Global Ferro Vanadium Market Size, Share, Growth Analysis Report - Forecast 2034

Ferro Vanadium Market By Grade (FeV40, FeV50, FeV60, FeV75, and FeV80), By Manufacturing Process (Aluminothermic Reduction Technique and Silicon Reduction Technique), Application (Concrete Reinforcing Bars, Structural Plates, Axles, Frames, Crankshafts, Titanium Alloys, Pipeline, and Others), End-Use (Building & Construction, Aerospace & Defense, Marine, Chemical Industry, Oil & Gas, Industrial Equipment, Hand Tools, Automotive, and Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

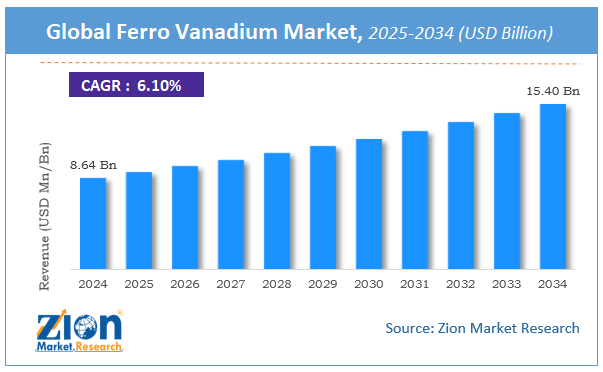

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 8.64 Billion | USD 15.40 Billion | 6.1% | 2024 |

Ferro Vanadium Industry Prospective:

The global ferro vanadium market size was worth around USD 8.64 Billion in 2024 and is predicted to grow to around USD 15.40 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 6.1% between 2025 and 2034. The report analyzes the global ferro vanadium market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the ferro vanadium industry.

Ferro Vanadium Market: Overview

A mixture of iron and vanadium with a vanadium content that ranges from 35% to 85% is called ferrovanadium (FeV). It aids a crystalline solid of greyish silver that can be crushed to create ferrovanadium dust. For steels including high-strength low-alloy (HSLA) steel, tool steels, and other ferrous-based goods, ferrovanadium serves as a universal hardener, strengthener, and anti-corrosive addition.

As an additive, ferrovanadium helps ferrous alloys perform better. It is also used to increase the metal's resistance to corrosion caused by sulphuric and hydrochloric acids, as well as alkaline reagents. It is used to increase a material's tensile strength-to-weight ratio.

Key Insights

- As per the analysis shared by our research analyst, the global ferro vanadium market is estimated to grow annually at a CAGR of around 6.1% over the forecast period (2025-2034).

- Regarding revenue, the global ferro vanadium market size was valued at around USD 8.64 Billion in 2024 and is projected to reach USD 15.40 Billion by 2034.

- The ferro vanadium market is projected to grow at a significant rate due to increasing steel production and demand for high-strength, corrosion-resistant alloys in construction and automotive industries.

- Based on Grade, the FeV80 segment is expected to lead the global market.

- On the basis of Manufacturing Process, the Aluminothermic Reduction Technique segment is growing at a high rate and will continue to dominate the global market.

- Based on the Application, the Concrete Reinforcing Bars segment is projected to swipe the largest market share.

- By End-Use, the Building & Construction segment is expected to dominate the global market.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Ferro Vanadium Market: Growth Drivers

Increasing demand for ferro vanadium from the oil & gas industry to drive the market growth

Steel is subjected to extreme strains and corrosion throughout the drilling, production, processing, storage, and transportation of oil and gas. The tubes or pipelines corrode when acid-bearing fluids are utilized in drilling operations. Consequently, the demand for ferro vanadium from the oil industries is increasing to strengthen the corrosion resistance of steels to acids as well as alkali solutions.

The need for ferro vanadium to increase the strength of the steel used in the oil sector is fueled by the thriving oil and gas sectors. For instance, the International Energy Agency (IEA) projects that by 2025, the world's oil demand would have increased by a total of 5.7 mb/d, with China and India contributing roughly half of the increase. The need for pipes is driven by the expanding cross-country pipeline and the growing city gas distributions (CGD) industry, which in turn fuels the expansion of this market. Because of its strength and application in oil and gas pipelines, high-strength low-alloy steel (HSLA) incorporating vanadium is common.

Ferro Vanadium Market: Restraints

Growing environmental concerns are expected to hamper market expansion

The growing environmental concerns along with fluctuations in the price of raw material is expected to hamper the growth of the market during the forecast period. For instance, according to the World Steel Association AISBL, in 2020, on average, every tonne of steel produced led to the emission of 1.89 tonnes of CO2 into the atmosphere. Furthermore, 1,860 million tonnes (Mt) of steel were produced, and total direct emissions from the sector were of the order of 2.6 billion tonnes, representing between 7% and 9% of global anthropogenic CO2 emissions.

Ferro Vanadium Market: Opportunities

The increasing government policies and investments in infrastructure provide a lucrative opportunity for the market growth

The government's emphasis on improving and building infrastructures like dams, highways, and bridges is driving up demand for steel, which in turn is fueling the expansion of the ferro vanadium industry. Ferrovanadium is a significant alloy that is primarily utilized in the production of steel to increase the material's hardness, strength, abrasion resistance, and ductility.

For instance, the Indian government's 2017 New Steel Policy, which directs the steel industry to reach 300 MT of steel production capacity by 2030, is projected to support market expansion. Ferrovanadium usage for the production of high-strength steel is also increased by the Smart City Mission and Heritage City Development and Augmentation Yojana (HRIDAY), which aims to introduce the most cutting-edge construction technology to India through a competitive platform.

Additionally, the ENABLE Build Program of the British government, which was introduced in 2019, offers financial assistance to smaller homebuilders so that they can contribute to the nation's infrastructure development. Additionally, initiatives like the California High-Speed Rail and Boston Harbor Dredging Project increase the need for steel, which has a big positive impact on the global ferro vanadium market's expansion.

Ferro Vanadium Market: Segmentation

The global ferro vanadium market is segmented based on the grade, manufacturing process, application, end-use industry, and region

Based on grade, the global market is bifurcated into FeV40, FeV50, FeV60, FeV75, and FeV80. The FeV80 segment held the largest market share of over 35% in 2021 and is expected to follow the same pattern during the forecast period. The market is growing due to the increased usage of FeV80 in steel industries, which has a maximum vanadium concentration of 80%. An increase in vanadium concentration not only improves steel yield and tensile strength but also promotes grain refinement. Global crude steel output climbed by 3.4% in 2019, according to the Worldsteel Association. The increased production of crude steel enhances the demand for ferro vanadium, which is used to improve the strength, malleability, and corrosion resistance of steel.

Based on the manufacturing process, the market is segmented into aluminothermic reduction technique and silicon reduction technique. The aluminothermic process is the most extensively utilized reduction method because it produces excellent product purity and yield. A charge of vanadium pentoxide, aluminum, lime/fluorspar, scrap iron, and iron oxide is put into a heated pot and fired by a priming mixture in the aluminothermic reduction process. The subsequent reaction reduces the vanadium and iron oxides, yielding molten ferrovanadium at the bottom of the pot. The key factors driving the rise of ferrovanadium through aluminothermic reduction are cost-effectiveness and relatively easy extraction of ferrovanadium.

By Application, the global ferro vanadium market is split into Concrete Reinforcing Bars, Structural Plates, Axles, Frames, Crankshafts, Titanium Alloys, Pipeline, and Others.

Based on the end-use industry, the market is bifurcated into building & construction, aerospace & defense, marine, chemical industry, oil & gas, industrial equipment, hand tools, automotive, and others. The building & construction segment is projected to hold the largest market share during the forecast period.

To boost strength and corrosion resistance to alkaline reagents such as sulfuric and hydrochloric acids, ferro vanadium is widely employed in concrete reinforcing bars and structural plates. Because of ferro vanadium steel's capacity to sustain severe loads without deforming, it is a useful material for use in beams and columns to offer structural support to buildings. Furthermore, rising construction activity around the world is boosting market growth. According to the Institution of Civil Engineers (ICE), global construction production will increase by 85% to $15.5 trillion by 2030, with three countries leading the way, accounting for 57% of total global growth.

Ferro Vanadium Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Ferro Vanadium Market |

| Market Size in 2024 | USD 8.64 Billion |

| Market Forecast in 2034 | USD 15.40 Billion |

| Growth Rate | CAGR of 6.1% |

| Number of Pages | 185 |

| Key Companies Covered | Hickman, Atlantic Ltd., AMG Advanced Metallurgical Group N.V., Williams & Company, Core Metals Group LLC, Bear Metallurgical Company, Jinzhou Guangda Ferroalloy Co., Ltd, Taiyo Koko Co., Ltd., Tremond Metals Corp., Gulf Chemical and Metallurgical Corporation, EVRAZ Vanadium, and Woojin Industry Co., Ltd, and others. |

| Segments Covered | By Grade, By Manufacturing Process, By Application, By End-Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Ferro Vanadium Market: Regional Analysis

The Asia Pacific region is expected to dominate the market during the forecast period

In 2021, Asia Pacific dominated the global ferro vanadium market, accounting for more than 45% of the market, followed by North America and Europe. The ferro vanadium market in APAC is expanding due to rapid industrial expansion and a growing population. Rising building activity in emerging markets such as China and India contributes to the market's expansion. In India, for example, the construction sector's gross value added (GVA) climbed from $183.5 billion in 2018-19 to $192 billion in 2019-20. Furthermore, as crude steel production rises, so does the demand for ferro vanadium to strengthen its properties. For instance, according to the Worldsteel Association, China's crude steel production in 2019 was 996.3 Mt, an 8.3% rise over 2018, and its global share of crude steel production climbed from 50.9% in 2018 to 53.3% in 2019. The Indian government's flagship PMAY scheme, which intends to build 20 million urban homes and 30 million rural households by 2022, also contributes to market growth.

Recent Developments:

- In September 2019, AMG Advanced Metallurgical Group has signed an agreement to supply 100% of its available ferrovanadium production to Glencore. Under the multimillion agreement, AMG will supply ferrovanadium from both the existing and the future facilities of the company in Ohio.

- In May 2020, EVRAZ Vanadium has established a new Research and Development Center located in Group subsidiary East Metals AG, Zug, Switzerland. Its main objective is to support sustainable and diversified usage of vanadium as an alloying element in current and future steel products.

Ferro Vanadium Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the ferro vanadium market on a global and regional basis.

The global ferro vanadium market is dominated by players like:

- Hickman

- Atlantic Ltd.

- AMG Advanced Metallurgical Group N.V.

- Williams & Company

- Core Metals Group LLC

- Bear Metallurgical Company

- Jinzhou Guangda Ferroalloy Co.

- Ltd Taiyo Koko Co. Ltd.

- Tremond Metals Corp.

- Gulf Chemical and Metallurgical Corporation

- EVRAZ Vanadium

- and Woojin Industry Co. Ltd

The global ferro vanadium market is segmented as follows:

By Grade

- FeV40

- FeV50

- FeV60

- FeV75

- FeV80

By Manufacturing Process

- Aluminothermic Reduction Technique

- Silicon Reduction Technique

By Application

- Concrete Reinforcing Bars

- Structural Plates

- Axles

- Frames

- Crankshafts

- Titanium Alloys

- Pipeline

- Others

By End-Use

- Building & Construction

- Aerospace & Defense

- Marine

- Chemical Industry

- Oil & Gas

- Industrial Equipment

- Hand Tools

- Automotive

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

Asia-Pacific is expected to dominate the ferro vanadium market over the forecast period.

Leading players in the global ferro vanadium market include Hickman, Atlantic Ltd., AMG Advanced Metallurgical Group N.V., Williams & Company, Core Metals Group LLC, Bear Metallurgical Company, Jinzhou Guangda Ferroalloy Co., Ltd, Taiyo Koko Co., Ltd., Tremond Metals Corp., Gulf Chemical and Metallurgical Corporation, EVRAZ Vanadium, and Woojin Industry Co., Ltd, among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed