Europe Mg-Al-Zn Coated Steel Market Size, Share Report, Analysis, Trends, Growth, 2030

Europe Mg-Al-Zn Coated Steel Market By Application (Construction, Automotive, Electric Power Consumption, Specialized Greenhouse Structures, and Industrial Heating, Ventilation, & Air Conditioning (HVAC)), By Type (Conventional Carbon Steel, Thick Carbon Steel, and Thin Carbon Steel), and By Region - regional and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 35.42 Million | USD 8100 Million | 10.66% | 2022 |

Europe Mg-Al-Zn Coated Steel Industry Prospective:

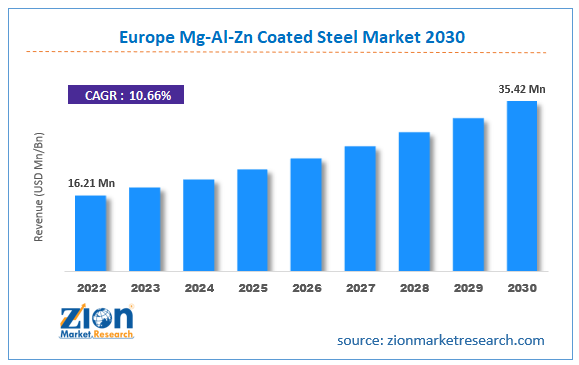

The regional Europe Mg-Al-Zn coated steel market size was worth around USD 16.21 million in 2022 and is predicted to grow to around USD 35.42 million by 2030 with a compound annual growth rate (CAGR) of roughly 10.66% between 2023 and 2030.

Europe Mg-Al-Zn Coated Steel Market: Overview

Mg-Al-Zn coated steel is also known as zinc-aluminum-magnesium (ZAM) coated steel. The Europe Mg-Al-Zn coated steel market deals with the production, distribution, and application of superior-performance steel in several European end-user verticals. It is a novel and innovative steel finish that has superior grade resistance to corrosion making it an ideal choice for end applications. Until a few years ago, pure zinc alloys were the most popular choices in terms of imparting corrosion resistance to metal surfaces, however, with the rampant innovation in steel-producing technology and demand for high-performance steel, the adoption of Mg-Al-Zn coated steel in Europe has improved. ZAM-coated steel consists of coated steel made with a specific amount of aluminum (Al) and magnesium (Mg) that have been added to an existing galvanized coating. In some cases, only a certain amount of Mg is added to the galvanized coating. The two main attributes of Mg-Al-Zon coated steel are high protection against trimming and corrosion resistance.

Key Insights:

- As per the analysis shared by our research analyst, the regional Europe Mg-Al-Zn coated steel market is estimated to grow annually at a CAGR of around 10.66% over the forecast period (2023-2030)

- In terms of revenue, the regional Europe Mg-Al-Zn coated steel market size was valued at around USD 16.21 million in 2022 and is projected to reach USD 35.42 million, by 2030.

- The Europe Mg-Al-Zn coated steel market is projected to grow at a significant rate due to the growing application in Europe’s automotive industry

- Based on application segmentation, automotive was predicted to show maximum market share in the year 2022

- Based on type segmentation, thin carbon steel was the leading segment in 2022

- On the basis of region, Germany was the leading revenue generator in 2022

Europe Mg-Al-Zn Coated Steel Market: Growth Drivers

Growing application in Europe’s automotive industry to drive market growth

The regional Europe Mg-Al-Zn coated steel market is projected to grow owing to the rising application of strengthened and high-performance steel in the region’s growing automotive industry. Since these variants offer excellent resistance to corrosion in harsh environments, the demand for ZAM-coated steel has grown at a tremendous pace in the last decade in Europe. The adopted rate was further amplified by the development of a cost-effective and highly optimized hot-dip galvanizing process thus promoting greater application of Mg-Al-Zn coated steel. As per official reports, Europe’s automotive industry plays a crucial role in driving the regional economy. It contributes to nearly 7% of Europe’s gross domestic product (GDP) and creates over 14 million direct or indirect jobs. The presence of key automobile manufacturers as well as the existence of a large number of consumer bases are the driving factors for the automotive industry in Europe. As of 2021, there were more than 250 million cars on the road.

Furthermore, the rising adoption of electric vehicles (EVs) is projected to push the demand for Mg-Al-Zn-coated steel. EV manufacturers are investing key resources in manufacturing top-quality vehicles where steel with higher resistance to corrosion can be helpful in helping the industry players meet their vision.

Europe Mg-Al-Zn Coated Steel Market: Restraints

High investment for sufficient production to restrict market growth

The Europe Mg-Al-Zn coated steel market growth may be restricted due to the high initial investment associated with sufficient production of premium quality Mg-Al-Zi coated steel. The production process is highly advanced. It requires skilled expertise and access to ultra-modern metallurgy technologies. Traditional hot-dipping methods are not recommended for the production of ZAM-coated steel since mg is highly chemically active and it can lead to the formation of molten slag when placed in a zinc bath. This means that manufacturers will have to invest in next-generation hot-dipping methods which can be expensive. The gap in the supply and demand of skilled professionals in Europe to participate in the hot-dip galvanizing process may further add to the growth barriers.

Europe Mg-Al-Zn Coated Steel Market: Opportunities

Growing innovation in hot-dip galvanizing technologies to create further growth opportunities

The Europe Mg-Al-Zn coated steel industry size may witness further expansion due to the ongoing advancements in hot-dip galvanizing technologies which is the backbone of Mg-Al-Zn coated steel production. The novel galvanizing procedures aim at reducing cost while delivering efficient results in terms of coating and ensuring less impact on the environment. For instance, several companies have started incorporating automated systems such as in-line quality inspection to ensure that the galvanizing process is thorough and no defects are caused. Additionally, technology providers are also focusing on reducing production waste by working on flux management and recycling. The most significant development is witnessed in the development of advanced furnaces with features such as reduced emission of greenhouse gasses and improved energy efficiency.

Production of specialized greenhouse structures has a high scope for further growth

Europe has been focusing on reducing the environmental impact of business operations. The region is working toward achieving net-zero greenhouse gas emissions by 2050. With the introduction of new rules in March 2023 regarding forestry and land use sectors, Europe is aiming to reduce carbon sinks by 15% during the forecast period. These factors are likely to create more demand for Mg-Al-Zn coated steel for the production of specialized greenhouse structures that trap the emission of environmentally harmful gasses.

Europe Mg-Al-Zn Coated Steel Market: Challenges

Availability and higher sales of alternatives to ZAM-coated steel may challenge market expansion

The Europe Mg-Al-Zn coated steel industry expansion trend may be challenged by the higher production and sale of alternatives to the highly effective material in terms of corrosion resistance. For instance, as of 2023, the traditional method of hot-dipping galvanized steel remains the most popular mode of improving steel attributes. It includes the use of zinc alloys as an additional coating. The increasing demand for composite material that not only imparts superior corrosion resistance but also has other improved mechanical and thermal properties could be a threat to the adoption of Mg-Al-Zn coated steel. On the other hand, the regional HVAC industry is also currently dominated by counterparts such as aluminized steel and pre-painted steel due to the high cost associated with Mg-Al-Zn coated steel.

Europe Mg-Al-Zn Coated Steel Market: Segmentation

The regional Europe Mg-Al-Zn coated steel market is segmented based on application, type, and region.

Based on application, the Europe Mg-Al-Zn coated steel market segments are construction, automotive, electric power consumption, specialized greenhouse structures, and industrial heating, ventilation, & air conditioning (HVAC). In 2022, the highest growth was registered in the regional automotive industry led by the increasing innovation and development in the production of advanced automobiles that meet customer expectations in terms of overperformance. Mg-Al-Zn coated steel is used to produce vehicle parts such as exhaust systems and body panels. Moreover, ZAC-coated steel helps in dampening vibration along with imparting excellent soundproofing. Luxembourg in Europe has a car density of 698 per 1000 people.

Based on type, the Europe Mg-Al-Zn coated steel industry divisions are conventional carbon steel, thick carbon steel, and thin carbon steel. In 2022, the most dominant segment was thin carbon steel due to higher demand for lightweight structural units across end-user verticals. Moreover, thin carbon steel has more buyers in the automotive sector as compared to the other two forms. The main reason is the lucrative balance achieved by thin carbon steel in terms of cost and performance. For instance, thick carbon steel may fail to deliver if the coating is inaccurate or a conventional variant may need additional coating. In most cases, 0.2–11% Mg and 0.1–3.5% Al is used in Mg-Al-Zn coated steel.

Europe Mg-Al-Zn Coated Steel Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Europe Mg-Al-Zn Coated Steel Market |

| Market Size in 2022 | USD 16.21 Million |

| Market Forecast in 2030 | USD 35.42 Million |

| Growth Rate | CAGR of 10.66% |

| Number of Pages | 227 |

| Key Companies Covered | Associated British Foods plc, AGRANA Beteiligungs-AG, TRADIN ORGANIC AGRICULTURE B.V., Samruddhi Organic Farm (India) Private Limited, ASR GROUP, TEREOS INTERNACIONAL S.A., BayCo Inc., Raízen, E.I.D. - Parry (India) Limited, Wilmar International Ltd., Florida Crystals Corporation, DW Montgomery & Company, Cargill Inc., International Sugars Inc., Pronatec AG, Louis Dreyfus Company, and others. |

| Segments Covered | By Application, By Type, and By Region |

| Countries Covered | Europe, Nordic Countries, Benelux Union, and Rest of Europe |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Europe Mg-Al-Zn Coated Steel Market: Regional Analysis

Germany to deliver the highest revenue during the projected timeline

The regional Europe Mg-Al-Zn coated steel market is expected to be dominated by Germany during the forecast period. Germany is home to one of the largest automotive industries in Europe and worldwide. In 2021, the regional automotive industry was valued at USD 412 billion and it is the major supplier of mid-range to luxury vehicles including cars and buses. In addition to this, the region has high domestic demand for passenger cars. As per reports by Germany’s Federal Statistical Office, around 68% of Germans use private cars for transport. Moreover, the consistent innovative approach adopted by German automobile makers has allowed them to deliver high results. The United Kingdom is projected to grow at a significant pace with the growing demand for corrosion-resistant coated steel for the production of greenhouse structural units. In 2022, the UK witnessed a reduction of greenhouse gasses by 2.4% as compared to 2021 and has adopted several initiatives to continue the trend in the coming years.

Europe Mg-Al-Zn Coated Steel Market: Competitive Analysis

The regional Europe Mg-Al-Zn coated steel market is led by players like:

- Associated British Foods plc

- AGRANA Beteiligungs-AG

- TRADIN ORGANIC AGRICULTURE B.V.

- Samruddhi Organic Farm (India) Private Limited

- ASR GROUP

- TEREOS INTERNACIONAL S.A.

- BayCo Inc.

- Raízen

- E.I.D. - Parry (India) Limited

- Wilmar International Ltd.

- Florida Crystals Corporation

- DW Montgomery & Company

- Cargill Inc.

- International Sugars Inc.

- Pronatec AG

- Louis Dreyfus Company

The regional Europe Mg-Al-Zn coated steel market is segmented as follows:

By Application

- Construction

- Automotive

- Electric Power Consumption

- Specialized Greenhouse Structures

- Industrial Heating, Ventilation, & Air Conditioning (HVAC)

By Type

- Conventional Carbon Steel

- Thick Carbon Steel

- Thin Carbon Steel

By Region

Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

Table Of Content

Methodology

FrequentlyAsked Questions

Mg-Al-Zn coated steel is also known as zinc-aluminum-magnesium (ZAM) coated steel. It is a novel and innovative steel finish that has superior grade resistance to corrosion making it an ideal choice for end applications.

The regional Europe Mg-Al-Zn coated steel market is projected to grow owing to the rising application of strengthened and high-performance steel in the region’s growing automotive industry.

According to study, the regional Europe Mg-Al-Zn coated steel market size was worth around USD 16.21 million in 2022 and is predicted to grow to around USD 35.42 million by 2030.

The CAGR value of Europe Mg-Al-Zn coated steel market is expected to be around 10.66% during 2023-2030.

The regional Europe Mg-Al-Zn coated steel market is expected to be dominated by Germany during the forecast period.

The regional Europe Mg-Al-Zn coated steel market is led by players like Associated British Foods plc, AGRANA Beteiligungs-AG, TRADIN ORGANIC AGRICULTURE B.V., Samruddhi Organic Farm (India) Private Limited, ASR GROUP, TEREOS INTERNACIONAL S.A., BayCo, Inc., Raízen, E.I.D. - Parry (India) Limited, Wilmar International Ltd., Florida Crystals Corporation, DW Montgomery & Company, Cargill, Inc., International Sugars Inc., Pronatec AG, Louis Dreyfus Company, and many more.

The report explores crucial aspects of the Europe Mg-Al-Zn coated steel market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed