

Furthermore, the Asia-Pacific equity management software industry is anticipated to record the fastest CAGR over the assessment period. The regional market growth over 2025-2034 can be due to a rise in awareness among the firms in the region about the benefits offered by equity management software. Moreover, swift urbanization and foreign direct investment in the countries such as China, Indonesia, India, Thailand, Taiwan, Singapore, and Malaysia due to globalization will prompt regional market growth trends.

Equity Management Software Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the equity management software market on a global and regional basis.

The global equity management software market is dominated by players like:

- Capdesk

- Euronext

- Gust

- Preqin Solutions

- Carta

- Eqvista

- Certent

- Ledgy

- DEEP POOL Financial Solutions Limited

- ALTVIA SOLUTIONS LLC

The global equity management software market is segmented as follows;

By Type

- Basic ($Under 50/Month)

- Standard ($50-100/Month)

- Senior ($Above 100/Month)

By Enterprise Size

- Large Enterprises

- Small and Medium-sized Enterprises

By Application

- Private Corporation

- Start-ups

- Listed Company

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

Equity management software helps end-users in providing their stakeholders with routine updates. It also helps the custom investor portal memorize the ownership of stakeholders along with promoting the growth of the firm. In addition to this, the product helps in the effective management of equity of the firm. The software is also referred to as cap table software and can accurately track the firm’s shares.

The global equity management software market is expected to grow due to rising startup ecosystems, increasing demand for automated cap table management, regulatory compliance needs, and growth in private equity investments.

According to a study, the global equity management software market size was worth around USD 800.34 Million in 2024 and is expected to reach USD 2485.73 Million by 2034.

The global equity management software market is expected to grow at a CAGR of 12% during the forecast period.

The North American equity management software industry is set to account for a major share of the global industry in the upcoming years subject to a rise in the adoptions of the product by various large-scale and small & medium-sized firms in the countries such as the U.S. and Canada.

Leading players in the global equity management software market include Capdesk, Euronext, Gust, Preqin Solutions, Carta, Eqvista, Certent, Ledgy, DEEP POOL Financial Solutions Limited, ALTVIA SOLUTIONS, LLC, among others.

The report explores crucial aspects of the equity management software market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed