Extra Virgin Olive Oil Market Size, Share, Growth, Trends, and Forecast 2030

Extra Virgin Olive Oil Market By Distribution Channel (Non-Store-Based and Store-Based), By Category (Conventional and Organic), By Packaging (Cans, Bottles & Jars, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

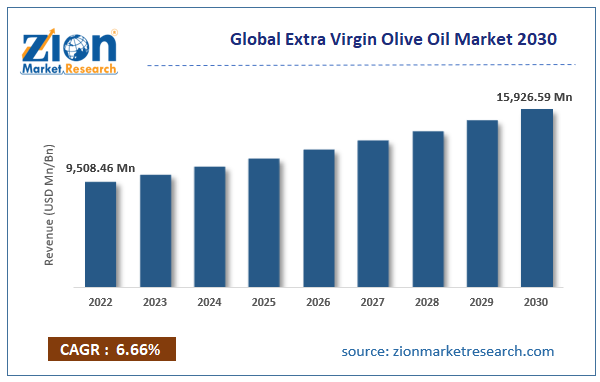

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 9,508.46 Million | USD 15,926.59 Million | 6.66% | 2022 |

Extra Virgin Olive Oil Industry Prospective:

The global extra virgin olive oil market size was worth around USD 9,508.46 million in 2022 and is predicted to grow to around USD 15,926.59 million by 2030 with a compound annual growth rate (CAGR) of roughly 6.66% between 2023 and 2030.

Extra Virgin Olive Oil Market: Overview

Extra virgin olive oil is a consumer good with specific applications in the culinary industry. Extra virgin olive oil is also known as EVOO and is considered the most flavorful, highest quality, and most expensive olive oil available in the market. Extra virgin olive oil does not contain any form of chemical or synthetically prepared ingredients leading to the product becoming exceptionally popular in the culinary industry. The most common application of EVOO can be witnessed in dips and as liquid ingredients drizzled over food products. It offers a pepper-based flavor with a grassy color.

Olive olive, in comparison to EVOO, is considered a lower-grade commodity since it undergoes some form of processing and refining. However, there are limited applications of extra virgin olive oil. Theoretically, it can be used in similar ways as olive oil is used across applications. However, if it's boiled at a higher temperature range, EVOO undergoes quality degradation. Furthermore, extra attention has to be paid to product storage which makes the product better maintained. The demand for extra virgin olive oil is growing at a steady rate.

Key Insights:

- As per the analysis shared by our research analyst, the global extra virgin olive oil market is estimated to grow annually at a CAGR of around 6.66% over the forecast period (2023-2030)

- In terms of revenue, the global extra virgin olive oil market size was valued at around USD 9,508.46 million in 2022 and is projected to reach USD 15,926.59 million, by 2030.

- The extra virgin olive oil market is projected to grow at a significant rate due to the rising demand for fine dining experiences

- Based on distribution channel segmentation, store-based was predicted to show maximum market share in the year 2022

- Based on packaging segmentation, bottles & jars were the leading segment in 2022

- On the basis of region, Europe was the leading revenue generator in 2022

Request Free Sample

Request Free Sample

Extra Virgin Olive Oil Market: Growth Drivers

Rising demand for fine dining experiences could propel the market growth rate

The global extra virgin olive oil market is expected to grow owing to the increasing demand for fine dining experiences. The increase in disposable income of the general population along with changes in lifestyle and eating habits has caused a growing number of the population to spend on unique experiences including gourmet dining. As per the latest statistics, more than 88% of people between the ages of 18 years to 35 years visit upscale or fine dining restaurants at least once a month. The growing concept of smaller families with more than one earning member also contributes to higher revenue in the fine dining experience sector.

In December 2023, Dabiz Munoz, an internationally famous Spanish chef, opened the latest brand of StreetXo, an upscale restaurant, in Dubai. In November 2023, Daniel Boulud, renowned restaurateur and chef, announced that his restaurants under the brand name Dinex Group had received four Michelin stars. One star was given to a restaurant named Joji, another star was given to Le Pavillon, and two stars were given to Restaurant DANIEL. All three restaurants are located in New York.

Rising global tourism to act as a growth driver during the projection period

The global tourism index will grow from 2021 to 2022. Lockdown impositions during COVID-19 encouraged more people to travel for leisure and experience once the impositions were lifted. Since then, the trend has gained high momentum driven by different types of travelers. For instance, there is a growing number of work-related travels reported globally, especially with the diminishing regional boundaries encouraging more employers to seek global talent.

In 2022, Europe registered over 590 million international tourists. Similar statistics were noted in other countries as well. This could significantly impact the demand and consumption in the global extra virgin olive oil market as food tourism is expected to take a leap in the coming years.

Extra Virgin Olive Oil Market: Restraints

High price of the commodity may restrict market expansion

The global industry for extra virgin olive oil is projected to be restricted due to the high cost of EVOO as compared to other oil brands and variants. The high price is due to the production method adopted for manufacturing extra virgin olive oil. Since it is purely derived using natural components, the cost increases significantly.

In addition to this, the production is currently limited to specific countries which means that the production quantity is highly restricted. It adds to the overall cost and value of extra virgin olive oil. The production adoption rate will also be impacted by the increasing prices of essential food products.

Extra Virgin Olive Oil Market: Opportunities

Rising investments toward improving olive production could deliver exceptional growth opportunities

The global extra virgin olive oil market players can expect more growth opportunities as investments toward improving olive production are on the rise. Regions with extensive olive production are working toward improving production and quality infrastructure to meet the growing consumer demands and expectations. In September 2023, Portugal and Spain witnessed the peaking rise of private equity firms in the regional olive farms as the companies are expecting immense profits in the coming years. In a move that followed, Beka Finance, a Spain-based finance manager, announced a collaboration with Bolschare, a Portugal-based industrial partner, by launching its first fund which will be used in farming procedures related to almond and super-intensive olive.

In August 2023, Italy announced an investment of €100M across olive mills. The funds will be allocated systematically by 2026 and are expected to help in upgrading olive mill facilities. The public fund is provided by the Italian Recovery and Resilience Plan and is a part of a broader Next Generation European Union (E.U.) initiative worth €750 billion.

Producing sustainable EVOO may attract a higher number of consumers during the projection period

Companies operating in the global extra virgin olive oil industry can benefit by leveraging the growing environmental consciousness among consumers. The introduction of EVOO produced using sustainable means can attract more buyers as people are increasingly preferring environmentally friendly brands. In May 2023, leading olive oil producer, Deoleo, announced the launch of new stock-keeping units (SKUs) for Carapelli and Bertolli brands.

Extra Virgin Olive Oil Market: Challenges

Storage limitations and extreme competition from olive oil could challenge the market growth rate

The global extra virgin olive oil market will be challenged by the storage limitations of EVOO. For instance, it should be stored in cold areas only. Furthermore, the containers have to be specially designed to protect product quality over time. Additionally, the higher demand for basic olive oil will further segment the market into several groups.

Extra Virgin Olive Oil Market: Segmentation

The global extra virgin olive oil market is segmented based on distribution channel, packaging, and region.

Based on distribution channel, the global market is segmented into non-store-based and store-based. In 2022, the highest growth was observed in the store-based segment led by the higher availability of EVOO brands in supermarkets, hypermarkets, and other brick-and-mortar retailers. The segment also benefits from restaurants and culinary units paternity with EVOO suppliers for bulk orders. Moreover, the non-store-based segment is growing rapidly with the increasing proliferation of e-commerce companies offering doorstep delivery of consumer products. 3 kilograms of olives are required to produce one liter of oil.

Based on packaging, the global market divisions are cans, bottles & jars, and others. In 2022. In 2022, bottles & jars were the leading revenue generator. Extra virgin olive oil should be stored in limited quantities and is recommended to be used as quickly as possible. Longer storage puts the product at risk of deteriorating. EVOO can last up to 18 to 24 months if stored under the right conditions.

Extra Virgin Olive Oil Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Extra Virgin Olive Oil Market |

| Market Size in 2022 | USD 9,508.46 Million |

| Market Forecast in 2030 | USD 15,926.59 Million |

| Growth Rate | CAGR of 6.66% |

| Number of Pages | 229 |

| Key Companies Covered | Borges International Group, Deoleo S.A., Sovena Group, Grupo Ybarra Alimentación, Salov S.p.A., Mueloliva, Bellucci Premium, Cargill Inc., California Olive Ranch Inc., Colavita S.p.A., Moulin Castelas, Luglio, Cobram Estate, Gaea, Pompeian Inc., and others. |

| Segments Covered | By Distribution Channel, By Category, By Packaging, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Extra Virgin Olive Oil Market: Regional Analysis

Europe to witness the highest growth rate during the projection period

The global extra virgin olive oil market is expected to witness the highest growth rate during the projection period. The growth rate is the result of the presence of an extensive oil farming culture in prominent European countries such as Italy, Spain, and Portugal. Between 2022 and 2023, Spain produced 1.5 million metric tons of olive oil production. It held control over more than 60% of the global olive oil production. Additionally, the region has high domestic demand since extra virgin olive oil is regularly used in culinary dishes across Europe. In March 2023, popular coffee house Starbucks announced the launch of a new variety of coffee infused with extra virgin olive oil in the Italian market. In June 2023, Bonolio, Europe’s largest exporter of olive oil to the US market, announced that it would open a new facility in New Jersey spread across 2,000 square meters.

North America is expected to witness a high growth rate driven by the increasing culinary tourism in the US. The country is home to some of the world’s most prominent restaurant chains and hosts millions of global travelers every year. The Middle East is a growing market led by the rising number of upscale food service providers. The growing rate of international tourism in Middle Eastern countries may act as a key growth contributor.

Extra Virgin Olive Oil Market: Competitive Analysis

The global extra virgin olive oil market is led by players like:

- Borges International Group

- Deoleo S.A.

- Sovena Group

- Grupo Ybarra Alimentación

- Salov S.p.A.

- Mueloliva

- Bellucci Premium

- Cargill Inc.

- California Olive Ranch Inc.

- Colavita S.p.A.

- Moulin Castelas

- Luglio

- Cobram Estate

- Gaea

- Pompeian Inc.

The global extra virgin olive oil market is segmented as follows:

By Distribution Channel

- Non-Store-Based

- Store-Based

By Category

- Conventional

- Organic

By Packaging

- Cans

- Bottles & Jars

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Extra virgin olive oil is a consumer good with specific applications in the culinary industry.

The global extra virgin olive oil market is expected to grow owing to the increasing demand for fine dining experiences.

According to study, the global extra virgin olive oil market size was worth around USD 9,508.46 million in 2022 and is predicted to grow to around USD 15,926.59 million by 2030.

The CAGR value of extra virgin olive oil market is expected to be around 6.66% during 2023-2030.

The global extra virgin olive oil market is expected to witness the highest growth rate during the projection period.

The global extra virgin olive oil market is led by players like Borges International Group, Deoleo S.A., Sovena Group, Grupo Ybarra Alimentación, Salov S.p.A., Mueloliva, Bellucci Premium, Cargill, Inc., California Olive Ranch, Inc., Colavita S.p.A., Moulin Castelas, Luglio, Cobram Estate, Gaea, and Pompeian, Inc.

The report explores crucial aspects of the extra virgin olive oil market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed